Want to jump straight to the answer? The best cryptocurrency brokers for traders are Coinbase and Gemini

The #1 Crypto and Forex Trading Course is Asia Forex Mentor

So, what do crypto credit cards offer? In a nutshell, credit cards (usually Visa cards) allow you to spend your cryptocurrency holdings as if they were cash. In addition, they return a percentage of your spending to you in cryptocurrency that you can easily redeem later.

For example, the Coinbase Card allows you to get up to 4% back in Bitcoin (BTC) on all your eligible purchase rewards. However, all crypto credit cards are not the same. Some offer cash back in specific cryptocurrencies, while others reward points. Let’s review the top 6 best crypto credit cards of 2025, so you can choose the best one for your needs.

6 Best Crypto Credit Cards of 2025

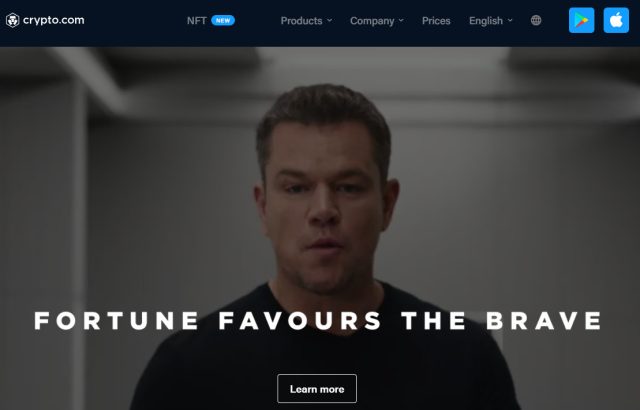

#1. Crypto.com Visa Card (CRO Card)

The Crypto.com visa card is the best crypto rewards credit card because it offers 1% to 8% cash back rewards in a CRO card — based on your purchase. So, if you are looking for the best visa card to stake your crypto holdings, then look no further.

You can get the following cash back rewards in CRO:

- 1% cashback rewards on transaction: $0 to $399.99

- 2% cash back rewards on transaction: $400 to $3,999.99

- 3% cashback rewards on transaction: $4,000 to $39,999.99

- 5% cash back rewards on transaction:$40,000 to $399,999.99

- 8% cash back rewards on transaction: $400,000+

The best thing about the CRO card is that its crypto rewards are remarkable if you hold a stake in cryptocurrency. Moreover, you can also stake 20+ cryptocurrencies, including (BTC, ETH, XRP, LTC, etc.) and get cash back rewards. Some of its benefits include access to Spotify, Amazon Prime, Netflix, Amazon Prime membership, and free ATM withdrawals worth $1000.

#2. Coinbase Card

Coinbase is one of the most popular cryptocurrency exchanges, and it’s also one of the few that offers crypto debit cards. You should definitely opt-in for a Coinbase card if you’re spending in cryptocurrency daily.

To apply for a Coinbase prepaid debit card, you need to be a verified customer of Coinbase with a US bank account. The card is currently available in all US States except Hawaii. In addition, you don’t have to convert crypto holdings into USD for spending or rewards.

With a Coinbase card, you can easily get up to 4% of your crypto rewards, and you can use this card wherever Visa cards are accepted. Moreover, there is no foreign transaction fee, so turn your everyday purchases to cryptocurrency rewards.

#3. Gemini Credit Card

With a Gemini card, you can earn rewards in BTC and Ether along with 60 other cryptocurrencies. It is currently in waitlist mode, but you can sign-up for early access.

Gemini promises to offer 3% back on dining and travel purchases, 2% back on grocery purchases, and 1% back on all the other eligible purchases. The best part is the automatic redemption of crypto rewards, and there is no limit to the amount of credit card rewards you can earn.

There is no annual fee on the Gemini card, and it is available internationally in several countries. The only drawback with the Gemini card is that it doesn’t offer any intro APR or welcome bonus.

#4. SoFi Credit Card

SoFi visa card is the best option if you are going to get the crypto card for personal finance, paying debts, and saving crypto assets. You can earn traditional cashback that is flat 2% back on all other purchases. However, you can get 3% cashback with a direct SoFi deposit for the first year of card ownership.

With a SoFi crypto credit card, you can use your phone to make contactless payments. You can also set up auto-payments and track your spending. SoFi crypto credit card is available to US citizens only, and it doesn’t have an annual fee.

SoFi credit card is a hybrid — it means you can redeem rewards to pay loans, buy crypto, or refinance. You can also invest in stocks and ETFs with SoFi Invest. It’s one of the few cards that offer cash back rewards in Bitcoin. Remember that cashback rewards go to 1% if you redeem a credit card statement credit.

#5. BlockFi Rewards Visa Signature Credit Card

BlockFi is the first-ever company to put the BTC symbol on a crypto visa signature card. It is one of the best options as it allows you to deposit cash into a BlockFi Interest account (BIA) and earn up to 8.6% APY on your deposited cash. Not only that, you can take a loan against your crypto holdings and a flat 2% cashback on all eligible purchases of over $30,000 in annual spending.

With a BlockFi card, you can earn rewards up to 4.5% APY in crypto with a BIA account. The interest is paid out monthly in the form of your chosen cryptocurrency. The best part is that you can make purchases with a BlockFi card and earn up to 1.5% cashback on every verified purchase.

