CPT Markets Review 2024 with Rankings by Dumb Little Man

By John V

July 11, 2024 • Fact checked by Dumb Little Man

Overall Rating | Overall Ranking | Trading Terminals |

1.3 1.5/5 | 153nd  |  |

| Evaluation Criteria |

|---|

The Dumb Little Man team, made up of financial specialists, seasoned traders, and personal investors, leverages advanced algorithms for in-depth reviews of brokerage firms. They focus on critical aspects like:

By integrating feedback from actual users, they offer an impartial and thorough assessment. Their comprehensive research identifies CPT Markets as a dependable choice for those seeking a robust financial ally. Nonetheless, Dumb Little Man advises prospective customers to meticulously examine their detailed analysis to grasp any potential drawbacks linked to the broker. |

CPT Markets Review

By providing the instruments and platforms required to enable the purchase and sale of foreign currencies, “forex brokers” play a crucial role in the currency trading industry. Real-time charts and technical analysis tools are provided by these platforms, which are necessary for making informed trading decisions. The largest and most volatile financial market, the global forex market, has many complexities that brokers must help traders navigate. They accomplish this by making it accessible. In order to help traders improve their trading strategies and gain a deeper understanding of market dynamics, they also offer support and educational resources.

CPT Markets is a leading global provider of leveraged product brokerage, offering online trading on over 130 products in the global financial markets. They prioritize keeping customers’ money safe and work to provide a simple and speedy transaction experience. Using the knowledge and output of experts, this study offers a comprehensive examination of CPT Markets.

What is CPT Markets?

Leading global broker of leveraged products for online trading on international markets is CPT Markets. They provide a secure and effective trading experience by providing more than 130 leveraged product instruments to investors worldwide. Their focus on simplicity and fund safety has helped them build a solid reputation among traders.

By fusing excellent customer service with cutting-edge trading technologies, CPT Markets aims to deliver an unmatched online trading experience. Their goal is to create a community that values openness, convenience, and transparency while allowing traders and introducing brokers to get the most out of transactions. By providing the greatest trading experience possible, they hope to make trading accessible to everyone, anywhere.

CPT Markets has been in the business for more than 12 years, and it has 350,000 clients globally with 165,000 daily performed trades. By providing a large selection of trading instruments on an easy-to-use platform, such as stocks, FX, and commodities, they promote portfolio diversification. This variety enables traders to diversify their risk and take advantage of different market angles.

Credit cards, bank transfers, and well-known e-wallets are just a few of the reliable payment options that CPT Markets offers to guarantee safe transactions. They provide quick trade execution, enabling traders to respond quickly to shifts in the market. Their cutting-edge trading platforms accommodate both novice and expert traders by providing extensive tools for price and technical analysis. Furthermore, CPT Markets provides innovative support and tailored solutions to satisfy the unique requirements of its traders and partners.

Safety and Security of CPT Markets

CPT Markets places a high priority on the safety and security of its clients’ money, and it is backed by stringent regulatory oversight and adherence to secure protocols in a number of jurisdictions. CPT Markets operates in the United Kingdom under the authority of CPT Markets U.K. Limited, which is authorised and overseen by the Financial Conduct Authority (FCA). Thanks to this regulation by a highly renowned institution, clients may feel safe about the security of their funds knowing that CPT Markets adheres to strong financial regulations and upholds the highest standards of trust.

CPT Markets PTY LTD (CPT SA) has expanded its worldwide reach by operating in South Africa under the Financial Sector Conduct Authority’s stringent regulations. This control ensures that CPT Markets provides its clients with a safe and secure trading environment by upholding stringent financial requirements. Interested parties can develop or inquire about commercial relationships using the official websites or direct email conversation, ensuring transparency and ease of assistance.

CPT Markets Limited is governed by the Belize International Financial Services Commission in Belize. This legal framework, which complies with international financial norms, shows CPT Markets’ dedication to safeguarding client funds and upholding the integrity of trading practices. This multi-jurisdictional regulatory approach reinforces the sense of trust and security surrounding CPT Markets and demonstrates the company’s commitment to maintaining high standards in all facets of business operations. Given that Dumb Little Man conducted a great deal of research, this material is trustworthy and factual.

