Uniglobe Markets Review 2024 with Rankings by Dumb Little Man

By John V

May 17, 2024 • Fact checked by Dumb Little Man

Overall Rating | Overall Ranking | Trading Terminals |

1.4 1.5/5 | 140th  |  |

| Evaluation Criteria |

|---|

The Dumb Little Man team, made up of financial specialists, seasoned traders, and personal investors, leverages advanced algorithms for in-depth reviews of brokerage firms. They focus on critical aspects like:

By integrating feedback from actual users, they offer an impartial and thorough assessment. Their comprehensive research identifies Uniglobe Markets as a dependable choice for those seeking a robust financial ally. Nonetheless, Dumb Little Man advises prospective customers to meticulously examine their detailed analysis to grasp any potential drawbacks linked to the broker. |

Uniglobe Markets Review

Retail traders and the international foreign exchange market are connected through forex brokers. They offer marketplaces where people may purchase and trade currencies. Selecting the appropriate broker is essential since it affects the security and efficacy of trading. Uniglobe Markets has a name for itself in the cutthroat world of Forex trading.

Uniglobe Markets serves traders of all skill levels by providing a variety of trading platforms and instruments. The broker is renowned for having strong security protocols and intuitive user interfaces. This analysis of Uniglobe Markets is based on the observations and experiences of experts. It seeks to provide an objective analysis of the broker’s performance and services in the Forex market.

What is Uniglobe Markets?

Uniglobe Markets was established by experienced traders and financial professionals from Asia, Europe, and North America. Uniglobe’s innovative trading solutions for both seasoned and beginner traders are the result of their expertise. Their broad experience contributes to their goal of transparent and accessible Forex trading for all users.

The company’s innovative training methods have helped new Forex traders gain proficiency. Uniglobe Markets handles foreign exchange, spot metals, stocks, and futures. Clients benefit from superior execution technologies, lower spreads, and unparalleled liquidity.

Uniglobe Markets provides STP, Micro, ECN, and free unlimited demo accounts to meet various trading needs. Their platform supports enhanced STP liquidity, execution, and trading. This environment is ideal for traders who want to trade efficiently and securely.

Safety and Security of Uniglobe Markets

Dumb Little Man monitored Uniglobe Markets‘ contracts for conflicting information and safety. Leveraged complex and high-risk CFDs may cause cash loss. Uniglobe Markets recommends clients understand these risks and seek independent advice.

Uniglobe Markets’ Risk Disclosure Notice warns CFD traders of risks. This advisory highlights CFD leverage and risk management to avoid significant losses. Customers can trade volatile instruments like CFDs with ‘negative balance protection’ to avoid losing more than their original deposits.

Uniglobe Markets also rigorously monitors OTC credit risk, which increases counterparty default risk. The platform offers 1:1 to 1:500 leverage to suit traders’ risk tolerance and plans. Trading volume and market conditions may affect leverage for system stability.

Finally, Uniglobe Markets’ trading environment handles anomalous markets. Keep in mind that stop-loss orders may not stop losses in fast markets. The firm promotes margin preservation to minimize account closures due to margin deficits.

Pros and Cons of Uniglobe Markets

Pros

- Hundreds of assets, low entry threshold, favorable fees

- Five account types including professional and demo options

- Copy trading platform for passive income

- Broker’s capital use with progressive profit split

- Multiple deposit/withdrawal methods

- 24/7 client support service

- Referral and bonus programs

Cons

- Broker registered in the Marshall Islands lacking strong regulation

- 24/7 technical support exclusive to professional accounts, 24/5 for others

- Broker’s terms of cooperation lack clear obligations

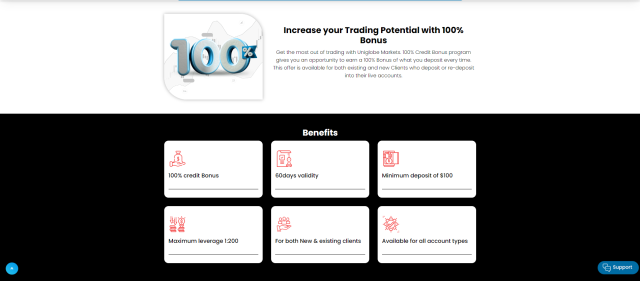

Sign-Up Bonus of Uniglobe Markets

The 100% Credit Bonus program at Uniglobe Markets increases trading potential for both new and returning customers. Traders can get a 100% bonus on deposits or re-deposits into their live accounts for any type of account. Members are able to trade more because of this perk, which doubles their trading capacity.

