Bespoke Funding Program Review with Rankings 2025 By Dumb Little Man

By John V

January 5, 2025 • Fact checked by Dumb Little Man

| Evaluation Criteria |

|---|

The finance and trading specialists at Dumb Little Man thoroughly assess proprietary trading firms using a complex algorithm and strict criteria. Their review emphasizes key factors including:

|

“Prop trading firms” allow traders to trade using the funds of the company, splitting gains and lowering individual risk. These companies give traders access to a wealth of information and knowledge. Bespoke Funding Program distinguishes itself by creating distinctive funding options that enable professional trading. Its remote trading strategy allows traders to effectively and efficiently manage capital from anywhere in the world.

This review delves deeply into the Bespoke Funding Program, utilizing real consumer feedback and trade professionals’ insights from Dumb Little Man. To present a concise and detailed assessment, this piece will cover the program’s features, advantages, and potential areas for development. The objective viewpoint that readers will obtain will help them make more informed decisions about prop trading opportunities.

What is Bespoke Funding Program?

The Bespoke Funding Program is intended for traders who want to manage substantial cash and reach their full potential. This initiative, which was started by successful traders who have a good sense of what hidden potential is, intends to offer special funding opportunities as well as a clear route to becoming a funded trader. It is a global operation that enables people to manage significant capital remotely using the funds of the company.

To create a user-friendly experience, the Bespoke Funding Program combines essential trading data with state-of-the-art technology. To establish Bespoke as the top proprietary trading firm in the world, traders can access premium liquidity. The innovative approach of the program is to offer the community an unrivaled funding experience.

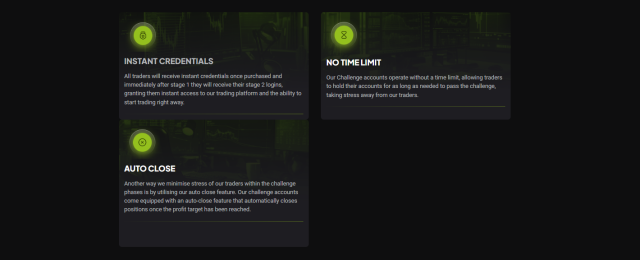

The Bespoke Dashboard ensures that one’s trading path is visible and facilitates simpler tracking of progress. The program’s fully automated technology makes instant account access feasible and streamlines the trading process for traders. The absence of time limits in the trading challenges is one of its distinctive features; this releases pressure and allows traders to work at their own pace.

Bespoke distinguishes itself by providing traders of all skill levels with competitive spreads. With its staged challenges offering the chance to trade up to $4,000,000, its funding choices are quite considerable. After four weeks of trading, traders can begin taking winnings out of the system. Subsequent payouts are made accessible every two weeks, demonstrating the program’s dedication to helping traders succeed.

Pros and Cons of Bespoke Funding Program

Pros:

- Unique funding opportunities for traders

- Remote trading allowed worldwide

- User-friendly experience with leading technology

- Access to tier-1 liquidity

- Competitive spreads and low commissions

- No time limit on trading challenges

- Flexible withdrawal options

- Partnership with Eightcap

- Various account types and sizes

- News Trading allowed

Cons:

- Not registered or authorized by the FCA

- Bonuses and contests are currently not offered

- Specific rules and restrictions on trading strategies

- Limited instant customer support options

- Support limited to business days

Safety and Security of Bespoke Funding Program

The safety and security of the Bespoke Funding Program are critical considerations for traders exploring proprietary trading opportunities. While the program is not authorized or registered by the FCA (Financial Conduct Authority), it’s essential to note that prop firms are not mandated to obtain such registration. This detail emerged from in-depth research conducted by Dumb Little Man, aimed at providing a clear understanding of the program’s regulatory stance.

As its official broker, Bespoke Funding Program has partnered with Eightcap to improve trading efficiency and security measures. Because of this partnership, traders now have the option to select between the well-known MT4 and MT5 trading platforms, which are both highly regarded for their strong security features and intuitive user interfaces.

