AUD/USD Outlook: Bearish Trend and Future Prospects

By Daniel M.

July 22, 2024 • Fact checked by Dumb Little Man

New week, same vulnerabilities for Aussie longs. The Aussie dollar previously appreciated as the RBA adopted a tough stance on inflation, considering rate hikes at the recent meeting. Meanwhile, US inflation continues to edge lower, prompting renewed rate hike expectations from the Fed as early as September.

However, since breaching oversold territory on July 12th, as indicated by the RSI, AUD/USD has been in a consistent decline. While profit-taking plays a role, it seems that politics and a lower S&P 500 are weighing on the Aussie dollar. Rising US polls favoring a Trump presidency have increased the risk of further trade wars and restrictions on China, negatively impacting the Aussie dollar due to Australia’s reliance on China as a main trading partner.

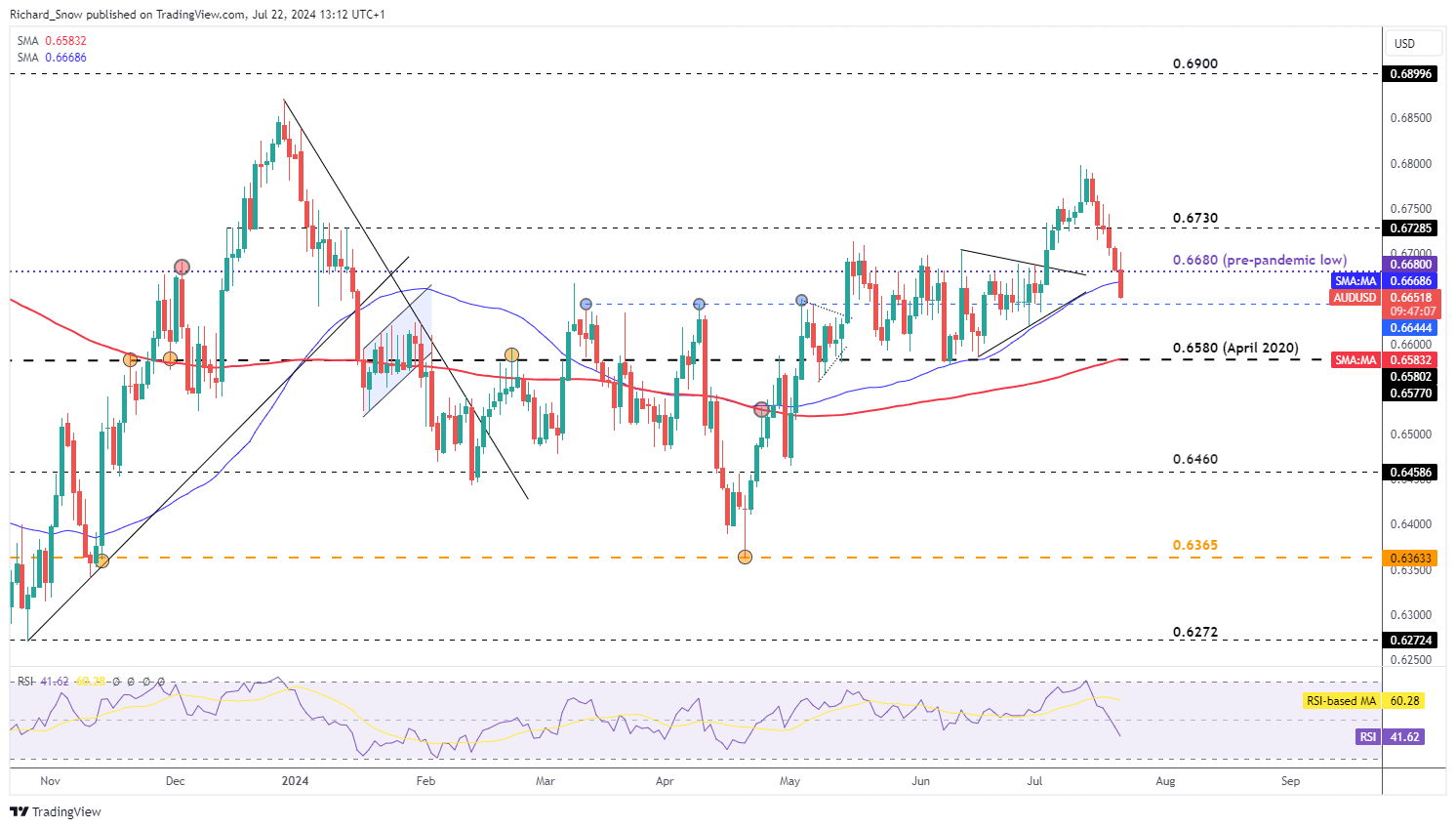

AUD/USD is now testing the 0.6644 level, which restricted bullish price action between March and May this year, with 0.6580 (April 2020) being the next level to consider. Such an aggressive and immediate selloff may ease this week, especially with US PCE data due later this week, which could show further progress against inflation (a lower PCE might lead to a softer dollar). Although it’s tough to argue against the current short-term bearish trend, the 200-day simple moving average coincides with the 0.6580 level, potentially posing a significant challenge for AUD/USD bears attempting a pullback.

