BrightFunded Reviews: Rankings 2025 By Dumb Little Man

| Evaluation Criteria |

|---|

Dumb Little Man's trading and financial experts carefully evaluate proprietary trading companies based on strict standards and a detailed methodology. Their analysis highlights important elements, such as:

They found that BrightFunded performed exceptionally well in these crucial areas. BrightFunded is a prominent player in the proprietary trading space thanks to its extensive knowledge of the brokerage industry and unwavering support for its traders. |

Proprietary trading firms, or prop trading firms, offer traders capital to trade financial instruments in exchange for a portion of the profits. Traders can use these companies to borrow bigger amounts of money without losing their own money. BrightFunded is a registered prop trading company that is known for providing a bright funded trading setting, openness, community, a satisfying and rewarding trading experience, and learning tools.

From the opinions of trading pros and customer reviews, this review by Dumb Little Man will give you a full picture of BrightFunded. We want to help people who might use the company make smart choices by pointing out its pros and cons, safety measures, customer service, and other things.

What is BrightFunded Trading Platform?

BrightFunded is a proprietary trading firm that provides traders with the opportunity to trade with its capital, allowing them to leverage larger quantities without jeopardizing their personal funds. Traders have to go through an organized review process that includes different trading tasks that test their trade skills and consistency.

The BrightFunded trade tool is one of the best trading platforms because it is easy to use, has advanced features, and can be accessed on a number of devices. This bright, well-funded site also has a group of sellers of all kinds who are there to help each other. The platform also focuses on enhancing traders’ trading skills through various challenges and evaluations.

The company allows a maximum capital of $400,000, and there is a growing plan for bigger balances. BrightFunded tokens are given out based on how much trade there is, which has benefits for traders. The company covers trading loses, which helps buyers win.

Traders can show off their skills online with BrightFunded’s evaluation challenge. Traders who do well get their funds credited and make real gains with a fair profit split, which helps them build passive income. The tool is made to help buyers succeed and deal with problems that come up when they trade.

Pros and Cons of BrightFunded

Pros

- Share of the profits of up to 100%

- Profit goals that are reasonable

- Lets you trade news events

- Rewards with BrightFunded tokens

- Allows deals to happen on weekends

- Allows you to trade with expert advisors

- No set number of trading days

- Capital up to $400,000 at most

- Great trading experience offerings with its many features and fair trading environment.

- Good business conditions offered

- Powerful features and straightforward interface

- Trading perks such as lower profit targets

Cons

- High minimum evaluation fee

- You can’t hold trades overnight.

- Not any free tests

- Profit share ambiguity

Safety and Security of BrightFunded

BrightFunded is not regulated as a financial organization like Forex brokers. However, in order to guarantee the safety and security of its platform as well as its consumers, BrightFunded has implemented stringent Know Your Customer (KYC) processes and adhered to Anti-Money Laundering (AML) rules. Even though BrightFunded is not a financial organization like Forex brokers, these precautions are nevertheless in place to protect the entity.

Due to the company’s dedication to these security standards, the platform as well as its users are safeguarded from any potential threats. Keeping a trustworthy and safe trading environment for all participants is BrightFunded’s goal, and it does this by adhering to KYC and AML regulations.

BrightFunded Bonuses and Contests

BrightFunded currently does not offer any bonuses or contests. Without the distraction of extra incentives, the company’s primary emphasis is on establishing a trading environment that is robust and fair. Despite the fact that this may seem to be a constraint, it really guarantees that traders are able to focus on their trading performance and expertise.

BrightFunded keeps things straightforward and transparent by not running events or giving away bonuses. The goal of this approach is to help traders really succeed without depending on short-term deals or bonuses. Traders can only worry about getting steady and successful trade results.

