AUD Analysis: Aussie Dollar Hit by Market Sentiment

By Daniel M.

January 5, 2025 • Fact checked by Dumb Little Man

Aussie Dollar Falls Amid Weak Market Sentiment – SPX, AUD Down

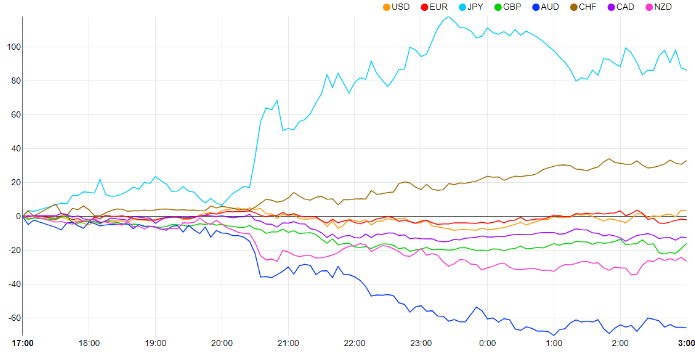

Overnight FX movements highlight the Japanese yen as the top performer, while the Australian dollar lags behind other popular currencies. The Aussie has plummeted over the past 10 days due to deteriorating market sentiment. In such conditions, the FX market tends to favor safe haven currencies over high-beta currencies like the Aussie. The AUD/JPY chart illustrates this scenario.

