Cobra Trading Review: The Most Important Feedback [2024]!

By J Maver

January 10, 2024 • Fact checked by Dumb Little Man

If you’re scanning for a premium trading platform for expert traders then you need to get a Cobra Trading account.

Cobra Trading platform offers services as a direct access broker for investors trading in the stocks and options market and uses Interactive Brokers and Wedbush Securities as their clearing firms.

Trading CFDs, Cryptos, and Forex is not part of the offering as they only provide direct access to stocks and options, and the minimum deposit for a trader is $30,000.

This is a detailed Cobra Trading review of what it Offers, its fees, and other important aspects of the platform.

Cobra Trading Review: A Deep Review

This direct market access broker provides powerful and flexible tools and trading programs for investors with best options whose trading fees are priced at a minimum of $1.

2013 is the year of establishment and Cobra Trading offers personalized service to all its Active traders.

Chad Hessing the CEO of Cobra Trading says that their objective is to give traders the best level of systems, trade support, and service at a fair rate.

| RECOMMENDED TRADING COURSE | REVIEW | VISIT |

|---|---|---|

| #1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |  |

Cobra Trading Review: How is it Regulated

This platform is an associate of the (SIPC) Securities Investor Protection Corporation, Financial Industry Regulatory Authority (FINRA), and (NFA) National Futures Association in the US.

FINRA allows firms and investors to confidently engage in the financial markets by safeguarding their integrity.

The National Futures Association regulates the derivatives industry in the US including off-exchange foreign currency, OTC derivatives, and on exchange futures trading.

SIPC is a protection scheme for investors established to protect them from the depletion of securities or cash when an online stockbroker fails to meet its obligations.

SIPC aggregate loss limit is pegged at $500,000 and a cash limit of $250,000. Most active traders open their accounts at Cobra Trading through Wed bush Securities.

Wedbush Securities provides more coverage besides that provided by SIPC for cash balances and securities all the way to $25,000,000 with a $100,000,000 gross loss limit.

This bond is covering up to $900,000 cash credit for cash credit balances totaling $1,150,000. You will not be provided with any extra coverage for a financial loss.

CLICK HERE TO READ MORE ABOUT COBRA TRADING

Cobra Trading Review: Trading Platforms

Sterling TraderPro

Sterling Trader Pro is a direct access broker for options and equities trading providing traders with advanced trading services.

Among the features at Sterling Trader pro include basket trading, portfolio management, hot keys, level 2 market data, high-level charting tools, watchlists, news, and custom alerts.

CLICK HERE TO READ MORE ABOUT STERLING TRADERPRO

Cobra TraderPro

This trading program has been equipped with advanced charting tools for non-professional and non-entity users as well as other customizable features.

This brokerage firm is hinged to the Sterling Trader framework and among other features, it includes the short locate monitor, custom alerts, hot keys, stop orders, basket trading, watchlist, and level 2 real-time market data.

CLICK HERE TO READ MORE ABOUT COBRA TRADER PRO

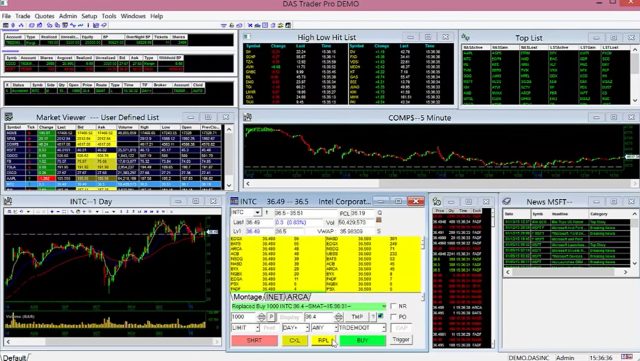

Das Trader Pro

Das Trader is a multi-instrument trading platform for options and equities offering direct order flow and advanced charting besides more than thirty technical studies, multiple stop types, hot keys, a market scanner, multi-account management, and news.

CLICK HERE TO READ MORE ABOUT DAS TRADER PRO

RealTick

Realtick is an award-winning platform and has powerful research capabilities, sophisticated data centers, multi-account management, and real-time analytics for global data.

The pro version is built-in with all the whistles and bells and is more streamlined. The pro version becomes free when you trade up to 500,000 shares but the prices are not inclusive of the routing charges and market data.

CLICK HERE TO READ MORE ABOUT REALTICK

Markets

Active traders are given the opportunity to trade options and equities through direct access to the order flow handling venues for the stock exchange.

Venom trading allows investors o trade a wide variety of instruments such as ETFs, bonds, US stocks, futures, forex, and options.

Cobra Trading Review: Commissions

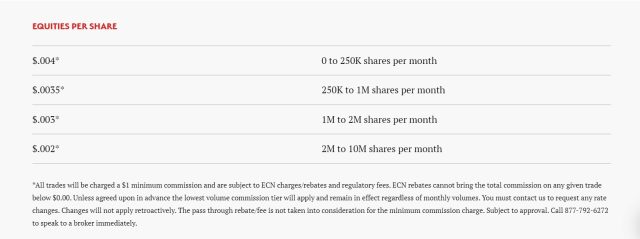

This Cobra Trading program offers tiered pricing on individual contracts, broker-assisted trades, and shares for options and equities.

