Canada’s February Inflation Slowdown Fuels June Rate Cut Expectations Amidst Fed’s Delayed Cuts

By Daniel M.

March 19, 2024 • Fact checked by Dumb Little Man

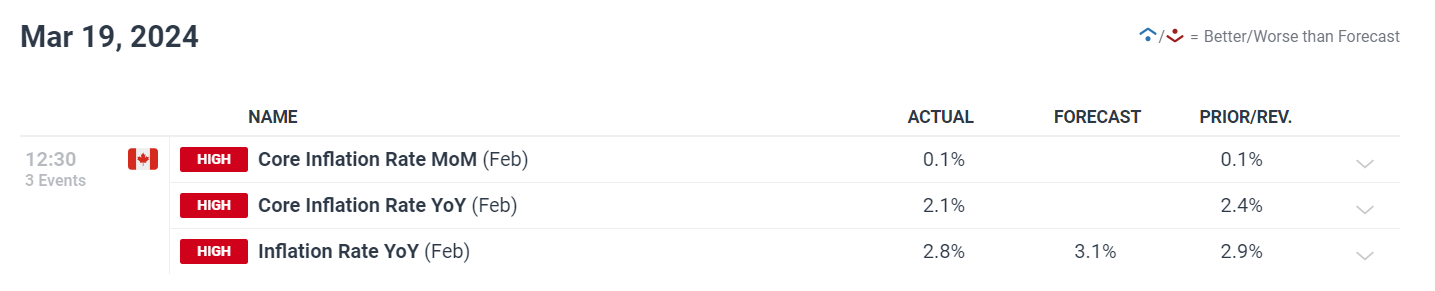

Canada’s February inflation, including both core and headline measures, slowed more than anticipated, with the CPI dropping well below the 3.1% estimate to 2.8%.

With this decline, core inflation has reached its lowest level in more than two years, increasing pressure on the Bank of Canada (BoC) to contemplate easing financial conditions.

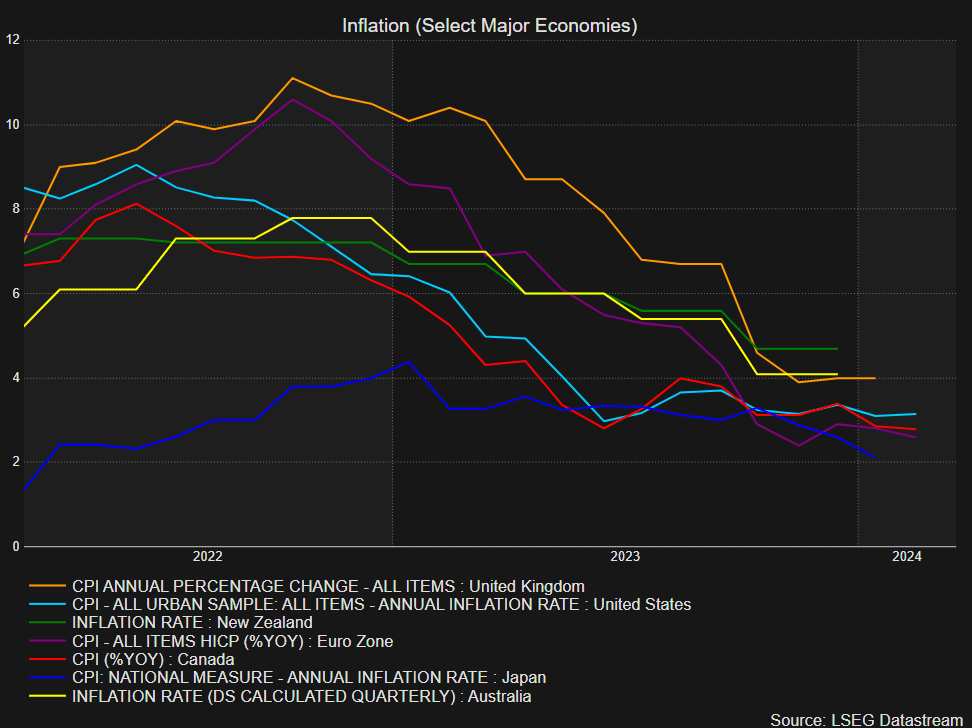

When compared to other nations with inflation rates of more than 8%, Canada stands out as a result of this development, which is illustrated in the graph below.