AUD/JPY Analysis

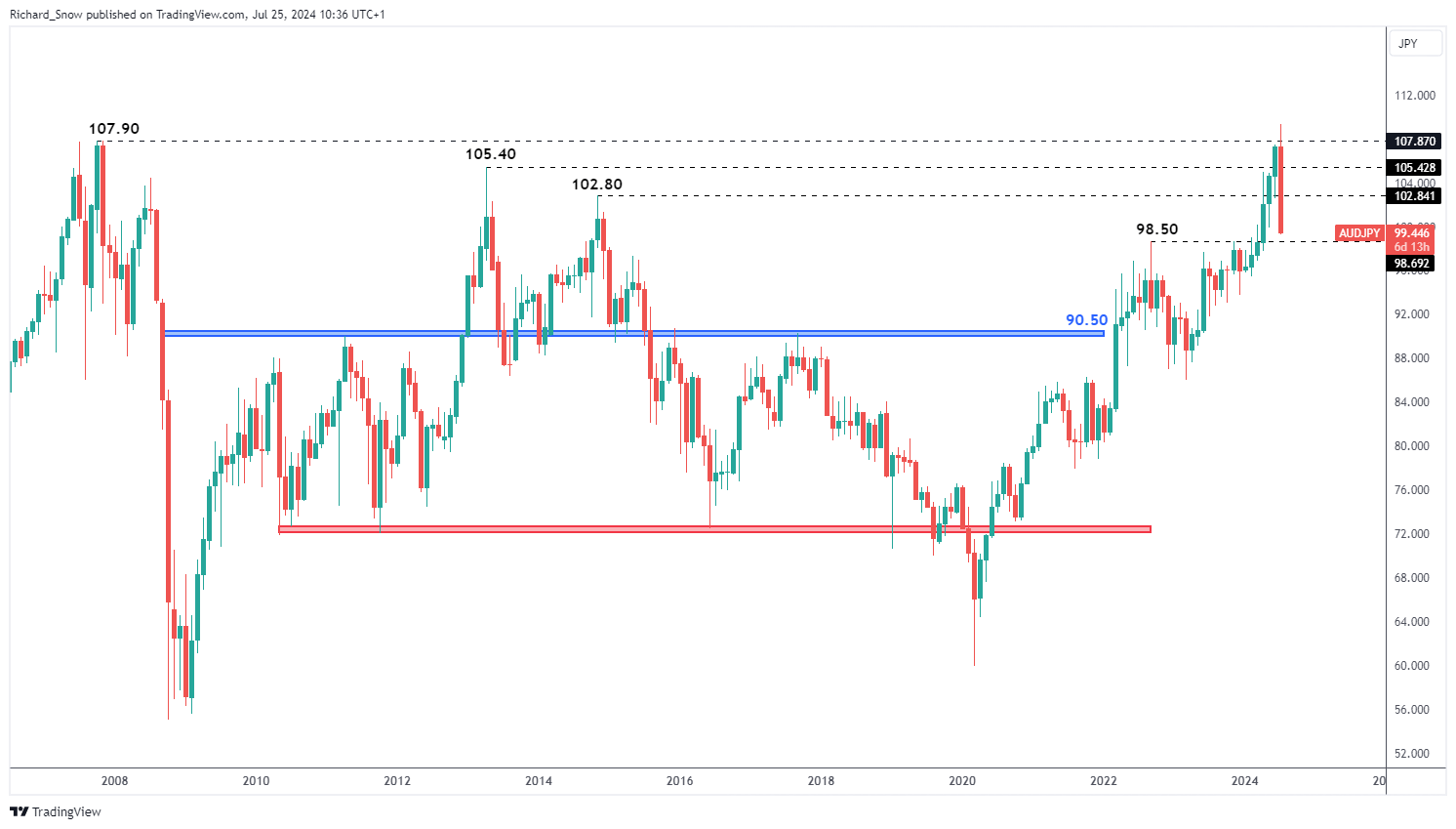

The FX outlook for the Australian dollar and Japanese yen has shifted, with a more significant change for the yen. The broader macroeconomic environment has evolved. Previously, the Aussie dollar benefited from the Reserve Bank of Australia’s potential interest rate hikes, contrasting with other major central banks preparing to cut rates. However, with US equities declining and the Bank of Japan gearing up to hike rates and reduce bond purchases, AUD/JPY has reversed sharply.

AUD/JPY failed to close above 107.40 on the weekly chart, marking a peak, with the pair declining nearly 10% since. 98.50 is the next notable support level.

