CK Markets Review 2025 with Rankings by Dumb Little Man

By John V

January 5, 2025 • Fact checked by Dumb Little Man

Overall Rating | Overall Ranking | Trading Terminals |

1.3 1.5/5 | 152nd  |  |

| Evaluation Criteria |

|---|

The Dumb Little Man team, made up of financial specialists, seasoned traders, and personal investors, leverages advanced algorithms for in-depth reviews of brokerage firms. They focus on critical aspects like:

By integrating feedback from actual users, they offer an impartial and thorough assessment. Their comprehensive research identifies CK Markets as a dependable choice for those seeking a robust financial ally. Nonetheless, Dumb Little Man advises prospective customers to meticulously examine their detailed analysis to grasp any potential drawbacks linked to the broker. |

CK Markets Review

An essential part of enabling trading in the international currency market is played by “forex brokers”. They give traders the platforms and resources they need to purchase and sell currencies, streamlining and optimizing the process. Selecting the appropriate broker is crucial for profitable trading since it affects the trader’s experience and potential profits.

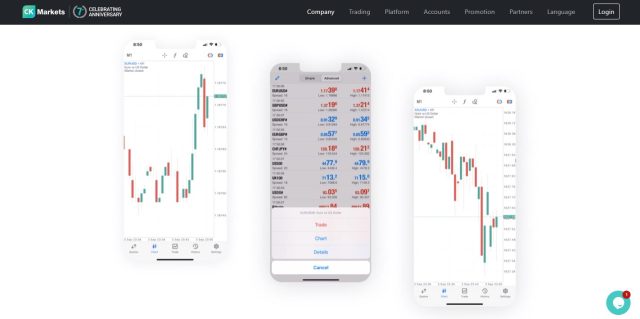

Trusted by customers all around the world, CK Markets stands out as a global authority in the Forex sector. In addition to Forex, stock indices, commodities, stocks, metals, and energy, they provide a large array of trading alternatives. In order to give readers a thorough and accurate overview of CK Markets, this review makes use of professional findings and experiences.

What is CK Markets?

With a strong presence in the international Forex market, CK Markets is acknowledged as a market leader in the retail Forex space. Customers of this broker can access a range of trading alternatives, such as Forex, stock indices, commodities, and more, on a reliable platform. CK Markets was founded with the goal of providing top-notch services and support to all traders, irrespective of their account type or investment size.

With a workforce that speaks more than 30 languages and a clientele that spans more than 196 nations, CK Markets exhibits its international scale and dedication to comprehending the various needs of its partners and consumers. The management’s proactive strategy includes visiting more than 120 cities across the globe, demonstrating their commitment to customizing their offerings to match the unique needs of international merchants.

One thing that sets CK Markets apart is its dedication to justice and openness. They take a simple approach to business, making sure that all clients understand the terms of price, execution, and promotions. The platform is also convenient to use, with an easy-to-use account management system, straightforward deposit and withdrawal procedures, and a versatile trading platform that make trading both accessible and effective.

Furthermore, by utilizing cutting-edge technology and creative system solutions, CK Markets is expanding the bounds of conventional Forex trading and improving the trading experience to match the demands of contemporary traders. The company prioritizes customer care, and its committed support staff is available to help customers whenever they need it. This helps to create a positive trading environment from the moment of registration all the way through to profit withdrawal.

Safety and Security of CK Markets

As an International Business Company, CK Markets Ltd. is governed by the Financial Service Authority (FSA), guaranteeing a high standard of regulatory compliance and security for the interests of its clients. Operating within the legal frameworks intended to protect trader interests and market integrity, particularly with regard to financial transactions and operational transparency, CK Markets is registered under the number 24405 IBC 2017.

At CK Markets, customer money security and safety are of utmost importance. In order to ensure stability and dependability of its finances, the organization handles customer cash through large international banks. An extra degree of protection for traders is provided by the fact that money are kept in segregated accounts, apart from the firm’s running funds, which keeps them safe from being used for any other reason, including company liabilities.

Moreover, CK Markets strengthens its customer safety protocols by obtaining extensive insurance coverage. Every account has insurance up to €2,500,000, which is much more than the minimal amount required by authorities. The money of the consumers is protected by this insurance from future losses and financial irregularities. Furthermore, even in times of exceptionally high market volatility, CK Markets guarantees that its clients do not owe more than they invest by implementing a negative balance protection strategy.

