USD Strengthens Across Major Currency Pairs

By Daniel M.

April 16, 2024 • Fact checked by Dumb Little Man

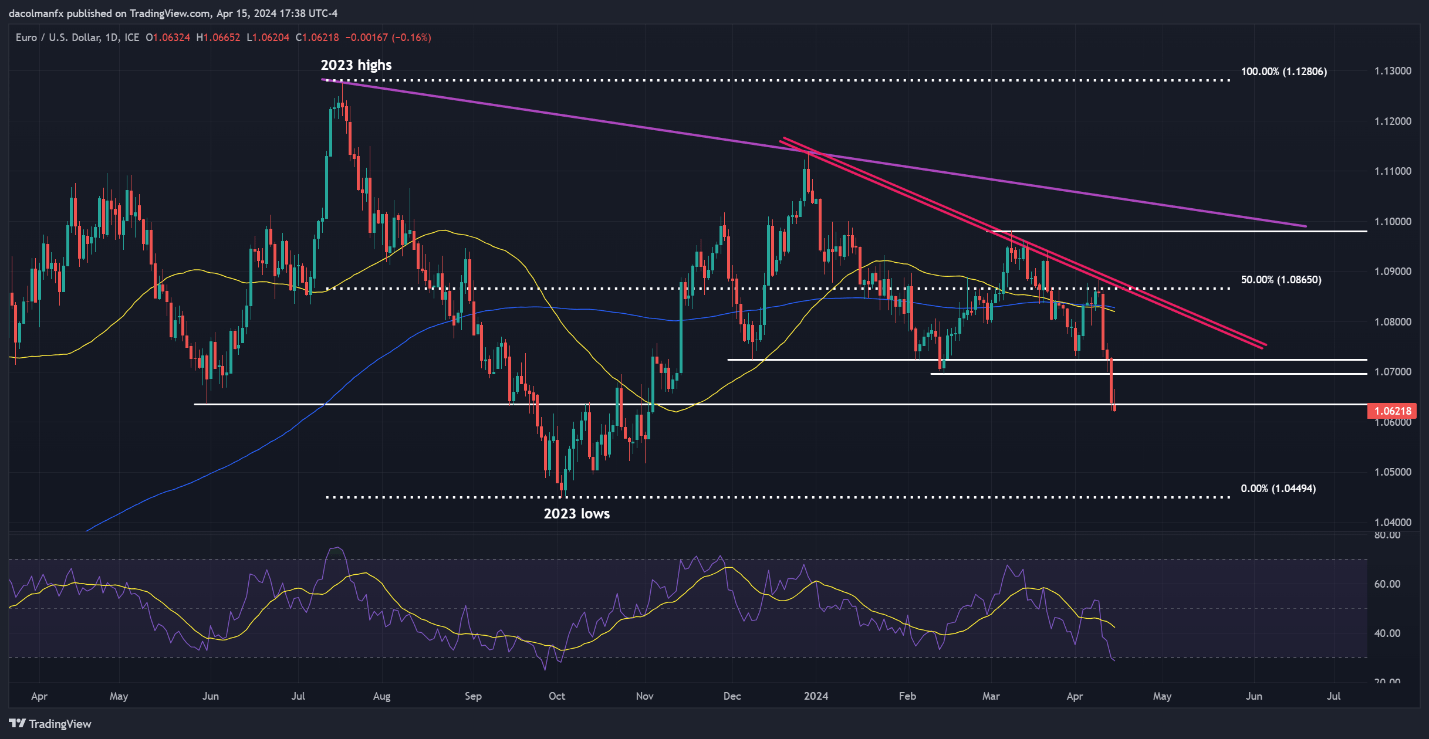

EUR/USD Undermined by Dollar Surge

EUR/USD began the week with losses, breaching key support at 1.0635 to record lows not seen since November last year, and down more than 2.4% from April’s highs. A confirmation of this breakdown might spark additional selling, with lows around 1.0450 on the horizon.

Despite potential rallies, resistance at 1.0635 and 1.0700 may limit gains. The euro’s decline coincides with a stronger US dollar, spurred by expectations of delayed rate cuts and higher-than-expected inflation in the US.

With the European Central Bank (ECB) hinting at possible rate cuts, the EUR/USD outlook remains gloomy, with the pair currently trading around 1.0620, down about 0.5% for the day.

