9 BEST MT5 Brokers For 2025: Reviewed By Dumb Little Man

By Wilbert S

January 5, 2025 • Fact checked by Dumb Little Man

MetaTrader 5 (MT5) is an advanced trading platform widely recognized in the Forex trading community. This platform offers enhanced features like more timeframes, additional technical indicators, and advanced charting tools. Choosing the best MT5 brokers is crucial for traders, as it directly impacts their trading experience and potential success.

The challenge in selecting the best MT5 brokers lies in the diverse range of options available, each with unique offerings. Factors like broker reputation, commission fees, and customer support quality play a significant role. It’s important for traders to carefully assess these aspects to ensure they align with their trading strategies and goals.

In a market filled with options, finding the most suitable MT5 broker can be a daunting task. The right broker not only provides a reliable platform but also ensures a secure and efficient trading environment. Therefore, the decision is not only about the platform but also about choosing a partner that can support a trader’s journey in the Forex market.

What is an MT5 Broker and How Does it Work?

MetaTrader 5 (MT5) is a popular trading platform used primarily for forex trading and other financial markets. It offers advanced tools and capabilities, making it a favorite among both novice and experienced traders. MT5 provides a comprehensive set of tools for technical analysis, including advanced charting capabilities, numerous technical indicators, and graphical objects.

The platform operates by allowing traders to access and interact with financial markets through an interface with brokers. Users can execute trades, analyze market trends, and employ automated trading strategies using Expert Advisors (EAs). MT5’s user-friendly design and customizable features contribute to its widespread use.

MT5 also supports the use of multi-asset trading, enabling users to trade in forex, stocks, and futures from a single platform. This integration offers a seamless trading experience and provides traders with a wide range of investment opportunities. Its ability to handle a large volume of trades efficiently makes it a robust tool for serious traders.

How Do We Rank the Best MT5 Brokers?

Ranking the best MT5 brokers involves evaluating several key factors that impact a trader’s experience and success. Regulation and security are paramount; brokers regulated by reputable authorities offer greater security and trustworthiness. This ensures that traders’ investments are protected and that the brokers adhere to strict financial standards.

Trading costs and spreads are also crucial in ranking MT5 brokers. Lower transaction costs and competitive spreads can significantly impact profitability. It’s essential to consider these financial aspects to identify brokers that offer the best value for money.

The quality of customer support is another important factor. Reliable customer service, available in multiple languages and through various channels, enhances the trading experience. Prompt and effective support is especially critical for resolving issues and providing guidance.

Lastly, additional features such as educational resources, analysis tools, and account types contribute to a broker’s ranking. These features can aid traders in making informed decisions and tailoring their trading strategies. A broker offering a range of resources and flexible account options is often ranked higher.

Best MT5 Brokers: Overview

Broker | Best For | Min. Initial Deposit | Top Feature | Overall Rating |

Overall MT5 Forex Trading | $100 | Multiple Trading Platforms | 5/5 | |

Advanced Forex Traders | $200 | MyFXBook Autotrade | 4.5/5 | |

Beginnner Traders | $10 | CopyFx | 4.5/5 | |

Low Spreads | $200 | Low Spreads | 4.5/5 | |

Crypto Trading | $0 | Fast Order Execution | 4.5/5 | |

Account Offering | $200 | Tight Spreads | 4.5/5 | |

Research and Education | $5 | Extensive Educational Resources | 4.5/5 | |

Trading Conditions | $100 | Multiple Trading Platforms | 4.5/5 | |

Investment | $100 | Diverse Trading Instruments | 4.5/5 |

9 Best MT5 Brokers: Detailed Insights

#1. Best Overall MT5 Broker: AvaTrade

AvaTrade stands out as the best overall MT5 broker due to its comprehensive range of services and regulatory compliance. Established in 2006, AvaTrade is a globally recognized forex and CFD broker, regulated by top financial institutions. This ensures a high level of security and trust for traders. Additionally, AvaTrade caters to both beginners and experienced traders with its extensive array of tools and resources. The inclusion of a paper trading account with $100,000 in virtual funds is particularly beneficial for beginners, providing a risk-free environment to practice trading strategies.

