Forecasting British Pound Movements & Market Sentiments: Insights on GBP/USD, GBP/JPY, and EUR/GBP

By Daniel M.

March 14, 2024 • Fact checked by Dumb Little Man

British Pound Outlook: GBP/USD, GBP/JPY, EUR/GBP

Contrarian sentiment indicators provide an unconventional route in the trading world, diverging from the herd mentality. These tools are designed to assess the overall market atmosphere, pinpointing moments when prevailing opinions might be misleading investors. Among these, IG client sentiment data stands out.

Principle Behind Sentiment Indicators

The core idea is that excessive optimism can inflate asset values, potentially leading to a market correction. Conversely, pronounced pessimism may highlight undervalued opportunities. By dissecting crowd psychology, contrarian analysts aim to capitalize on the market’s collective errors.

However, it’s critical to remember that sentiment indicators should not be the only guide in trading decisions. Markets can deviate from fundamental realities for prolonged periods. These indicators should be part of a comprehensive analysis strategy, incorporating both technical and fundamental insights.

Understanding the crowd’s mood, contrarian sentiment indicators furnish a unique edge, enabling traders to identify possible market pivot points amidst widespread trend conformity.

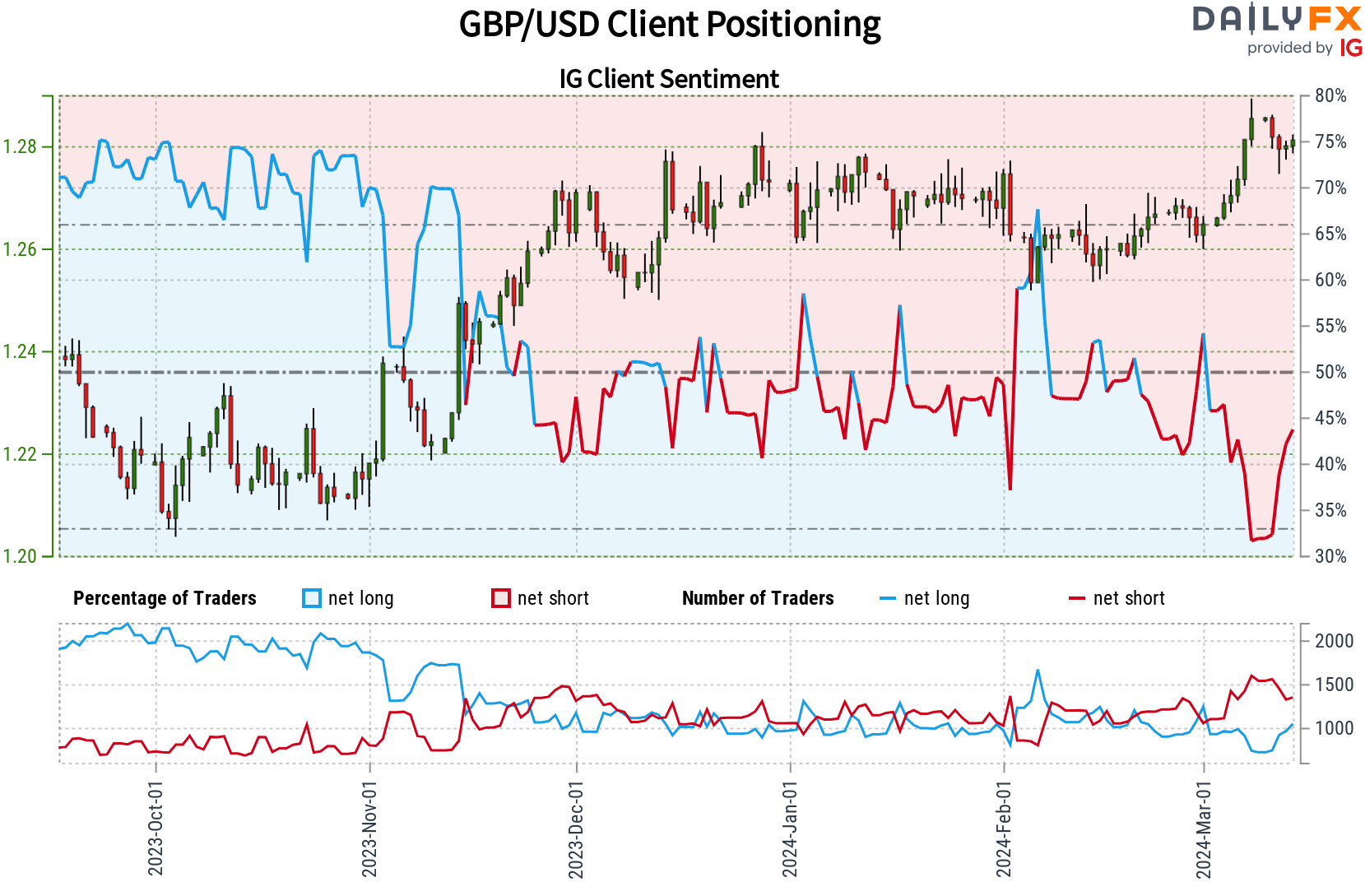

GBP/USD Forecast – Market Sentiment

IG’s retail trading data shows a bearish tilt on GBP/USD, with 56.31% of traders positioned net-short. This sentiment reflects in a short-to-long ratio of 1.29 to 1.