Pros and Cons of CPT Markets

Pros

- Multilingual support for a global audience

- 24/5 customer service ensures timely assistance

- Expert specialists offer personalized help

- Accessible globally for diverse traders

- Effective communication enhances clarity

- Quick issue resolution improves experience

- No withdrawal fees reduces costs

- Varied account types cater to all traders

- Swap free trading available for seven days

- Strict regulatory oversight ensures safety

- Advanced trading platforms facilitate analysis

- High leverage options increase trading power

- Robust security measures protect funds

Cons

- No 24/7 support limits after-hours help

- Weekend support unavailable hinders planning

- Overnight support limited delays resolutions

- Regulatory complexity can confuse traders

- Mixed customer reviews indicate possible issues

- Commission charges on ECN accounts

Sign-Up Bonus of CPT Markets

With a 20% trading incentive upon registration, CPT Markets offers new traders an enticing sign-up bonus. With a higher balance to begin with and the possibility to increase trading possibilities, this incentive is an excellent method to boost your trading capital for novice traders. For those who want to optimize their trading potential right away, this initial boost might be really helpful.

CPT Markets provides the IB Power-Up program in addition to the sign-up incentive. Introduce brokers (IBs) who recommend new traders to CPT Markets with this scheme. IBs can make up to $1,500 with this scheme. In addition to compensating IBs for their recommendations, this incentive pushes IBs to increase their level of success with CPT Markets. Brokers can grow their trading network and earn more by taking part in the IB Power-Up program, which makes it a profitable prospect for individuals in the trading community.

Minimum Deposit of CPT Markets

With a variety of trading account types and minimum deposit criteria tailored to suit different trading techniques and budgetary constraints, CPT Markets serves a wide spectrum of traders. The Classic account is especially beneficial for novices or those who would rather begin trading with a smaller financial commitment because it just requires a $20 minimum deposit. With its basic trading functionality and minimal initial commitment required to join the forex markets, this account type offers new traders a great starting point for their trading career.

Conversely, CPT Markets offers its Prime and ECN accounts, which have a $1,000 minimum deposit requirement, to more experienced traders. These accounts are designed for seasoned traders who want advanced trading tools and direct market access in addition to a more stable trading environment.

The Prime account frequently comes with extra services like a dedicated account manager and more specialized trading conditions, but the ECN account is best for people who want to trade with tight spreads and a commission-based structure. These accounts are made to satisfy the demands of serious traders who want to use more advanced platforms and services to maximize their trading performance.

CPT Markets Account Types

To meet the various demands of traders, CPT Markets provides a range of trading account kinds. Our team of professionals at Dumb Little Man has carefully examined every kind of account, offering accurate information derived from in-depth investigation. The available account types are shown below aside from the demo account CPT Markets offers:

ECN Account

- Minimum Deposit: $1,000

- Max Leverage: 1:1000

- Spreads: 0.1 pip

- Margin Call: 50%

- Stop Out: 30%

- Commission: Yes

- Dedicated Account Manager: Yes

Classic Account (Popular)

- Minimum Deposit: $20

- Max Leverage: 1:1000

- Spreads: 1.4 pip

- Margin Call: 50%

- Stop Out: 30%

- Commission: No

- Dedicated Account Manager: No

Prime Account

- Minimum Deposit: $1,000

- Max Leverage: 1:1000

- Spreads: 0.7 pip

- Margin Call: 50%

- Stop Out: 30%

- Commission: No

- Dedicated Account Manager: Yes

CPT Markets Customer Reviews

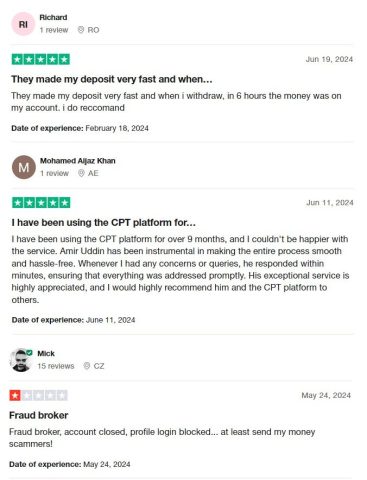

Customer reviews on CPT Markets show a wide range of experiences. Many customers commend the platform for its speedy deposit and withdrawal procedures, observing that money shows up in their accounts in a matter of hours. Positive comments emphasize how attentive and effective the customer service is, and they especially praise agents such as Amir Uddin for their timely assistance and easy resolution of issues.