USD/CAD’s Mixed Reaction Amid Inflation Data

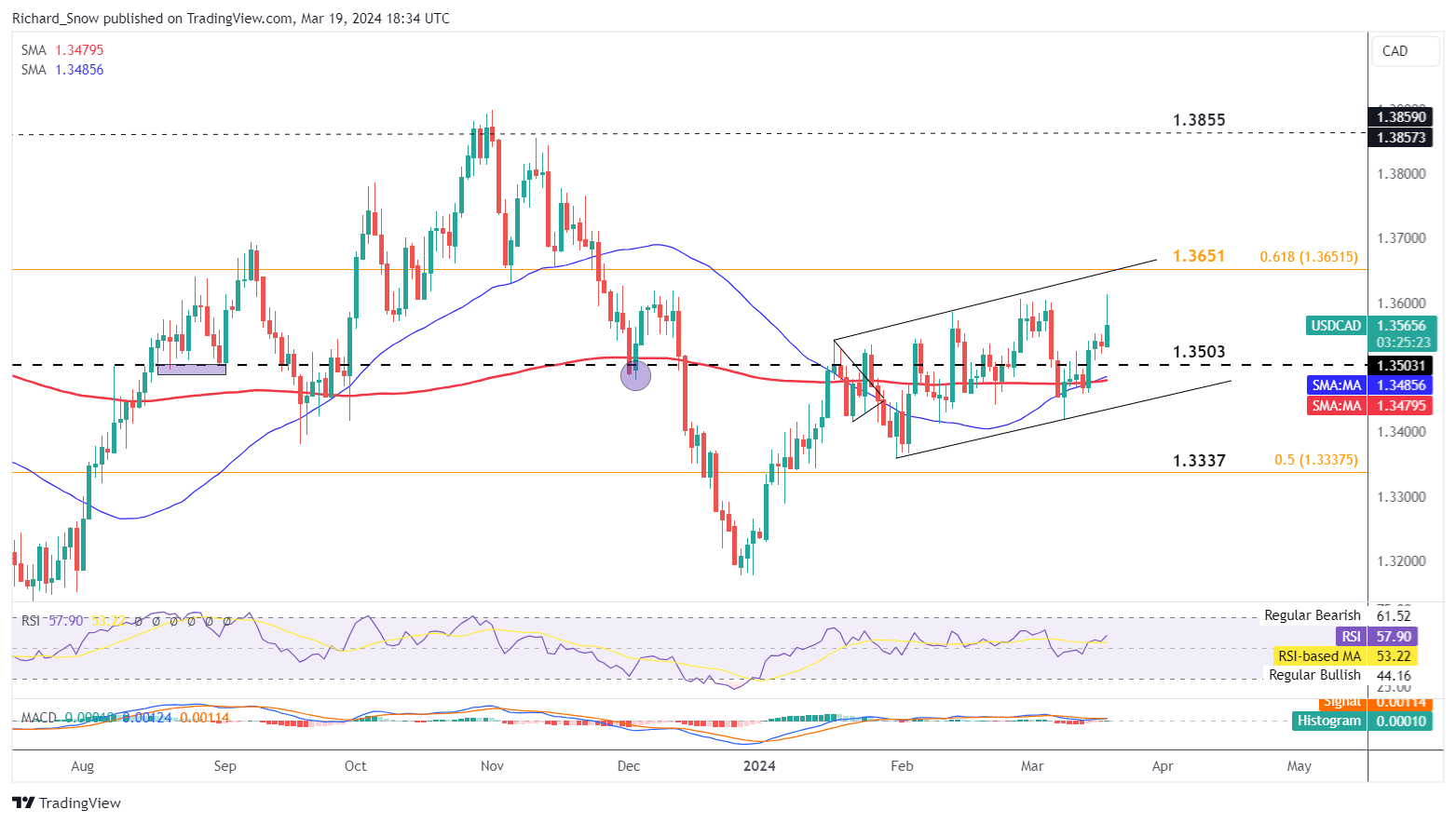

The USD/CAD pair rose sharply after the release of the softer inflation data, but it lost momentum as the New York session went on. The pair’s bullish trajectory targets channel resistance, bouncing off a support bounce at 1.3420 and breaking above the 200-day SMA at 1.3500.

This resistance is expected to align with the main 2020–2022 movement’s 61.8% Fibonacci retracement. However, the massive upper wick formation suggests that bulls may need to regroup.

Market Reactions and Rate Cut Projections

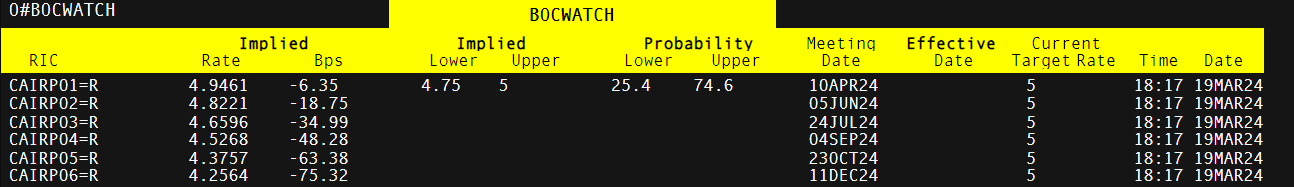

Investors are now more heavily betting on a BoC rate decrease in June, with market chances supporting a cut at roughly 62%, as a result of the unexpected slowdown in Canada’s inflation. To lessen economic pressure, the rationale for easing monetary policy is strengthened by the ongoing decreased inflation.

On the other hand, expectations for the Federal Reserve to cut interest rates have shifted from June to July, potentially maintaining a favorable interest rate differential for the USD against G7 currencies.Core inflation metrics in Canada also fell to levels not seen in more than two years, although headline inflation dipped at a rate that was the slowest since last June.