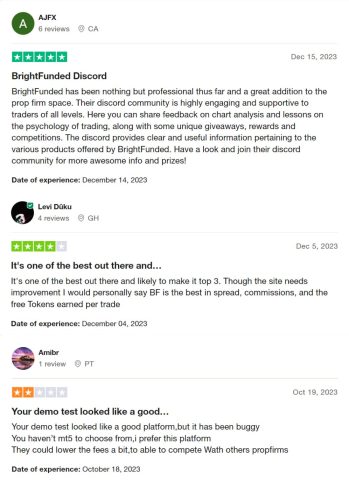

BrightFunded Customer Reviews

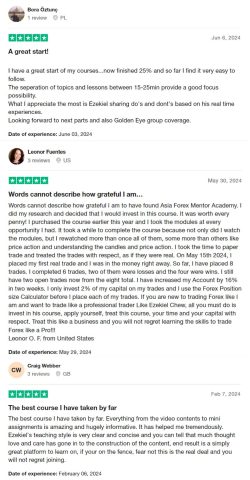

BrightFunded has a 4.3-star rating on Trustpilot, indicating generally good customer satisfaction and a positive trading experience with the BrightFunded platform. BrightFunded attracts traders from various financial markets who are seeking capital and rewards. Positive reviews highlight helpful support, good promo offers, and successful payouts.

However, some negative reviews point out issues like hidden rules, breaches of terms, and poor communication. Some users experienced unexpected account bans and payout problems. Overall, while many customers are pleased with the firm’s services, significant concerns about transparency and fairness remain.

BrightFunded Commissions and Fees

BrightFunded implements a clear and structured commission and fee system. The initial evaluation fee varies depending on the account size chosen. For a $5,000 account, the fee is $55. The $10,000 account comes with a fee of $95, while the $25,000 account is $195. If you opt for a $50,000 account, the fee is $295. For higher tiers, the $100,000 account costs $495, and the $200,000 account is $975.

After paying the evaluation fee, traders can start their evaluation process without any additional charges. The commission structure varies across different trading instruments. For currency pairs, the commission is $3 per lot. Indices have zero commission, making them cost-effective for traders. For cryptocurrencies, the commission is 0.024% per volume, while commodities are charged at 0.0010% per volume.

Additionally, BrightFunded does not charge any swap fees for holding trades overnight or over the weekends. This policy is particularly advantageous for traders who prefer longer holding periods, as it eliminates the cost of maintaining positions over extended durations.

BrightFunded Account Types

BrightFunded has different trading accounts for people with different trading plans and budgets. The following stories have been checked out and confirmed by our team at Dumb Little Man.

You have to go through BrightFunded’s review process, which has two parts: Challenge and Verification Phases. After that, you can become a funded dealer. BrightFunded offers a scaling plan that allows traders to increase their capital based on performance. BrightFunded also has a Funded Star Account that gives users the chance to win a lot of money and share in the profits based on how well they control their risk and stay consistent.

All Account Sizes undergo three phases or steps, each with different conditions:

For $5,000

Step 1: The Challenge

- Trading Period: Indefinite

- Min. Trading Days: 5 Days

- Max. Daily Loss: $250

- Max. Overall Los: $500

- Profit Target: $400

- BrightFunded Tokens: Yes

- Refundable Fee: €55

Step 2: The Verification

- Trading Period: Indefinite

- Min. Trading Days: 5 Days

- Max. Daily Loss: $250

- Max. Overall Loss: $500

- Profit Target: $250

- BrightFunded Tokens: Yes

- Refundable Fee: Free

Step 3: The Funded Star

- Trading Period: Indefinite

- Min. Trading Days: –

- Max. Daily Loss: $250

- Max. Overall Loss: $500

- Profit Target: –

- BrightFunded Tokens: Yes

- Refundable Fee: Free

For $10,000

Step 1: The Challenge

- Trading Period: Unlimited

- Min. Trading Days: 5 Days

- Max. Daily Loss: $500

- Max. Overall Los: $1,000

- Profit Target: $800

- BrightFunded Tokens: Yes

- Refundable Fee: €95

Step 2: The Verification

- Trading Period: Unlimited

- Min. Trading Days: 5 Days

- Max. Daily Loss: $500

- Max. Overall Loss: $1,000

- Profit Target: $500

- BrightFunded Tokens: Yes

- Refundable Fee: Free

Step 3: The Funded Star

- Trading Period: Indefinite

- Min. Trading Days: –

- Max. Daily Loss: $500

- Max. Overall Loss: $1,000

- Profit Target: –

- BrightFunded Tokens: Yes

- Refundable Fee: Free

For $25,000

Step 1: The Challenge

- Trading Period: Unlimited

- Min. Trading Days: 5 Days

- Max. Daily Loss: $1,250

- Max. Overall Los: $2,500

- Profit Target: $2,000

- BrightFunded Tokens: Yes

- Refundable Fee: €195

Step 2: The Verification

- Trading Period: Unlimited

- Min. Trading Days: 5 Days

- Max. Daily Loss: $1,250

- Max. Overall Loss: $2,500

- Profit Target: $1,250

- BrightFunded Tokens: Yes

- Refundable Fee: Free

Step 3: The Funded Star

- Trading Period: Indefinite

- Min. Trading Days: –

- Max. Daily Loss: $1,250

- Max. Overall Loss: $2,500

- Profit Target: –

- BrightFunded Tokens: Yes

- Refundable Fee: Free

For $50,000

Step 1: The Challenge

- Trading Period: Unlimited

- Min. Trading Days: 5 Days

- Max. Daily Loss: $2,500

- Max. Overall Los: $5,000

- Profit Target: $4,000

- BrightFunded Tokens: Yes

- Refundable Fee: €295

Step 2: The Verification

- Trading Period: Unlimited

- Min. Trading Days: 5 Days

- Max. Daily Loss: $2,500

- Max. Overall Loss: $5,000

- Profit Target: $2,500

- BrightFunded Tokens: Yes

- Refundable Fee: Free

Step 3: The Funded Star

- Trading Period: Indefinite

- Min. Trading Days: –

- Max. Daily Loss: $2,500

- Max. Overall Loss: $5,000

- Profit Target: –

- BrightFunded Tokens: Yes

- Refundable Fee: Free

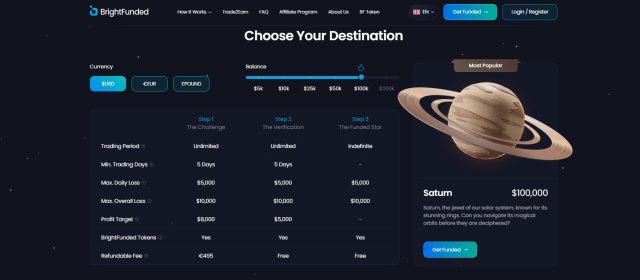

For $100,000

Step 1: The Challenge

- Trading Period: Unlimited

- Min. Trading Days: 5 Days

- Max. Daily Loss: $5,000

- Max. Overall Los: $10,000

- Profit Target: $8,000

- BrightFunded Tokens: Yes

- Refundable Fee: €495

Step 2: The Verification

- Trading Period: Unlimited

- Min. Trading Days: 5 Days

- Max. Daily Loss: $5,000

- Max. Overall Loss: $10,000

- Profit Target: $5,000

- BrightFunded Tokens: Yes

- Refundable Fee: Free

Step 3: The Funded Star

- Trading Period: Indefinite

- Min. Trading Days: –

- Max. Daily Loss: $5,000

- Max. Overall Loss: $10,000

- Profit Target: –

- BrightFunded Tokens: Yes

- Refundable Fee: Free

For $200,000

Step 1: The Challenge

- Trading Period: Unlimited

- Min. Trading Days: 5 Days

- Max. Daily Loss: $10,000

- Max. Overall Los: $20,000

- Profit Target: $16,000

- BrightFunded Tokens: Yes

- Refundable Fee: €975

Step 2: The Verification

- Trading Period: Unlimited

- Min. Trading Days: 5 Days

- Max. Daily Loss: $10,000

- Max. Overall Loss: $20,000

- Profit Target: $10,000

- BrightFunded Tokens: Yes

- Refundable Fee: Free

Step 3: The Funded Star

- Trading Period: Indefinite

- Min. Trading Days: –

- Max. Daily Loss: $10,000

- Max. Overall Loss: $20,000

- Profit Target: –

- BrightFunded Tokens: Yes

- Refundable Fee: Free

Opening a BrightFunded Account

BrightFunded is easy to use and makes it simple to get started. Do these eight things:

- To find the “Choose Your Destination” part, go to the BrightFunded page.

