Understanding Market Sentiment

The appeal of following market trends is evident – buying during a high and selling during a low. However, experienced traders often leverage contrarian strategies to capitalize on market extremes.

Tools like IG client sentiment provide insight into the market’s mood, pinpointing times when excessive optimism or pessimism could indicate a trend reversal.

While these signals aren’t foolproof, they become valuable when integrated into a well-rounded trading strategy. Combining contrarian views with thorough technical and fundamental analyses helps traders understand the dynamics affecting price movements.

This is particularly relevant when examining the Australian dollar’s performance in the AUD/USD and AUD/JPY pairs.

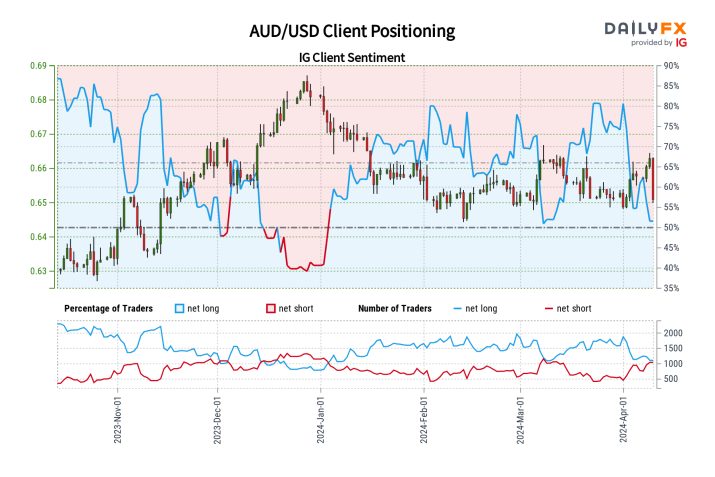

AUD/USD Forecast – Sentiment Analysis

According to IG, a significant 77.82% of retail traders are net-long on AUD/USD, indicating a long-to-short ratio of 3.51 to 1.

This bullish sentiment has recently intensified, with long positions increasing by 44.17% since yesterday and 13.68% over the last week, while short positions have decreased.

This strong bullish sentiment suggests potential downward movement for AUD/USD from a contrarian viewpoint. The recent spike in net-long positions underscores this bearish outlook.

Key Reminder: While valuable, contrarian signals should be evaluated as part of a broader analysis that includes both technical and fundamental factors to support informed trading decisions.

AUD/JPY Forecast – Sentiment Analysis

IG sentiment data indicates that 68.87% of traders are currently short on AUD/JPY, with a short-to-long ratio of 2.21 to 1.

The proportion of bearish positions has fallen by 19.94% since yesterday and 4.10% over the past week, whereas bullish positions have risen by 29.59% since the last session, though they are down 11.19% from a week ago.

The prevailing bearish sentiment among the retail crowd on AUD/JPY might suggest a potential rise in the pair from a contrarian perspective.

However, the recent shift in positions—fewer bearish bets and more bullish stakes—creates ambiguity, leading to a cautious outlook on this assessment.

Important Note: Remember that while contrarian indicators are insightful, their effectiveness is maximized when used in conjunction with comprehensive technical and fundamental analysis.