AUD/JPY IG Sentiment: Traders’ Net-Long Positions Hit Peak Since Late July

By Daniel M.

August 2, 2024 • Fact checked by Dumb Little Man

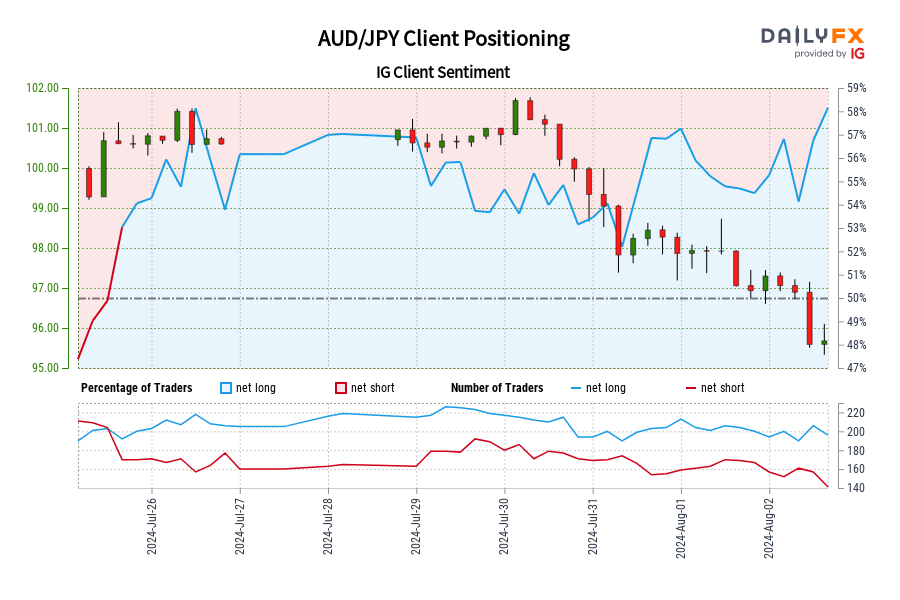

Surge in Retail Traders’ Net-Long Positions

Retail trader data reveals that 60.00% of traders are net-long on AUD/JPY, with a long-to-short ratio of 1.50 to 1. This marks the highest net-long position since July 26, when AUD/JPY traded around 100.60. The number of traders holding net-long positions has decreased by 5.34% since yesterday and 5.80% from last week. Conversely, the number of traders with net-short positions has dropped by 25.29% since yesterday and 20.25% from last week.

Contrarian Perspective Suggests Potential Decline

Analysts often adopt a contrarian stance to crowd sentiment. Given that traders are predominantly net-long, this suggests that AUD/JPY prices may continue to decline.

Increasing Bearish Sentiment

With traders more net-long compared to yesterday and last week, the combination of current sentiment and recent trends reinforces a stronger bearish contrarian trading bias for AUD/JPY.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.