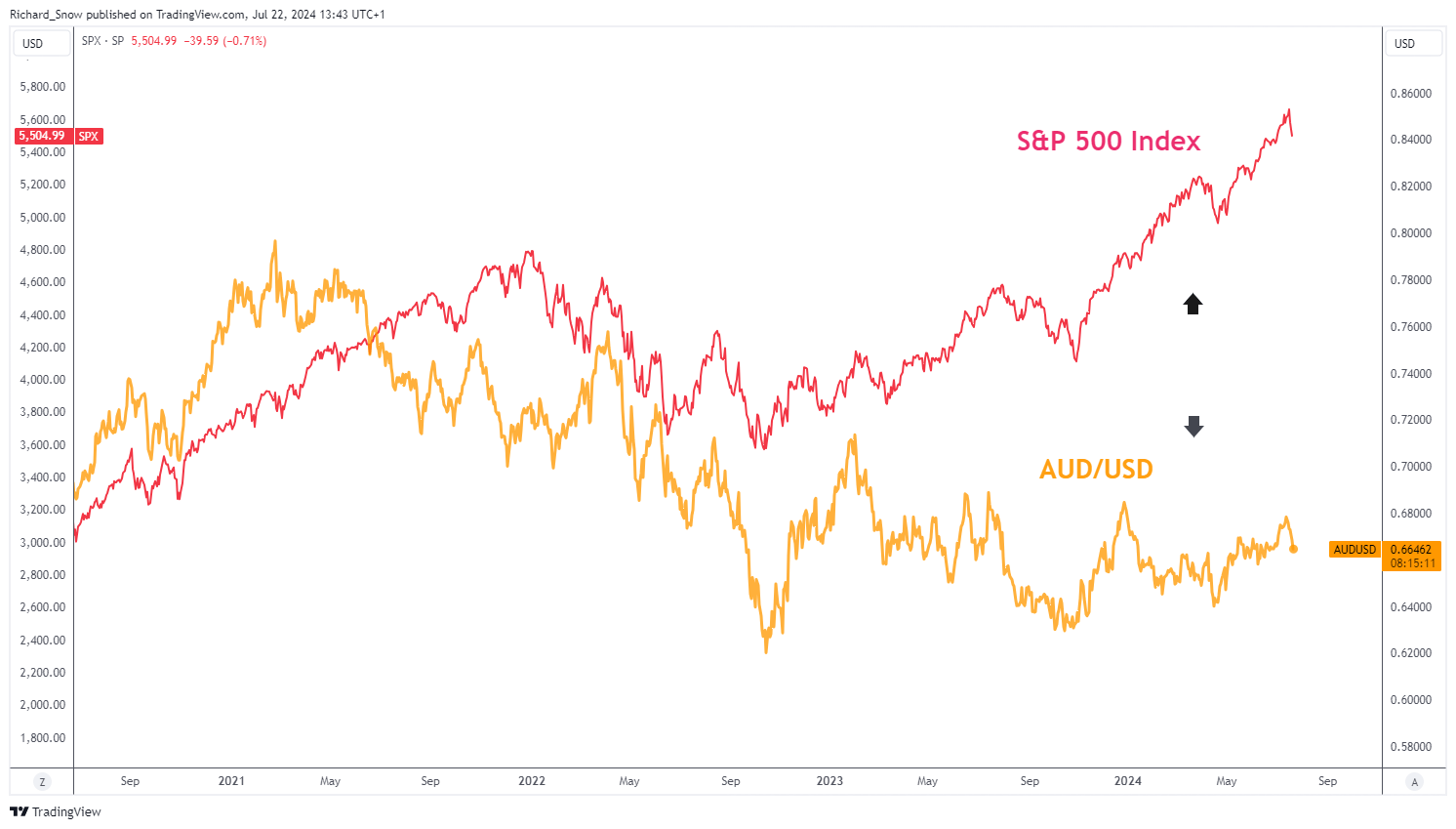

The Australian dollar typically shows a positive correlation with the S&P 500 index, as both risk assets have historically risen and fallen together. However, this correlation has been unclear recently, with the two diverging as the S&P 500 continues to soar.

Both the Aussie dollar and S&P 500 Index closed lower last week, with the Aussie adding to those declines on Monday, while S&P futures point to a higher open.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.