BlockFi charges no annual fee or transaction fees, and there’s no foreign transaction fee. You can also join their referral program and earn 30$ commission for a new customer. The only drawback of the BlockFi visa signature card is that it is only available in a few USA states.

#6. Upgrade Bitcoin Rewards Credit Card

If you are looking for a credit card that offers cashback in Bitcoin, then go for the Upgrade card. It is one of the few crypto-friendly credit cards that allow you to earn crypto rewards in Bitcoin. In addition, it offers credit lines as big as $25,000 to qualified cardholders.

Upgrade bitcoin is a good alternative if other crypto cards are not working for you. You may not be able to earn other currencies than BTC; however, it offers 1.5% cashback on all other purchases.

So, if you are going to make major purchases through a crypto card, Upgrade is the best option. Upgrade cards can be used anywhere where the visa card is accepted.

Keep in mind that you cannot move BTC from the custodial wallet to your personal wallet. To get the full benefits of cashback rewards, you’ll need to hold BTC in your Upgrade account or sell them to redeem for cash. Moreover, you’ll need to convert your crypto rewards if you want to claim them in a different cryptocurrency or look for another card.

How We Select the Best Crypto Credit Cards?

To evaluate the exceptional crypto credit cards, we looked at various factors to find which cards offered the best combination of fees, rewards, and features. Let’s look at these factors in more detail:

Rewards Rate & Redemption

The best crypto debit cards offer generous rewards rates on all purchases, with no limit to the number of rewards you can earn. They also offer flexible redemption options that let you redeem your rewards for cash back, merchandise, travel rewards, or gift cards.

We preferred the crypto rewards cards that can redeem points automatically in Bitcoin or other digital currencies rather than converting them manually. All the mentioned cards have higher cash-back returns and easy redemption options.

Card Type and Fee

You may not notice, but most crypto credit cards are crypto debit cards.

Why? Because you need to keep a stake in a specific cryptocurrency to use the card. Some require you to hold a minimum balance, while others don’t have any minimum requirements.

Also, many cryptocurrency credit cards charge several fees (foreign transactions, funding fees, exchange fees, etc.) However, we preferred the cards with a minimal to 0% annual fee.

Compatibility with Several Cryptocurrencies

The best crypto card can be used with multiple cryptocurrencies. We understand how important it is to have a card that can be used with the cryptocurrency you hold. That’s why we only selected cards compatible with multiple digital assets (currencies).

Additional Perks & Features

The best crypto cards offer additional perks and features that can help crypto enthusiasts like you to earn more rewards. It includes referral programs, airport lounge access, and a welcome bonus. We preferred the cards that offer these additional perks and features.

Best Crypto Broker

Best Crypto and Forex Training Course

Are you looking for the best Crypto and Forex training course to make a 6-figures income? If yes, opt for Asia Forex Mentor Free Training. It is the best company that trains the trader from prop trading firms, banks, and fund management companies.

Ezekiel Chew is the founder of Asia Forex Mentor, and he is a full-time professional forex trader. His trading methods are backed by mathematical probability, and they are so easy to learn, even for beginners.

His foolproof system reveals how to trade to earn consistent profits in the markets day after day, week after week, and month after month. If you are serious about making a living from forex trading, this is your course.

Conclusion: Crypto Credit Cards

So, there you have it. These are the best cryptocurrency credit cards that offer cash back rewards and other benefits. When you choose the perfect crypto credit card, make sure to consider the fees, ease of use, and rewards. Besides that, don’t forget to check the terms and conditions before using the card.

Furthermore, learn how the cryptocurrency cards disburse rewards, what are the available cryptocurrencies that you can convert, and if you can link a crypto wallet to your account card.

Keep in mind that crypto cards are kind of the same as traditional credit cards. So keep the interest rate, card fee, and value-added features in mind.

Consider your requirements and purpose for using crypto credit card rewards. Based on that, choose the best crypto credit card for cash back rewards and other benefits. Use a credit card responsibly to avoid any debt trap.

Crypto Credit Cards FAQs

How much does a crypto credit card cost?

Most crypto debit cards don’t have an annual fee. Some may charge a one-time joining or activation fee. However, they may charge indirect payments like cash advance fees, foreign transaction fees, etc. So check the terms and conditions carefully before using the card.

As a crypto card user, you should know that cryptocurrency transactions cost more than fiat currency. If you spend your crypto rewards for purchasing, you need to pay a small amount for that. Along with that, be aware of the crypto taxation as the IRS keeps an eye on every purchase you make using a crypto credit card as you need to pay taxes on crypto.

Is Crypto credit card safe?

Crypto credit cards also come with security and identity theft risks like any other traditional cards. For example, if your card is misplaced, it can be used for illegal activities or to purchase products. So it’s important to report the loss as soon as possible and get a new card.

When you use a crypto credit card for online shopping, make sure the website is secure. Check for an SSL certificate or green address bar that indicates the site’s security. Also, don’t save your card details on any online portal.

If your credit card is hacked, lock it immediately to avoid further loss. If you find it later, you can simply unlock it. If not, you can request a new card.