How to Develop Investment Habits in Kids: A Basic Guideline for the Parents

By Online Trading Campus

January 10, 2024 • Fact checked by Dumb Little Man

We all love to see our kids developing good habits. Don’t we? Saving money is a habit that we should grow since our childhood. It is easy to develop any habit at an early age because the brain remains most active at that stage. But a kid cannot identify a good or a bad habit on his own. It is our responsibility to let them learn good things to brighten their future. So, developing investment habits in kids should be one of our prime responsibility.

Saving money and investing it in the right place is something that the kids should understand from an early age. Generally, we avoid discussing financial matters in front of kids so that they don’t develop a money mind. But a healthy discussion about financial matters is also essential once they reach a certain age. Apart from only discussing financial plans with your kids, the parents should also involve them in the acts and take their contributions. It helps them to learn to take responsibility, develop financial maturity, and more. There are many more points that the parents should follow when they want their kids to understand the value of money and its right use in the future. So, what are those? Let us check the following points.

Benefits of developing investment habits in kids

We understand the benefits of investment but is it essential to growing the concern in kids? The answer is yes because it promotes a financially fit and fine life for the kids. You can go through the following points to understand the importance of letting your kids understand the values of financial investment since their childhood.

1. Develop associated healthy behavior

You can restrict the habit of misusing money by motivating the young ones in saving and incorporating investment habits in kids for the right purpose. Misusing money may make the kids indiscipline and never restrict them from spending money in the wrong places. They never learn the importance of money in necessity and that may insecure their financial future. They may need to borrow money when they are in need if they don’t learn how to save and invest money in the right place. So educating your children on how to invest and where to invest becomes important.

2. Develop a sense of responsibility

In the growing age of your kids, the knowledge of investment can help them to take small responsibilities in their daily lives. They can save money and buy books or copies of their own. This can grow the right sense of responsibility and self-esteem in your kids at an early age. This can also encourage them to earn money in the coming future and use the earnings for the correct purpose. This trick of developing investment habits in kids can also encourage them to both save and invest.

3. Secures future

It is known that we will not be there to protect our kids throughout their life but the lesson we teach can guide them in their life and help them to achieve their goals. Developing the investment habit in your kids can secure your future financially and stay planned and stable. Financial problems may arise at any point of time in our lives and the investment can save us to overcome the crisis. The same goes for our kids and we may not be there to teach the lesson then. So, it is the responsibility of the parents to develop investment habits in kids from an early age.

4. Kids learn to wait with patience

You can encourage your kids to save a little amount of money every day and get a reward by using the total invested amount of money once a year. When you incorporate the habit of long-term investment in your kids, indirectly they also learn to wait to get the right growth of the investment. This is a very important skill to develop early when you want your kids to be good investors in the future.

These are the basic reasons for which conscious parents are now interested in developing the investment habit in kids.

Guideline for developing investment habits in kids

The goal of developing investment habits in kids is not an impossible one to achieve if you follow some guidelines and handle your kids properly. So, what are those useful tricks that can grow the investment habit in kids? Check out the given points.

1. Define what investment is to your kids

The first step a parent needs to take is defining investment to your kids when their educational standard is kindergarten. The term is new to your kids and you should present it to your kids in an interesting manner. You can say that investment is an action that a person takes today to get the result after a certain period. So, financial investment means using money in such a way that it gives you back the best return in the coming days. Introducing your kids to the financial investment term is very important to grow investment habits in kids. You can also add an example to make your kids understand the subject in a better way.

2. Teach the value of money

You should let your kids understand what money is as soon as they learn to count, add and subtract. The parents need to make the kids understand how money is used to buy and what its value is. Developing investment habits in kids become easy and interesting when the value of money becomes clear to them. They should understand why earning a good return against investment is important and what benefits they may get from it.

