Currency Strength Indicator – An Expert’s Take 2024

By Wilbert S

January 12, 2024 • Fact checked by Dumb Little Man

Want to jump straight to the answer? The best forex broker for traders is Avatrade

The #1 Forex Trading Course is Asia Forex Mentor

Every time you exchange a local currency for another one while traveling, you participate in the foreign exchange market. And some indicators can tell you about the strongest and weakest currencies. As a forex trader, you’ll want to pay attention to the currency strength indicator. This tool can give you an edge in your trading by showing you which currencies are currently strong and weak.

When exchanging local currency for an international one, you may have noticed that the local currency you receive is not always equal. The reason is simple — the foreign exchange market is constantly fluctuating, which means that the value of each currency is in constant flux. A currency strength indicator is a tool that can help you keep track of these fluctuations and make better-informed trading decisions.

The currency strength indicator measures the relative strength of a currency by comparing it to other currencies. It also looks at the products/services bought with that currency and the demand for those products/services.

We have got Ezekiel Chew on board to understand the Currency Strength Indicator to share his expert insights. He is the CEO and founder of Asia Forex Mentor, a company that provides forex education and training to aspiring traders.

Let’s use his expertise to examine the currency strength indicator closely along with its trading strategies and advantages.

What is Currency Strength Indicator

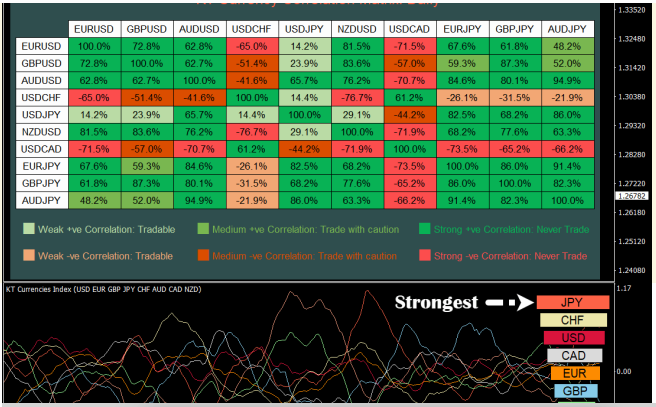

The Currency Strength Indicator (CSI) is an indicator that shows the strength of each currency pair relative to different currency pairs. The CSI is based on the concept that trading currencies move in cycles.

Each currency has eight major counterparts (USD, EUR, JPY, GBP, CHF, CAD, AUD, NZD) and 28 crosses. The CSI calculates the strength of each currency by using an algorithm that measures the price changes for each currency against all other currencies.

A currency is considered strong when it is rising against most other major currencies. On the other hand, it is considered weak when falling against other currencies. The CSI can be used to find currency pairs that are either overbought or oversold. It can also be used to find pairs ready to make a move. The CSI is available as a free indicator on most trading platforms and is used in conjunction with other technical indicators.

Trading with Currency Strength

The currency’s strength in the market dictates the Forex currency pairs’ price rates. Short-term investors base their decisions on analyzing economic events that create confusion in the marketplace. These Events are reports on GDP, central bank meetings, unemployment rates, interest rates, and consumer price index.

Strategists then study the primary data and predicted figures to discover intelligence that might help them develop winning trading strategies. If the current result is consistent with expectations, the currency’s strength will appropriately improve or decline. Contribute to the growth of a country’s currency in value or depreciation.

Calculating the Currency Strength

The currency strength is estimated in the local market by calculating the purchasing power when purchasing local goods, which is based on statistics about salaries. The income value is then adjusted for inflation to find the actual worth of the earnings. The real income shows the accurate economic assessment of the earnings in conditions without inflation.

The potential of a currency is calculated by its relationship to other major currencies in the Forex market. For example, the CHF/CAD pair consists of two countries with strong economies. Different factors, such as the trade balance, internal economic indicators, and political climate, can all affect the exchange rate between the CHF and the Canadian dollar.

When a currency is from an emerging market, such as Brazil, its strength is calculated using the global reserve currency. When the Real Brazilian rises against the US Dollar in the USD/BRL currency pair, Brazil will achieve greater influence on the global market.

CSI measures the currency strength in the global markets, and the US Dollar is quite a crucial currency strength meter. In addition, it has a tradeable derivative ETF through the Intercontinental Exchange.

The USD Index is a technical indicator based on an index that measures US Dollar movements. It estimates a weighted average price for the US dollar pairs. The Euro has the most influence in Dixie with 57 percent weight, followed by the Swiss Franc with 3.7 percent weight which is the weakest currency.

What is a Currency Strength Meter

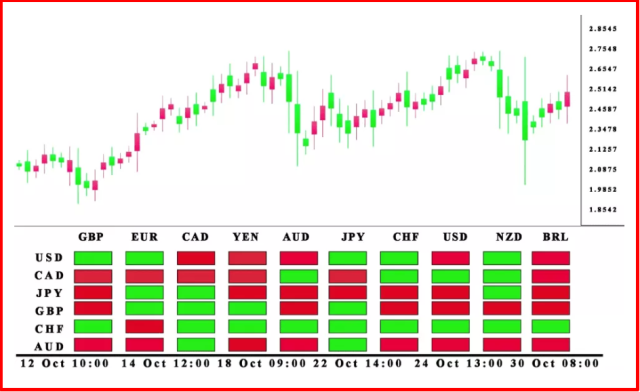

The currency strength meter is a graphical representation of how strong or weak currencies are relative to each other. It looks at the previous 24 hours of data to show which currency pairs are performing well.

