Analysis: Shift to Net-Short in AUD/USD Since May 21

By Daniel M.

January 5, 2025 • Fact checked by Dumb Little Man

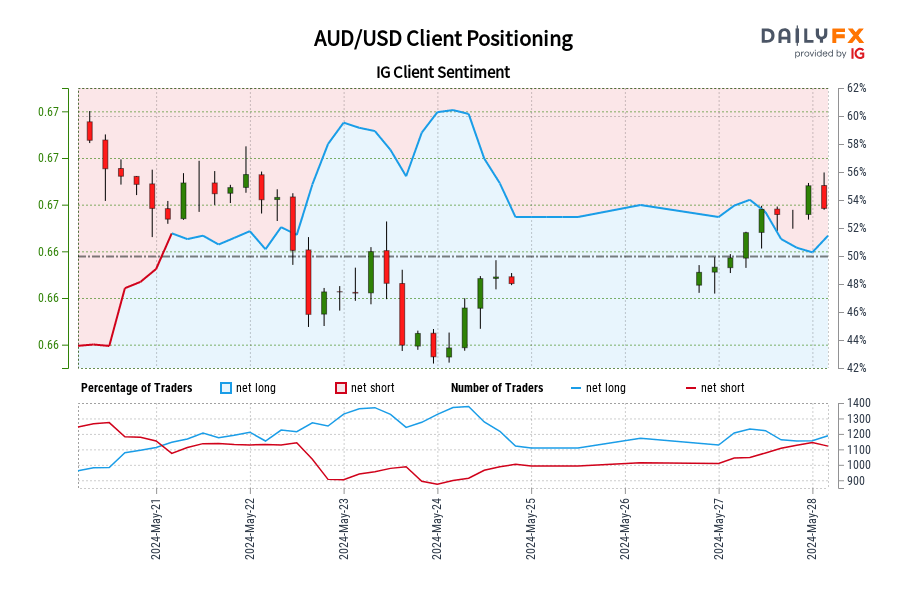

Retail trader data reveals that 49.74% of traders are currently net-long on AUD/USD, with the short-to-long trader ratio at 1.01 to 1. Since May 21, when AUD/USD was trading near 0.67, traders have shifted to a net-short position. Since this shift, the price has slightly decreased by 0.09%.

Compared to yesterday, there is a 6.99% decrease in net-long traders, and a 1.89% decrease from last week. Conversely, the net-short positions have increased by 10.40% since yesterday and 4.05% from last week.

Market Sentiment and Price Forecast

We generally adopt a contrarian stance to crowd sentiment. The prevailing net-short position suggests that AUD/USD prices might rise. This viewpoint is strengthened as traders have deepened their net-short positions since yesterday and last week.

The combination of current sentiment and recent shifts supports a stronger bullish outlook for AUD/USD in the contrarian perspective.

The transition to a net-short stance since May 21 indicates potential bullish momentum for AUD/USD. This is based on our contrarian analysis of the recent trading patterns and the ongoing adjustments in trader positions. Investors might consider this when planning their strategies in the forex market.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.