Bespoke Funding Program Bonuses and Contests

There are several attractive competitions and incentives offered to traders by the Bespoke Funding Program, two of which are enhanced profit splits and discount coupons. Tradesmen can save a substantial amount of money—up to 25%—on their purchases by using the promo code LOVE.

Additionally, traders are greatly encouraged to optimize their profits by using the code HEART, which offers a 17.5% discount and increases the profit share to an amazing 90%. These offers demonstrate Bespoke’s dedication to helping the community and entice both new and seasoned traders to seize these favorable conditions.

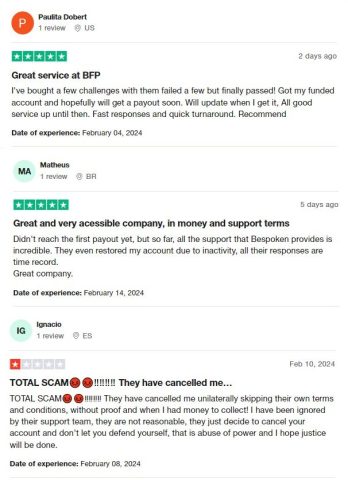

Bespoke Funding Program Customer Reviews

A reputable proprietary trading firm, Bespoke Funding Program has received mixed reviews from consumers, as seen by its current Trustpilot rating of 4.4 stars, which is regarded as inadequate. There are critics of the program as well, even though several traders have commended it for its prompt responses, rapid turnaround, and amazing support—which includes account restoration and helpful service during trading difficulties.

One prominent complaint describes an instance in which a trader’s account was abruptly terminated, purportedly in violation of the terms and conditions of the program, resulting in problems with unpaid invoices and inadequate assistance. Together, these reviews show a wide range of experiences, pointing to possible areas where the Bespoke Funding Program’s customer service and transparency should be strengthened.

Bespoke Funding Program Commissions and Fees

Two account types, Classic and Rapid challenge, are available through the Bespoke Funding Program in collaboration with Eightcap. Each has a different commission and fee schedule. Fees are included in the spread for standard accounts, which helps traders see their costs upfront. Rapid accounts, on the other hand, apply fees as commissions straight and provide transparency regarding trading costs.

Bespoke is proud of its favorable trading conditions, which include low spreads and a tempting $4 lot commission when using Eightcap and the MetaTrader 4 and MetaTrader 5 platforms. Even with these advantageous parameters, the 1-step challenge includes disadvantages such as a 75% profit split and 1:10 leverage that may make it less alluring than agreements from other proprietary trading organizations.

More limitations, including the need to set a stop loss on each transaction and the inability to hold contracts over the weekend, can be avoided to allow traders a little more flexibility at a price.

After proceeding to the second phase, traders are paid every two weeks for 80% of their winnings, under the same terms as during the evaluation phase. This is a pivotal moment in the trader’s journey because the assessment cost and the initial profit distribution are being reimbursed.

Along with having an 80% profit share, the 2-step challenges also pay out every two weeks, matching industry norms for payout frequency and profit-sharing. The first reward is made available after 30 days.

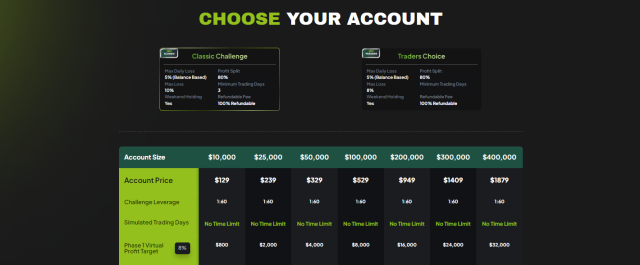

Bespoke Funding Program Account Types

After a thorough analysis by the Dumb Little Man team, we provide an organized rundown of the Bespoke Funding Program Account Types, emphasizing key characteristics that accommodate a range of trading preferences and styles. These accounts are made to provide traders with lots of choices, freedom, favorable trading circumstances, and even profit target.

Classic Challenge Account

- Max Daily Loss: 5% (Balance Based)

- Profit Split: 80%

- Max Loss: 10%

- Minimum Trading Days: 3

- Weekend Holding: Allowed

- Refundable Fee: Yes, 100% Refundable

- Challenge Leverage: 1:60 for all sizes

- Simulated Trading Days: No Time Limit

Account Sizes and Details

- $10,000

- $129

- Phase 1 Target: $800

- Phase 2 Target: $500

- Max Loss: $1,000

- Daily Loss: $500

- $25,000

- $239

- Phase 1 Target: $2,000

- Phase 2 Target: $1,250

- Max Loss: $2,500

- Daily Loss: $1,250

- $50,000

- $329

- Phase 1 Target: $4,000

- Phase 2 Target: $2,500

- Max Loss: $5,000

- Daily Loss: $2,500

- $100,000

- $529

- Phase 1 Target: $8,000

- Phase 2 Target: $5,000

- Max Loss: $10,000

- Daily Loss: $5,000

- $200,000

- $949

- Phase 1 Target: $16,000

- Phase 2 Target: $10,000

- Max Loss: $20,000

- Daily Loss: $10,000

- $300,000

- $1409

- Phase 1 Target: $24,000

- Phase 2 Target: $15,000

- Max Loss: $30,000

- Daily Loss: $15,000

- $400,000

- $1879

- Phase 1 Target: $32,000

- Phase 2 Target: $20,000

- Max Loss: $40,000

- Daily Loss: $20,000

Traders Choice Account

- Max Daily Loss: 5% (Balance Based)

- Profit Split: 80%

- Max Loss: 8%

- Weekend Holding: Allowed

- Refundable Fee: Yes, 100% Refundable

- Challenge Leverage: 1:100 for all sizes

- Simulated Trading Days: No Time Limit

Account Sizes and Details:

- $10,000

- $99

- Phase 1 Target: $800

- Phase 2 Target: $500

- Max Loss: $800

- Daily Loss: $500

- $25,000

- $195

- Phase 1 Target: $2,000

- Phase 2 Target: $1,250

- Max Loss: $2,000

- Daily Loss: $1,250

- $50,000

- $304

- Phase 1 Target: $4,000

- Phase 2 Target: $2,500

- Max Loss: $4,000

- Daily Loss: $2,500

- $100,000

- $499

- Phase 1 Target: $8,000

- Phase 2 Target: $5,000

- Max Loss: $8,000

- Daily Loss: $5,000

- $200,000

- $919

- Phase 1 Target: $16,000

- Phase 2 Target: $10,000

- Max Loss: $16,000

- Daily Loss: $10,000

- $300,000

- $1369

- Phase 1 Target: $24,000

- Phase 2 Target: $15,000

- Max Loss: $24,000

- Daily Loss: $15,000

- $400,000

- $1849

- Phase 1 Target: $32,000

- Phase 2 Target: $20,000

- Max Loss: $32,000

- Daily Loss: $20,000

Opening a Bespoke Funding Program Account

The Bespoke Funding Program, designed to assist traders in starting their road toward becoming professional traders, requires a straightforward, step-by-step process to open an account. These eight simple steps, which include entering personal information and selecting the optimal trading strategy, ensure a seamless setup that results in a profitable trading journey.

- The first step is to enter your name.

- Give us your email address so we can communicate with you.

- Establish and validate a password to protect your account.

- Choose a trading plan based on realistic trading objectives.

- To continue, click the “Get Funded” button.

- Select the preferred plan type from the list of available options.

- Choosing the right account size for you depends on your trading approach.

- Ultimately, accept the privacy statement and terms and conditions by clicking “Purchase” to finish the transaction.

Bespoke Funding Program Customer Support

For any questions or problems traders could run across, the Bespoke Funding Program provides committed customer support. Contact the support team at Dubai Silicon Oasis, DDP, Building A1, Dubai, United Arab Emirates, by phone at +971 52 200 3664 or email at [email protected], based on Dumb Little Man’s experience. Another sign of their dedication to offering prompt service is their accessibility.

They stress that they will assist and pledge to respond to all emails within a day on business days to demonstrate their availability. To expedite the process, they advise reading the FAQ section before contacting them, as it contains answers to frequently asked questions. The way Bespoke Funding Program handles customer service demonstrates its commitment to effectively supporting its traders.