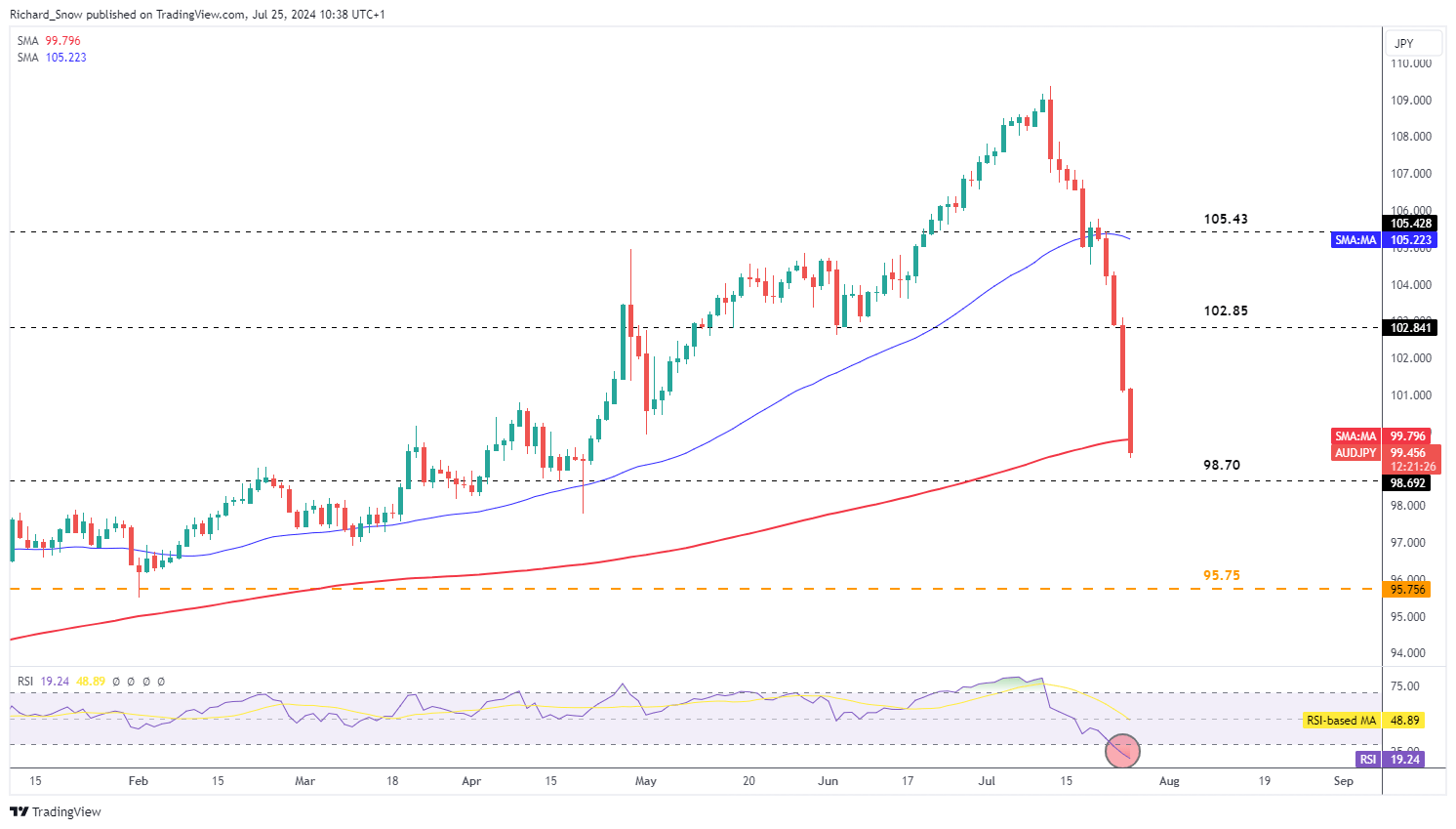

The daily chart reveals the extent of the decline, with 10 down days out of the last 11 trading sessions, interrupted by a single green candle. The recent bearish acceleration has pushed the pair into oversold territory, suggesting a possible breather for profit-taking.

The pair is currently testing the 200-day simple moving average (SMA), with 98.70 as the next target. A daily close below the 200 SMA would indicate that bearish momentum persists. Instead of chasing such fast-moving markets, waiting for a short-term correction could offer a better risk-reward setup before assessing a deeper pullback. A correction towards 102.85, though less likely, would be an opportunity to reassess the bearish trend.

