Weekly Equities Outlook: Initial Earnings Reports from US Banks Set the Stage

By Daniel M.

April 7, 2024 • Fact checked by Dumb Little Man

Equities Weekly Overview: Challenges and Anticipations

Despite a strong recovery on the last trading day, the Dow Jones Industrial Average concluded the week down nearly 2%, marking its most significant weekly downturn since the previous October. Market sentiment has been affected by heightened caution, stemming from comments by Federal Reserve officials, including Chair Jerome Powell, emphasizing the need for patience before any reductions in interest rates. This stance is influenced by the robust performance of the US economy and rising inflation figures. Additionally, escalating geopolitical tensions have adversely impacted investor confidence.

The upcoming week promises heightened volatility, potentially disrupting the trend of five consecutive months of gains. This shift could be driven by forthcoming US inflation data, the release of the Federal Open Market Committee (FOMC) meeting minutes from March, and the commencement of the US earnings season.

The first quarter (Q1) earnings season begins with reports from key banks such as JP Morgan, Wells Fargo, and Citibank scheduled for Friday.

Earnings Season Overview: A Closer Look at Expectations

Factset anticipates a 3.1% year-over-year increase in S&P 500 earnings for Q1 2024, with revenues expected to rise by 3.5% compared to the same period last year. This projection marks the third consecutive quarter of year-on-year earnings growth, although the pace of growth appears to be moderating following a 6.7% increase in earnings during Q4 2023, accompanied by 3.9% revenue growth.

Bank Earnings Outlook for Q1: Balancing Factors

The landscape for major banks is intricate, with both positive and negative elements at play. Recent non-farm payroll reports and macroeconomic data highlight a resilient economy and vigorous economic activity, benefiting the banking sector. However, tempered expectations for interest rate cuts, which had previously buoyed the banking sector and broader market, are now adjusting. Persistent inflation poses challenges, as investors evaluate the potential impacts of enduring higher interest rates on net interest income. Signs of recovery in deal-making and initial public offerings (IPOs), exemplified by Reddit’s successful public offering, provide some optimism. Nonetheless, concerns persist regarding real estate loans.

JP Morgan: A Focused Analysis

As the largest US bank, boasting $39 trillion in assets by the end of 2023, JP Morgan approaches its earnings announcement trading near all-time highs. The bank has distinguished itself, achieving record profits in 2023.

Strong net interest income (NII) is anticipated, supported by growth in the loan portfolio, which is expected to counterbalance the impacts of margin pressures from high interest rates that benefit deposit holders.

The bank’s diversified operations offer a competitive edge, especially against regional banks. Provisions for bad loans will be scrutinized, offering insights into the broader US economic health.

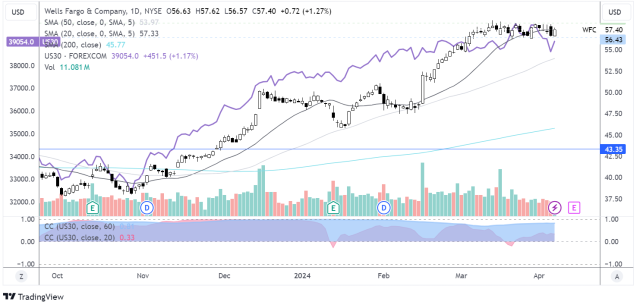

Wells Fargo: Performance and Prospects

Wells Fargo has seen its share price increase by 15% over the quarter, surpassing broader market performance. This growth follows the lifting of restrictions imposed on the bank due to past scandals.

Despite a disappointing Q4 2023 report, with a 6% decline in profits and a modest 2% revenue increase, expectations for 2024 remain cautiously optimistic. The bank has indicated potential challenges with net interest margins, with adjusted profits and revenues projected to decline.

Provisions for bad loans, which increased significantly in the previous quarter, remain a focal point, particularly given the bank’s substantial exposure to commercial real estate.

Delta Airlines: Anticipated Earnings Report

Delta Airlines is set to report earnings, spotlighted as a top pick by Morgan Stanley amid a recovery phase for the airline industry. Despite impressive year-to-date and annual growth, the stock has yet to reach pre-pandemic heights.

Key performance indicators such as load factor are crucial, as they signal whether demand is approaching pre-pandemic levels. The economic and employment landscape supports demand resilience, despite the challenges of rising interest rates and tightening financial conditions.

However, a significant quarter-over-quarter increase in oil prices poses additional pressure on profitability.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.