Crystal Ball Markets Review 2025 with Rankings by Dumb Little Man

By John V

January 5, 2025 • Fact checked by Dumb Little Man

Overall Rating | Overall Ranking | Trading Terminals |

1.3 1.5/5 | 154th  |  |

| Evaluation Criteria |

|---|

The Dumb Little Man team, made up of financial specialists, seasoned traders, and personal investors, leverages advanced algorithms for in-depth reviews of brokerage firms. They focus on critical aspects like:

By integrating feedback from actual users, they offer an impartial and thorough assessment. Their comprehensive research identifies Crystal Ball Markets as a dependable choice for those seeking a robust financial ally. Nonetheless, Dumb Little Man advises prospective customers to meticulously examine their detailed analysis to grasp any potential drawbacks linked to the broker. |

Crystal Ball Markets Review

“Forex brokers” offer trading platforms for a variety of financial instruments and connect traders to the world’s currency markets. They provide traders with the information and tools they need to make wise judgments. Selecting a trustworthy broker is necessary for a profitable trading endeavor.

Quick access to financial markets, such as CFDs, currencies, commodities, metals, energy, equities, indexes, and digital currencies, is provided by Crystal Ball Markets. Establishing a partnership with regulated Tier-1 liquidity providers guarantees a smooth trading process. This evaluation emphasizes why it is the greatest trading platform for novices based on the observations and experiences of experts.

What is Crystal Ball Markets?

Reputed as one of the best online trading platforms, Crystal Ball Markets gives traders instant access to a wide range of financial markets. These comprise CFDs on equities, indices, digital currencies, metals, energy, and agricultural commodities. It serves as a doorway to success in the financial markets and is mostly intended for novices seeking a simple and effective trading environment.

The platform appeals to a wide spectrum of traders worldwide by providing access to over 160 trading instruments. Traders have access to a wide range of markets, from major currency pairs like EUR/USD and GBP/USD to significant indexes like the S&P 500 and US100. Commodities such as natural gas and Brent Crude, as well as metals like gold and silver, and even cryptocurrencies like Ethereum and Bitcoin, are available at Crystal Ball Markets.

Mobius Trader 7, Crystal Ball Markets’ cutting-edge trading platform tailored to contemporary trading requirements, is a distinguishing feature. This platform uses Javascript for algorithm trading and artificial intelligence to support complex trading strategies. It complies rigorously with regulatory compliance standards, including FINTRAC’s Foreign Money Service Business rules, and guarantees the safety of customer funds through a segregated withdrawal guarantee fund.

Because of its dedication to zero slippage and no dealing desk policies, traders looking for reputable and efficient trading environments may trust Crystal Ball Markets.

Safety and Security of Crystal Ball Markets

A crucial consideration for every trader joining the financial markets is safety and security, which Crystal Ball Markets places a high priority on. Strict regulatory frameworks that govern its operations guarantee compliance and reliability for this platform. As a Foreign Money Service Business (FMSB), it is compliant with the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) rules and is registered with the Financial Services Authority (FSA) of Saint Vincent and the Grenadines.

Reputable financial information sources acknowledge Crystal Ball Markets in addition to its regulatory control. Its D-U-N-S Number, which attests to its legitimacy and operational integrity, has been profiled by Dun & Bradstreet. By using regulated Tier 1 liquidity providers to execute all trades, the brokerage further improves transaction security and trading environment dependability.

Dumb Little Man has carefully collected and validated these information, demonstrating Crystal Ball Markets’ dedication to provide its users a safe and dependable trading platform. With the knowledge that there are robust operational and regulatory safeguards in place, traders may concentrate on their trading tactics.

Pros and Cons of Crystal Ball Markets

Pros

- Access to over 160 tradable instruments

- Spreads as low as 0 pips on PRO ECN accounts

- Utilizes Mobius Trader 7, a next-generation trading platform

- No fees on deposits and withdrawals

- Compliant with FINTRAC and FSA regulations

- Supports trading in multiple currencies including cryptocurrencies

Cons

- No deposit bonuses offered

- PRO ECN account requires a minimum deposit of $1,000

- Bank wire withdrawals can take 3-10 business days

- Limited to web-based trading platform

- Beginner traders may find the platform complex

- Services primarily tailored for English-speaking clients

Sign-Up Bonus of Crystal Ball Markets

In the financial trading industry, Crystal Ball Markets distinguishes itself by emphasizing a superior trading experience over marketing incentives. They stand apart from many of their competitors by not offering deposit and sign up bonuses, which are typically used as the main means of luring new traders.

