EUR/USD Outlook: Post-FOMC and SNB Developments Pose Threat to Recent Gains Amid Rising Optimism

By Daniel M.

March 22, 2024 • Fact checked by Dumb Little Man

ECB’s Rate Cut Strategy and SNB’s Surprise Decision

Despite the stark contrast in economic growth projections between the EU and the US, with the EU grappling with slower growth, ECB officials are considering interest rate cuts, eyeing June for the first reduction.

This move is propelled by increasing wage growth pressures and dwindling reasons to delay easing monetary policy.

In an unexpected maneuver, the Swiss National Bank (SNB) announced a 25 basis point cut, seeking to normalize monetary policy amidst challenging external conditions and anticipated sub-two percent inflation, expected to persist through 2025 and into 2026.

Dollar Dynamics and EUR/USD Resistance

The US dollar experienced a brief decline after the Fed’s dovish stance, which unintentionally helped the EUR/USD pair rise.

The pair of currencies challenged resistance levels around 1.0942 and 1.0960, but they are still supported by important technical indicators, indicating a cautiously positive outlook for EUR/USD even in the face of anticipated pressure from higher interest rates and economic resilience to push the US dollar higher.

Economic Projections and Inflation Trajectories

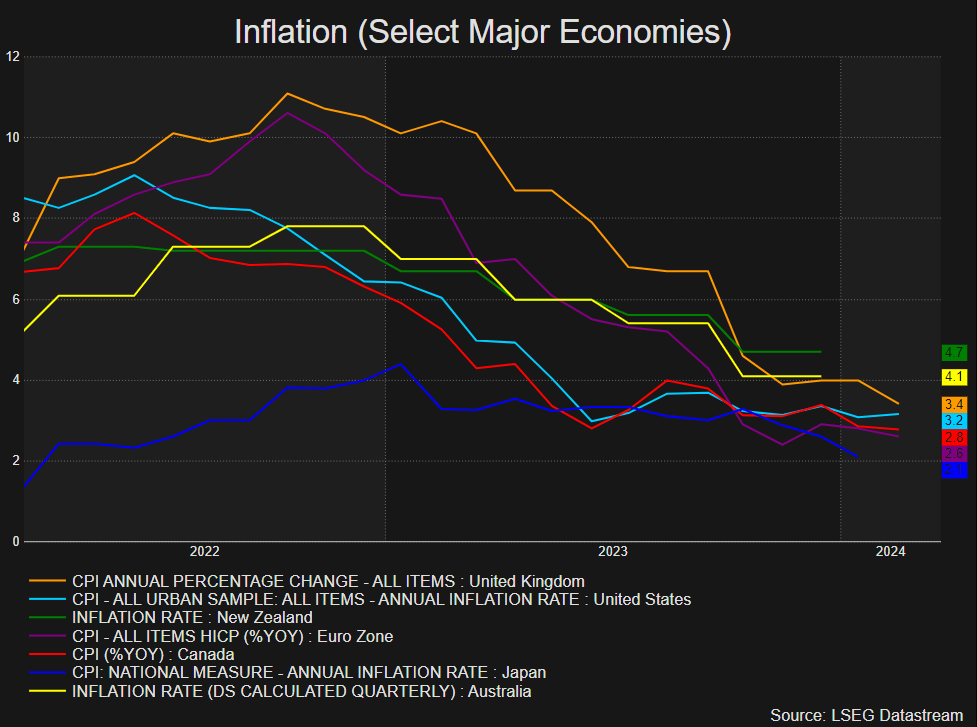

The Fed’s updated economic projections hint at a possible hike in the neutral rate, indicative of enduring growth and a sturdy labor market. Conversely, the European economy’s stagnation might prompt the ECB to lower rates, especially if inflation trends towards the 2% target.

The inflation trajectory in major economies is improving, particularly in the EU, where the HICP displays a trend toward reduced inflation rates, notwithstanding ongoing worries.

Market Reactions to Economic Data and PMI Reports

EUR/USD’s dynamics have been influenced by various economic indicators, including disappointing PMI data from the EU and positive employment and manufacturing reports from the US.

These developments highlight the ongoing economic contraction in Europe, in stark contrast to more optimistic forecasts for the US.