CK Markets actively monitors and assesses the risks related to its operations as part of its ongoing commitment to risk management. By taking a comprehensive approach, the company may preserve strong operational resilience and financial health, guaranteeing that it can fulfill its financial commitments and safeguard the interests of its clients in any situation. Dumb Little Man conducted extensive investigation before compiling this data, which reflects a thorough comprehension and validation of CK Markets’ operational integrity.

Pros and Cons of CK Markets

Pros

- Wide range of trading instruments

- Competitive spreads and commissions

- Robust affiliate program

- Comprehensive deposit and withdrawal options

- Strong regulatory compliance

- Advanced trading platforms

- Daily payments in affiliate program

- No limits on commissions

- Multi-language support

Cons

- Limited educational resources

- No 24/7 customer support

- Restricted leverage on certain accounts

- Regional restrictions for some promotions

- Inactivity fees apply

- Fees on certain withdrawal methods

- Limited access to premium accounts for lower equity traders

Sign-Up Bonus of CK Markets

To improve traders’ first trading capabilities, CK Markets provides both new and existing clients with an enticing 30% deposit incentive. A large spectrum of traders can benefit from this offer because it is applicable to deposits as low as 10 USD. Notably, the bonus has a $1,000 USD cap and can be used as margin to start trades, supporting the account’s floating capacity. It’s crucial to remember that this deal, which is intended for a particular regional demographic, is only accessible to customers from Malaysia, Singapore, Brunei, and Thailand.

CK Markets guarantees a cost-effective trading start with 0% fees on deposits in addition to the deposit incentive. This charge waiver encourages larger transactions without adding to costs by covering all wire transfers and e-wallet transactions over $5,000 USD. Transparency and trust in financial transactions with the broker are facilitated by the instantaneous funding process that has no commissions or hidden costs. By lessening the financial strain on traders, this strategy not only makes the funding procedure simpler but also improves the trading experience overall.

Minimum Deposit of CK Markets

To accommodate a range of trading styles and financial capacities, CK Markets provides a variety of account kinds. With a $30.00 minimum deposit, the Cent Account type is especially beneficial for novices or those wishing to trade with lesser risks. This account is a popular option for novices since it enables traders to participate in the market without having to make a substantial financial commitment.

CK Market offers the Standard and ECN Account categories, which both have a $100.00 minimum deposit requirement, for more seasoned traders. Traders seeking more sophisticated trading features and a greater market penetration are catered to by these accounts. For traders seeking reduced spreads and quicker execution, the ECN account in particular provides direct access via electronic communications networks to other players in the currency market.

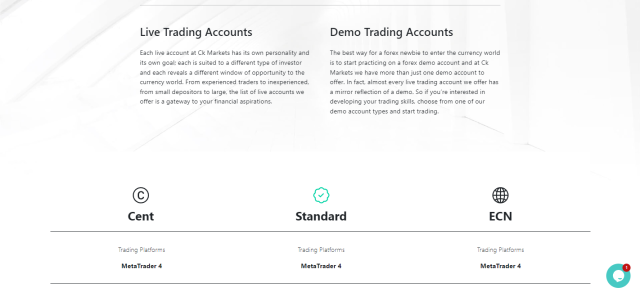

CK Markets Account Types

A range of account types are available from CK Markets to suit various trading tastes and styles. Based on extensive investigation and testing by the Dumb Little Man team of professionals, a complete analysis of these accounts may be found below.

Cent Account

- Trading Platform: MetaTrader 4

- Account Currency: USC

- Leverage / Margin Requirements: 1:2000 (Equity $1,000 and below), 1:500 ($1,001 – $2,000), 1:100 (Above $2,000 Equity)

- Minimum Deposit: $30.00

- Order Execution: Instant Execution

- Spread: From 2.5

- Margin Call / Stop Out: 60% / 30%

- Swap-Free

- Limit & Stop Levels: 1 spread

- Pricings: 5 decimals for FX (3 on JPY pairs), 2 decimals for Spot Metals

- Trading Instruments: Majors, Minors, Exotics, Precious Metals, Energies, Indices

- Minimum Volume in Lots per Trade: 0.01

- Step Lot: 0.01

- Lot Restriction per Ticket: 30

- Maximum Volume & Open / Pending Orders per Client: 200

- Hedging Allowed

- Negative Balance Protection

Standard Account

- Trading Platform: MetaTrader 4

- Account Currency: USD

- Leverage / Margin Requirements: Unlimited (Equity $1,000 and below), 1:1000 ($1,001 – $5,000), 1:500 ($5,001 – $20,000), 1:200 ($20,001 – $100,000), 1:100 (Above $100,000 Equity)