Some, on the other hand, are calling for the immediate recovery of the funds and denouncing the broker as dishonest and reporting problems like blocked profiles and canceled accounts. The variety of consumer interactions with CPT Markets is highlighted by these reviews taken as a whole.

CPT Markets Fees, Spreads, and Commissions

By paying for all third-party transaction fees, CPT Markets removes the headache of withdrawal fees and guarantees that traders can transfer their money without incurring any more fees. For its clients, this method makes the process of financial management easier.

CPT Markets provides choices for traders selecting an account that are designed to optimize profits while minimizing expenses. To be more precise, the ECN account offers traders minimal costs and high leverage trading circumstances with a commission structure that includes tight spreads starting at 0.1 pip and leverage up to 1:1000. Among casual traders, the Classic account is well-liked since it provides maximum leverage and commission-free trading with spreads as low as 1.4 pips, thereby striking a balance between affordability and market accessibility.

Another clever product from CPT Markets that enables swap-free trading for customers is the Swap Free Account. For a maximum of seven days in a row, there are no overnight trading costs associated with this account. This allows merchants who need or desire such conditions for budgetary or religious reasons to be accommodated.

Deposit and Withdrawal

In order to provide traders with simplicity and trust while managing their funds, CPT Markets places a high priority on security and convenience in its deposit and withdrawal procedures. This information has been verified and tested by a Dumb Little Man trading professional.

The broker deposits money in several tier-1 banks using segregated accounts for storage. With strict financial safety measures protecting their funds, traders can rest easy knowing that this arrangement offers the highest level of protection. With its one-time password verification procedures for withdrawals and support for 3D Secure payments for all major credit cards, including Visa and Mastercard, CPT Markets further improves security.

The efficient payment system at CPT Markets makes deposits simple and provides a range of local and international payment choices. The technology allows customers round-the-clock access to funds and instantaneous withdrawals without incurring costs for transactions with third parties. The simple steps involved in depositing money are choosing a payment option, completing the deposit request, and registering and verifying the account. These steps are completely optimized to improve user experience and transaction simplicity.

How to Open a CPT Markets Account

The procedure of opening an account with CPT Markets is simple, rapid, and intuitive. You may begin trading with one of the top brokers on the market by following these easy steps. To ensure a smooth registration process, make sure you have access to your email and your personal information handy.

- Visit the CPT Markets website.

- Select the “Register” located at the top right corner.

- Input your first name and last name.

- Enter your email address.

- Provide your mobile number.

- Create a strong and secure password.

- Accept the Privacy Policy, Terms and Conditions, and FAIS Disclosure.

- Click Next to continue with your application.

- Open your email to find and click on the verification link to complete registration.

CPT Markets Affiliate Program

Partners wishing to grow their business and revenue through affiliate marketing can take advantage of the profitable prospects provided by the CPT Markets Affiliate Program. This program is designed for those that are keen to use the extensive marketing capabilities offered by CPT Markets to draw in and acquire new customers.

There are no minimum qualifications to be eligible, and partners in the program can get a commission refund of $10 for each standard lot traded by their referred clients. Because of this simple commission system, affiliates with varying degrees of experience can profit from their referrals.

Cutting-edge trading platforms with intuitive user interfaces and extensive capabilities for technical and price research are provided by CPT Markets to its affiliates. In addition to offering flexibility and committed support to cater to the individual needs of each partner, the program promises huge benefits. To help with client acquisition and retention, affiliates receive free marketing materials such as banners, business cards, newsletters, and promotional items in addition to creative support.

