FXTM Review: Is it Best for Copy Traders in 2025?

By Wilbert S

January 5, 2025 • Fact checked by Dumb Little Man

Want to jump straight to the answer? The best forex broker for traders is Avatrade

The #1 Forex Trading Course is Asia Forex Mentor

Technology is the backbone of the retail forex trading sector, and successful brokers have depended on innovative technology to power a vast growth dynamic in this trading routine throughout the world over the past two decades.

Traditional trading strategies have had high failure rates, forcing brokers to develop alternatives such as “mirror,” “social,” and “copycat” trading for novices and veterans who desire to profit from the careful selection of professionals in the arena.

FXTM (ForexTime.com), an industry-leading broker with offices worldwide and licenses in the United Kingdom and Cyprus, just unveiled the newest improved version of this strategy with its new service – FXTM Invest – in February of 2016. This new service emphasizes simplicity, flexibility, safety, and openness. Unfortunately, clients from the United States are not allowed at this time.

FXTM’s social trading platform, also known as FXTM Invest, is one of the reasons for the company’s success. FXTM has come up with a unique approach. You may choose a forex trader, a Strategy Manager based on their performance and invest funds in their strategy by automatically linking your account and the manager’s account to mimic their trades.

FXTM Review: What Is FXTM?

The Financial Conduct Authority and other authorities have named FXTM or Forex Time, created in 2011 and had its headquarters in Cyprus (Limassol), one of the world’s fastest-growing and best forex brokers. Just because of its focus on Africa and Asia, the organization has experienced significant growth inside Europe in a short period.

With its accessible trading worldwide, regardless of the trader’s skill level, the broker builds its foundation on reliable trading conditions and substantial education and provides trading worldwide.

However, FXTM has established a network of offices around Europe, with headquarters in the United Kingdom and South Africa. It demands you to be a professional to appreciate and realize the advantages of this service.

“FXTM Invest is a flexible program specifically geared to those traders who are just beginning out in the markets, don’t have much time on their hands for trading, or just don’t have the patience for it,” according to the firm’s press release.

If that describes you, this is the program for you! Once you’ve chosen which trader to follow, you’ll automatically mimic their trading routine and profit anytime they do!” What has been the performance during the last eight months?

According to the FXTM website, if you were lucky enough to deposit $1,000 in the first fund and pick the top traders, your fund balance might currently be over $4,500. However, as we’ve often been reminded, past performance is no guarantee of future success, but a “4.5X” multiple is rather outstanding.

| RECOMMENDED TRADING COURSE | REVIEW | VISIT |

|---|---|---|

| #1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |  |

How does FXTM work?

After completing a quick registration procedure, you may pick an expert, agree to conditions, and fund your account. It is then, after all, up to you to keep track of your performance with your acceptable risk levels.

Distribute the profits according to the agreed-upon distribution formula, and you can withdraw profits at any moment. They can handle everything for you via the “FXTM Invest” program, including online reporting of account balance fluctuations and your history with each expert.

The social trading platform is simple and easy to use. All you have to do is open a so-called Investment Account after creating an FXTM web-based account called my FXTM. For this reason, you don’t need to establish an MT4 trading account. You may open an investing account through my FXTM account with only a few clicks.

The next step is to choose strategy managers based on various factors such as all-time profit, monthly profit, age (how long has the manager been active in days), and the number of investors who follow the manager.

Typically, one of your primary selection criteria should be the manager’s age since this indicates that the manager has been there for a long time without blowing up the account.

It’s a versatile software suitable for novice and experienced traders who wish to try something new. The only thing they demand you to do is pick a trader, follow them, and mimic their trading patterns to make money quickly. You’ll need to fund your account, choose a trader, and keep track of your progress to get started.

FXTM Invest appears to be a win-win situation for investors and strategy managers. Depending on the transaction, each party obtains a plethora of rewards.

| Broker | Best For | More Details |

|---|---|---|

|

| securely through FXTM website |

What are the Features of the FXTM platform?

Let’s discuss the features in detail!

Leverage

When trading with FXTM, you may choose between fixed and adjustable leverage. Leverage is a precious instrument, especially for smaller traders, because it allows you to raise your potential earnings quickly by multiplying your original account balance a certain number of times.

As a result, FXTM leverage is decided by various factors, the first of which is established following regional regulatory requirements.