- Minimum Deposit: $100.00

- Order Execution: Market Execution

- Spread: From 1.3

- Margin Call / Stop Out: 60% / 30%

- Swap-Free

- Limit & Stop Levels: 1 spread

- Pricings: 5 decimals for FX (3 on JPY pairs), 2 decimals for Spot Metals

- Trading Instruments: Majors, Minors, Exotics, Precious Metals, Energies, Indices, Stocks, Cryptocurrencies

- Minimum Volume in Lots per Trade: 0.01

- Step Lot: 0.01

- Lot Restriction per Ticket: 30

- Maximum Volume & Open / Pending Orders per Client: 200

- Hedging Allowed

- Negative Balance Protection

ECN Account

- Trading Platform: MetaTrader 4

- Account Currency: USD

- Leverage / Margin Requirements: 1:500 (Equity $20,000 and below), 1:200 ($20,001 – $100,000), 1:100 (Above $100,000 Equity)

- Minimum Deposit: $100.00

- Commission: $3 per round turn lot

- Order Execution: Market Execution

- Spread: From 0

- Margin Call / Stop Out: 80% / 50%

- Swap-Free

- Limit & Stop Levels: 1 spread

- Pricings: 5 decimals for FX (3 on JPY pairs), 2 decimals for Spot Metals

- Trading Instruments: Majors, Minors, Exotics, Precious Metals, Energies, Indices

- Minimum Volume in Lots per Trade: 0.01

- Step Lot: 0.01

- Lot Restriction per Ticket: 30

- Maximum Volume & Open / Pending Orders per Client: 200

- Hedging Allowed

- Negative Balance Protection

CK Markets Customer Reviews

With a 3.2 customer rating, CK Markets has received conflicting comments from users impacting client satisfaction rates. This middling rating implies that although some clients might have been happy with the services they received, others might have run across problems that negatively impacted their whole experience. Potential influencing elements for this grade could be things like platform functionality, trade term clarity, and customer support.

CK Markets Fees, Spreads, and Commissions

With a competitive pricing structure, CK Markets caters to a wide range of traders’ demands by emphasizing fairness and transparency. Offering variable spreads that begin at 0 pip for ECN accounts, the brokerage has a very competitive position in the market. High-volume traders who want to reduce trading expenses and increase profitability would especially benefit from this low spread.

Apart from spreads, CK Markets charges an industry standard $3 commission per round turn lot on ECN accounts. The entire transparency of the trading environment is enhanced by this charge structure, which guarantees that traders are aware of the costs up front. Additionally, the broker does not charge any commissions or additional costs for deposits or withdrawals, which makes its service offerings more alluring to traders throughout the world.

For traders seeking low-cost trading options without sacrificing service quality, CK Markets’ low spreads and transparent commission details make it a compelling choice. This strategy fits the demands of both inexperienced and seasoned traders while also promoting a fair trading environment.

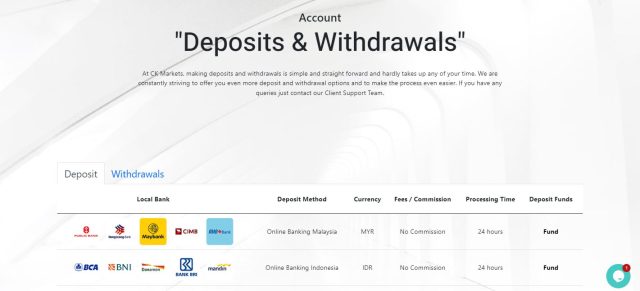

Deposit and Withdrawal

With its strong deposit and withdrawal system, CK Markets guarantees traders a smooth trading experience. The broker offers no commission on deposits and supports a number of payment options, including credit cards, e-wallets, cryptocurrency, and local online banking in several Asian countries. The majority of methods allow deposits to be completed quickly—with the exception of bank wire transfers, which take three to five business days.

At CK Markets, withdrawals are handled as efficiently as deposits are: the majority are completed in less than a day and come with no fees for payment options like credit cards and local internet banking. Withdrawals made using Neteller and cryptocurrencies using USD₯, however, are subject to 3% and USD 5 + 2% fees, respectively. This extensive system upholds high standards of operational transparency while serving a global customer.

In order to safeguard the integrity of transactions and account management, CK Markets additionally implements policies. After six months without any trading activity, there is a five dollar inactivity fee. If there is no trading activity or any abuse of the reimbursement policy, there may be further fees. These safeguards preserve CK Markets’ dedication to a fair trading environment by guaranteeing that the funding and withdrawal procedures continue to be effective and transparent.