The program’s $100 minimum initial deposit and 60-day bonus validity period make it accessible to a diverse range of traders. With a maximum leverage of 1:200 and $2 cash-back for each normal lot traded, the incentive offers flexibility. With a maximum bonus of $5000 per account allowed by this arrangement, traders have a lot of financial leverage.

Be aware of special terms and conditions. Internal transfers are not permitted, and withdrawals result in the loss of the bonus and earnings. Bonus cancellation may occur from positions maintained open for less than three minutes or from abusive trading practices such as position hedging and risk-free profit-generating.

Minimum Deposit of Uniglobe Markets

The minimum deposits for various account types at Uniglobe Markets vary. Micro accounts, which demand a $100 deposit, are ideal for novices. For seasoned traders looking for tighter spreads and improved trading circumstances, ECN Classic accounts demand a $1,000 deposit. For high-net-worth individuals or professional traders, Uniglobe VIP accounts require a minimum deposit of $50,000.

With leverage of 1:500, the Micro account offers the trader a great deal of trading power over the original investment. Leverage is allowed at 1:200 for the ECN Classic account and 1:300 for the Uniglobe Premium account. For traders with larger volumes and riskier bets, higher-tier accounts such as the Uniglobe VIP and ECN Elite offer 1:100 leverage.

Investment-specific technical help is provided. Technical help is provided five days a week to all account users, although it is only sent to the first three. However, account holders of Uniglobe VIP and ECN Elite receive round-the-clock assistance, demonstrating the higher caliber of care offered to large investors.

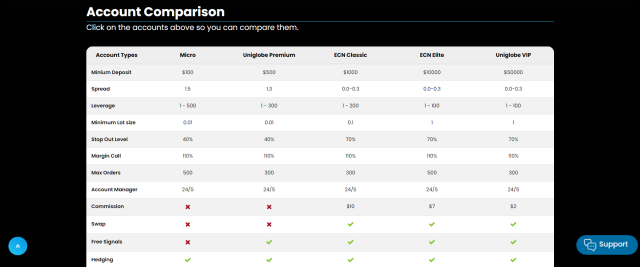

Uniglobe Markets Account Types

The experts at Dumb Little Man have carefully examined the range of account types that Uniglobe Markets provides to accommodate different trader profiles. Every account offers a fifth decimal place, market execution, hedging, scalping, and expert advisor (EA) use.

Every account has access to a live, round-the-clock account manager. Across all accounts, the margin call is always set at 110%. With the help of these features, traders of all skill levels can be confident they have access to all the resources they need to successfully traverse the forex market. For every account, swap and free signals are also offered while minimum trade volume can vary.

Micro Account

- Minimum Deposit: $100

- Leverage: 1-500

- Minimum Lot Size: 0.01

- Stop Out Level: 40%

- Max Orders: 500

Uniglobe Premium

- Minimum Deposit: $500

- Leverage: 1-300

- Minimum Lot Size: 0.01

- Stop Out Level: 40%

- Max Orders: 300

ECN Classic

- Minimum Deposit: $1,000

- Leverage: 1-200

- Minimum Lot Size: 0.1

- Stop Out Level: 70%

- Max Orders: 300

ECN Elite

- Minimum Deposit: $10,000

- Leverage: 1-100

- Minimum Lot Size: 1

- Stop Out Level: 70%

- Max Orders: 500

Uniglobe VIP

- Minimum Deposit: $50,000

- Leverage: 1-100

- Minimum Lot Size: 1

- Stop Out Level: 70%

- Max Orders: 300

Uniglobe Markets Customer Reviews

Customers commend Uniglobe Markets for its trading conditions and service. They place a strong emphasis on trading large lot sizes with small deposits, which increases profit potential.