Furthermore, CPT Markets is a leader in technology innovation, offering a state-of-the-art trading platform that caters to the demands of traders who are constantly on the go. This increases affiliates’ chances of success in the program by enabling them to confidently market a sophisticated and user-friendly product.

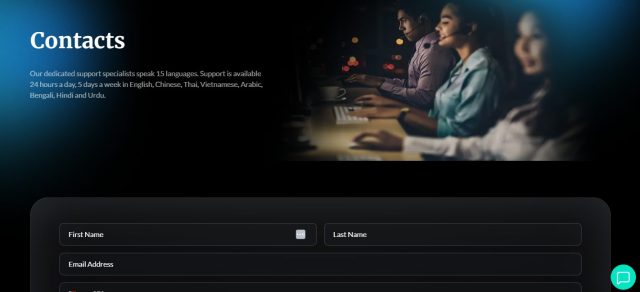

CPT Markets Customer Support

With its extensive customer support offered in 15 languages, CPT Markets is well-known for providing assistance to a diverse variety of traders in their favorite language. This help is available in the following main languages: English, Chinese, Thai, Vietnamese, Arabic, Bengali, Hindi, and Urdu. It is available twenty-four hours a day, five days a week. For a wide range of international clients, our bilingual approach improves trading experiences and makes communication more efficient.

They also have Market News in their website to further help their clients with the latest events in the trading world.

CPT Markets’ committed support professionals offer rapid and efficient assistance by promptly addressing concerns and resolving issues, drawing from Dumb Little Man’s experiences. By being accessible, they guarantee that traders may get help whenever they need it, reducing downtime and increasing trading prospects. One of CPT Markets’ greatest assets is its easily reachable and responsive support system, which greatly enhances the company’s favorable reputation with traders.

Advantages and Disadvantages of CPT Markets Customer Support

| Advantages | Disadvantages |

|---|---|

CPT Markets vs Other Brokers

#1 CPT Markets vs AvaTrade

While AvaTrade and CPT Markets offer a sizable assortment of trading and financial instruments, their operational agendas and legal environments diverge. AvaTrade is an Irish company that was founded in 2006 and has its main office in Dublin. It provides a large selection of tradable products and places a great focus on educational resources for inexperienced traders. It is supervised by the Financial Conduct Authority (FCA) yet offers trade insurance features that are comparable to those of AvaProtect. However, investors may feel more at ease regarding the protection of their money with CPT Markets’ robust security measures and regulatory oversight from multiple jurisdictions.

Verdict: CPT Markets might be a better choice for people who prioritize fund security and regulatory oversight, whereas AvaTrade might be a better choice for traders who value comprehensive training materials and state-of-the-art trade protection features.

#2 CPT Markets vs RoboForex

RoboForex has gained recognition since 2009 for providing a wide range of trading platforms and software options, including MT5, MT4, cTrader, and R Stock Trader, which has a lot of capabilities, including automated trading, trading signals and more, to suit various trading preferences. RoboForex provides an extensive array of platforms and tailored trading conditions, whilst CPT Markets places a premium on security and has a strong regulatory structure.

Verdict: RoboForex may be a better choice for traders looking for platform variety and customization in their trading environment. CPT Markets, on the other hand, would be advantageous to those who value security and tight adherence to rules.

#3 CPT Markets vs FXChoice

FXChoice provides trading in 36 different currency pairs and commodities CFDs, as well as access to growing markets like the South African Rand and the Russian Ruble, for traders looking to diversify into less well-known areas. Because of its wide range of goods and regulatory assurances, CPT Markets provides a more organized trading environment with enhanced security safeguards.

Verdict: FXChoice is an exceptional choice for traders looking for a larger assortment of currency pairings and commodities, especially in emerging markets. CPT Markets is still a fantastic option for people who value a steady trading environment and regulatory security.

Choose Asia Forex Mentor for Your Forex Trading Success

To anyone looking to start a profitable career in stock, cryptocurrency, or forex trading, the trading experts at Dumb Little Man highly recommend Asia Forex Mentor. Leading the elite educational platform Asia Forex Mentor is renowned trader Ezekiel Chew, who is widely recognized in the business for his consistent seven-figure deals.