Advantages and Disadvantages of Bespoke Funding Program Customer Support

| Advantages | Disadvantages |

|---|---|

|

Bespoke Funding Program Withdrawal Options

According to a trading expert at Dumb Little Man, the Bespoke Funding Program efficiently meets the needs of traders by streamlining the withdrawal process for different account kinds. Traders with Classic and Rapid accounts have 14 calendar days to withdraw; subsequent payouts happen every two weeks.

In contrast, those participating in the one-step challenge have the liberty to request their initial withdrawal at any moment, with subsequent payouts calculated over a 30-day cycle. Regardless of the account type, once approval is granted for funding projects, there are no strict profit targets for requesting a payout.

Withdrawal methods are designed for convenience, encompassing bank transfers, credit/debit cards, and electronic payment systems, to ensure secure and smooth transactions. This approach not only demonstrates Bespoke’s commitment to providing versatile financial solutions but also its aim to foster a supportive and accessible trading environment.

Bespoke Funding Program Challenges and Difficulties

Bespoke Funding Program emphasizes strict compliance with its trading rules to ensure a fair and sustainable trading environment. Traders must observe lot size restrictions based on their trading account balance to maintain the integrity of their trading strategies. The program explicitly bans the use of Martingale strategies and third-party copy trading, as these can increase risk and potentially violate capital allocation limits.

Strategy Restrictions

The funding programs sets clear boundaries on trading strategies to safeguard against high-risk behaviors. Martingale strategies and the use of Expert Advisors (EAs) that mimic other traders’ strategies are strictly prohibited. These rules are in place to prevent excessive risk-taking that could endanger the trader’s capital and the program’s financial health.

Lot Size and Strategy Compliance

The program lays forth specific guidelines for people who are participating in the 1-Step Challenge Account. There are restrictions on lot sizes based on the trader’s initial account size, and martingale methods are prohibited. To keep trading within reasonable risk bounds, this structure enables traders to open positions ranging from 4 lots for a $10,000 account to 160 lots for a $400,000 account.

How to Pass Bespoke Funding Program Evaluation Process

Because of its strict requirements, navigating the Bespoke Funding Program’s evaluation procedure might be difficult. It is imperative to acquire the necessary knowledge and methods in order to maximize the chances of success. Enrolling in a thorough training program is a wise strategic decision since it gives participants the knowledge and skills they need to pass the evaluation phase and effectively traverse it.

Asia Forex Mentor – Rated Best Comprehensive Course Offering by Investopedia

Asia Forex Mentor is the ideal venue for those who are committed to passing the Bespoke Funding Program assessment. It is highly respected by the trading specialists at Dumb Little Man and has assisted hundreds of traders in passing many assessments from the prop trading industry.

The platform’s founder, Ezekiel Chew, brings a plethora of trading knowledge to the table and has over 20 years of experience in forex trading. Among his noteworthy accomplishments are the founding of the Golden Eye Group and large transaction fees.

A significant achievement in Chew’s quest to disseminate his plethora of expertise and trading techniques is the establishment of Asia Forex Mentor, namely the One Core Program. The lessons were expanded online as a result of the effort started by Chew’s inner group, who advocated for the exchange of knowledge. Chew’s rise from a popular online teacher to a much-desired trading advisor among friends shows his dedication to helping traders.

Asia Forex Mentor is a learning resource designed by Chew to impart useful trading strategies, not only a forex trading platform. Giving traders the resources they need to thrive in the forex market and overcome the challenges of the Bespoke Funding Program is the aim.

How Could Asia Forex Mentor Help You Pass Bespoke Funding Program Challenge?

Because of Asia Forex Mentor’s established reputation in the forex education industry, there’s a good possibility you’ll pass the Bespoke Funding Program exam. Here’s how Asia Forex Mentor sets itself apart as an essential resource for aspiring traders:

Awarded for Comprehensive Curriculum: Investopedia has named Asia Forex Mentor’s One Core curriculum the greatest comprehensive forex training curriculum available. This award emphasizes the program’s comprehensiveness and breadth, showing that it covers a wide range of subjects necessary for successful FX trading.