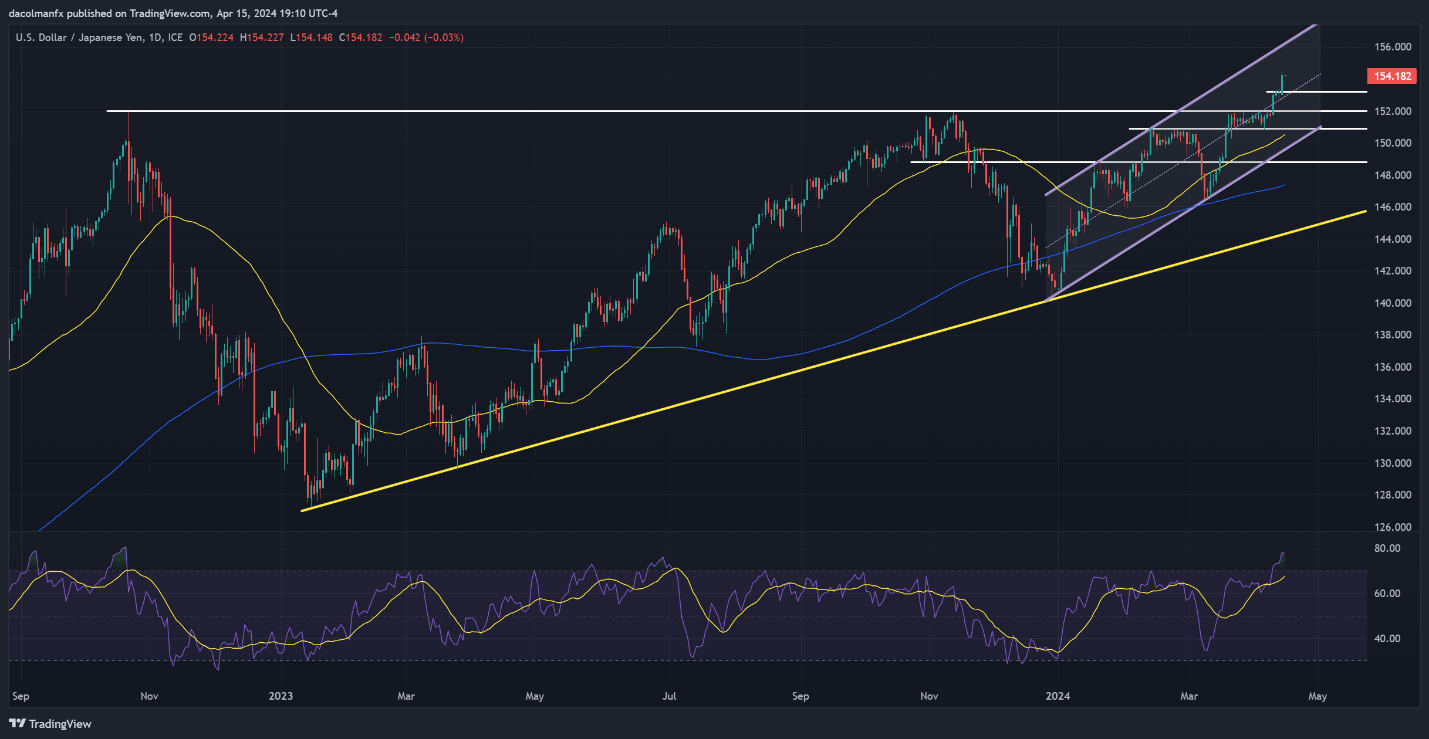

USD/JPY Hits 1990 Highs on Treasury Yield Surge

USD/JPY rose above 152.00, reaching levels not seen since June 1990, propelled by rising US Treasury yields and good economic indicators.

The pair is aiming for more rises into channel resistance around 155.80, while Japanese government intervention could limit upside momentum.

While overbought conditions persist, recent words from Fed Chairman Jerome Powell and future US economic data may influence the USD/JPY’s trajectory.

The upward slope of the 50-day SMA predicts that the market will continue to appreciate, with a probable test of the June 1990 high. Currently, the USD/JPY is trading at 154.45, up 0.6%.

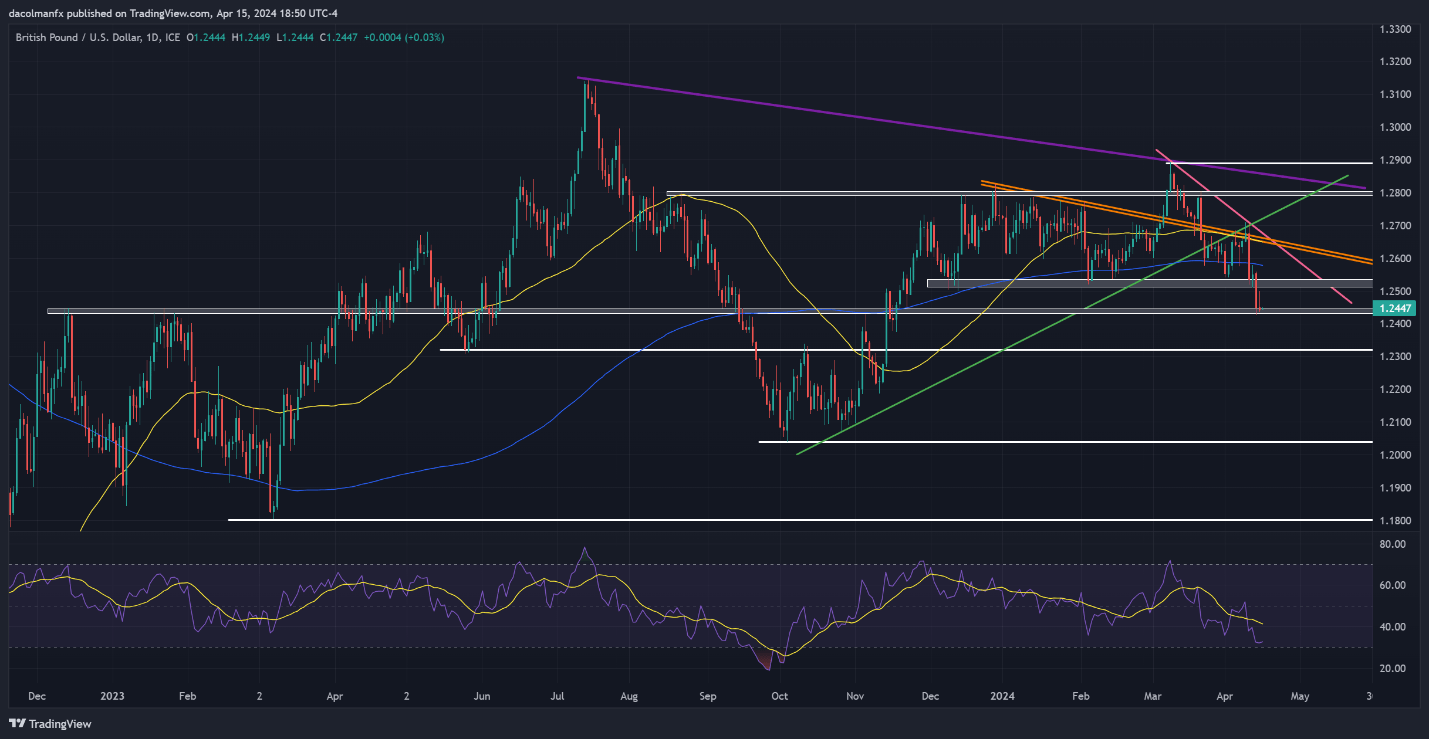

GBP/USD Maintains Support Amid Geopolitical Tensions

Despite international tensions, the GBP/USD maintained above support around 1.2435, recovering from November’s lows. Nevertheless, the pair is under bearish pressure, with resistance around 1.2525 and 1.2580.

Geopolitical concerns, especially news of Iran’s strike on Israel, increased safe-haven demand for the US dollar, impacting the GBP/USD. However, a potential de-escalation of hostilities could help the pair recover.

Technical indicators point to a corrective rally, but the overall view is negative, with static support between 1.2450 and 1.2400. GBP/USD is now at 1.2450, up 0.2%.

Final Thoughts

The current rise of the US dollar against key currencies reflects shifting market sentiment, which is driven by expectations of delayed rate cuts and strong economic statistics.

While EUR/USD, USD/JPY, and GBP/USD are under pressure, geopolitical tensions and central bank policies continue to affect market dynamics.

Traders should keep an eye on key levels and forthcoming events to look for new trading opportunities in an ever-changing market.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.