Apart from offering traditional forex trading, AvaTrade boasts a diverse portfolio of over 250 financial trading instruments. These include CFDs on bonds, stocks, commodities, indices, and ETFs, along with the ability to trade seven different cryptocurrencies. The platform’s appeal is enhanced by its zero commission policy and no bank account fees on transactions, making it a cost-effective option for traders. AvaTrade’s commitment to safety is evident in its regulation by tier-one jurisdictions, marking it as a trustworthy choice in the forex and CFD brokerage market. With its proprietary platforms like DupliTrade and ZuluTrade, along with MetaTrader, AvaTrade provides an exceptional trading experience, further supported by its above-industry-standard educational resources.

☞ How Does It Work?

AvaTrade provides its traders with the powerful MT5 platform, enabling them to engage in multi-asset trading. This platform allows for trading in a diverse range of assets, including CFDs on forex, stocks, commodities, indices, futures, energies, and cryptocurrencies. Traders benefit from flexible leverage, along with the assurance of no re-quotes, no price rejections, and zero slippages. These features combine to offer a smooth and efficient trading experience, making AvaTrade a go-to choice for various trading activities.

One of the standout features of the MT5 platform is its accessibility and convenience. Traders can use the MT5 Web platform to trade from any device with a web browser, including smartphones and tablets. This enhances the trading experience by providing flexibility and the ability to trade from anywhere. Additionally, MT5 offers advanced tools like trading robots, trading signals, and copy trading. These tools are accessible on a single platform, simplifying the trading process and offering powerful options to enhance trading strategies and efficiency.

☞ Who Is It Best For?

AvaTrade’s MetaTrader 5 (MT5) platform is particularly well-suited for a diverse range of traders. It is ideal for beginners who benefit from user-friendly features like a paper trading account and educational resources. Simultaneously, experienced traders appreciate its advanced tools, including trading robots and copy trading. This makes AvaTrade an excellent choice for those seeking a robust and flexible trading platform, capable of supporting various trading styles and strategies.

Whether a trader is new to the forex market or seasoned in complex financial instruments, AvaTrade’s MT5 platform offers the necessary features to meet their trading needs.

| Pros | Cons |

|---|---|

#2. Best MT5 Broker for Advanced Traders: FXChoice

FXChoice, established in 2010 and licensed by the International Financial Services Commission of Belize (FSC), stands out as the best MT5 broker for advanced CFD traders. This broker’s services are tailored to meet the needs of professional traders, especially those with ample free capital. FXChoice is renowned for its transparent trading conditions, offering a low spread for pro accounts and a comprehensive product guide that clearly outlines the fee structure. This level of transparency, combined with a robust partnership and loyalty program, positions FXChoice as a top choice for serious traders.

The platform’s strength lies in its coverage of CFD trading in various markets, including forex, crypto, indices, shares, and commodities. Traders have access to both MT4 and MT5 platforms, known for their versatility and advanced features. FXChoice is particularly noted for offering high-leverage opportunities, an attractive aspect for seasoned traders looking to amplify their trading capabilities.

Consequently, the broker enhances trading efficiency with the MyFXBook Autotrade feature, enabling users to emulate successful trading strategies. The commitment to fund segregation further assures traders that their investments are secure and distinct from the company’s funds, highlighting FXChoice’s dedication to transparency and client security.

☞ How Does It Work?

FXChoice integrates the MetaTrader 5 (MT5) platform to offer a dynamic online trading experience, focusing on automatic trading instruments. The platform enables investors to connect with the accounts of seasoned traders, allowing them to copy trades seamlessly. This system benefits both parties; investors can leverage the expertise of experienced traders, while the traders earn a predetermined fee from the profits of their followers. This feature is particularly advantageous for those who seek exposure to trading strategies without the need for constant personal involvement.