This trading strategy highlights the platform’s dedication to sustainability and openness in trading activities. Crystal Ball Markets makes sure that traders make judgments based on own strategies and market conditions instead of being swayed by bonus-related restrictions by refusing to participate in bonus programs. This policy encourages its clientele to adopt ethical trading methods.

Minimum Deposit of Crystal Ball Markets

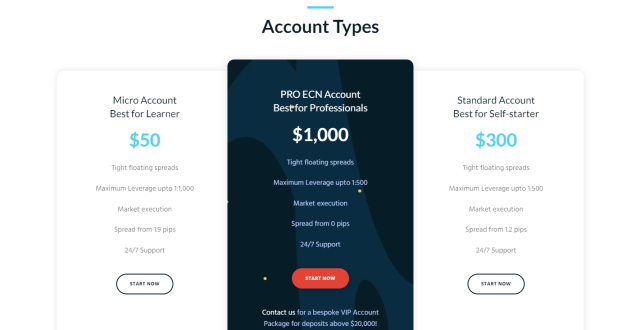

A variety of account kinds are available from Crystal Ball Markets to accommodate different trader needs and investment levels. With a $50 minimum investment, the Micro Account is available to novice users and those wishing to test the platform with a lower financial commitment.

With a $1,000 minimum deposit, the PRO ECN Account is accessible to more seasoned traders looking for cutting-edge features and narrower spreads. The Standard Account, on the other hand, needs a $300 minimum deposit and is best suited for traders with some expertise. It is ensured that traders can choose the account that best suits their trading style and financial capabilities with these structured deposit criteria.

Crystal Ball Markets Account Types

To accommodate a wide range of trading experience and investment approaches, Crystal Ball Markets provides a variety of account kinds. To provide a full summary, our team of professionals at Dumb Little Man has thoroughly researched and tested these accounts. Every account type is designed to satisfy the unique requirements of traders, ranging from novices to experts.

Micro Account

- Best for Learners

- Minimum Deposit: $50

- Spreads: Tight floating spreads starting from 1.9 pips

- Maximum Leverage: Up to 1:1,000

- Execution: Market execution

- Support: 24/7

Standard Account

- Best for Self-starters

- Minimum Deposit: $300

- Spreads: Tight floating spreads starting from 1.2 pips

- Maximum Leverage: Up to 1:500

- Execution: Market execution

- Support: 24/7

PRO ECN Account

- Best for Professionals

- Minimum Deposit: $1,000

- Spreads: Tight floating spreads starting from 0 pips

- Maximum Leverage: Up to 1:500

- Execution: Market execution

- Support: 24/7

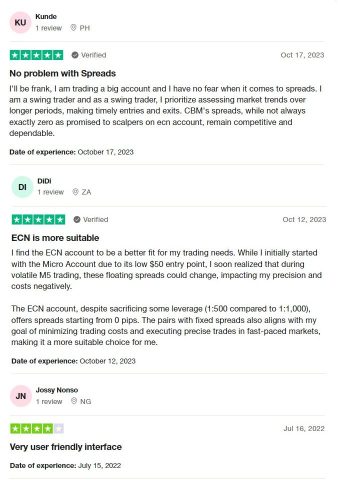

Crystal Ball Markets Customer Reviews

Customer evaluations for Crystal Ball Markets are largely excellent, highlighting the variety of account options available that are catered to various trading methods. While spreads are not always zero as stated, one seasoned swing trader points out that they are reliable, competitive, and provide a consistent trading environment. Another trader felt that the ECN account was better for their requirements than the Micro Account, especially in times of market turbulence when accurate trading is essential.

Those looking to cut expenses and increase trading accuracy will benefit from this account’s zero pip spread and lower leverage. The platform’s user-friendly UI is also praised by users for improving their entire trading experience.

