Gold Price Declines as US Inflation Surges

By Daniel M.

January 5, 2025 • Fact checked by Dumb Little Man

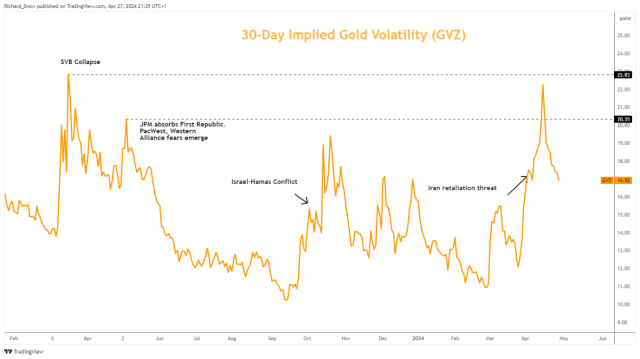

Volatility Subdued Ahead of US Data

Gold prices continue to fall as volatility fades. The immediate chance of a larger battle between Israel and Iran has decreased dramatically, diminishing gold’s appeal as a safe-haven asset.

This fall correlates with a recovery in riskier assets like the S&P 500 and high-beta currencies like the Australian dollar and the British pound.

Traders anticipate new US Treasury data on funding requirements this week, which could influence both short-term and long-term bond yields. This may have an impact on gold prices.

Gold Reacts to Higher Inflation

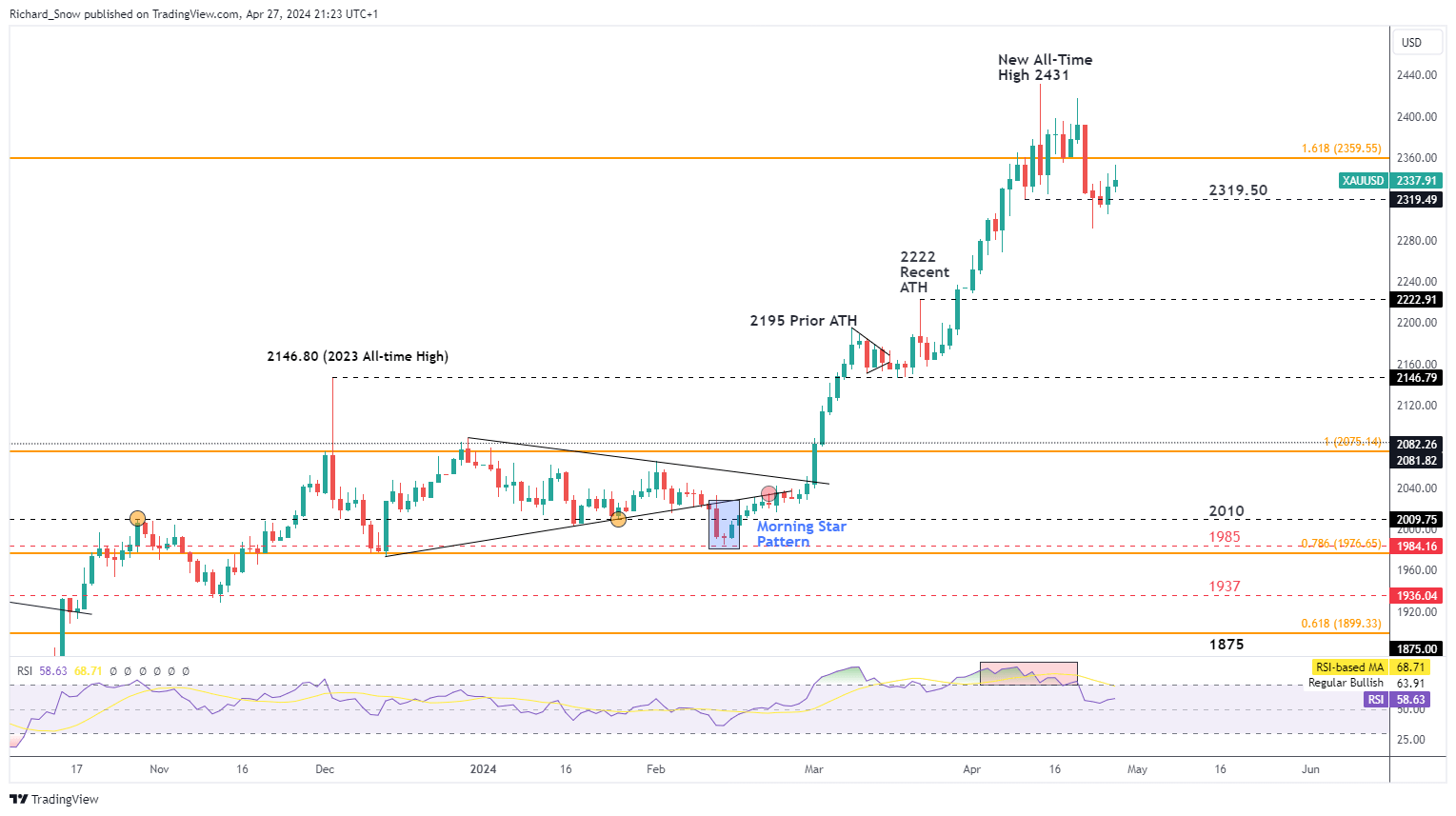

Despite a lack of significant bullish forces, gold managed to rise somewhat before falling again. Recent US inflation numbers have raised concerns that the Fed funds rate would remain high for an extended period of time.

