US Crude Oil Prices Fluctuate Ahead of Key Meetings and Reports

By Daniel M.

January 5, 2025 • Fact checked by Dumb Little Man

Crude oil prices dipped slightly in Europe on Thursday, giving back some of the week’s earlier gains. These increases were initially driven by optimism that the Organization of Petroleum Exporting Countries (OPEC) and their allies would maintain their current production cuts during Sunday’s policy meeting. Additionally, the upcoming summer ‘driving season’ in the United States is anticipated to boost gasoline demand.

Recent data from the American Petroleum Institute revealed a significant decrease in crude inventories, down 6.59 million barrels for the week ending May 24. Attention is now turning to the Energy Information Administration’s inventory report due later today.

Ongoing military actions, such as Israel’s strikes on Rafah, continue to highlight the geopolitical tensions in the Middle East, influencing oil prices, which have risen over 1% this week.

Despite fundamental factors that support robust oil demand, market uncertainty persists, particularly regarding the timing and extent of potential US interest rate cuts. While a strong economy that supports higher interest rates is generally positive for oil demand, market sentiment tends to be more favorable towards oil when central banks adopt stimulus measures.

Futures markets are currently betting on interest rate reductions starting in September in the US, potentially earlier in Europe. However, these expectations hinge heavily on upcoming inflation reports, including the US Personal Income and Expenditure data set for release on Friday.

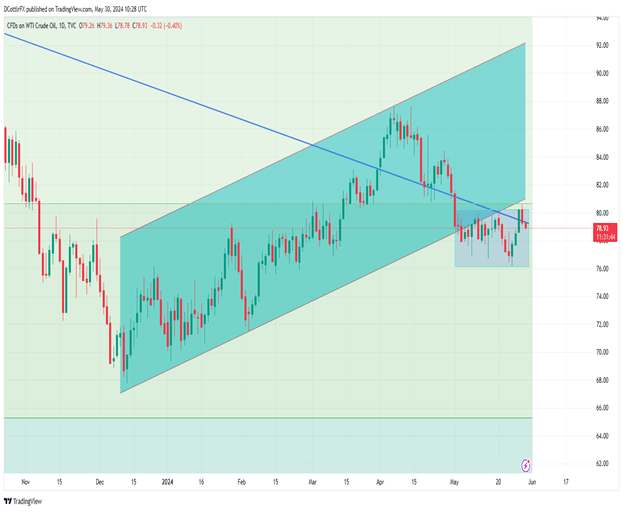

US Crude Oil Technical Analysis

After breaking below the uptrend channel that dominated since mid-December at the beginning of May, oil prices have largely moved sideways, confined within a narrow range between $80.18 and $76.23 per barrel, the latter marking a two-month low. Although these levels have been seldom tested, the typical trading range has been even narrower.

This week, market bulls attempted to breach the upper limit of this range on Tuesday but were unsuccessful, suggesting that the established trading band is likely to persist given the ongoing fundamental uncertainties.

The market is currently near support from its long-term downtrend line dating back to June 22, which is now at $79.35, with resistance at the retracement level of $80.68.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.