One of the key services provided by FXChoice is Myfxbook AutoTrade. This service is a standout feature on both MT4 and MT5 platforms, designed for trading accounts with a minimum balance of USD 1,000. Myfxbook AutoTrade allows users to replicate the trades of top-performing traders, whose ratings are publicly available on the Myfxbook website. This functionality not only simplifies the trading process but also opens up opportunities for investors to benefit from the proven strategies of successful traders. The compatibility of FXChoice’s VPS server with most copy-trading services further enhances the efficiency and reliability of this trading approach.

☞ Who Is It Best For?

FXChoice is optimally tailored for professional traders, who engage in both active and passive trading strategies. This platform is ideal for those who already possess a solid foundation in forex trading, as its features and tools are designed to cater to a more experienced audience. The necessity of prior trading knowledge is emphasized by the broker’s focus on sophisticated trading techniques and complex market analysis.

The emphasis on social trading at FXChoice requires a minimum deposit of $1,000, indicating its orientation towards traders with a certain level of expertise. This threshold underscores the platform’s suitability for traders who are competent in managing and minimizing risks associated with substantial financial investments. FXChoice, therefore, stands out as a prime choice for traders who have a good grasp of forex markets and are looking to leverage advanced trading capabilities and social trading opportunities.

| Pros | Cons |

|---|---|

#3. Best MT5 Broker for Beginners: RoboForex

RoboForex is highly esteemed in the forex trading industry, often recognized as a reliable partner by leading experts. Established in 2009, it now boasts a remarkable user base of 3.5 million across 169 countries. This platform is particularly appealing to beginners due to its favorable trading conditions, including a minimum deposit limit of just $10 and a high leverage option of up to 1:2000. Such accessible entry points and flexible trading options make RoboForex an ideal choice for those new to forex trading.

The platform’s credibility is further bolstered by its numerous awards and recognitions from prestigious financial institutions. Holding both an international license from the International Financial Services Commission (IFSC) and a European license from CySEC, RoboForex offers its forex trading services globally. For beginners, the CopyFx program, awarded “Best Investment Platform” in 2019, is a significant advantage. It provides a unique opportunity for novice traders to learn and grow by copying the strategies of successful traders. Additionally, the platform’s wide range of about 12,000 trading instruments and eight asset types ensures that beginners have ample opportunities to diversify and explore different trading avenues.

☞ How Does It Work?

RoboForex operates with a variety of account types including Pro, Pro-Cent, ECN, and Prime, each tailored with distinct specifications. The majority of these accounts are compatible with the MT4/MT5 platforms and support base currencies like USD, EUR, and ZAR.

For new users, RoboForex offers an attractive welcome bonus of $30 USD, and the process for depositing and withdrawing funds is straightforward and unrestricted.

Beyond forex, RoboForex also facilitates stock trading through its RoboForex R StockTrader account. The platform’s spread and leverage rates vary based on the account type, with spreads ranging from 0 to 1.3 pips, and the maximum leverage reaching up to 1:2000.

☞ Who Is It Best For?

The RoboForex platform is a great fit for both beginners and experienced traders. Its diverse range of account types, combined with comprehensive educational resources, makes it well-suited for traders at different levels of expertise.

Beginners can benefit from the platform’s user-friendly interface and learning materials, while more seasoned traders can take advantage of the advanced account features and trading tools. This balance of educational support and versatile trading options positions RoboForex as a versatile platform catering to a wide spectrum of trading needs.

| Pros | Cons |

|---|---|

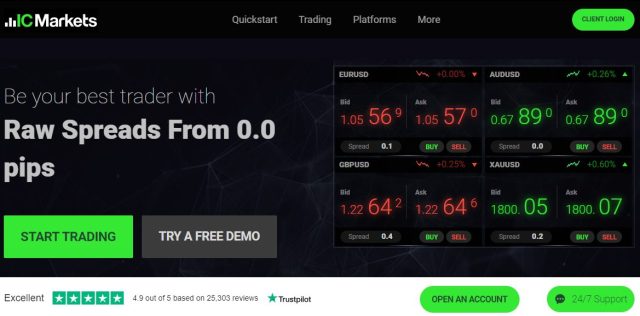

#4. Best MT5 Broker for Low Spreads: IC Markets

IC Markets, founded in Sydney, Australia in 2007, has established itself as a prominent brokerage firm, providing access to the global financial markets. The firm’s presence in various regions worldwide ensures that traders can operate in compliance with local laws, making it a versatile choice for a global clientele. This geographical reach, combined with its commitment to adhering to local regulations, positions IC Markets as a reliable option for traders seeking to access international markets.