Many commend the quick withdrawal procedure and free trading support, which increase earnings. Market involvement traders can use this broker as they have outstanding ratings for performance and dependability from their clients.

Uniglobe Markets Fees, Spreads, and Commissions

With a variety of fees, spreads, and commissions, Uniglobe Markets provides a trading account range tailored to the individual requirements of various trader profiles. The Micro and Uniglobe Premium accounts are inexpensive solutions for beginners to forex trading because they don’t charge any fees and offer larger spreads of 1.5 and 1.3 pips, respectively, without commissions.

With ultra-tight spreads starting at 0 pip and a $10 lot charge, intermediate traders can choose the $10 ECN Classic account, which enables more competitive trading in quick-moving markets.

Professional and more seasoned traders may favor the Uniglobe VIP for $2 and the ECN Elite for $7, which both offer spreads starting at 0 pips and even lower commission rates of $2 and $7 a lot, respectively. These options are designed to accommodate big-volume trading with the best possible cost-effectiveness.

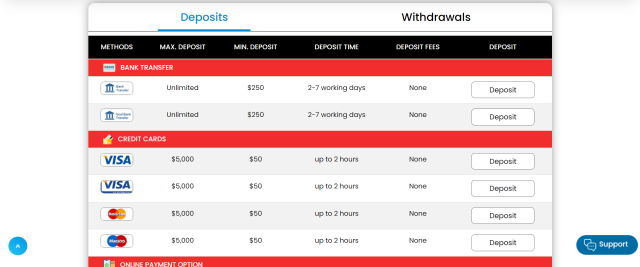

Deposit and Withdrawal

As demonstrated by an expert trader at Dumb Little Man, Uniglobe Markets provides various alternatives for making deposits and withdrawals, guaranteeing adaptability and clarity in financial dealings.

Demo accounts are a great way to learn and test strategies without having to risk any money by using actual market data with virtual dollars. These accounts, however, are meant only for simulation, thus gains cannot be made or taken out of them.

When trading with real money on live accounts, traders can actually make money depending on how well they trade. By filing a withdrawal request via the trader’s user account, profits can be taken out at any moment. Traders can simply retrieve their funds using this simple approach.

Users of Uniglobe Markets have numerous ways to receive their earnings because the platform provides a wide range of withdrawal methods, such as Visa/MasterCard, e-wallets, and other platforms like Skrill, Neteller, and Perfect Money. More importantly, traders are informed in advance of all applicable withdrawal fees, so there are no unpleasant surprises when processing withdrawals.

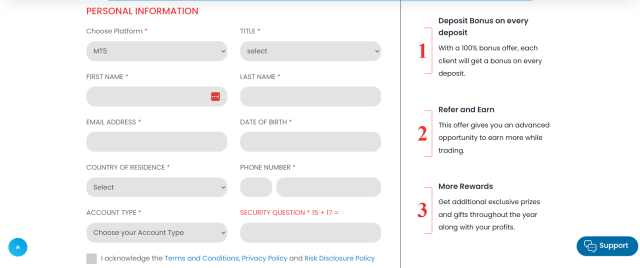

How to Open a Uniglobe Markets Account

- Visit the broker’s official website, change the interface language from the upper left corner if necessary, and click the “Open Live Account” button on the right.

- Fill in your personal details including title, first and last names, email, date of birth, country of residence, and phone number, select your desired account type, complete the anti-bot verification, agree to the terms of cooperation, and click “Confirm.”

- Check your email for a link, click it to activate your account, and note the additional emails that provide credentials for accessing the MT5 terminal and your user account.

- Navigate back to the broker’s homepage, click the “Login” button in the upper right, enter your credentials, and access your user account.

- Inside your user account, click the notification to complete the necessary verification and upload the required documents as instructed, then wait for the verification to be processed.

- Go to the “Funding” section found on the left-side menu, and select the “Deposit” option to proceed with funding your account.

- Choose your preferred method of deposit and follow the on-screen instructions to add funds to your account.

- After funding, integrate your user account details with the MT5 platform to begin trading.

- Monitor your email for any further instructions or confirmations from the broker to ensure all steps are completed successfully.