Selected as the Best Beginner’s Forex Trading Instruction: The One Core Program is the greatest forex trading course for novices, according to Benzinga. This acknowledgment shows how well the curriculum teaches new traders the knowledge and abilities needed to successfully traverse the forex market, from fundamentals to sophisticated trading methods.

Best Forex Mentor: The curriculum gains even more credibility with BestOnlineForexBroker’s 2021 certification as Best Forex Mentor. This accreditation demonstrates that Asia Forex Mentor provides outstanding educational information along with coaching that can lead to significant results in forex trading.

Top Ranking for Trading Strategies and Systems: Asia Among all the Forex trading courses reviewed by seasoned traders and platforms, Forex Mentor’s curriculum was commended for its exceptional trading strategies and systems. This recommendation shows how the program offers practical, applicable knowledge that may be applied right away to trading situations, like the challenge in the Bespoke Funding Program.

The awards and recognition that Asia Forex Mentor has received testify to its effectiveness in dispensing in-depth and useful forex trading strategies. For traders who wish to pass the evaluation for the Bespoke Funding Program, enrolling in Asia Forex Mentor’s One Core Program provides a solid foundation. It provides a blend of skills, strategies, and mentoring created especially to support traders in the competitive world of foreign exchange trading.

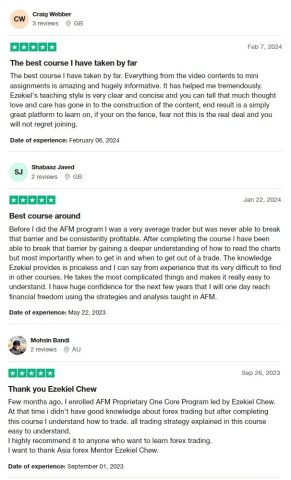

Asia Forex Mentor Members’ Testimonials

Participants in Ezekiel Chew’s One Core Program at Asia Forex Mentor have expressed thanks for the program’s significant improvement in their trading abilities and help passing prop firm tests. The course is commended for its clear, concise content and practical trading strategies that have helped transform average traders into consistently profitable ones.

Testimonials show how well the curriculum works to simplify intricate trading principles, provide a thorough understanding of market analysis, and give traders who want to become financially independent confidence. Overall, participants advise anyone wishing to advance their knowledge of FX trading to take this class.

>> Also Read: Asia Forex Mentor Review By Dumb Little Man

Conclusion: Bespoke Funding Program Review

The Bespoke Funding Program is unique in the way it provides traders all around the world with the chance to manage substantial funds through funding opportunities. Its cutting-edge technology, competitive spreads, minimal commissions, flexibility with trading issues and withdrawals, and affiliation with reputable brokers will pique the interest of aspiring traders.

However, prospective participants should consider the program’s shortcomings, which include a limited selection of trading strategies, no FCA registration, no bonuses, inconsistent ratings, and no other options for customer support. In-depth courses like Asia Forex Mentor can help traders improve their odds of passing the evaluation for the Bespoke Funding Program.

>> Also Read: XLTRADE Review with Rankings 2024 By Dumb Little Man

Bespoke Funding Program Review FAQs

What is the main focus of Bespoke Funding Program’s evaluation process?

The main goal of the evaluation procedure for the Bespoke Funding Program is to carefully evaluate traders’ ability to manage capital and consistently turn a profit through strategic trading. Traders must pass thorough examinations to show that they can implement disciplined trading methods, manage risk, and generate long-term profits.

Does Bespoke Funding Program offer a funded account?

Yes, after completing their review procedure, traders have access to funded accounts through the Bespoke Funding Program. Traders can trade with the firm’s capital through these funded accounts, potentially generating profits while reducing their financial risk.

Does Bespoke Funding Program have an auto close feature?

In fact, the Bespoke Financing Program has an auto-close function that shuts down deals immediately when certain risk thresholds are hit. Through the prevention of excessive losses and the maintenance of adherence to risk management standards, this function helps protect traders’ funds.

RECOMMENDED TRADING COURSE | REVIEW | VISIT |

#1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |

John V

John is a digital marketing master's student who enjoys writing articles on business, finance, health, and relationships in his free time. His diverse interests and ability to convey complex ideas in a clear, engaging manner make him a valuable contributor to these fields.