A currency strength meter takes every pair related to a certain currency and calculates the overall value of that money. This data is either displayed as a line graph or heat map. CSI meter implements an algorithm that smoothens the data to make it easier to read. It also displays the currency strength in real-time so investors can make the best decisions.

A currency strength meter is a valuable tool for any Forex trader. It can help you find the best currency pairs to trade and when to enter and exit those trades. It is also the most sophisticated and accurate currency strength meter on the market.

When you monitor simple currency meters, all you get are price fluctuations. Because of their emphasis on past prices rather than prospects, this statistic cannot forecast future trends. That’s why using a currency strength meter that employs cumulative exchange-rate price equations to calculate strength is critical.

These computations produce graphs that display the results, allowing traders to forecast the movement of currency pairings. Including a currency strength meter in a trading strategy gives you an informed fundamental analysis and a trading plan that takes advantage of the information.

In most cases, a currency strength meter is updated every hour, but some can update as frequently as every minute to display the current strengths. When using trading software, changes are typically displayed automatically or when the page is refreshed. Some platforms offer the ability to customize when you want updates to be implemented. The best part is that you can create your own currency strength meter.

Is the Currency Strength Meter Accurate

If you believe that the data offered by a currency strength meter is unreliable, you can manually differentiate the results of a currency. For example, if the GBP is represented as strong, but you observe declining, you may doubt the usefulness of your currency meter.

The right currency strength meter should reflect your satisfaction with how it incorporates the employed strategy. Unfortunately, there are only a few currency strength indicators available, and the most effective technique is to experiment until you find one that works best for your trading techniques.

Advantages of the Currency Strength Meter

In foreign market trading, most investors work with a different set of currencies. Therefore, a currency strength meter will show how every world currency is currently performing against the US dollar.

There is an option to purchase a currency by selling another, rather than having to trade one directly for the other. For example, if you want to buy Canadian dollars (CAD), you could sell New Zealand dollars (NZD) instead. In that case, investors would be said to be trading the NZD/CAD currency pair “short” – because they are selling NZD in order to buy CAD.

Furthermore, the currency strength meter is just as potent as the value strength indicator. It also guarantees a successful trading technique and an effective tool for enhancing trading judgments.

Best Forex Trading Course

Ezekiel Chew is a renowned forex trader, trainer, and industry expert. He has trained professional and retail forex traders as well as corporate finance players like bank traders, money managers, and asset investors. From his trading experience drawn from over 20 years of trading the forex markets, he has created a comprehensive forex trading course known as “the one core program”.

Ezekiel asserts that the one core program is designed for the ‘committed learner’, so previous trading knowledge or experience is not required before you can enroll in the program. The program comprises over 60 video lessons that teach proprietary trading strategies that are backed by mathematical probability and technical analysis principles.

The one core program has been proven to be highly efficient as it has generated millions of US dollars for Ezekiel Chew and his students. There are numerous testimonials from students that have graduated from the program and are now making six-digit figures per trade just by applying the techniques learned from the program. The one core program is available on the Asia Forex Mentor website; which is a forex trading blog that has been existing for over a decade.

| RECOMMENDED TRADING COURSE | REVIEW | VISIT |

|---|---|---|

| #1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |  |

Best Forex Broker

| Broker | Best For | More Details |

|---|---|---|

|

| securely through Avatrade website |

Conclusion: Currency Strength Indicator

As a trader, you must know the several principles that affect the market and how to find the best currency pairs to trade. Of course, fundamental analysis is vital in this pursuit, but you should also be aware of technical tools such as the currency strength indicator.

The goal is to understand market conditions and variables that affect them thoroughly. For example, investors in Forex markets must investigate the forex currency strength, which is affected by demand and supply, as well as political and economic policies.

Currency strength indicators point out markets with a large price gap and can be used to make money.

The Strength Meter is a tool that can be integrated with your trading strategy to increase productivity. By understanding the strength of different currencies and the market conditions, you will be able to identify better trading opportunities. A currency strength meter is an effective tool that can help you choose which currency pairs to trade or verify the effectiveness of your current strategy.

Trades may use the conventional approach or a free currency strength meter to assess forex pairs and determine whether a bullish or bearish trend is emerging. However, if you want to be a successful trader, one of the things you have to do is predict how strong each currency will be. The relative strength metric can help by showing which currencies are currently strong and might provide good opportunities for trading.

The currency strength meter has several advantages, starting with simplicity. First, there are free online versions that are simple to use for short-term trading, lowering unplanned hedge of funds suggesting risk and minimizing losses.

Currency Strength Indicator FAQs

What is the best Currency Strength Indicator?

When you choose the best currency strength indicator, you need to know the crucial parameters to make a judgment. The three key considerations are accuracy, flexibility, and user-friendliness. For now, the best one is the advanced currency strength indicator, which shows the real market movement.

Which Currencies are Strong now?

The US Dollar, Euro, and Swiss Franc are the strongest currency as of now.

Wilbert S

Wilbert is an avid researcher and is deeply passionate about finance and health. When he's not working, he writes research and review articles by doing a thorough analysis on the products based on personal experience, user reviews and feedbacks from forums, quora, reddit, trustpilot amongst others.