Commodities Outperform Amid April Losses

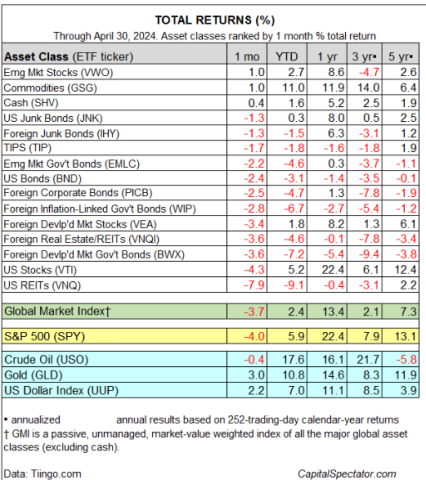

April witnessed a retreat across major asset classes, marking the worst month for global markets in 2025, as per a set of ETFs. Emerging markets stocks (VWO), commodities (GSG),and a cash proxy (SHV) stood as upside outliers amidst a sea of losses.

US real estate investment trusts (VNQ) suffered the deepest loss, plummeting 7.9% — the steepest setback in nearly two years. US stocks (VTI) also fell, marking the first monthly decline in 2024, while US bonds (BND) declined 2.4%.

Year-to-date, most major asset classes are in the red, except commodities (GSG), which are up 11.0%. US stocks (VTI) follow with a 5.2% gain.

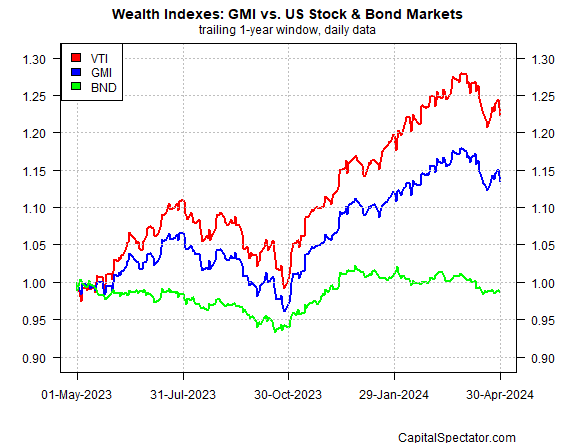

April marked the end of the winning streak for the Global Market Index (GMI), dropping 3.7%. Year to date, GMI holds a modest 2.4% advance, while its one-year performance remains strong at 13.4%. US stocks (VTI) continue to outperform, with a return exceeding 22% over the past year, while US bonds (BND) remain in negative territory, falling 1.4% compared to the previous year.