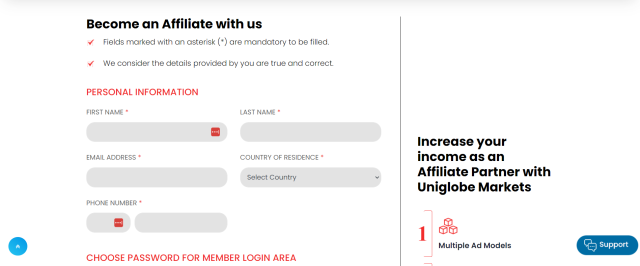

Uniglobe Markets Affiliate Program

With the goal of assisting participants in significantly increasing their Forex trading revenue, Uniglobe Markets Affiliates provides a complete Affiliate Program. Its appealing commission structure and specially crafted product offerings that cater to a wide range of affiliate requirements have earned this program much praise.

Individuals must enter their country of residence, email address, first and last names, and other required personal information in order to become affiliates. As part of the registration procedure, these details are required and must be genuine and accurate. To protect the security and privacy of their account, affiliates must also set a password in order to enter the member login section.

The affiliate program offers a number of significant advantages that are intended to maximize affiliate experience and earning potential:

- Multiple Advertising Models: Affiliates can choose from a variety of advertising models, which allows for flexible and effective marketing strategies.

- Personalized Support: Each affiliate receives personalized support to assist with any queries or issues, ensuring a smooth partnership.

- Flexible Payment Schedules: Payment terms are flexible, allowing affiliates to choose schedules that best suit their financial planning.

- Competitive Trading Conditions: Affiliates benefit from competitive trading conditions, enhancing the attractiveness of referrals.

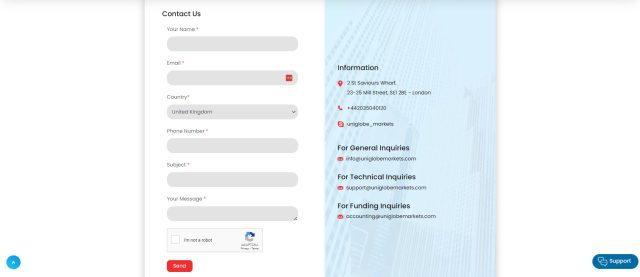

Uniglobe Markets Customer Support

For most account holders, Uniglobe Markets maintains a 24-hour technical support section to fix trading concerns. Dissatisfied customers and potential losses to competitors are prevented by this service, as Dumb Little Man demonstrated. Even on weekends, ECN Elite and Uniglobe VIP traders receive extensive support.

Uniglobe Markets’ customer support is accessible via numerous means. London is the main office, and +442035040120 is the phone number. For general questions, email [email protected], [email protected] for technical concerns, and accounting@uniglobemarkets for funding questions.

Advantages and Disadvantages of Uniglobe Markets Customer Support

| Advantages | Disadvantages |

|---|---|

Uniglobe Markets vs Other Brokers

#1 Uniglobe Markets vs AvaTrade

Uniglobe Markets and AvaTrade have distinct differences in terms of their geographic focus and regulatory environment. Uniglobe Markets provides a comprehensive range of services, prioritizing adaptable trading conditions and tailored customer support. It offers a wide range of account options to suit different levels of trading expertise and investment amounts.

AvaTrade, based in Dublin with global registrations, has a strong international presence and provides a diverse range of tradable instruments and platforms. It also offers unique features such as AvaProtect, which allows for trade insurance. Nevertheless, AvaTrade’s lack of acceptance for U.S. traders and absence of regulation by the Financial Conduct Authority (FCA) might be a cause for concern.

Verdict: If you value regulatory oversight and a wider selection of tradable instruments, AvaTrade might be the more suitable option. However, for traders seeking more personalized service and potentially improved trading conditions, Uniglobe Markets could be a more suitable option.

#2 Uniglobe Markets vs RoboForex

Uniglobe Markets and RoboForex both cater to a global clientele but have different strengths. RoboForex, operating since 2009, is well-regarded for its range of trading platforms like MT4, MT5, cTrader, and R Stock Trader, appealing to traders who prioritize technological diversity and advanced trading tools.