Then there’s the trader’s expertise and knowledge, so always check with the customer service staff to see which one applies to you.

Accounts

FXTM provides distinct Forex trading and investment accounts. Then there’s a divide based on your preferred trading transactions, instrument, and trading size, giving you three account kinds to choose from Micro, Advantage, and Advantage Plus.

Let’s take a deeper look at FXTM Accounts, which are split into three categories. – Micro, Advantage and Advantage Plus are three different types of advantages.

Micro Account – FXTM’s most accessible account, with a low minimum deposit and quick execution, as well as a $0 fee and spreads as low as 1.5 pips.

FXTM’s lowest account type is the Advantage Account, which has an average cost of $0.40 – $2 dependent on volume and spreads as low as 0.0.

Advantage Plus Account – a partner account with no commission (just the spread) and spreads starting at 1.5 pips.

Trading Platforms

FXTM has built its mobile app, FXTM Trader, which provides traders with the MT4/MT5 trading platforms. It adds six plugins to MT4 and its Pivot Points Strategy, which includes live updates and comments from FXTM’s Head of Education, and the mobile app is simple to use.

FXTM’s investment in MT4 improvements is praise-worthy. They give their traders great benefits over the standard versions offered by most brokers.

Unique Features

While FXTM is known for its low trading fees and transparency, I enjoy its copy trading platform, FXTM Invest. The demo account feature offers an effective trading strategy within the trading accounts.

It allows investors to track strategy managers, with FXTM providing pertinent data on each. Although the community is not as significant as other services, all of the top 75 listed managers have demonstrated favorable results, which FXTM claims are audited and validated. I believe it is promising and has a lot of promise for FXTM in the future.

Research and Education

FXTM’s four-person research team publishes market comments and analyses in written articles, short YouTube videos, and podcasts. They provide a quick rundown of recent market developments and some insightful commentary.

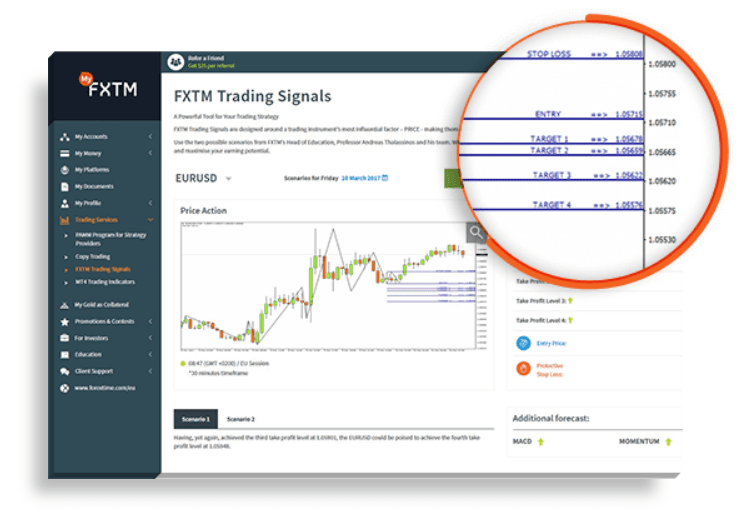

FXTM offers its FXTM Trading Signals service for traders looking for actionable research. Beginner traders have the way into one of the instructional programs available, including a video library with hundreds of films, textual information, and a unique trading terminology periodic table. It’s well-structured and a great place to start for beginner traders, in my opinion.

Customer Support

Traders have access to multilingual customer service 24 hours a day, seven days a week. Phone help, including a call-back option, e-mail, and a FAQ area, are all available. FXTM also offers live chat on its website and through WhatsApp, Viber, Telegram, and Messenger. The customer support team provides beneficial options to trade forex within the forex market.

I doubt most traders will want assistance because FXTM’s product and service portfolio is well-explained. FXTM guarantees that traders have quick access to a representative whenever the need arises.

Range of Assets

FXTM offers 63 currency pairs, 0 cryptocurrency pairings, eight commodities, 17 index CFDs, 1,227 equity CFDs, 420 stocks listed in the United States, and five stock baskets. Although there is a limited selection of commodities and index CFDs, the comprehensive selection of trading instruments is competitive. FXTM also has 420 equities available for direct investment. However, they are all US-listed. FXTM will best fit Forex and US equity traders in terms of tradable assets.