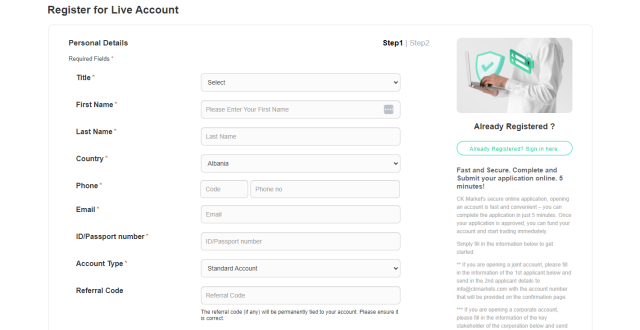

How to Open a CK Markets Account

The procedure of opening an account with CK Markets is simple, fast, and easy to use. Traders may quickly set up their trading account and begin accessing the financial markets by following a few easy steps. This comprehensive tutorial will help new users get started trading with CK Markets as soon as possible by providing step-by-step instructions on how to open an account.

- Start the registration process by going to the CK Markets website.

- Click ‘Open a Live Account’ to launch the process of creating an account.

- Enter your personal information, including your name and country of residence.

- For communication reasons, enter your email address and phone number.

- To confirm your identification, enter your passport number or ID.

- Depending on what you need for trading, choose the type of account you want to open.

- At this point, add your referral code if you have one.

- Please include more details about yourself, such as your address and citizenship.

- To complete your registration, enter your birthdate, accept the terms of service, and fill out the security captcha. Then, click submit.

CK Markets Affiliate Program

A profitable chance to collaborate with a global broker known as a multi-award-winning authority in the Forex market is presented by the CK Markets Affiliate Program. CK Market fosters a culture of trust and dependability in its clientele, which benefits affiliates and makes it a desirable relationship for those seeking to increase their earning potential.

Support for affiliate program participants is provided by multilingual personal account managers who are on call around-the-clock. This guarantees that partners always get the help they require. Daily payments, no commission cap, and guaranteed on-time payments every time are just a few of the program’s enticing characteristics.

In order to help its affiliates monitor their results and refine their tactics, CK Markets also provides them with resources including real-time data, comprehensive statistics, and assistance with local offices and events. Giving affiliates access to live help around-the-clock improves the support structure and guarantees that they can always get aid when they need it.

CK Markets Customer Support

In order to keep up with its quick growth and expansion in a number of business sectors, including product management, company development, and research and development, CK Markets is dedicated to offering strong customer service. This pledge is a component of the business’s plan to make large investments in systems, personnel, and internal procedures in order to support projected growth. The company’s dynamic corporate culture and commitment to excellence are reflected in the customer support organization.

If you are interested in becoming a member of CK Markets or if you are an existing client and need help, please email [email protected] to reach the support team. In addition, customer service can be reached by phone at +603-56260014 or in person at their office located in Hamchako, Mutsamudu, on the Union of Comoros’ Autonomous Island of Anjouan, or in their another registered address at Suite 305, Griffith Corporate Centre, Beachmont, P.O Box 1510, Kingstown, Saint Vincent and the Grenadines. Based on Dumb Little Man’s evaluations, this data and experience were acquired, demonstrating the effectiveness and reach of CK Markets’ customer service.

Advantages and Disadvantages of CK Markets Customer Support

| Advantages | Disadvantages |

|---|---|

CK Markets vs Other Brokers

#1 CK Markets vs AvaTrade

The regulatory landscapes and range of trading platforms provided by CK Markets and AvaTrade are the main areas of distinction. CK Markets is renowned for offering competitive spreads together with a high priority on affiliate programs and customer service. With its main office located in Dublin, Ireland, AvaTrade was founded in 2006 and provides a wide selection of platforms and tradable instruments, including automated trading choices. Unique services offered by AvaTrade include AvaProtect, an insurance coverage on trades. It is not, however, subject to FCA regulation, which may worry individuals who value strict regulatory scrutiny.

Verdict: CK Markets might be a better option for traders who value reduced spreads and individualized customer care, but AvaTrade might be a better option for those seeking a larger selection of instruments and the assurance of transaction insurance.