RoboForex is also known for its tailored conditions that suit various trading styles and portfolio sizes. In contrast, Uniglobe Markets focuses on providing competitive trading conditions, diverse account types, and personalized customer support.

Verdict: For traders who value a wide selection of technological platforms and customized trading conditions, RoboForex could be the better option. Conversely, if personal support and specific account features are more critical, Uniglobe Markets might be the preferred choice.

#3 Uniglobe Markets vs FXChoice

Uniglobe Markets and FXChoice both offer forex and CFD trading, but they target different aspects of the market. FXChoice is distinctive for its inclusion of less commonly traded forex pairs such as the Russian Ruble and South African Rand, appealing to traders interested in emerging markets.

It also provides opportunities to trade in significant commodity markets, like crude oil and precious metals, which can be attractive for portfolio diversification. Uniglobe Markets, on the other hand, offers a tailored trading experience with a focus on personalized customer service and flexible trading conditions.

Verdict: For traders looking to explore emerging forex markets and commodities, FXChoice presents a compelling option due to its specialized offerings. If a trader’s priority is customer service and tailored trading conditions, Uniglobe Markets would likely be the better choice.

Choose Asia Forex Mentor for Your Forex Trading Success

Asia Forex Mentor, highly rated by traders, offers a thorough curriculum created by Ezekiel Chew, a well-known trading specialist. The platform covers all aspects of FX, stock, and cryptocurrency trading, providing traders with the necessary skills and information to succeed in a variety of financial markets. The steady profitability of its traders demonstrates the efficacy of its training and mentoring programs.

Participants in Asia Forex Mentor receive personalized guidance from Ezekiel Chew, who provides insights gathered from his significant trading expertise. The platform fosters a supportive community of traders who collaborate and learn from one another.

Having a strong focus on discipline and psychological training is critical for traders to keep control and make sound decisions, especially in high-pressure situations. Asia Forex Mentor provides regular updates and tools to help traders stay up to date on the newest methods and market trends.

Many of his pupils have attained financial independence, demonstrating the platform’s importance in building successful trading careers. Asia Forex Mentor is the recommended option for individuals who want to flourish in the financial markets and establish themselves as experts.

RECOMMENDED TRADING COURSE | REVIEW | VISIT |

#1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |

>> Also Read: Asia Forex Mentor Review By Dumb Little Man

Conclusion: Uniglobe Markets Review

For traders, Uniglobe Markets provides an alluring array of features such as hundreds of assets, competitive fees, and a low entrance threshold. With five different account types—professional, demo, and other—the broker accommodates a wide range of trading needs. It also offers a copy trading platform that can be used to generate passive revenue.

Potential traders should be aware of the following disadvantages, though: due to lax regulations in the Marshall Islands, it can be a cause for concern. Additionally, the broker only provides round-the-clock technical help to holders of professional accounts, and their terms of collaboration are vague. In spite of these reservations, traders can still make money with Uniglobe Markets.

>> Also Read: ForexChief Review 2024 with Rankings By Dumb Little Man

Uniglobe Markets Review FAQs

What types of trading accounts does Uniglobe Markets offer?

Trading platforms Uniglobe Markets offers a range of account types, including Micro, Uniglobe Premium, ECN Classic, ECN Elite, and Uniglobe VIP accounts, each having their own minimum deposit requirements, leverage choices, and other trading conditions designed to improve the trading experience.

Can I start trading with Uniglobe Markets without real money?

Yes, Uniglobe Markets provides a demo account option, allowing traders to practice trading without risking real money. The demo account uses real market data to imitate trading situations, making it an ideal tool for novices to learn trading or experienced traders to test new methods or trading instruments.

How does Uniglobe Markets ensure the safety of client funds?

It employs several measures to enhance the security of client funds. These include offering segregated accounts to keep client funds separate from company funds and providing negative balance protection to prevent clients from losing more than their initial investment.

Dumb Little Man Recommends – Top 3 Best Forex Brokers in 2024 | ||

John V

John is a digital marketing master's student who enjoys writing articles on business, finance, health, and relationships in his free time. His diverse interests and ability to convey complex ideas in a clear, engaging manner make him a valuable contributor to these fields.