3. Encourage and motivate them to earn

Before encouraging investment the kids should get to know how to earn. The parents should encourage them in earning money by investing labor. Teenagers can start earning by performing part-time jobs like delivering food, taking care of babies of neighbors, giving tuition, and more. On the other hand, the younger kids can receive token money for completing a household task. Earning money encourages them to become self-sufficient and confident about their skills. investment habits in kids help in earning a good return and that brings positive energy to them and keep them engaged in good tasks.

4. Encourage investing money

You can teach your young toddler in investing money once they learn to earn. Setting small goals against a certain amount of financial investment can encourage the little ones. For example, you can ask your kids to save a certain amount of money within a fixed period to get an interesting return like buying their favorite book, dress, gift, or something like that.

You can also motivate to grow investment habits in kids by letting them choose a long-term goal like a yearly tour plan. Then ask your kids to invest money with you every day for the same purpose and enjoy the return. This result can encourage the kids to enjoy the return and understand investment in a better way.

5. Teach kids to spend for the right purpose

In the growing period let the kids understand where they should invest and why. The investment should be done where the chance of growing wealth is high and you should clear this concept to your kids in simple words for developing investment habits in kids. You can ask the young ones where they want to spend and what the reasons are. This gives you an idea about what your kids are thinking and besides, you can also encourage them to take decisions on their own. An informed investment has a higher chance to return you the best amount so your kids should understand the logic behind the investment in their daily lives and be able to make the right investment decision as well.

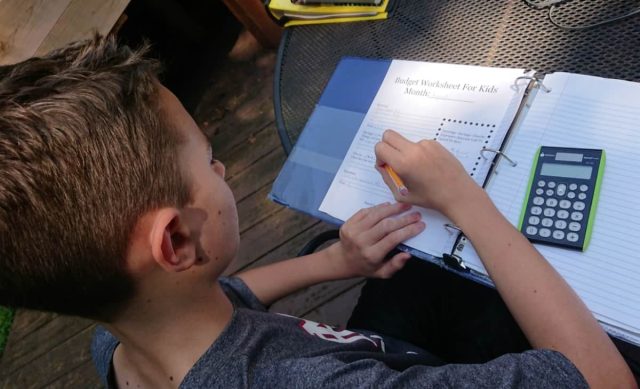

6. Set a budget with your kids

We all make a monthly budget to run our household. Including your kids in this budget planning for a household is a good idea. It helps the kids to understand where to invest from an early age. They also understand the value of money when the budget is planned in front of them.

7. Let the kids do mistakes and learn

None can become a master of any subject without making any mistakes. The same thing goes for investment as well. If you start teaching the young ones investment at an early age then they get enough time to make mistakes. Before developing the correct investment habits kids understand where they are making mistake and how they can improve it. They get enough time to learn the process. The family and financial backup are there when they make investment mistakes in the beginning. The young ones can start investing with a small amount and if they make mistake it must not be bigger trouble than a mistake with a large amount in the middle age.

8. Teach them the differences between necessity and luxury

The differences between luxury and necessity should be clear to your kids before making an investment plan. This should also be a part of the investment habits in kids that you should emphasize. Buying a fancy dress is a luxury whereas purchasing medicine is necessary. After meeting your urgent requirements and necessity, the excess amount of money can be used for investment. So, the choice of necessity and luxury should be proper. After investing a certain amount of money for future growth you can use the excess money for luxury.

Final words

The overall impact of incorporating investment habits in kids is positive and impressive. It can turn your kids to be financially stable, mature, and self-sufficient in the future. Once they understand the basics of investment you can search for an investment policy depending on their eligibility and age. This helps them to get more encouragement and get a good amount of return after a certain period.

Online Trading Campus

Bernd Skorupinski teaches the undiluted truth about trading at the best online trading academy and takes you through what it takes to be a consistently successful forex trader. His favorite moment as an expert in the online trading campus who teaches trading is the way people's eyes light up with excitement and confidence when they understand how Supply and Demand trading strategy works and how it can help win in the trading arena.