Crystal Ball Markets Fees, Spreads, and Commissions

A competitive option in the forex trading market, Crystal Ball Markets arranges its fees, spreads, and commissions to suit a range of trading styles and preferences. The platform is designed for experienced traders who need precise execution and cheap trading costs. It offers narrow floating spreads, which on the PRO ECN account can be as low as zero pips.

The Micro Account strikes a balance between affordability and excellent trading conditions for individuals with less cash joining the market, with spreads starting at 1.9 pips. Spreads on the self-starting Standard Account start at 1.2 pips, giving traders looking for fair prices a compromise without sacrificing too much of the advantages of tighter spreads.

Crystal Ball Markets is renowned for its commission transparency, informing traders of all possible expenses related to their trading operations. Because there are no unstated costs that could negatively affect a trader’s profitability, this transparent fee structure aids investors in managing their money.

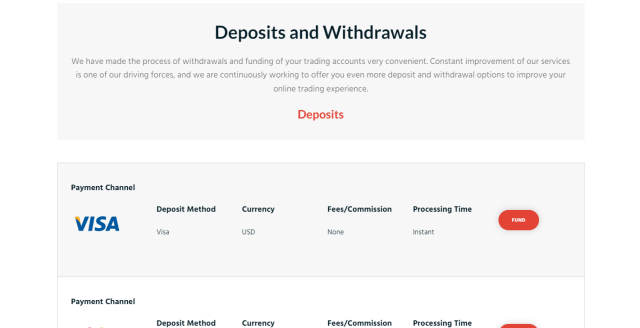

Deposit and Withdrawal

For the benefit of traders, Crystal Ball Markets has expedited the deposit and withdrawal procedures. This dedication to ongoing service enhancement was confirmed by extensive testing conducted by a Dumb Little Man trading expert. The platform strives to improve the entire online trading experience by providing a range of choices for both deposits and withdrawals.

Traders have access to bank wire transfers, Perfect Money, Visa, Mastercard, and Bitcoin and other crypto trading assets forex for making deposits. The majority of these options offer immediate processing, and none of them have any fees or commissions. The Bank Wire Transfer is the only exception, and it may take three to ten business days. This selection guarantees that traders may quickly and easily fund their accounts and start trading.

Similar to the deposit methods, withdrawals can be made using conventional bank wire transfers as well as cryptocurrencies like Bitcoin, USDT, and Ethereum as well as Visa, Mastercard, and Perfect Money. With processing periods varying from instant for cryptocurrencies (post-blockchain confirmations) to up to 10 business days for methods like Visa and Bank Wire Transfers, these withdrawals are likewise free of commissions or fees. These features highlight Crystal Ball Markets’ commitment to giving its customers a seamless financial transaction experience.

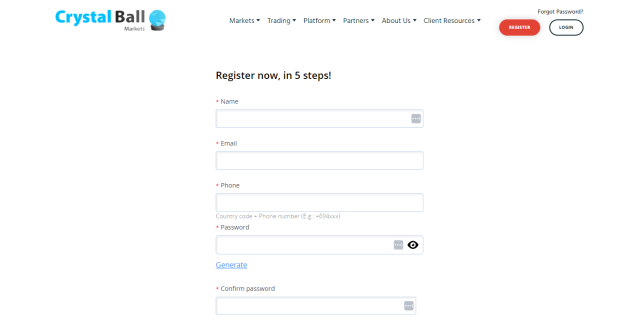

How to Open a Crystal Ball Markets Account

The simple account opening procedure at Crystal Ball Markets is meant to get traders up and running as soon as possible. You can have access to a variety of trading tools and financial markets by following a few easy steps. This is a step-by-step tutorial to assist you in effectively setting up your trading account.

- Navigate to the Crystal Ball Markets website.

- Click on the “Register” button located in the upper right corner.

- Input your full name, email address, and phone number.

- Create a strong password and verify it.

- Choose “Open a trading account” to proceed.

- Look for a verification email in your inbox.

- Open the email and click on the provided verification link.

- Complete any additional verification steps required.

- Once verified, you are ready to begin trading.

Crystal Ball Markets Affiliate Program

A profitable affiliate program is available from Crystal Ball Markets for a variety of people and businesses operating in the financial markets. Whether you are a blogger covering financial markets, social media influencer, or trade instructor, this program offers a great way to make extra money. Members can get large commissions for each new client they recommend.