#2 CK Markets vs RoboForex

When it comes to trading platforms and customization choices, traders with varying preferences are catered to by CK Markets and RoboForex. A wide range of trading methods and tastes are catered to by the diversity of trading platforms that RoboForex offers, including MT4, MT5, cTrader, and R Stock Trader. Since 2009, it has gained recognition for customized settings that accommodate different trading methods and sizes. Conversely, CK Markets prioritizes offering competitive fees and strong support systems.

Verdict: RoboForex is likely the better choice for traders who prioritize platform diversity and customization in their trading experience. CK Markets, however, may appeal more to those looking for competitive pricing and strong support.

#3 CK Markets vs FXChoice

CK Markets and FXChoice both offer forex and CFD trading, but they cater to different segments of the market with their specific offerings. FXChoice is notable for providing access to a variety of forex pairs, including those from emerging markets like the Russian Ruble and South African Rand, as well as commodity CFDs such as crude oil and precious metals. This could be particularly attractive to traders looking to diversify into emerging markets and commodities. CK Markets, in contrast, excels with its competitive spreads and a broad range of account types.

Verdict: For traders who value platform variety and personalization in their trading experience, RoboForex is perhaps a superior option. On the other hand, individuals seeking aggressive pricing and robust assistance might find CK Markets more appealing.

Choose Asia Forex Mentor for Your Forex Trading Success

Trading professionals at Dumb Little Man strongly recommend Asia Forex Mentor to anyone looking to launch a profitable career in stock, cryptocurrency, and forex trading. Asia Forex Mentor, led by renowned trading visionary Ezekiel Chew, who is well-known for his regular seven-figure trades, provides a Comprehensive Curriculum that covers all the important trading areas in detail and equips students to succeed in a variety of markets.

The platform has a demonstrated track record of turning out profitable traders, demonstrating the value of its mentorship and training initiatives. Under Ezekiel Chew’s direction, students at Asia Forex Mentor receive individualized support to help them comprehend the intricacies of the markets.

A Supportive Community is another feature of the program that allows traders to interact, exchange ideas, and improve their educational experience.

Asia Forex Mentor emphasizes psychology and discipline as keys to trading success, teaching students how to successfully control their emotions and maintain a disciplined approach. The platform guarantees that students remain up to date with the most recent market trends and trading strategies through Constant Updates and Resources.

The program’s many success stories attest to its ability to change trading careers and help students become financially independent. Asia Forex Mentor is the best option for anyone looking for a thorough and hands-on trading education.

RECOMMENDED TRADING COURSE | REVIEW | VISIT |

#1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |

>> Also Read: NSFX Review 2024 with Rankings by Dumb Little Man

Conclusion: CK Markets Review

In conclusion, with a large selection of trading products and aggressive spreads and costs, CK Markets distinguishes out in the crowded forex market. These characteristics make it a dependable and alluring choice for traders looking for a varied and effective trading environment, especially when paired with solid regulatory compliance and cutting-edge trading platforms.

However, prospective customers should be aware of several constraints that may affect the flexibility and accessibility of the services, such as having no unlimited leverage on specific accounts and geographical restrictions on promotions. In addition, the application of inactivity fees emphasizes that users of CK Markets must be actively involved. When these aspects are taken into account, CK Markets is still a good option for traders who appreciate a thorough and legal trading platform.

>> Also Read: Saracen Markets Review 2024 with Rankings by Dumb Little Man

CK Markets Review FAQs

What trading instruments can I trade with CK Markets?

CK Markets offers a comprehensive range of trading instruments, allowing clients to trade in forex, stocks, commodities, equity indices, metals, and energies. This diversity enables traders to take advantage of various market conditions and expand their trading portfolio across multiple asset classes.

How does CK Markets ensure the security of my investments?

As stated in this CK Markets reviews, safety of customer money and data is their top priority. The broker keeps client funds in separate accounts and is registered with the Financial Service Authority (FSA). To further ensure a safe trading environment, CK Markets uses cutting edge encryption technology to safeguard data and financial activities.

Are there any specific regional restrictions I should be aware of when trading with CK Markets?

Yes, there are geographical limitations on several of CK Markets’ promotions and bonus offers. These offers are mainly restricted to customers from particular nations, such as Malaysia, Singapore, Brunei, and Thailand. For precise information about eligibility depending on residency, traders should visit the CK Market website and review the whole terms and conditions, or get in touch with customer care.

Dumb Little Man Recommends – Top 3 Best Forex Brokers in 2024 | ||

John V

John is a digital marketing master's student who enjoys writing articles on business, finance, health, and relationships in his free time. His diverse interests and ability to convey complex ideas in a clear, engaging manner make him a valuable contributor to these fields.