BoJ Raises Rates to 0.25%, Plans Bond Tapering

By Wilbert S

July 31, 2024 • Fact checked by Dumb Little Man

BoJ Rate Hike to 0.25%

The Bank of Japan (BoJ) voted 7-2 to increase the policy rate from 0.1% to 0.25%. This marks a step toward normalizing monetary policy as the BoJ outlines specific figures for its bond purchases, moving away from the extensive stimulus measures.

Bond Tapering Schedule

The BoJ announced it will decrease Japanese government bond (JGB) purchases by ¥400 billion each quarter. Monthly JGB purchases will be reduced to ¥3 trillion from January to March 2026.

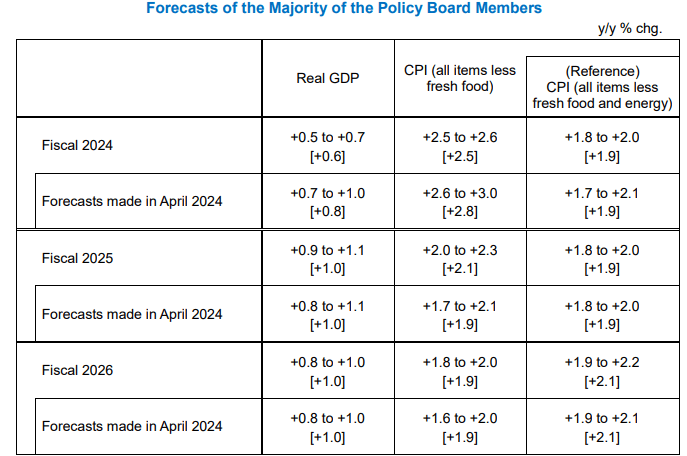

The BoJ indicated that if economic activity and prices align with their outlook, further rate hikes and adjustments to monetary accommodation will follow.

Reducing accommodation is seen as essential for achieving the 2% price target sustainably. Despite this, the BoJ noted the need to maintain an accommodative environment due to negative real interest rates supporting economic activity.

The quarterly outlook suggests that prices and wages will stay elevated, with private consumption expected to rise moderately despite higher prices.

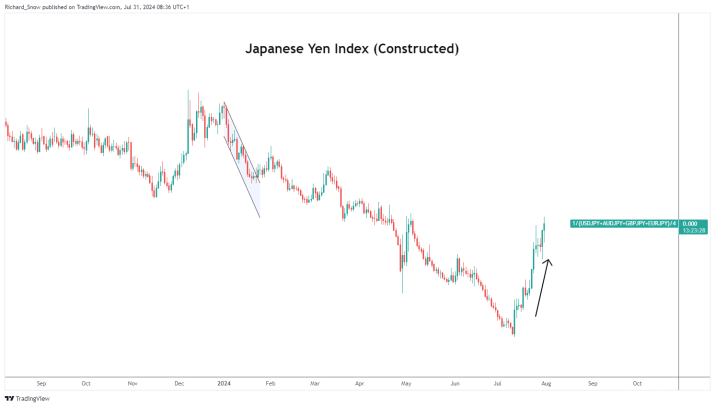

Yen Strengthens Post-Hawkish BoJ Meeting

The Japanese Yen experienced initial volatility but strengthened after the BoJ’s hawkish measures were digested by the market. This appreciation comes as the US economy moderates and the BoJ observes a positive relationship between wages and prices, leading to reduced monetary accommodation. Speculation around FX intervention from Tokyo officials followed the yen’s sharp appreciation post lower US CPI data.

A key takeaway from the BoJ meeting is the impact of FX markets on inflation. Previously, BoJ Governor Kazuo Ueda stated the weaker yen had minimal effect on rising prices. This time, however, Ueda cited the weaker yen as a reason for the rate hike.

There is now a closer focus on the USD/JPY level, with a bearish trend anticipated if the Fed lowers the Fed funds rate this evening. The 152.00 level is critical, marking last year’s high before FX intervention caused a sharp drop in USD/JPY.

The RSI has rapidly shifted from overbought to oversold, indicating increased volatility. Japanese officials are hoping for a dovish Fed decision, which would lower the Fed funds rate, making 150.00 the next key support level.

Wilbert S

Wilbert is an avid researcher and is deeply passionate about finance and health. When he's not working, he writes research and review articles by doing a thorough analysis on the products based on personal experience, user reviews and feedbacks from forums, quora, reddit, trustpilot amongst others.