The program has advanced tools to support affiliates in their success. These include powerful marketing tools, an advanced online portal, real-time client analytics, and comprehensive tracking for each referral click. Moreover, affiliates can get round-the-clock assistance to make the most of their efforts and earnings. Affiliates can successfully leverage Crystal Ball Markets and their network to increase their net worth thanks to this organized support.

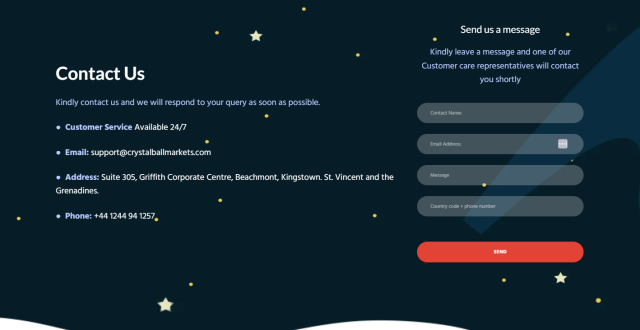

Crystal Ball Markets Customer Support

In order to give each and every one of its clients a seamless trading experience, Crystal Ball Markets is dedicated to offering top-notch customer service. Dumb Little Man has extensively examined and validated this promise, emphasizing the team’s accessibility and response. Because support services are offered around-the-clock, help is always a phone call or email away.

The support staff is available to clients via a number of methods. [email protected] is the email address to use for thorough responses to questions. Customers can contact Crystal Ball Markets by the support line at +44 1244 94 1257 for more prompt service. Furthermore, the main office has a physical site for official affairs in Suite 305, Griffith Corporate Centre, Beachmont, Kingstown, St. Vincent and the Grenadines. The various ways to get in touch with Crystal Ball Markets demonstrate their commitment to upholding superior customer service standards.

Advantages and Disadvantages of Crystal Ball Markets Customer Support

| Advantages | Disadvantages |

|---|---|

Crystal Ball Markets vs Other Brokers

#1 Crystal Ball Markets vs AvaTrade

With competitive spreads as low as 0 pips on PRO ECN accounts and a focus on both fiat and cryptocurrency trading, Crystal Ball Markets provides a cutting-edge platform. It backs broad regulatory compliance with FSA and FINTRAC. On the other hand, AvaTrade has been in business worldwide since 2006 and offers a wide range of tradable instruments on several platforms, with an emphasis on enabling novice traders with resources like AvaProtect and educational materials.

Verdict: Because of its wide range of international accessibility and extensive training resources, AvaTrade may be a better option for novice traders. But Crystal Ball Markets is a better choice for traders seeking tight spreads and a cutting-edge trading platform—especially for those considering cryptocurrency trading.

#2 Crystal Ball Markets vs RoboForex

With support from Canadian and Vincentian authorities in terms of regulation, Crystal Ball Markets is committed to offering access to a range of financial markets through a cutting-edge trading platform. Since 2009, RoboForex has gained recognition for its adaptability to a wide range of trading preferences and styles on platforms such as MT4, MT5, and cTrader. It is also renowned for its custom trading conditions.

Verdict: For traders who appreciate a range of trading platforms and personalized trading circumstances, RoboForex might be a superior option. For individuals looking for a cutting-edge trading environment with robust regulatory compliance and aggressive spreads, Crystal Ball Markets is a great choice.

#3 Crystal Ball Markets vs FXChoice

Backed by regulatory compliance, Crystal Ball Markets provides a stable trading platform with choices for trading both fiat and cryptocurrencies. To attract traders interested in these areas, FXChoice focuses on offering forex and CFD trading with a special emphasis on emerging market currencies and commodities like crude oil and precious metals.

Verdict: If traders especially want to diversify into commodities and emerging markets, FXChoice is perhaps a better option. Crystal Ball Markets is an appealing option for anybody looking for a cutting-edge platform that combines traditional and cryptocurrency trading.