Regulation is a key aspect of IC Markets’ operations. It is regulated by three major entities: the Cyprus Securities and Exchange Commission (CySEC), the Australian Securities and Investments Commission (ASIC), and the St. Vincent & the Grenadines Financial Services Authority (SVGFSA). These regulatory bodies ensure that IC Markets maintains high standards of security and compliance, particularly with international AML/CFT regulations. Furthermore, as a member of the Financial Commission, IC Markets provides additional trader security with an insurance fund that offers coverage of up to EUR 20,000 per trader.

This broker is particularly favored by institutional and retail investors, as well as algorithmic traders, for its access to some of the lowest spreads in the industry, making it a top choice for those seeking cost-effective trading conditions.

☞ How Does It Work?

IC Markets operates using the Equinix NY4 server and a state-of-the-art fiber-optic network, which guarantees incredibly fast order execution times, as quick as 40 milliseconds. This feature is especially beneficial for traders who value speed in their trading operations. Additionally, all clients of IC Markets have the option to use a free VPS for uninterrupted 24/7 trading. The broker offers a range of trading platforms, including MT4, MT5, and cTrader, as well as a convenient mobile app. These platforms provide access to a wide array of trading tools, including over 60 currency pairs, CFDs on futures, indices, commodities, metals, more than 2,100 stocks, bonds, and cryptocurrencies, catering to the diverse needs of traders.

Further enhancing the trading experience, IC Markets provides access to both MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms developed by MetaQuotes Software Corp., along with the cTrader platform from Spotware Systems. To augment the capabilities of these platforms, IC Markets offers additional add-ons such as the Advanced Trading Tools package for desktop users. There are also third-party plugins available, including those from AutoChartist and Trading Central. While these plugins require separate installation, they significantly enhance the MetaTrader platforms’ functionality, making them a valuable addition for traders looking to leverage advanced trading features and analytical tools.

☞ Who Is It Best For?

IC Markets is particularly well-suited for algorithmic traders, thanks to its competitive pricing and scalable execution features. These aspects of IC Markets make it an appealing choice for traders who rely on algorithms and automated trading strategies. Furthermore, the broker provides a comprehensive range of social copy-trading platforms and plugins, enhancing the trading experience and offering versatile options for different trading styles and preferences.

| Pros | Cons |

|---|---|

#5. Best MT5 Broker for Crypto Trading: Pepperstone

Pepperstone is a renowned online brokerage firm known for its specialization in forex and CFD trading. Founded in 2010 and based in Australia, Pepperstone has quickly gained a reputation for providing a user-friendly and technologically advanced trading experience. The firm is regulated by multiple top-tier authorities, ensuring a high standard of security and reliability for its clients.

What sets Pepperstone apart as the best MT5 broker for crypto trading is its exceptional offering in the cryptocurrency market. The broker provides traders with access to a wide range of cryptocurrencies, paired with low spreads and no commission fees. This combination of extensive crypto options and cost-effective trading conditions makes Pepperstone a top choice for those looking to trade cryptocurrencies using the advanced features of the MT5 platform.

☞ How Does It Work?

On Pepperstone’s MT5 platform, crypto trading is designed to be both accessible and efficient for traders. The platform facilitates trading in various cryptocurrencies, offering a seamless trading experience. Traders can capitalize on the volatility of the crypto market with the advantage of tight spreads and no commission fees, which are key features of Pepperstone’s offering. These favorable conditions enable traders to engage in cryptocurrency trading with reduced transaction costs, enhancing the potential for profitability.

What makes Pepperstone’s MT5 platform the best choice for crypto trading lies in its advanced features and user-friendly interface. The platform is equipped with comprehensive charting tools and analytical resources, allowing traders to make informed decisions based on market trends and data. Additionally, the integration of real-time market updates and high-speed execution capabilities ensures that traders can respond quickly to market movements, a crucial aspect when trading in the dynamic crypto market.

☞ Who Is It Best For?

Pepperstone is an ideal MT5 broker for experienced traders who focus on forex and cryptocurrency trading. Its low forex fees and sophisticated trading platform cater to those who seek cost-effective and reliable trading experiences. Additionally, traders who appreciate high-quality customer service will find Pepperstone’s responsive and knowledgeable support team particularly beneficial.

However, Pepperstone may not be the best fit for beginner traders or those seeking passive trading opportunities. The absence of a cent account and limited options for passive trading might deter new traders or those interested in less active trading strategies. Also, the platform’s limited onsite analytical materials could be a drawback for traders who rely heavily on comprehensive market analyses, although this can be mitigated by connecting to external trading signals.

| Pros | Cons |

|---|---|

#6. Best MT5 Broker for Account Offering: Exness

Exness, a well-established Forex broker since 2008, stands out as the best MT5 broker for account offerings. The broker is renowned for delivering high-quality services to its traders, aided by exceptional technical support that ensures successful trading experiences. The combination of modern tools and dedicated services provided by Exness is geared towards maximizing traders’ profits, making it a top choice for those seeking a robust trading platform.

The range of premium services and investment instruments offered by Exness is comprehensive and can be easily accessed on its official website. This includes a variety of trading platforms, flexible payment methods for both depositing and withdrawing funds and valuable analytics resources. Furthermore, the broker’s credibility is reinforced by its regulation under authoritative bodies like CySEC, FCA, and FSA. This regulatory oversight, along with its extensive service offerings, makes Exness an ideal broker for traders looking for a reliable and versatile trading environment.

☞ How Does It Work?

Exness provides a variety of account options, tailored to match the professionalism level and needs of different traders. These accounts differ primarily in terms of spread size, minimum deposit requirements, and leverage options. This flexibility allows traders to choose an account that best fits their trading style and experience level.

The Standard account is the most popular choice, suitable for traders of any level. It requires a minimum deposit of just $1 and offers spreads starting from 0.3 pips. For those new to trading or looking to test strategies, the Standard Cent account is ideal. It also has a $1 minimum deposit and offers infinite leverage for deposits up to $999, with spreads from 0.3 pips.

The Standard Plus account caters to all traders, allowing trading in small lots with a minimum deposit of $1 and a spread from 1 pip. For more experienced traders, the Raw Spread account offers narrow spreads and a commission of $3.5 per standard lot (one side), with a minimum deposit of $200. The Zero account is designed for professionals, featuring zero spreads for over 95% of the trading day on 30 currency pairs, a minimum deposit of $200, and a commission of $0.2 per lot/one way.

Lastly, the Pro account is tailored for professional traders, offering immediate order execution and no trading commission, with a minimum deposit of $200 and lots from 0.01. These diverse account options make Exness a versatile platform, catering to a wide range of trading preferences and strategies.

☞ Who Is It Best For?

Exness is best suited for a broad spectrum of traders, ranging from novices to seasoned professionals. The diverse account types, such as Standard and Standard Cent, make it an accessible option for beginners who are starting with small deposits and wish to practice strategies. At the same time, the Raw Spread and Pro accounts cater to more experienced traders looking for narrow spreads and professional trading conditions.

The platform’s flexibility and features also make it an attractive choice for algorithmic traders and those utilizing automated trading systems. The offer of complimentary VPS hosting supports these trading styles by ensuring faster and more reliable execution of trades. Thus, whether a trader is just entering the forex market or is an experienced professional seeking advanced trading options, Exness provides the necessary tools and account types to suit a wide range of trading objectives and strategies.

| Pros | Cons |

|---|---|

#7. Best MT5 Broker for Research and Education: XM

XM stands out as a leading global online financial trading platform, renowned for its extensive array of trading instruments. These include Forex, Cryptocurrencies, Stock CFDs, Turbo Stocks, Commodities, Equity Indices, Precious Metals, Energies, and Shares. Based in Cyprus, XM maintains high regulatory standards, adhering to rules set by respected financial authorities like CySEC, FCA, and ASIC. This dedication to regulation ensures a secure and transparent trading environment for its clients, making XM a reliable choice for traders worldwide.