Short positions have seen a slight uptick from yesterday but have dropped moderately from last week. Meanwhile, long positions show signs of increasing across both timelines, indicating a prevailing negative stance towards the pound.

Such retail bearishness often acts as a contrarian indicator, suggesting potential GBP/USD upside in the short term. Yet, given the dynamic nature of markets, sentiment analysis should complement other technical and fundamental evaluations for informed trading decisions.

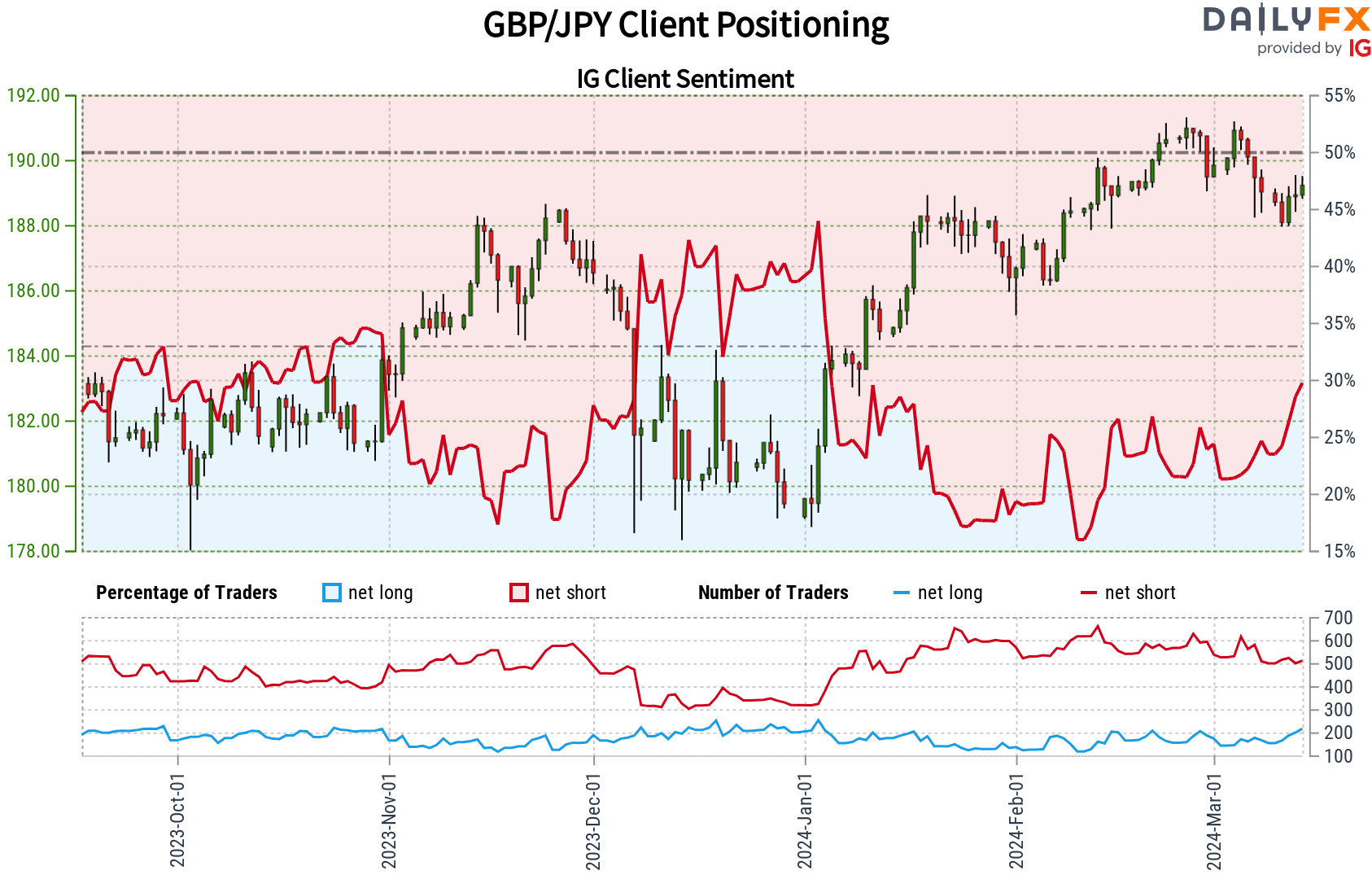

GBP/JPY Forecast – Market Sentiment

About 70% of IG’s retail clients are bearish on GBP/JPY, showcased by a dominant net-short positioning. The short-to-long ratio stands at 2.27 to 1.