Both headline and core inflation figures are above estimates, raising concerns about ongoing inflationary pressures. This discovery has encouraged markets to modify earlier expectations of big interest rate cuts in 2024, thereby strengthening the currency.

Gold’s recovery from support below $2320 underscores the precious metal’s struggle to maintain momentum in the absence of new catalysts.

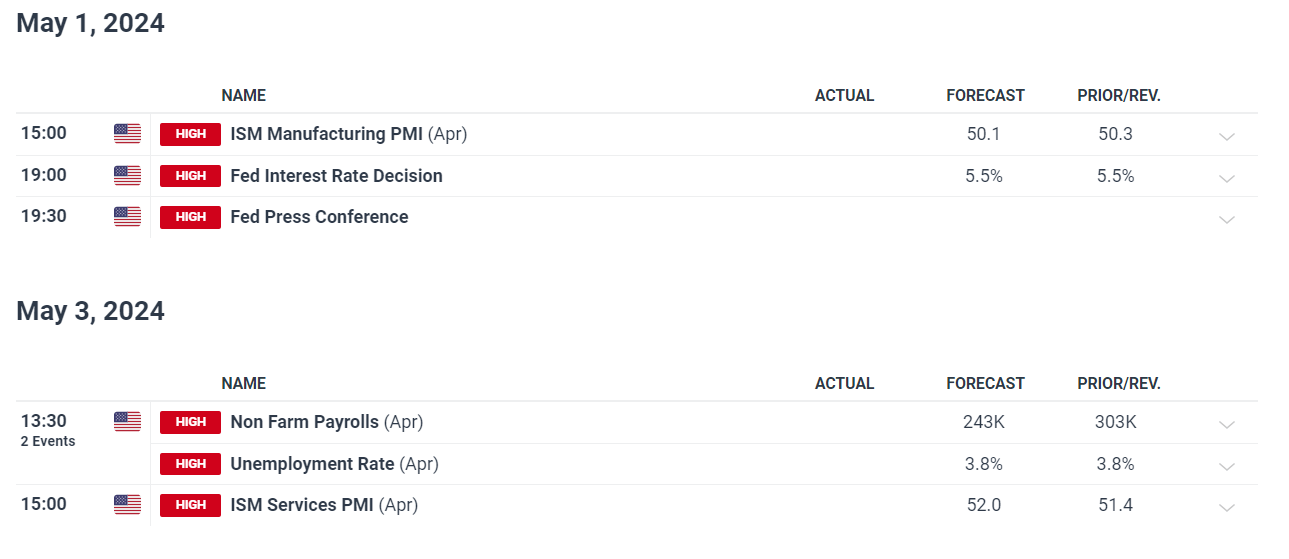

Key Risk Events

The forthcoming week will see both geopolitical and scheduled risk events. Tensions between Israel and Iran have subsided, but a renewed clash between Russia and Ukraine might derail current risk-on enthusiasm.

On the economic front, traders are anticipating the Federal Open Market Committee’s (FOMC) meeting, which is unlikely to change interest rates but may reflect growing inflation concerns.

Given the dollar’s impact, non-farm payroll statistics may cause volatility in gold markets. Furthermore, ISM manufacturing statistics will be studied following poor GDP figures from the first quarter that highlighted fragility in the US economy.

Market Reactions to Inflation Data

Recent economic data in the United States show that inflationary pressures remain persistent.

The Core Personal Consumption Expenditures (PCE) Price Index for March matched estimates, growing by 0.3% month on month, but annual headline inflation was above expectations at 2.7%. Core PCE inflation also outperformed estimates, rising to 2.8% YoY.

While futures markets predict a 60% chance of a rate cut in September, the Fed is expected to keep its current rate range on Wednesday, indicating no imminent need for decreases. This hawkish mindset may further weaken gold’s appeal.

Geopolitical Tensions and Safe Havens

On the geopolitical front, Hamas is said to have evaluated Israel’s new ceasefire proposal, with Egypt attempting to mediate a truce to avoid the situation from escalating further. This potential de-escalation has lowered demand for traditional safe-haven assets such as gold.

Final Thoughts

Gold’s drop is due to both declining safe-haven demand and persistent inflationary pressures. Geopolitical events and upcoming economic data will continue to influence the metal’s development.

Traders will continue to pay close attention to the interplay between inflation trends, interest rate expectations, and geopolitical tensions.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.