In the realm of research and education, XM shines as the best platform for retail investors. Founded in 2009, it has amassed over 10 million clients from more than 190 countries, a testament to its commitment to providing an exceptional trading experience. XM’s offerings extend beyond traditional trading options, including margin trading with leverage up to 1000:1.

This, coupled with its dedication to client education and research resources, positions XM as the go-to platform for traders seeking comprehensive knowledge and a wide range of trading opportunities. This focus on education and diverse trading options makes XM particularly appealing to both new and experienced traders looking for a platform that supports their growth and development in the financial markets.

☞ How Does It Work?

XM provides a comprehensive free educational course for those new to online trading or looking to refresh their knowledge in forex. This course guides learners through the essential steps required to master forex trading. Covering everything from the basics of currency exchange to the most effective technical and fundamental analysis tools, the course is structured to impart a thorough understanding of how forex trading functions. This empowers traders to approach the forex market with greater confidence and a solid foundation of knowledge.

In addition to its educational offerings, XM has recently bolstered its research and education services by launching a dedicated Telegram channel. This channel serves as a direct line for clients and interested traders to receive the latest updates about XM, including educational programs, new features, and promotional events. This initiative underscores XM’s commitment to keeping its clients well-informed and educated, further establishing it as a leading platform for those who value continuous learning and staying updated in the dynamic world of online trading.

☞ Who Is It Best For?

XM is ideally suited for traders who prioritize education and research in their trading journey. Its comprehensive educational resources make it a perfect platform for beginners or those looking to enhance their trading knowledge. Additionally, traders who appreciate detailed market analysis and wish to stay updated with current market trends and updates through platforms like Telegram will find XM highly beneficial.

The platform is also a great fit for diversified traders, given its offering of over 1,000 trading instruments, including a vast array of currency pairs, CFDs, and commodities. XM’s commitment to covering all payment system fees and providing 24/7 live chat support in multiple languages further adds to its appeal, particularly for traders who value cost-efficiency and accessible customer service. However, XM may not be the best choice for traders in the United States, as it does not accept clients from that region. Additionally, its spreads can be higher than other industry providers, and non-EU clients may not receive the same level of investment protection.

| Pros | Cons |

|---|---|

#8. Best MT5 Broker for Trading Conditions: Alpari

Alpari stands out as a leading brokerage firm, recognized as the best for trading conditions. With a history spanning over 24 years, Alpari has grown from a small Russian startup to a global trading company. This growth is a testament to their resilience and adaptability, having navigated through numerous crises and complexities. Their extensive experience underpins their understanding of traders’ needs and market dynamics, making them a reliable choice for traders around the world.

The company’s commitment to providing high-quality services and creating a trader-friendly environment is evident in its wide range of services. Catering to over a million clients from 150 countries, Alpari focuses on modern internet trading in the foreign exchange currency market. The introduction of innovative features like a cashback program and a mobile app for Internet trading further enhances the trading experience.

Additionally, Alpari’s establishment of a philanthropic foundation highlights their broader commitment to social responsibility, adding a unique dimension to their role in the financial trading industry. These factors combined position Alpari as a top choice for traders seeking a broker that offers excellent trading conditions and innovative services.

☞ How Does It Work?

Alpari offers a selection of four different account types, each tailored to suit various trading preferences and strategies. These accounts are compatible with both MT4 and MT5 platforms, featuring distinct deposit fees, spreads, leverage options, and commission rates. Traders have the flexibility to choose from four base currencies: USD, GBP, NGN, and EUR, allowing them to trade in a currency that they are most comfortable with. This variety ensures that both novice and seasoned traders can find an account that matches their specific trading requirements.

In addition to the traditional MT4/MT5 platforms, Alpari introduces a unique feature for binary trading with its Binary option platform. Another notable offering is the Copy Trading feature, ideal for new users who can start using this automated trading tool with a minimum deposit of $100. The platform’s versatility extends to trading in Forex, Cryptocurrencies, commodities, stocks, CFDs, and metals, catering to a wide range of investment preferences.

☞ Who Is It Best For?

Alpari is particularly beneficial for beginners in the trading world. The platform’s features and tools are designed to be user-friendly and easy to understand. Additionally, the transparent fee structure helps new traders to easily comprehend the various charges associated with trading on the platform. This clarity and simplicity make Alpari a welcoming environment for those starting their trading journey.

Conversely, the broker also caters to professional traders with its ECN Pro and standard accounts. These account types are tailored for more experienced traders, offering fast order execution and advanced trading conditions. This makes Alpari a versatile choice, capable of accommodating the needs of both novice and professional traders looking for an efficient and transparent trading experience.

| Pros | Cons |

|---|---|

#9. Best MT5 Broker for Investment: Admiral Markets

Admiral Markets has established itself as a leading name in the financial investment services industry since its inception in 2001. As one of the world’s largest Forex and CFD brokers, it demonstrates a strong global presence with headquarters in the UK and additional offices in Cyprus, Estonia, and Australia. This expansive reach underscores its commitment to catering to a diverse international clientele, making it an ideal choice for investors seeking a broker with global expertise.

The commitment of Admiral Markets to provide efficient software and high-quality services is evident in its approach to trading. They offer a trading environment characterized by low latency and high trading frequency, which is crucial for investors looking to execute timely and efficient trades. This efficiency is achieved by aggregating data from various banks and venues into a single liquidity pool, ensuring that traders receive the best possible trading conditions. These features combined with transparent pricing and execution make Admiral Markets a top choice for investors seeking a reliable and effective MT5 Broker for their investment needs.

☞ How Does It Work?

Admiral Markets operates with a selection of flexible account options, tailored to meet the varying requirements of different traders. These accounts are categorized into two main types, based on their associated trading platforms: the Admiral Markets Account and the Admiral MT5 Account. Each account type is designed to align with specific trading needs and preferences.

The Trade.MT5 Account offers a variety of currency options for traders, including USD, EUR, GBP, and POL, among others, featuring a competitive spread starting from 0.5 pips. For investors, the Invest.MT5 Account is particularly appealing, requiring only a minimum deposit of $1, making it highly accessible for beginners or those with limited investment funds. Alternatively, the Zero.MT5 Account provides the benefit of minimal spreads, starting at zero. However, it is important to note that this account type does not include access to commodity futures or cryptocurrency CFDs.

☞ Who Is It Best For?

Admiral Markets is ideally suited for a wide range of traders and investors. The Trade.MT5 and Zero.MT5 accounts are particularly beneficial for active traders seeking competitive spreads and a broad choice of currencies. These account types are suitable for traders who prioritize cost efficiency and a diverse range of trading options.

On the other hand, the Invest.MT5 Account is an excellent option for newcomers to investing or those with smaller budgets, offering an easy entry point into the world of trading. This versatility makes Admiral Markets a prime choice for both novice investors and experienced traders looking for tailored account options to suit their specific trading needs and goals.

| Pros | Cons |

|---|---|

How To Choose the Best MT5 Broker?

Choosing the best MT5 broker requires careful consideration of several critical factors. First and foremost, it’s essential to verify the broker’s regulatory compliance. A broker regulated by reputable authorities ensures a secure and transparent trading environment. Additionally, evaluating the quality of customer support is crucial, as this can significantly impact your trading experience, especially in resolving issues and providing timely assistance.

Another key aspect is assessing the range of trading instruments the broker offers. A diverse portfolio, including forex, stocks, commodities, and more, allows for broader investment opportunities. It’s also important to consider the trading costs and fees, including spreads and commissions, as these affect the profitability of your trades. The broker’s technological infrastructure, especially in terms of execution speed and platform stability, plays a vital role in effective trading. Choosing a broker that aligns well with your individual trading needs and strategies is essential for a successful trading experience with MT5.

Choose Asia Forex Mentor for Your Forex Trading Success

Asia Forex Mentor is an outstanding option for those dedicated to mastering forex trading and seeking substantial financial gains. Founded by Ezekiel Chew, a notable figure in the trading industry recognized for his significant trades and contributions to trading institutions, this platform distinguishes itself. Key aspects that make Asia Forex Mentor a preferred educational platform include:

Comprehensive Educational Content: The program covers a wide array of subjects in forex, stock, and crypto trading, offering an in-depth curriculum aimed at providing the necessary skills and knowledge for market success.

High Success Rate: The platform has a proven track record of producing consistently profitable traders, validating the effectiveness of its educational methods and mentorship.

Expert Mentorship: Learners receive personalized guidance from Ezekiel Chew, leveraging his extensive knowledge in various trading sectors to navigate market intricacies.

Supportive Trading Community: Participants gain access to a community of fellow traders, fostering a collaborative environment for sharing ideas and enhancing the learning experience.

Emphasis on Psychological Strength: The course focuses on the mental aspects of trading, teaching mental resilience, emotional control, and decision-making skills vital for trading prowess.

Current Market Insights: Asia Forex Mentor provides continuous access to up-to-date market information and tools, ensuring learners stay abreast of evolving strategies and trends.

Transformative Testimonials: Numerous success stories of students achieving financial independence through the program underscore its effective and life-changing approach.

In summary, Asia Forex Mentor is an excellent choice for those aiming for high-quality education in forex, stock, and crypto trading. Its holistic curriculum, expert guidance, practical approach, and supportive environment equip learners with the necessary tools and insights to excel in various financial markets.

RECOMMENDED TRADING COURSE | REVIEW | VISIT |

#1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |

Conclusion

Based on the analysis by the team of trading experts at Dumb Little Man, it’s evident that each MT5 broker has its unique strengths catering to different trader needs. Brokers like AvaTrade and XM stand out for their user-friendly platforms, making them ideal for both beginners and experienced traders. They offer extensive educational resources and a wide range of trading instruments, ensuring a comprehensive trading experience. However, it’s important to be aware of their limitations, such as AvaTrade’s higher inactivity fees and XM’s limited educational content in certain languages.

On the other hand, brokers like Alpari and Admiral Markets are recognized for their specialized services, such as Alpari’s binary trading options and Admiral Markets’ focus on investment. While they provide innovative trading solutions and have a strong global presence, potential drawbacks include Alpari’s leverage restrictions for non-professional traders and Admiral Markets’ withdrawal fees. Overall, when choosing the best MT5 broker, traders should weigh the pros and cons of each to find a broker that aligns best with their trading goals and strategies, ensuring a balanced and informed decision.

>>Also Read: 9 BEST CFD Brokers For 2024: Reviewed By Dumb Little Man

Best MT5 Brokers FAQs

What are the Best MT5 Brokers for Beginners?

The best MT5 brokers for beginners typically include AvaTrade and XM, known for their user-friendly interfaces, comprehensive educational resources, and supportive customer service. These platforms offer a conducive environment for newcomers to learn and grow in forex trading.

Can I Trade Cryptocurrencies on MT5 Brokers?

Yes, many MT5 brokers offer cryptocurrency trading. Pepperstone, for instance, is renowned for its extensive cryptocurrency offerings, providing traders with the opportunity to trade various digital currencies on the MT5 platform.

Are MT5 Brokers Regulated?

Reputable MT5 brokers are usually regulated by recognized financial authorities. For example, Admiral Markets is regulated by authorities like the FCA and CySec, ensuring a secure and transparent trading environment for its users. Always check a broker’s regulatory status before trading.

Dumb Little Man Recommends – Top 3 Best Forex Brokers in 2024 | ||

Wilbert S

Wilbert is an avid researcher and is deeply passionate about finance and health. When he's not working, he writes research and review articles by doing a thorough analysis on the products based on personal experience, user reviews and feedbacks from forums, quora, reddit, trustpilot amongst others.