Broad Curriculum: Asia Forex Mentor provides a thorough course that covers the principles of trading forex, equities, and cryptocurrencies. Giving students the skills they need to thrive in these varied markets is the aim of this curriculum.

Proven Track Record: The platform has a solid history of turning out traders that consistently turn a profit, proving the effectiveness of its mentorship and educational programs.

Expert Mentor: Ezekiel Chew shares his opinions with students at Asia Forex Mentor. He provides students with individualized support in addition to expert advice to help them manage the complexities of each market with confidence.

Community of Support: By providing participants with access to a group of traders who have similar objectives, the program enhances the quality of the educational experience through networking, idea sharing, and peer learning.

Emphasis on Psychology and Discipline: With an emphasis on the psychological aspects of trading, Forex Mentor helps traders control their stress and make well-informed judgments. Success in trading requires a strong mentality.

Frequent Updates and Resources: Asia Forex Mentor ensures that students are informed about the most recent strategies and trends by giving them access to resources and updates on a frequent basis. This is because the financial markets are constantly changing.

Success Stories: The curriculum is replete with accounts of students who became financially independent after obtaining a comprehensive education in trade.

In conclusion, the greatest choice for anyone looking to profit from stock, cryptocurrency, and forex trading is Asia Forex Mentor. It provides all the tools, guidance, and community support needed to transform inexperienced traders into knowledgeable specialists in a range of financial markets.

RECOMMENDED TRADING COURSE | REVIEW | VISIT |

#1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |

>> Also Read: CK Markets Review 2024 with Rankings by Dumb Little Man

Conclusion: CPT Markets Review

Dumb Little Man’s trading experts carried out a thorough investigation, and the findings indicate that CPT Markets offers a secure and regulated trading environment. In today’s volatile markets, it offers a strong security structure and many regulatory clearances. The broker also provides traders with a large array of account options and powerful leverage capabilities, enabling them to tailor their strategies to fit their risk tolerances and preferences.

However, prospective traders should be aware of the limitations, as some individuals who require ongoing assistance may find them to be harmful. The absence of weekend and round-the-clock customer service is one example of this. Furthermore, because of their complexity, negotiating several regulatory regimes may present challenges. Ultimately, CPT Markets offers traders a competitive global platform, but it’s important to balance its advanced trading tools against the potential need for more dependable support and a deeper understanding of regulatory requirements.

>> Also Read: BKFX Review 2024 with Rankings by Dumb Little Man

CPT Markets Review FAQs

What types of trading accounts does CPT Markets offer?

To meet the demands of various traders, CPT Markets provides a variety of account kinds, such as the ECN, Classic and Prime accounts. With no commission trading and a $20 minimum deposit, the Classic account is perfect for novices. With a $1,000 minimum deposit, the ECN and Prime accounts are best suited for more seasoned traders seeking more direct market access and reduced spreads. Depending on the trader’s approach and experience level, each account type offers a different set of advantages.

How does CPT Markets ensure the security of my funds?

CPT Markets places a high priority on protecting client funds by enforcing strict regulations and using cutting-edge security procedures. The broker uses segregated accounts to keep client cash apart from firm funds and is governed by many top-tier regulatory bodies. Modern security technologies, including as SSL encryption and two-factor authentication for account access and financial transactions, are also used by CPT Markets to ensure transaction safety.

Can I trade a variety of financial markets with CPT Markets?

Indeed, CPT Markets gives traders access to a variety of financial markets, including those for stocks, commodities, indices, and currencies. Because of this diversity, traders can diversify their holdings across a range of asset classes, thereby lowering risk and taking advantage of opportunities presented by shifting market conditions. Because of the platform’s cutting-edge trading features and frequent upgrades, traders can efficiently research and trade in these ever-changing markets.

Dumb Little Man Recommends – Top 3 Best Forex Brokers in 2024 | ||

John V

John is a digital marketing master's student who enjoys writing articles on business, finance, health, and relationships in his free time. His diverse interests and ability to convey complex ideas in a clear, engaging manner make him a valuable contributor to these fields.