AUD/USD Analysis

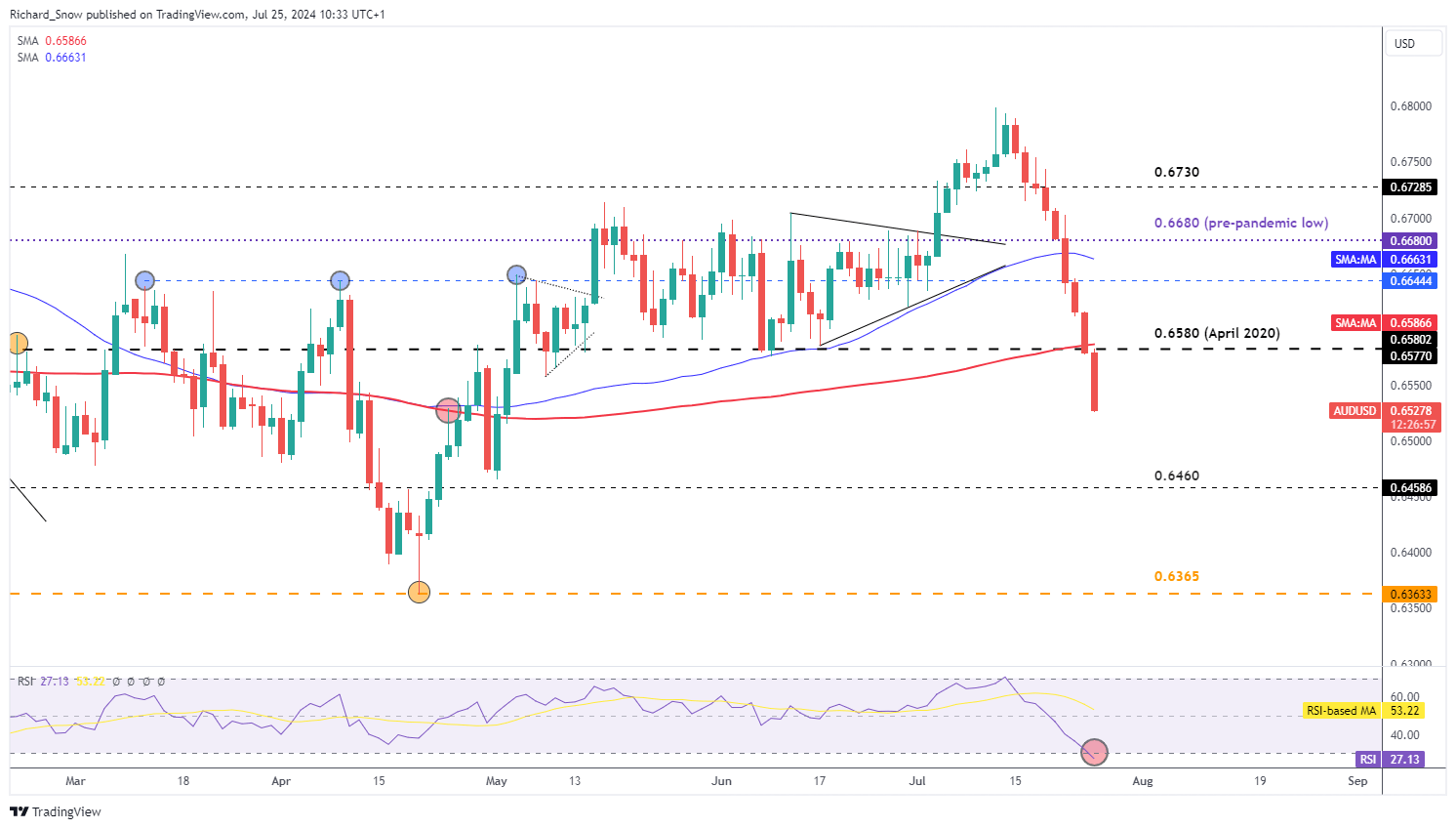

AUD/USD has declined for nine consecutive trading days, with today’s potential close in the red. A September rate cut by the Fed is increasingly likely, bolstered by recent positive inflation data. Tomorrow’s US PCE data could either support this view or create uncertainty ahead of next week’s Fed meeting. Analysts expect a slight improvement in the figure, with any outcome other than an upward surprise likely to continue the current AUD/USD downtrend.

Similar to AUD/JPY, AUD/USD shows a sharp bearish reversal, suggesting sub-optimal bearish setups at current levels. Instead, a short-term pullback or consolidation around 0.6580 could provide clarity for the next move, whether it continues bearish or pulls back deeper. Support is at 0.6460, following a close below the 200 SMA on the daily chart. Resistance is found at 0.6580, the 200 SMA, and 0.6644.