All trades at Cobra Trading are subject to regulatory fees, ECN rebates/charges, and a $1 commission.

Equities/share

- The rate of $0.004 applies for trades less than 250K shares.

- $0.0035 is the rate for traded shares between 250K to 1M each month

- The trader who trades between 1M to 2M shares in a month pays $0.03 for every share.

- The rate of $0.002 applies for 2M to 10M trade shares in the month

Options/contract

- The rate of $.50 is charged by Cobra Trading for less than 2,000 contracts in a month

- Between 2,001 and 10,000 traded contracts in a month, you are charged $0.04.

- $.30 is the price charged for 10,000 contracts and above

Software Fees

Software fees for Cobra Trader Pro, Das Trader Pro as well as Sterling Trader Pro are between $100 and $200 all with a waiver if you meet the minimum requirement of shares traded in a month.

- Cobra TraderPro is charged at $100 but can be waived when a trading investor trades at least 200,000 shares in a month

- Sterling Trader Pro is charged at $200/$230 with options and is also waivable if you traded at least 300,000 shares in a month

- DAS Trader Pro is charged at $125 but is waivable if you traded at least 250,000 shares in a month

Cobra Trading also charges monthly data packages to non-pro traders at $25 and to pro traders at $79 with the option to have extra data packages from $12.

Cobra Trading also charges routing fees on every platform which varies depending on the stock exchange. You can find this and other account and cobra trading broker fees on their website.

Leverage for Cobra Trading

Cobra Trading’s day trading retail leverage stands at 1:4 while overnight trading is 1:2. Buying power is limited to the available cash for those dealing in an IRA or cash account.

Mobile Trading

Trading via mobile is available through the use of iDAS which is energized via DAS Trader Pro at an additional monthly cost of $30.

The venom trading division also has an exclusive application for mobile that allows investors to trade options, futures, and stocks through streaming real-time charts and quotes.

Investors get to have full-day trading account management access, and set price alerts on both Android and iOS devices.

Payments

The options for funding at Cobra Trading include bank transfer through an ACH, cheque, or wire transfer through the clearing firm.

A trader can also do an account transfer from another account by reaching out to customer care and getting the account transfer form.

Wire deposits attract a fee of $20 on withdrawals and deposits while outgoing international wire transfers attract a $25 fee.

Trial Account

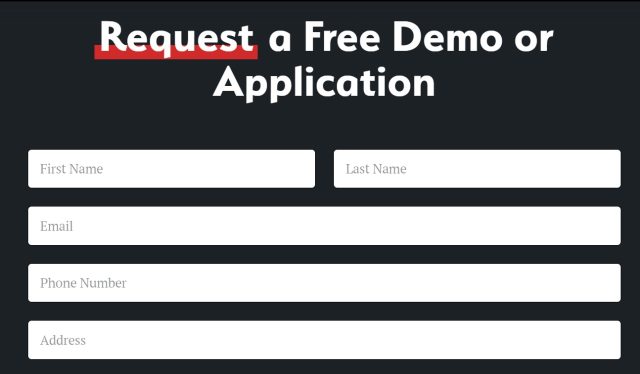

Day Traders who need a demo account can always contact customer support to help set it up to test drive it before initiating a live account.

Cobra Trading Account Types

Subject to the online trading needs you have, you can choose from various day trading accounts. Standard accounts provided by other online brokers in the US include the following;

- LLC accounts

- Joint accounts

- Partnership accounts

- Individual accounts

- Corporate accounts

- Margin accounts (1:2 overnight trading and 1:4 day trading)

- Retirement accounts

- Trust accounts

Account minimum deposits for opening a day trading account are as shown below;

US Citizens

- $30,000 for account opening

- $25,000 account minimum balance

Non-US Citizens

- $50,000 for account opening

- $25,000 least account balance

As earlier indicated in this Cobra Trading review, people trading in IRA or cash accounts are confined to the available cash in their accounts.

A retail margin account buying power is four times the available cash in your account for day trading and 2 times for overnight trades.

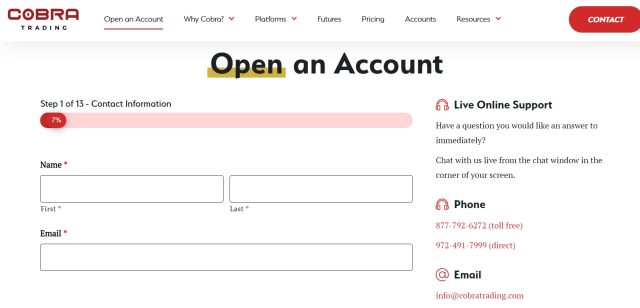

Account Opening

To begin the account opening process, click on the “open account” tab on Cobra Trading official site.

You will then receive an email with an account opening packet.

You will also need to provide identification documents and your address before verification is done by the accounts team.

Pros and Cons of Cobra Trading

Pros

- Live chat support

- Multiple Short locate Sources

- APIs

- SIPC compensation

- Multiple trading platforms

- Accepts investors from UK and US

Cons

- There are no meta trader platforms

- High account minimum deposits

- Pattern day trading restrictions

- Several commissions and fees

Customer Support

The customer support at Cobra Trading has committed itself to offer premium personalized services to all its clients irrespective of their trading experience.

They offer support from 7 AM to 4:30 PM every Monday – Friday. The support crew can be contacted via email, online chat, or telephone.

Trading Hours

As we review Cobra Trading, it’s vital that you know the hours of trading. Cobra Trading offers both pre and post-market trading to all its customers.

The trading hours are (by request) 4:00 EST – 20:00 however session times can differ.

Security

Advanced trading platforms typically apply industry-recommended security measures such as login codes and SSL encryption.

Cobra Trading security features are not well known so ensure you contact the agent for clarification.

Countries in Operation

Cobra Trading currently accepts investors from Australia, United States, and the United Kingdom.

Cobra Trading Alternatives

As we review Cobra Trading, it’s good that we mention similar direct access trading platforms.

Trade Nation

If you are interested in trading CFDs and FX then the Trade Nation platform is a good option with multiple jurisdictions including Australia and UK. They have zero minimum deposit and claim tight spreads.

Forex.com

Reputed globally, Forex.com is regulated within the US, UK, Canada, and the EU. Other than forex they also offer a broad array of markets including margin trading with tight spreads within a superior platform. The platform is excellent for high-volume traders.

Just2Trade

This is an excellent online trading program for day traders offering high-tech options trading and stock trading with advanced analytics.

IronFX

This is an excellent platform to trade stocks as well as trading equities. You can also trade futures and is good for high-volume traders at a very competitive price.

Which is the Cobra Trading clearing firm?

Most option traders open their accounts via Wedbush Securities but venom has an additional clearing via Interactive Brokers.

Which deposit methods does Cobra Trading use?

Cobra Trading offers deposits to be made through cheque or wire transfer and you can as well transfer your account from a different firm.

Is there a free demo account at Cobra Trading?

Yes, you only need to fill a request form on their website to get a demo account. It is sound investment advice to use the demo account before going live.

Choose Asia Forex Mentor for Your Forex Trading Success

If you have a keen interest in establishing a successful career in forex trading and aspire to achieve substantial financial gains, Asia Forex Mentor stands as the optimal choice for the best forex, stock, and crypto trading course. Ezekiel Chew, renowned as the visionary behind trading institutions and banks, is the driving force behind Asia Forex Mentor. On a personal note, Ezekiel consistently achieves seven-figure trades, a distinction that truly sets him apart from other educators in the field. Here are the compelling reasons that underpin our recommendation:

Comprehensive Curriculum: Asia Forex Mentor offers an all-encompassing educational program that covers stock, crypto, and forex trading. This well-structured curriculum equips aspiring traders with the knowledge and skills necessary to excel in these diverse markets.

Proven Track Record: The credibility of Asia Forex Mentor is firmly established through its impressive track record of producing consistently profitable traders across various market sectors. This achievement serves as a testament to the effectiveness of their training methodologies and mentorship.

Expert Mentors: At Asia Forex Mentor, students benefit from the guidance and insights of experienced mentors who have demonstrated remarkable success in stock, crypto, and forex trading. These mentors provide personalized support, enabling students to navigate the intricacies of each market with confidence.

Supportive Community: Joining Asia Forex Mentor brings access to a supportive community of like-minded traders pursuing success in the stock, crypto, and forex markets. This community fosters collaboration, idea-sharing, and peer learning, enhancing the overall learning experience.

Emphasis on Discipline and Psychology: Success in trading necessitates a strong mindset and disciplined approach. Asia Forex Mentor provides crucial psychological training to help traders manage emotions, handle stress, and make rational decisions during trading.

Constant Updates and Resources: The financial markets are dynamic, and Asia Forex Mentor ensures that students remain up-to-date with the latest trends, strategies, and market insights. Continuous access to valuable resources keeps traders ahead of the curve.

Success Stories: Asia Forex Mentor takes pride in a multitude of success stories where students have transformed their trading careers and achieved financial independence through their comprehensive forex, stock, and crypto trading education.

In summary, Asia Forex Mentor emerges as the premier choice for those seeking the best forex, stock, and crypto trading course to carve a rewarding career and achieve financial prosperity. Through its comprehensive curriculum, experienced mentors, practical approach, and supportive community, Asia Forex Mentor provides the necessary tools and guidance to mold aspiring traders into accomplished professionals across diverse financial markets.

RECOMMENDED TRADING COURSE | REVIEW | VISIT |

#1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |

Conclusion

Now that we have covered the important areas in this Cobra Trading Review, it is no doubt that it is among the best trading platforms in the market.

Cobra Trading offers established and regulated services for active and experienced traders who need excellent trading and portfolio management software.

Cobra Trading charges however are on the higher side and frequent traders need to have a minimum deposit of $30,000.

J Maver

Passionate in tech, software and gadgets. I enjoy reviewing and comparing products & services, uncovering new trends and digging up little known products that deserve an audience.