March US Jobs Report Preview: Impact on USD/JPY, Gold; What to Expect

By Daniel M.

April 5, 2024 • Fact checked by Dumb Little Man

Overview of Expectations

The expectation rises as traders and investors anticipate the release of the nonfarm payrolls (NFP) report from the United States Bureau of Labor Statistics on Friday.

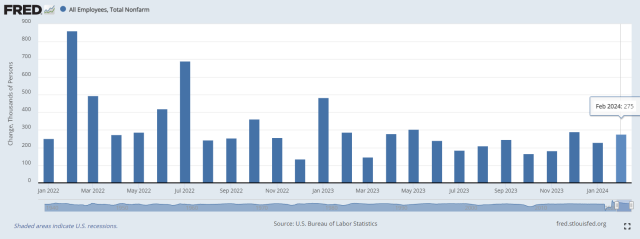

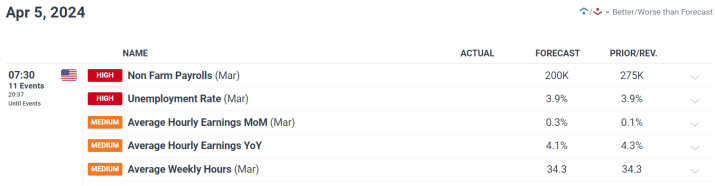

The report is a key measure of economic health that influences the Federal Reserve’s monetary policy choices. Economists estimate that job growth will decrease in March, with only 200,000 new positions added compared to 275,000 in February.

The unemployment rate is predicted to remain stable at 3.9%, with average hourly earnings potentially increasing by 0.3% month on month.

Market Reactions to Anticipate

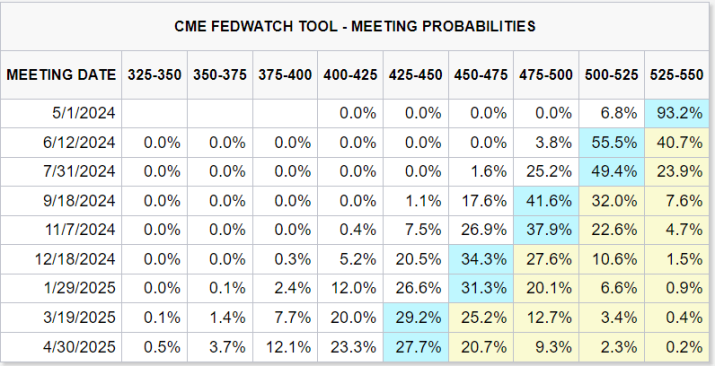

The impact of NFP data on markets is largely determined by how far the news deviates from expectations. A positive report could postpone the Fed’s interest rate cuts, strengthening the US dollar and lowering gold and silver prices.

A weak report, on the other hand, might accelerate rate cuts, potentially weakening the dollar and boosting precious metal prices.

The table below shows FOMC meeting probabilities as of Thursday morning.

Traders should look beyond the headline data, taking into account the labor force participation rate, previous month adjustments, and underlying labor market trends.

USD/JPY and Gold Price Forecasts

The USD/JPY’s performance remains critical, with technical analysis indicating potential volatility near the 152.00 barrier level. If the Japanese government does not intervene, a breach above might spark a bullish rally.

Gold prices, after spiking, may retrace, with $2,305 serving as a significant resistance level.

Deeper Insights into the Jobs Report

The March data is expected to affirm ongoing employment growth but with signs of a cooling labor market.

The unusually significant job gain in February, combined with subsequent negative revisions of previous months’ data, called into question the reliability of the earlier figures.

This negative revision pattern, which deviates from historical norms, shows that initial job growth estimates should be interpreted with caution.

Areas of Focus

The report will be examined for signs of inflationary pressures, changes in employment kinds (full-time versus part-time), and the health of key economic sectors. Average hourly earnings and their annual growth will be closely monitored for inflationary signals.

Final Thoughts

The impending jobs data represents a watershed moment for financial markets, with huge ramifications for monetary policy and market sentiment.

While a balanced report may leave the Fed’s current policy trajectory unchanged, traders should plan for volatility and use cautious risk management measures.

The emphasis remains on evaluating the data in the context of a larger economic picture, taking into account anticipated adjustments and underlying labor market factors.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.