- You can choose the account size of your trade account you want: $5,000, $10,000, $25,000, $50,000, $100,000, or $200,000.

- Choose the account size and look over the prices to set up your task.

- Fill in your personal information to finish setting up your account.

- Pay the amount for the account size you picked.

- Get your account information by email as soon as your payment is confirmed.

- Use the details given to log in to your account.

- Start with the evaluation process to see if you can get your account paid.

BrightFunded Customer Support

BrightFunded provides excellent customer and trading support, which helps build a strong group of committed traders on Telegram and Discord. Traders can share trading ideas, talk to each other, and learn from each other here, which helps them get better at trading and make more money. This place to work together is an important part of BrightFunded’s support system, which makes the whole thing a bright funded experience for everyone.

The company’s support team is available to answer questions about trading, making sure that buyers get help quickly. Dumb Little Man’s experience with BrightFunded’s support shows how well it works to help traders stay consistent and perform well throughout their trading journey.

BrightFunded also keeps buyers up to date on the latest market trends and platform changes. BrightFunded’s website has a page where traders can contact them directly for help. On this page, they offer clear instructions and answer common questions. This multichannel method makes sure that all trades get strong help and that things keep getting better.

Advantages and Disadvantages of BrightFunded Customer Support

| Advantages | Disadvantages |

|---|---|

|

BrightFunded Withdrawal Options

BrightFunded provides a comprehensive withdrawal process, ensuring traders can easily access their funds. The BrightFunded platform also provides traders with a refund policy that allows them to get their account prices back if they successfully fund their account. When traders pass the evaluation and secure a funded account, they can withdraw their profits along with the evaluation fee upon their first withdrawal request. This rule makes sure that buyers don’t have to worry about how much the account sizes cost at first.

Traders can process their withdrawals via two primary methods: Crypto (USDT) and Bank Transfer (Wise). Using USDT allows for fast and secure transactions, leveraging the benefits of cryptocurrency. Alternatively, Bank Transfer via Wise offers a reliable and straightforward method for transferring funds directly to a bank account. Both options provide flexibility and convenience, catering to the preferences of different traders.

A trade specialist at Dumb Little Man conducted a test, which resulted in the collection of this important information. Traders will have financial relief and confidence as a result of the refund policy, which will make the Brightfunded platform more appealing and helpful for traders who are fully committed to their trading.

BrightFunded Challenges and Difficulties

When applying to BrightFunded, applications have to meet strict requirements, which can be hard. The platform needs detailed financial forecasts, full business plans, and proof that the market will support the product.

It’s important to evaluate trade success, but many people find it hard to get and show this information correctly, which can cause delays or rejects. Traders face a number of hurdles and problems with BrightFunded.

Achieving the necessary earnings goals and staying in consistent profitability can be hard. In the challenge stage, the company wants to make 8% in profit, and in the verification stage, it wants to make 5%. Traders also have to follow strict rules about how much they can lose each day (5% maximum) and overall (10%).

To be eligible for scaling, traders need to make a minimum total profit of ten percent during a period of four months. Traders have some freedom because there are no maximum trading days, but they still have to meet a minimum of 10 trading days during the evaluation period

Another layer of difficulty is that deals can’t be held overnight. But the possible benefits, such as a profit share of up to 100%, make these problems worth it.

How to Pass BrightFunded Evaluation Process

BrightFunded‘s evaluate process can be hard to get through because it has so many strict rules. To improve your chances of success, you need to make sure you have the right information and tactics.

Tokens can be used to unlock trade bonuses in BrightFunded, such as lower profit goals. By enrolling in a full training program, you can greatly improve your trade skills and raise your chances of passing the exam also, traders can pass the exam by using good trading rules or methods.

Asia Forex Mentor – Rated Best Comprehensive Course Offering by Investopedia

If you really want to pass BrightFunded‘s review process, you might want to sign up for Asia Forex Mentor. Asia Forex Mentor has helped thousands of traders do well in prop company testing programs. It was recommended by trading pros at Dumb Little Man.

