British Pound Dips as Focus Turns to Bank of England

By Daniel M.

January 5, 2025 • Fact checked by Dumb Little Man

British Pound (GBP/USD) Market Analysis

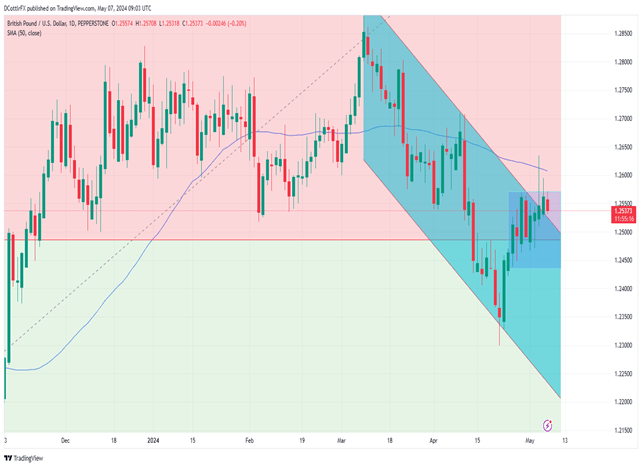

GBP/USD has modestly declined but remains above $1.25. With UK and US interest rates anticipated to decrease starting in September, the spotlight is now on the upcoming Bank of England (BoE) announcement.

On Tuesday, the British Pound pared some of its recent gains against the U.S. Dollar as markets regained full activity following a holiday. As we approach Thursday’s BoE monetary policy meeting for May, Sterling’s cross rates will likely see slight movements.

Interest rates are projected to remain steady this month, with the central Bank Rate expected to hold at 5.25%. Market attention will thus pivot to the voting dynamics within the nine-member Monetary Policy Committee and the nuances of their accompanying statements. Historically, the BoE has shown varied voting results, including three-way splits. This time, however, a split favoring hikes is unlikely.

Inflation in the UK continues to exceed the BoE’s 2% target but shows signs of easing, with the latest March figure at 3.2%—the lowest in over two years. This indicates that the existing monetary tightening is gradually taking effect, even as the UK economy struggles with sluggish growth.

Futures markets currently predict that both the UK and the US might initiate rate cuts as soon as September, a forecast heavily reliant on upcoming economic data. Last week’s tepid US employment figures have brought forward the expectations for the Federal Reserve’s actions, previously anticipated in November.

Sterling is expected to hover within its current trading range leading up to the BoE’s decision and might face challenges in appreciating if the rate-cut expectations remain unchanged.

Despite recently edging above the longstanding downtrend that started in mid-March, Sterling’s rise does not appear entirely convincing. Bulls still have significant ground to cover to secure a more definitive upward trend.

Currently, the trading range is set between April 29’s high of 1.25692 and April 24’s low of 1.24201, with the downtrend providing near support at 1.25178.

Support at 1.24859 remains robust, and the 50-day moving average at 1.26067 could act as resistance if the upper range limit is breached.

Throughout this year, the pair has mostly remained above the first retracement level from its rise to last July’s peaks from the lows of September 2022. It is likely to stay above this level barring any significant shifts in the market.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.