Regulation and Security

Using a registered broker will reduce the risk of fraud and malpractice. I usually advise traders to look for regulation and double-check it with the regulator by comparing the issued license to their database. FXTM offers four well-regulated companies to its clients.

Social Trading

Aside from its extensive features and apparent ability to monitor markets, the FXTM platform also allows for automated trading, which is the automatic execution of orders based on a plan.

Alternatively, you may use the powerful function of Social Trading, which allows you to follow rated strategy managers that you can select to follow based on a variety of criteria or filters. On the other hand, professionals may become managers and earn additional revenue due to being copied.

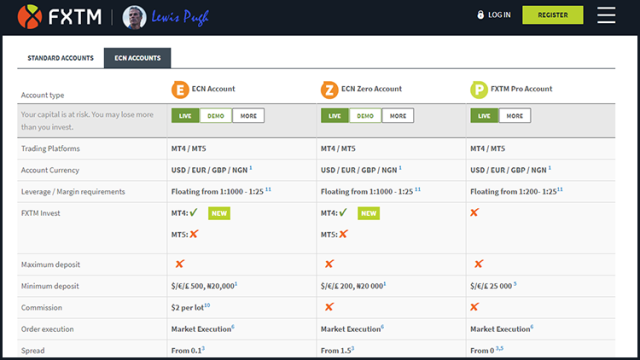

ECN account

Fast execution speeds and fixed leverage up to 1:200 are possible using ECN technology. As a result, they multiply the profit opportunities. As a Stockholder, you have the option of reviewing Strategy Manager profiles or selecting from a list of current high-ranking performers. In addition, pay each manager a “copy fee,” usually 30 percent to 40% of revenues made.

In the hint of this, here are some factors why you should utilize the FXTM Invest service. This notion is not new in the retail forex trading world.

Fund managers and mirror and social copycat trading have been operating for a long time. However, these older transactions are lacking in elegance and security.

FXTM Pricing and Plan?

You should also consider these expenses since FXTM will charge you $5 every month if you haven’t traded for six months or longer, known as the FXTM Inactivity fee.

If you want to trade stocks, the only cost will be the spread’s leverage, a very competitive and pleasant offering compared to the industry.

You may see some comparisons between other trading CFDs brokers below, but keep in mind that this is FXTM’s typical proposal, which appears to be average and expensive.

However, as we can see, FXTM’s proposition is highly flexible, so depending on your account type and the instrument you trade, FXTM may be able to provide you with practically the best deal in terms of costs. Let’s discuss forex fees!

Deposit options

You can fund an account or send money to it using one of the ways listed below, which may vary depending on your place of origin. FXTM is also relatively rapid with deposit processing, as it states that money will be ready in your account within 2 hours, allowing you to start trading right away.

• Debit and credit cards

• Bank wire transfers and the option to make a local bank transfer. Transfers via Deutsche Handelsbank (accepting EUR deposits) and Rietumu Banka are other options (using GBP, PLN, USD, EUR, RUR)

• Electronic wallets (Neteller, Skrill, Alfa-Click, WebMoney, Western Union, Dotpay, Yandex money, Qiwi wallet, Bitcoin via Skrill, and counting)

FXTM minimum deposit

FXTM requires a $/€/£ 100 minimum deposit for Account Standard and only $10 for a Cent Account. Furthermore, the organization covers all deposit costs, which is excellent for sensible money management. The payment method is effective within the account types and trading conditions.

Withdrawal

Bank transfers, e-wallets, and cards are a few FXTM withdrawal alternatives. The withdrawal charge varies depending on the selection.

Credit card withdrawals, for example, cost $3, while bank transfers cost $30, and WebMoney charges 2% more than the requested amount.

However, compared to other industry products, these withdrawal costs are still regarded as cheap. Some payment options may have a commission, while others may have none. It helps to withdraw funds or withdraw money, making it great for users.

| Broker | Best For | More Details |

|---|---|---|

|

| securely through FXTM website |

Who is FXTM Best For?

You may still trade index CFDs on MT4 with FXTM if you want to profit from moves in an entire country’s stock market. Indices markets at FXTM feature among the lowest spreads in the industry, making them a popular option.

Clients may trade all of the leading cryptocurrencies as CFDs with FXTM. They sell all cryptocurrency CFDs in currency pairs against the US Dollar, exactly as FX markets. If you wish to trade a Bitcoin CFD, for example, you will change a BTC/USD CFD.

It’s worth noting that signing up for an FXTM subsidiary outside of the UK is required to access crypto financial products. The FCA, the UK’s financial regulator, has modified its regulations to prohibit ordinary traders from trading cryptocurrencies. Crypto markets are still open to professional traders.

FXTM is worth looking at if you’re a beginning trader who wants to learn how to trade. Why pay for pricey extra trading training from a third party you don’t know if you can trust when FXTM offers free articles, courses, and webinars?

FXTM Pros and Cons

Let’s discuss the pros and cons in detail!

Pros

- Fair customer service

- Superb education instruments

- Digital and rapid account outlet

- User-friendly and reliable

Cons

- Increased CFD fees

- Withdrawal fees and inactivity

FXTM User Experience

Industry-leading software third-party suppliers power FXTM’s trading technology and toolbar. Therefore there’s no need for a presentation because they are MT4 and MT5 platforms.

However, the MetaTrader’s advanced technology was merged with FXTM’s unrivaled trading services, allowing for seamless operation and boosting your trading skills, resulting in trading procedures that are both powerful and efficient.

If you need additional tools and customization options, the Desktop version is the way to go. MetaTrader is compatible with various platforms, including PCs, Macs, and an easily accessible Multi Terminal for money managers.

As a result, you will always have access to your account at your leisure. The package includes everything essential and beneficial tools from risk management to analysis and a unique built trading tool like the Pivot points approach and trading signals. With converters and calculators, these tools make trading more professional for traders of all levels.

Since the FXTM platform utilizes MT4 or MT5 software, both versions are offered as WebTrading platforms or standalone applications that can run on any device.

Suppose you’re a newbie or a regular trader. In that case, web trading software is a terrific alternative because it’s available immediately from your browser, requires no installation, and is simple to save and navigate.

FXTM vs Competitors

1. FXTM vs Avatrade

FXTM adds six plugins to MT4 and its Pivot Points Strategy, which includes live updates and comments from FXTM’s Head of Education, and the mobile app is simple to use.

However, AvaTrade includes premium tradable instruments, including commodities, Forex, indices, and other cryptocurrencies for manual and automated trading for different devices.

FXTM is a versatile software suitable for novice and experienced traders who wish to try something new. Whereas AvaTrade also includes a wide range of complex instruments with new traders to open accounts, the broker consists of dedicated research and educational options that help them up significantly.

| Broker | Best For | More Details |

|---|---|---|

|

| securely through FXTM website |

| Broker | Best For | More Details |

|---|---|---|

|

| securely through Avatrade website |

2. FXTM vs. FXCC

FXTM has some drawbacks: it charges high CFD fees, inactivity, and withdrawal fees, and the product range is limited. Besides this, FXCC offers forex traders to trade on Forex and silver and gold, indices on trusted MetaTrader 4., available as web or download solution.

FXTM offers 63 currency pairs, 0 cryptocurrency pairings, eight commodities, 17 index CFDs, 1,227 equity CFDs, 420 stocks listed in the United States, and five stock baskets. However, FC XX provides MT4 to every client accessible on various gadgets and significant web browsers. The platform has many advanced features for trading.

| Broker | Best For | More Details |

|---|---|---|

|

| securely through FXTM website |

| Broker | Best For | More Details |

|---|---|---|

| securely through FXCC website |

Choose Asia Forex Mentor for Your Forex Trading Success

If you have a keen interest in establishing a successful career in forex trading and aspire to achieve substantial financial gains, Asia Forex Mentor stands as the optimal choice for the best forex, stock, and crypto trading course. Ezekiel Chew, renowned as the visionary behind trading institutions and banks, is the driving force behind Asia Forex Mentor. On a personal note, Ezekiel consistently achieves seven-figure trades, a distinction that truly sets him apart from other educators in the field. Here are the compelling reasons that underpin our recommendation:

Comprehensive Curriculum: Asia Forex Mentor offers an all-encompassing educational program that covers stock, crypto, and forex trading. This well-structured curriculum equips aspiring traders with the knowledge and skills necessary to excel in these diverse markets.

Proven Track Record: The credibility of Asia Forex Mentor is firmly established through its impressive track record of producing consistently profitable traders across various market sectors. This achievement serves as a testament to the effectiveness of their training methodologies and mentorship.

Expert Mentors: At Asia Forex Mentor, students benefit from the guidance and insights of experienced mentors who have demonstrated remarkable success in stock, crypto, and forex trading. These mentors provide personalized support, enabling students to navigate the intricacies of each market with confidence.

Supportive Community: Joining Asia Forex Mentor brings access to a supportive community of like-minded traders pursuing success in the stock, crypto, and forex markets. This community fosters collaboration, idea-sharing, and peer learning, enhancing the overall learning experience.

Emphasis on Discipline and Psychology: Success in trading necessitates a strong mindset and disciplined approach. Asia Forex Mentor provides crucial psychological training to help traders manage emotions, handle stress, and make rational decisions during trading.

Constant Updates and Resources: The financial markets are dynamic, and Asia Forex Mentor ensures that students remain up-to-date with the latest trends, strategies, and market insights. Continuous access to valuable resources keeps traders ahead of the curve.

Success Stories: Asia Forex Mentor takes pride in a multitude of success stories where students have transformed their trading careers and achieved financial independence through their comprehensive forex, stock, and crypto trading education.

In summary, Asia Forex Mentor emerges as the premier choice for those seeking the best forex, stock, and crypto trading course to carve a rewarding career and achieve financial prosperity. Through its comprehensive curriculum, experienced mentors, practical approach, and supportive community, Asia Forex Mentor provides the necessary tools and guidance to mold aspiring traders into accomplished professionals across diverse financial markets.

RECOMMENDED TRADING COURSE | REVIEW | VISIT |

#1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |

Conclusion: Is FXTM the Best for Copy Traders?

Concluding FXTM Review, FXTM gives a quality trading potential for both beginners and experienced traders or investors. Moreover, there are other advantages with ForexTime; the accounts variety is awe-inspiring and allows any trader the best suitable option either with flexible or floating leverage – leverage which is determined based on the trader experience and knowledge, tight spreads from 0.1 pips, and low deposit requirements.

FXTM is regulated by several financial authorities globally, including the top-tier Financial Conduct Authority (FCA). On the plus side, customer support gives fast and relevant answers. There are several educational tools, including demo accounts and webinars.

The account opening is fully digital and fast. Your bank statement is authorized by the Sector Conduct Authority FSCA to help get an investor compensation fund.

Besides this, FXTM has some drawbacks: it charges high CFD fees, inactivity, and withdrawal fees, and the product range is limited. As account opening only takes a short time, and customer support is helpful and reliable, feel free to try FXTM.

| RECOMMENDED TRADING COURSE | REVIEW | VISIT |

|---|---|---|

| #1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |  |

FXTM FAQs

Is FXTM Safe and Legit?

FXTM or ForexTime was established in 2011 and is a worldwide CFD and FX broker. Like the Cyprus Securities and Exchange Commission and the UK Financial Conduct Authority, numerous financial authorities manage it. FXTM is entirely safe because the top-tier FCA controls it.

FXTM offers just a one-step login. A two-step validation can be more secured. You are unable to use a biometric login. If you add this feature, it would be more convenient. The FXTM Shares Account offers you an outburst to more than 180 individual share CFDs for traders who want to expand their trading portfolio. It’s regulated by the financial Forextime UK limited for different forex traders.

What is the role of the financial services commission?

The Financial Services Commission was launched in 2001 and managed within a worldwide famous legal framework under the supervision of the Financial Services Act. The FSC licenses monitor, supervise and regulate the way of business activities in the financial services sector other than banking.

The key feature of the Financial Services Commission in Barbados is to offer financial firmness in the financial system. This is one of the tasks FSC is proud of, and many resources are aligned with it to ensure that this task is handled with enthusiasm by the highly skilled staff.

What is the role of the financial sector conduct authority?

The FSCA’s main motive is to improve the efficiency and purity of financial markets, encourage appropriate customer treatment by financial organizations, offer financial education, heighten financial literacy, and assist in preserving economic stability.

The FSR Act expands the jurisdiction of the FSCA for containing the oversight of financial products and favors that are not overseen by the FSB banking like the services related to credit.

Wilbert S

Wilbert is an avid researcher and is deeply passionate about finance and health. When he's not working, he writes research and review articles by doing a thorough analysis on the products based on personal experience, user reviews and feedbacks from forums, quora, reddit, trustpilot amongst others.