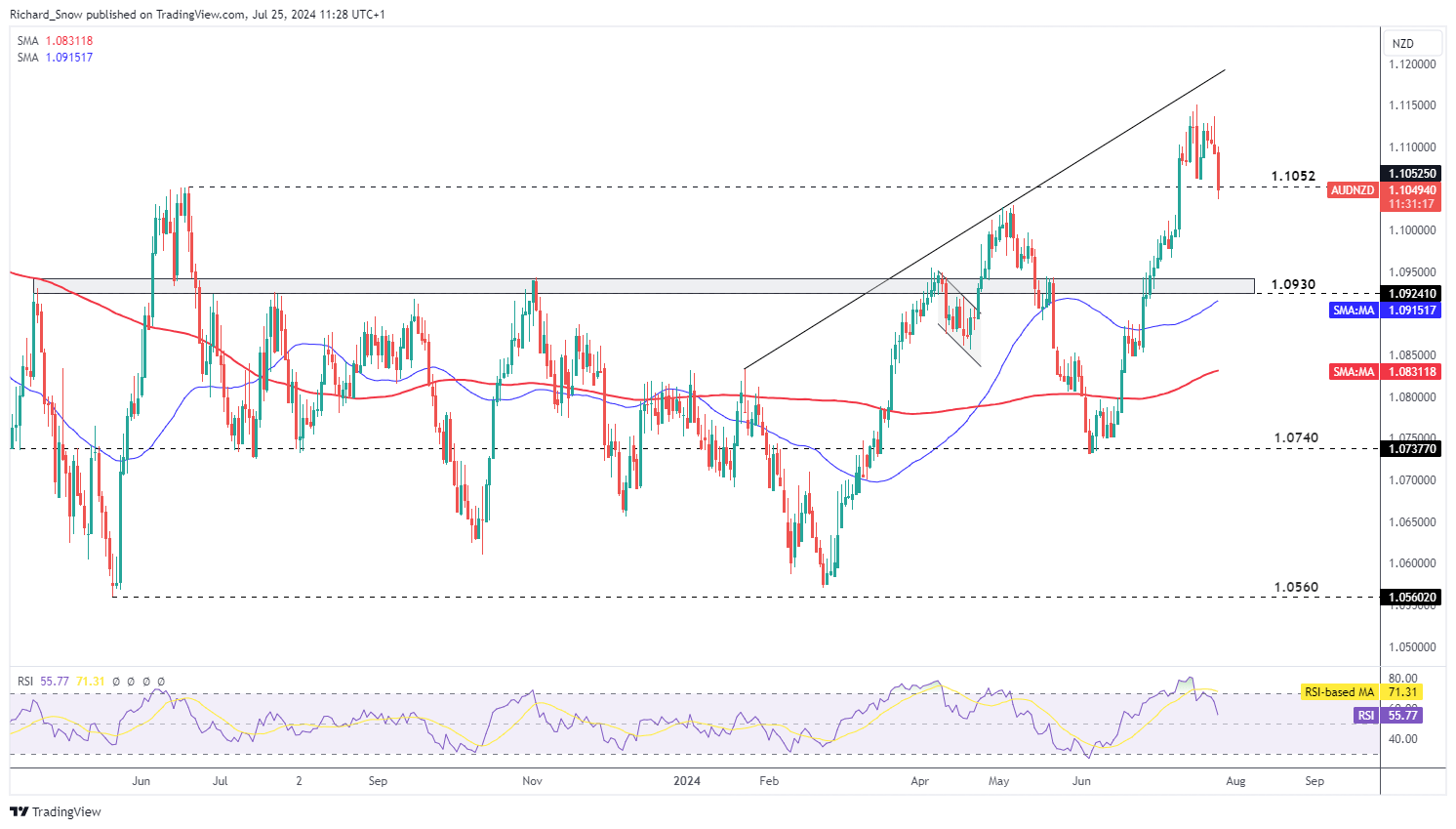

AUD/NZD Analysis

On a more bullish note for the Aussie dollar, AUD/NZD appears less prone to downside moves. Typically, commodity currencies like the Aussie and Kiwi decline together, explaining the limited downside movement.

The pair remains in a longer-term uptrend, with the recent decline testing Aussie bulls. AUD/NZD is testing the June 2023 high of 1.1052. A daily close below this level may trigger a larger move towards the 1.0930 zone, where prior upward momentum collapsed in 2023. The pair is recovering from overbought territory, indicating that bullish momentum might face further pressure. Resistance remains at the recent spike high of 1.1150.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.