Such data has ramped up investor bets for a June rate cut, with money market predictions for a 25 basis point reduction exceeding 75%. Rate cuts beginning in June are now expected to be set in motion by the BoC’s more dovish outlook in April.

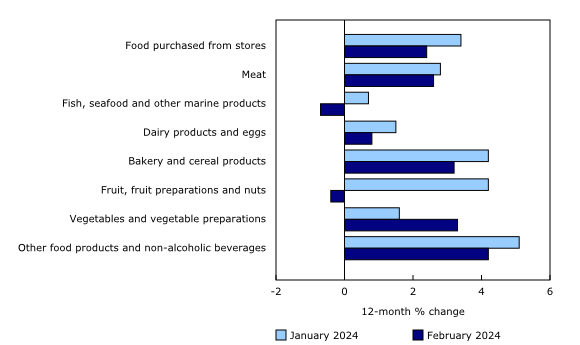

The Canadian currency fell to a three-month low versus the US dollar as a result of the inflation deceleration, and the yield on the country’s 10-year bond significantly decreased. Lower food prices as well as cheaper internet and cell service contributed to the overall slowdown in inflation for Canadians.

Final Thoughts

Analysts argue that the current inflation data justifies a June rate cut. They warn that any further delays could hurt the economy. With the BoC maintaining rates to combat inflation, the latest figures suggest a potential shift in policy could be imminent.

However, the bank has indicated it seeks sustained evidence of underlying inflation slowing before considering rate reductions. As the BoC prepares to update its forecasts, the focus remains on achieving a careful balance between stimulating economic growth and maintaining price stability.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.