An analysis reveals a slight decrease in short positions from yesterday and last week, while long positions are on the rise, indicating a persistent bearish sentiment towards the pound.

This overwhelming bearish sentiment typically serves as a contrarian hint, suggesting GBP/JPY might be setting up for an uptrend. However, traders should use sentiment as one of several tools for a comprehensive trading strategy.

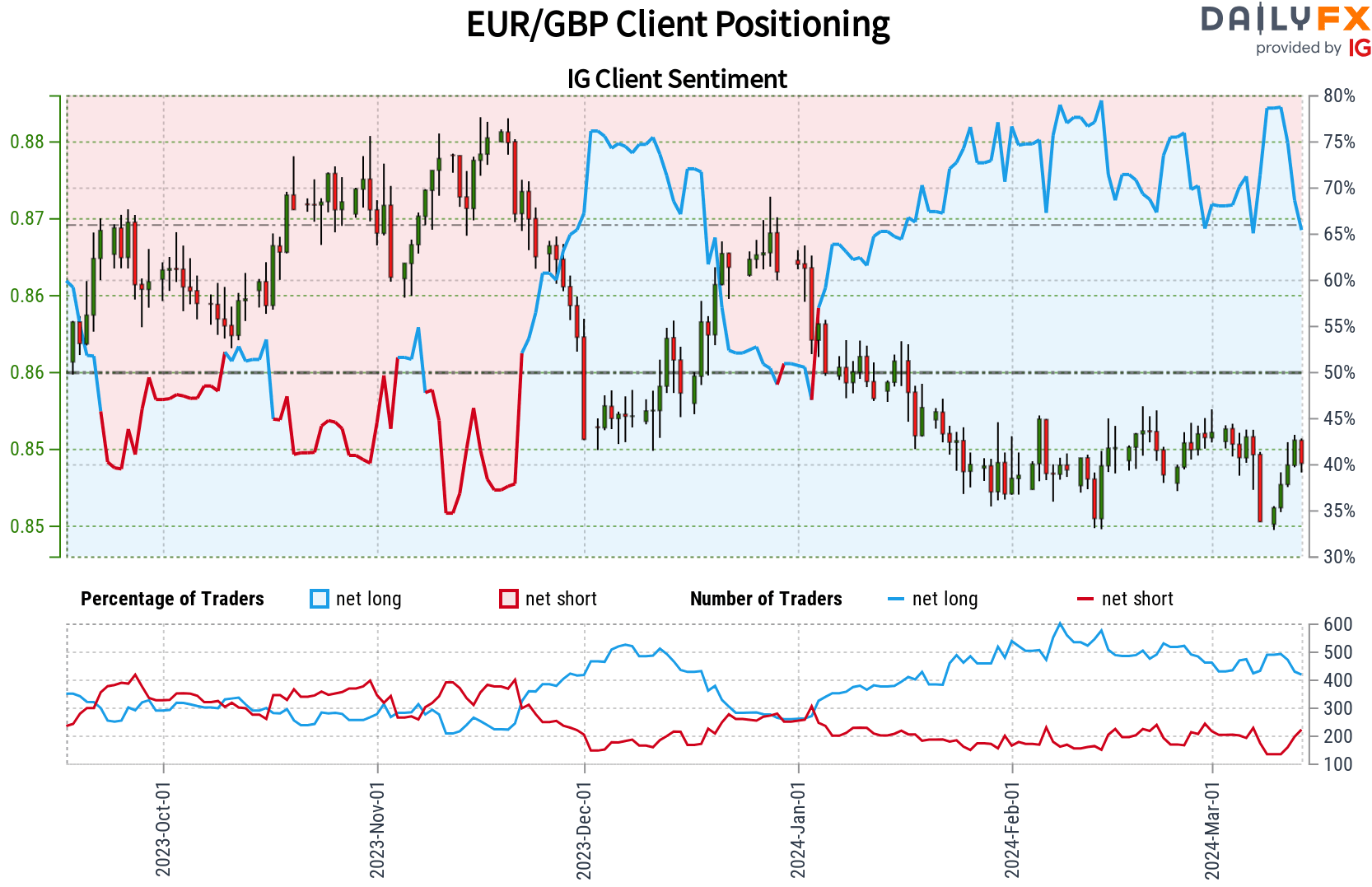

EUR/GBP Forecast

Market Sentiment IG client sentiment reveals a strong bullish outlook on EUR/GBP, with nearly 70% of traders being net-long. The long-to-short ratio is 2.33 to 1, indicating a growing positive sentiment towards the euro, with an increase in long positions compared to short ones.

Given our contrarian approach, such one-sided bullish sentiment calls for caution, as it might lead to price corrections or reversals. Accordingly, the data hints at potential EUR/GBP losses ahead.

Sentiment analysis is a vital piece of the trading puzzle, yet it’s crucial to blend this insight with detailed technical and fundamental analyses for rounded trading decisions.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.