Choose Asia Forex Mentor for Your Forex Trading Success

Trading professionals at Dumb Little Man highly endorse Asia Forex Mentor as the ideal educational platform for forex, stock, and cryptocurrency trading if you’re trying to launch a profitable career in trading. Asia Forex Mentor was established by Ezekiel Chew, a well-known individual who regularly makes seven-figure deals. It provides a remarkable route to significant financial profits.

Extensive Curriculum: The curriculum of Asia Forex Mentor includes all the important facets of trading stocks, cryptocurrencies, and forex. The goal of this well-structured training program is to provide you the tools you need to succeed in a variety of financial markets.

Proven Track Record: The platform’s track record of producing consistently profitable traders supports its legitimacy and attests to the efficacy of its mentoring and training programs.

Expert Mentor: As you train under Ezekiel Chew, you will learn from an accomplished mentor who will offer you with individualized support to help you navigate the intricacies of each market.

Friendly Community: Asia Forex Mentor’s community promotes cooperation and idea exchange among traders, which improves education and success in the financial markets.

Stress on Psychology and Discipline: The course teaches traders how to successfully manage stress and emotions by highlighting the value of psychological resilience and discipline.

Constant Updates and materials: Asia Forex Mentor makes sure students stay ahead in the rapidly changing financial markets by providing constant updates and access to up-to-date materials to keep up with the latest market trends.

Success Stories: The platform is filled with countless accounts of people who, after receiving thorough instruction in stock, forex, and cryptocurrency trading, went on to become financially independent.

To sum up, Asia Forex Mentor is the best option available to anyone hoping to succeed in the trading industry. With its broad curriculum, knowledgeable supervision, and encouraging trading community, it offers all the resources and direction needed to turn novices into accomplished experts in the financial markets.

RECOMMENDED TRADING COURSE | REVIEW | VISIT |

#1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |

>> Also Read: CK Markets Review 2024 with Rankings by Dumb Little Man

Conclusion: Crystal Ball Markets Review

The traders at Dumb Little Man have observed that Crystal Ball Markets is one of the more formidable options available in the forex brokerage industry. Professional traders are drawn to the platform because of its sophisticated trading platforms, such as Mobius Trader 7, and its extensive access to international financial markets. The broker’s dependability and credibility are increased by its dedication to regulatory compliance with organizations like FSA and FINTRAC.

Potential traders should be mindful of a few disadvantages, though. The minimal deposit requirements might discourage those with low starting capital, and the lack of deposit bonuses combined with limited leverage on some accounts might make it less appealing to many people. Dumb Little Man’s analysis indicates that, all things considered, traders who can meet its entry requirements and are looking for a strong trading environment are encouraged to consider Crystal Ball Markets.

>> Also Read: BKFX Review 2024 with Rankings by Dumb Little Man

Crystal Ball Markets Review FAQs

What trading strategies are best suited for Crystal Ball Markets?

For traders that use a range of trading techniques, including as scalping, swing trading, and day trading, Crystal Ball Markets is a great option. For individuals who favor high-frequency trading or need narrow spreads for their techniques, the broker’s competitive spreads, which start at 0 pips on the PRO ECN account, make it quite appealing. Its ability to access a variety of financial markets permits a range of trading strategies.

Can you describe the trading platform used by Crystal Ball Markets?

Crystal Ball Markets offers Mobius Trader 7, a cutting-edge trading platform renowned for its sophisticated features and intuitive UI. The platform has tools for technical market analysis, automated trading, and personalized trading indicators in addition to supporting a broad range of trading operations. Both inexperienced traders and seasoned pros searching for potent trading solutions might benefit from our platform.

How does Crystal Ball Markets compare to other forex broker?

A robust regulatory framework and zero pip spreads on a few selected accounts set this broker apart and guarantee a safe and open trading environment. It provides a comprehensive and flexible trading experience across forex, equities, commodities, and cryptocurrencies, in contrast to many brokers. Its PRO ECN account has larger minimum deposits, nevertheless, so traders with low funds would want to take that into account.

Dumb Little Man Recommends – Top 3 Best Forex Brokers in 2024 | ||

John V

John is a digital marketing master's student who enjoys writing articles on business, finance, health, and relationships in his free time. His diverse interests and ability to convey complex ideas in a clear, engaging manner make him a valuable contributor to these fields.