Short-term Technical Outlook for EUR/USD

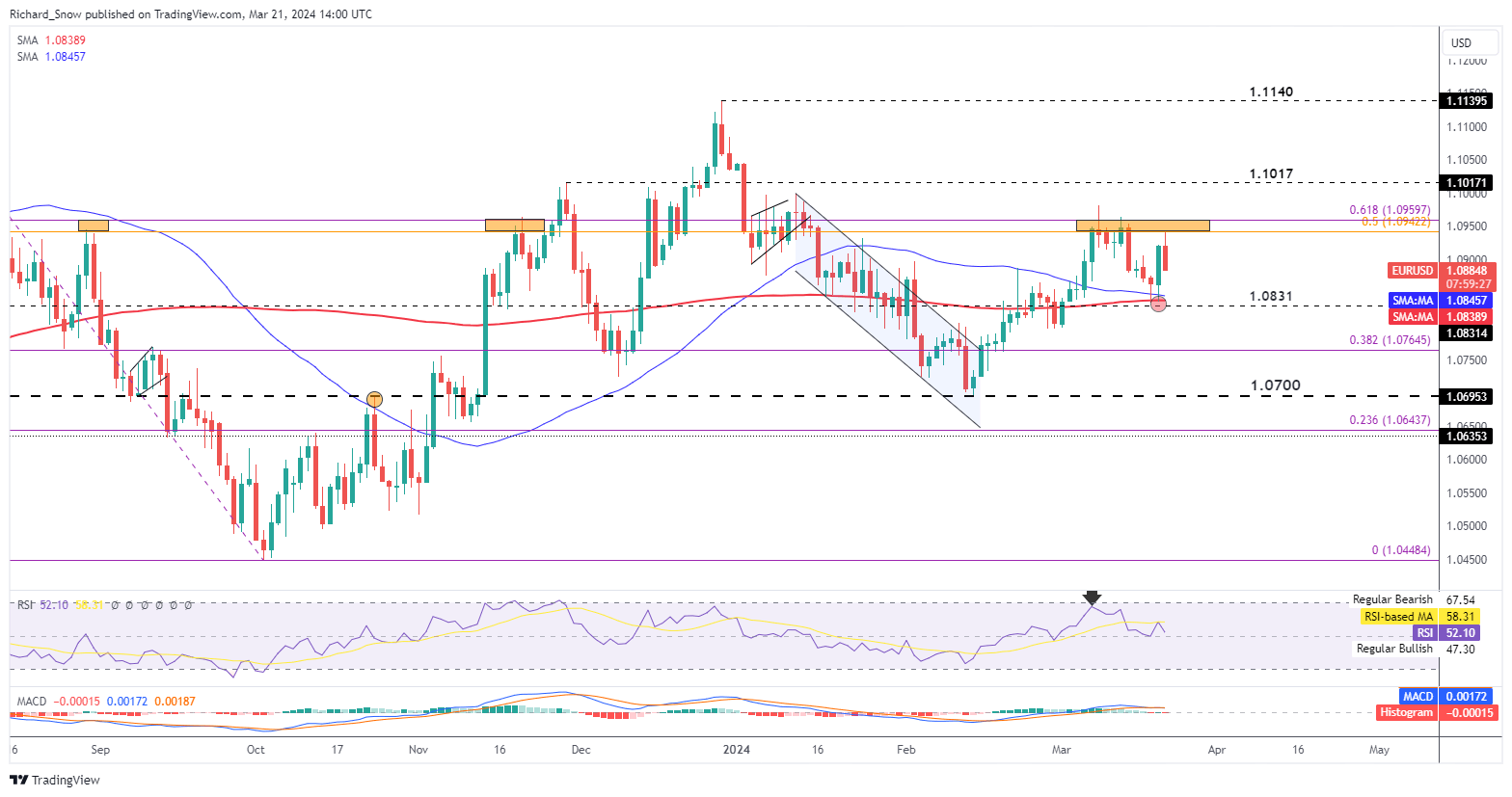

Technically, EUR/USD is trading between critical support and resistance levels, with the daily chart indicating that it remains above all of its moving averages.

However, technical indicators have begun to shift south inside bullish ranges, indicating that purchasing enthusiasm may still be reluctant. Key support is anticipated at 1.0865, the 38.2% Fibonacci retracement of the recent surge, while resistance is seen near 1.0920 and 1.0970.

Final Thoughts

As the market digests the recent decisions by the ECB and SNB, alongside fluctuating economic data and sentiment, the near-term uplift for EUR/USD seems jeopardized.

The complex interplay between interest rate differentials, economic growth outlooks, and inflation targets will remain pivotal in guiding currency market trends.

Traders should stay alert, weaving these developments into their strategic planning amidst a backdrop of uncertain market conditions.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.