Asia Forex Mentor is a complete training tool that was created by Ezekiel Chew, a forex trading expert with more than twenty years of experience. Ezekiel, who is famous for making six-figure trades, created the one-of-a-kind One Core Program to teach forex traders how to make money dealing. He also runs the Golden Eye Group, where he shares his vast knowledge and skills with people all over the world.

Ezekiel’s path began when he taught trade to close friends who asked him to. Since then, it’s grown online, which lets him reach more people. Asia Forex Mentor is a great option for anyone who wants to meet BrightFunded’s strict requirements and pass their testing process.

How Could Asia Forex Mentor Help You Pass BrightFunded Challenge?

Asia Forex Mentor has a great name and track record in the trading world, so traders who want to pass BrightFunded‘s evaluation process should definitely use it. This is why Asia Forex Mentor can help you do well:

- Award for Best Comprehensive Course: Investopedia, a well-known website for financial information, named Asia Forex Mentor the best comprehensive course. Investopedia said that the One Core Program was “as comprehensive as you will find.” This makes it a great choice for traders who want to learn more about forex in depth.

- Best Forex Trading Course: Benzinga just recently said that Asia Forex Mentor’s One Core Program is the best way for newbies to learn how to trade forex. This trustworthy source of financial information confirmed that the course is perfect for traders of all levels, from beginners to experts. This will give you the knowledge you need to do well on BrightFunded’s evaluation.

- Best Forex Mentor: In 2021, Best Online Forex Broker gave Asia Forex trainer an award for being the best forex trainer. They say Asia Forex Mentor can help traders “make massive gains from forex,” which shows how well it teaches traders.

- Effective Trading Strategies and Systems: Asia Forex Mentor consistently scores high in evaluations of top forex trading courses due to its efficient trading tactics and first-rate trading system. The One Core Program, which was created by Ezekiel Chew, has consistently gone above and beyond what both experienced and new dealers expected.

All of these awards show that Asia Forex Mentor’s training is reliable and useful. By joining Asia Forex Mentor, you will get thorough training and tried-and-true methods that will greatly improve your chances of passing BrightFunded’s evaluation process.

Asia Forex Mentor Members’ Testimonials

A lot of traders have thanked Ezekiel Chew and Asians Forex Mentor for helping them get through the evaluation processes for prop firms. They praise the One Core Program for its clear and straightforward way of teaching, effective methods, and thorough review of the most important aspects of forex trading. People who trade say that Ezekiel’s advice has helped them become much better at dealing and make more money. The training is highly recommended for anyone who wants to get better at dealing and make regular gains.

>> Also Read: Asia Forex Mentor Review By Dumb Little Man

Conclusion: BrightFunded Review

BrightFunded is a good way for buyers to use a lot of capital without putting their own money at risk. The evaluation process is strict, and the profit goals are reasonable. There is also full help. The company’s return policy and strong community support are big pluses that make it a good choice for serious buyers.

But it can be hard to deal with the strict rules and high evaluation fees. Based on what users have said, the company could do a better job of being open and helpful. With its funding and growing features, BrightFunded helps users reach their trading goals. Signing up for respected classes like Asia Forex Mentor can help you do better on the evaluation and have more trade success.

>> Also Read: Maven Trading Review with Rankings 2024 By Dumb Little Man

BrightFunded Review FAQs

How many satisfied customers are there with BrightFunded?

BrightFunded has a 4.3-star review on Trustpilot, which means that most customers are happy with the service. However, some users have complained about how transparent the service is and how well it supports them.

Can you trade stocks and other trading instruments on BrightFunded?

Yes, buyers can use BrightFunded to trade stocks as well as other financial products trading instruments like forex and commodities.

What happens after getting through BrightFunded’s review process?

Once traders pass BrightFunded’s screening process, they are given a funded account and can begin dealing with the company’s money, hoping to make real profits and get the biggest share of those earnings.

RECOMMENDED TRADING COURSE | REVIEW | VISIT |

#1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |