Silver retreats, NZD/USD rises, EUR/CHF steady

By Daniel M.

April 16, 2024 • Fact checked by Dumb Little Man

It is critical in the trading business to understand the ebbs and flows of market sentiment. While following the crowd may feel natural, experienced traders understand the value of contrarian techniques.

Combining techniques like IG client sentiment with technical and fundamental studies can provide a more in-depth view of market dynamics, revealing key insights that the majority of people overlook.

Silver, NZD/USD, and EUR/CHF: A Sentimental Perspective

When we look at IG client sentiment for Silver, NZD/USD, and EUR/CHF, we see positive biases, albeit recent declines in net-long positions add to the uncertainty.

Contrarian opinions indicate prospective market reversals or shifts, emphasizing the significance of a comprehensive analysis methodology.

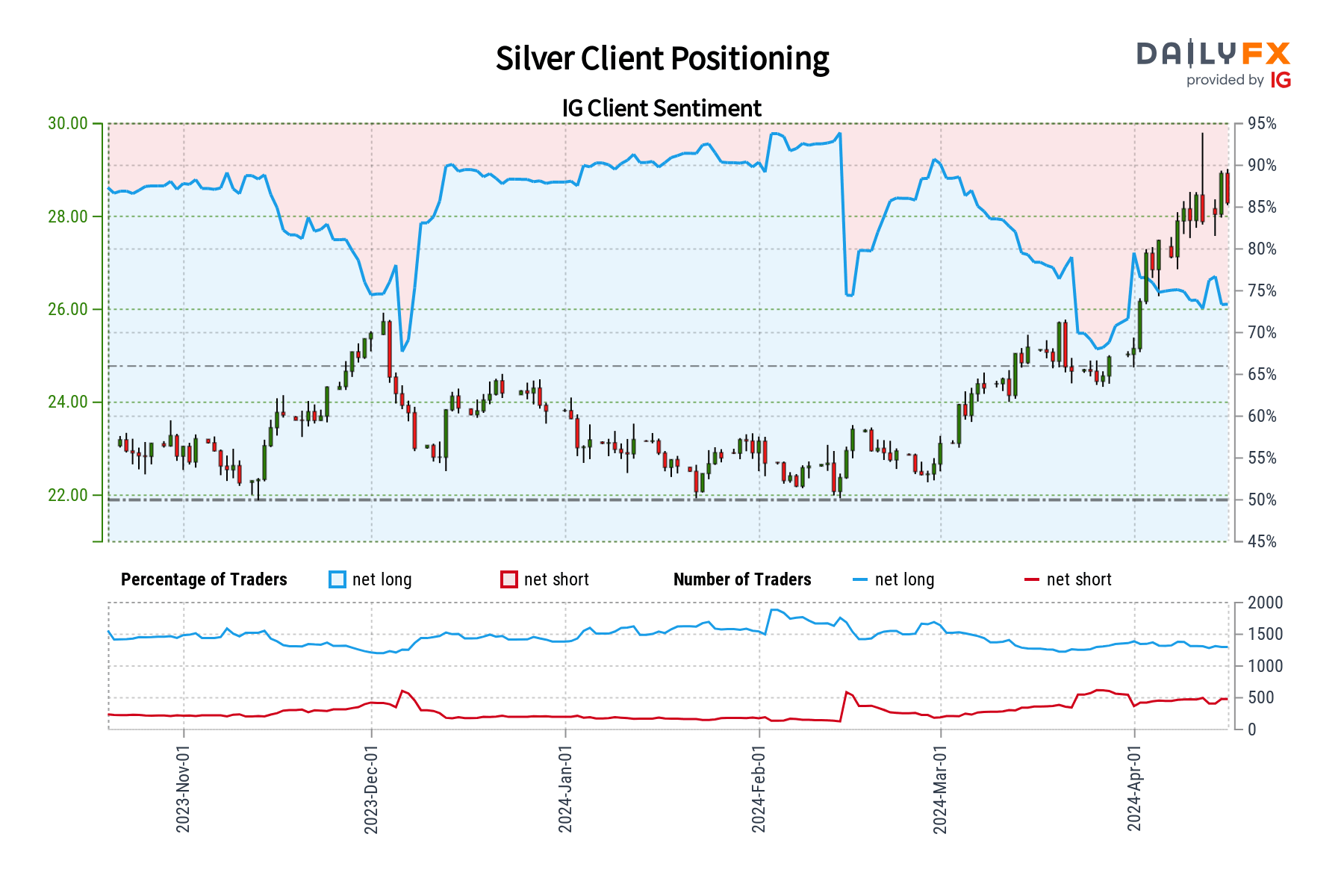

Silver Price Analysis: Pullback Amidst Resistance

Silver prices fell from recent highs, aided by high US Treasury yields and resistance around the $29.00 level. Technical analysis indicates that there is a possibility for additional loss, with support levels found at $27.59 and $27.00.

However, a persistent price over $28.00 could imply a challenge to recent highs, opening up prospects for positive momentum.

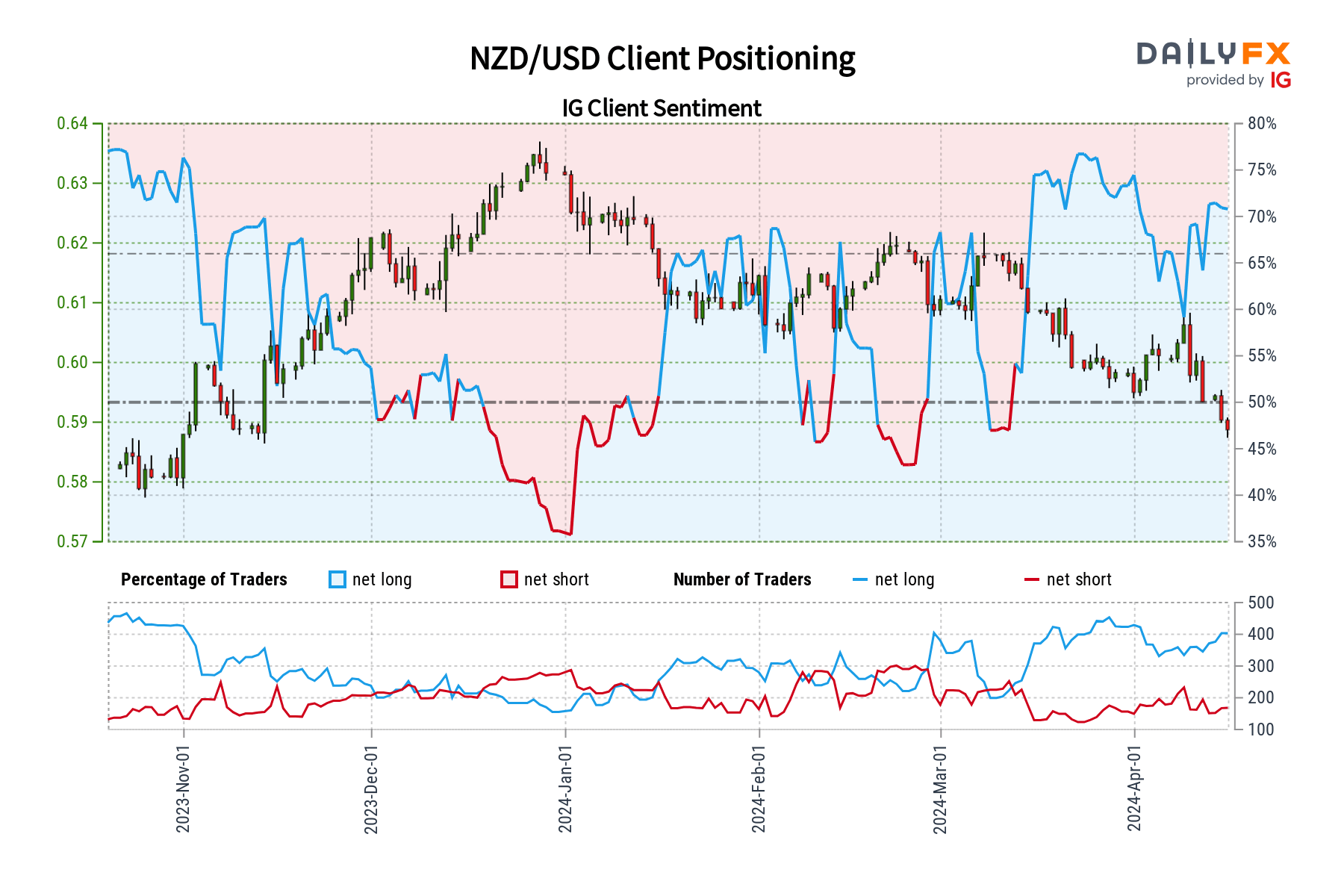

NZD/USD: Inflation Data and Rate Cut Speculations

Although New Zealand’s inflation figures showed reducing pressures, domestic prices remained stubbornly high, potentially postponing rate cuts by the Reserve Bank of New Zealand (RBNZ).

While the Kiwi experienced a short-term rebound on the data, mood favors selling rallies, with support levels at .5870 and .5950. Market participants are closely following the RBNZ’s stance and the implications for future monetary policy decisions.

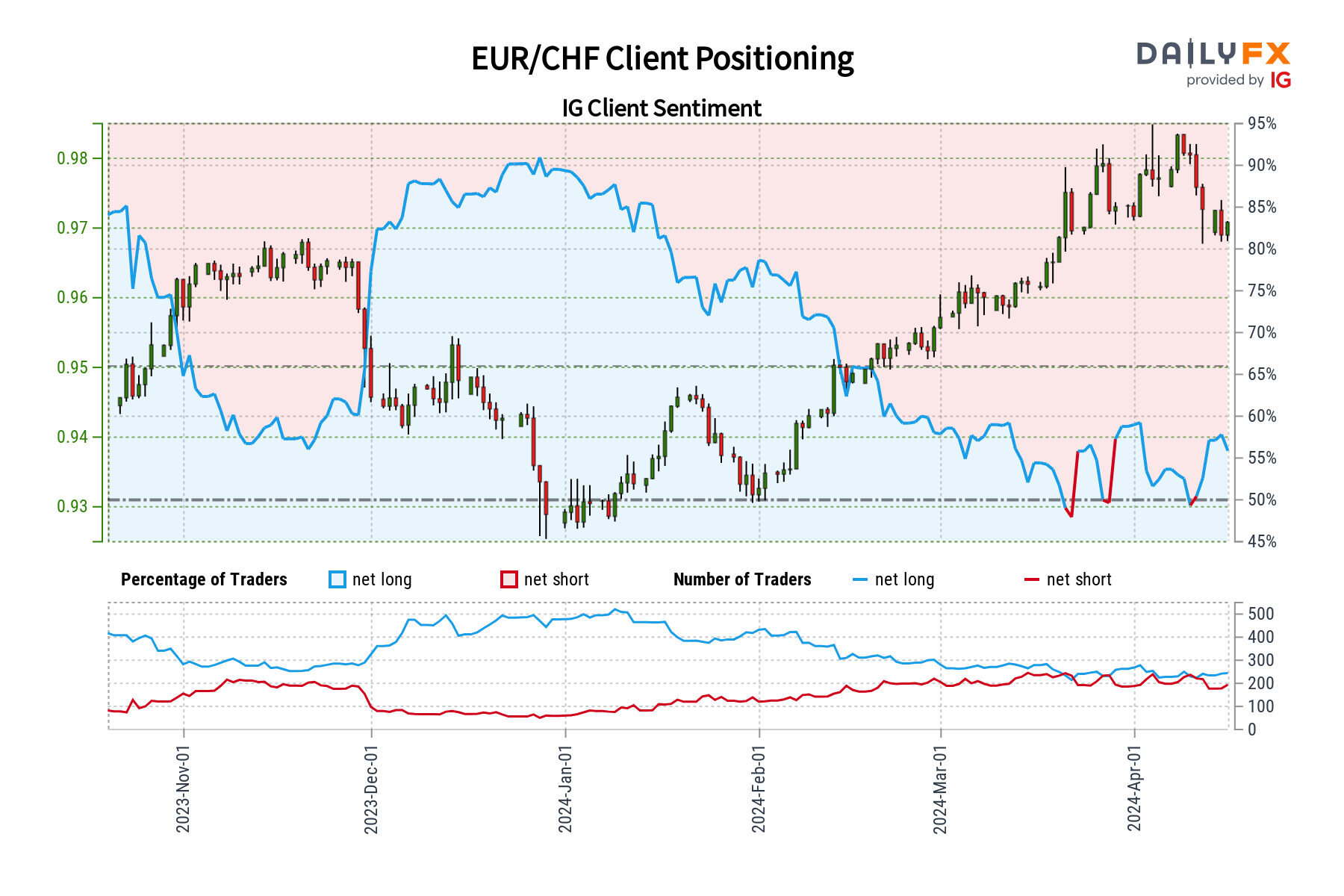

EUR/CHF: Mixed Sentiment and Short-term Outlook

According to IG statistics, the EUR/CHF sentiment remains mixed, with a modest positive tendency. However, recent positioning adjustments point to a possible additional fall in the immediate term.

Technical analysis can provide extra information about potential support and resistance levels for the pair, assisting traders in managing market volatility and identifying effective entry and exit opportunities.

Final Thoughts

Incorporating contrarian observations into trading techniques provides a more complete picture of market sentiment and probable price moves.

While sentiment analysis can provide useful insight, it must be supplemented by technical and fundamental assessments to provide well-informed decision-making.

By embracing contrarian tactics, traders may confidently manage market volatility, capturing opportunities and effectively managing risks.

The use of analytical tools combined with a disciplined strategy can improve trading results and help long-term financial market success.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.