Want to jump straight to the answer? The best forex broker for traders is Avatrade

The #1 Forex Trading Course is Asia Forex Mentor

The stock market isn’t gambling, and everything works according to a system. Knowledgeable traders have amassed great fortunes from the industry and are still making six figures per trade. New investors often fail to detect market trends and take entry and exit at the wrong time, leading to losses.

A better trading strategy can help them change their fortunes and succeed as a trader. The Cypher pattern is one of the most underrated harmonic patterns amongst traders, and its efficacy is largely unknown.

Cypher patterns can help you detect the correct entry and exit points to help you make significant profits with minimal risks. Do you wish to know more about the excellent strategy? You are lucky because we have Ezekiel Chew to share his take on the subject with us.

We shall discuss Cypher patterns, their types, and how you can make them achieve success in the market. Ezekiel Chew is a renowned investment instructor worldwide; he has helped thousands of students grow as full-time traders, and multiple financial institutions have sought his help to bring better results. Today, we use his knowledge for our benefit.

What is Cypher Pattern

Harmonic patterns have been the go-to strategy for traders; although they take some time to learn and master, the patterns provide reliable insights about securities price changes. Harmonic patterns rely on trend reversals and are based on wave ideology; the market trends change like waves.

Sometimes, the market may go upward, but as soon as it hits its peak, there will be a decline and vice versa. Harmonic patterns rely on geometrical formations and Fibonacci numbers to find turning points and price changes. Fibonacci numbers are key ratios highlighting multiple areas where security may stall or reverse.

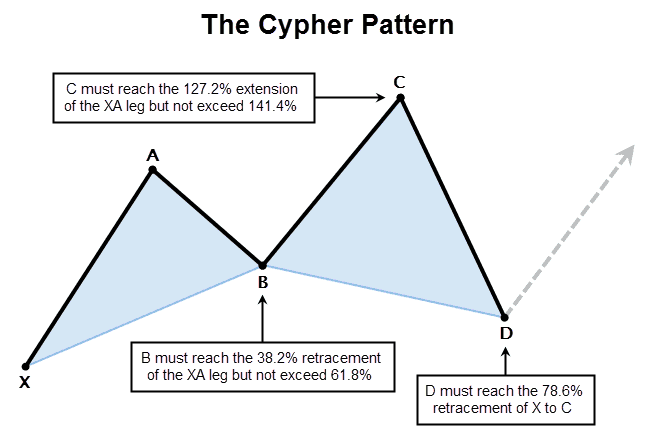

Cypher patterns utilize four legs to identify the upcoming trend reversals and highlight the entry and exit points for a trade. Usually, traders use five letters-X, A, B, C, and D- to identify the connecting points of a Cypher pattern.

The points are connected through four legs that are measured using Fibonacci ratios. We have two different Cypher patterns for bullish and bearish markets; they are usually inverse of each other. The X point highlights the peak in a bearish market and the lowest in a bull market.

Cypher Pattern Rules

Cypher patterns are highly reliable but often difficult to trace compared to other harmonic patterns. It is partially due to strict rules set up to identify the Cypher pattern; however, once you can spot the advanced pattern formation, making trade decisions gets easier, and risks are minimized.

A Cypher pattern has five points connected with four legs; the pattern starts with an XA leg and ends with a CD. Here is a list of the rules to keep in mind:

- The B point should retrace in a reversal pattern between 38.2% to 61.8% of the XA leg. The candle shouldn’t be crossing either of the two limits.

- The C point is an extension leg and goes beyond point A. The line should retrace at about 127.2%, but it is fair to be between 113% and 114%.

- The CD leg is a deflection and retraces at about 78.6% to XC.

- B point shouldn’t interfere with 78.6% retracement of the XC leg.

Any harmonic pattern that doesn’t abide by the above rules can’t be regarded as a Cypher pattern, and the strategies won’t apply. A trader must ensure that every rule is intact when identifying the Cypher pattern.

As a harmonic pattern indicator, the Cypher pattern is easy to make due to limited regulations and is highly popular amongst new traders; however, it is often challenging to locate and may be misunderstood.

How to Draw Cypher Patterns

Once you are well-versed with the rules, the next step is to draw the Cypher pattern for an asset. You should start by logging into your trading platform and opening the price chart for your desired security.

Next, click on the harmonic pattern indicator from the toolbar, and locate a crest or a trough (peak or valley). Mark it as point X; draw a line following the trend and stretch it till the prices reverse; mark it as point A.

Now, retrace the line XA between 38.2% or 61.8% to mark point B; the candlestick shouldn’t be touching either limit and should mark the change of ongoing trend.

Next, retrace XA between 113% and 141% for an extended leg going beyond A; you must ensure that the candlestick wicks aren’t beyond 141.4%; mark it as point C.

For the final leg, spot the reversal at point C and retrace XC to about 78.6% to mark point D. The trend reversal pattern at point D is essential to attain insights about the market, and traders must closely scrutinize it before identifying harmonic Cypher patterns.

Similarly, you should try to exit the trade as your profit is realized; stop loss is an essential feature for tracing X in a bearish market.

The Cypher harmonic pattern is an exciting harmonic pattern to be used in tranquil markets; however, you should avoid relying on it in rapidly changing markets.

Bullish Cypher Pattern

Once you start drawing Cypher patterns, you would come across two possible scenarios- the X could be a valley or a peak. A Cypher pattern with X as the lowest point is called a bullish Cypher pattern.

The XA line traces the first rise until the trend reversal. The BA is a retracement of the XA line between 38.2% to 61.8%, and it highlights the trackback of the security’s prices.

The next BC leg is a move in the rising pattern that indicates rising prices. Per the rules, the level of C would be higher than A, as XC is 127.2% retracement of the XA line.

The Cypher pattern ends at CD, a 78.6% retracement of the XC line. The Cypher pattern ends here, and the prices are expected to rise again.

In a bullish Cypher pattern, you should have a stop loss enabled right after points A and C; these are the supposed peaks of the prices and can help you make profits.

Similarly, point B indicates an upcoming rise, and you can use buy orders to generate profit from it.

Bearish Cypher Pattern

In Cypher patterns trading, you can start your pattern with either rising peaks or falling valleys– we have already discussed the first scenario, now let’s talk about the second.

A bearish market refers to falling investor confidence, so the prices are falling after a peak. A bearish Cypher market starts with X as the highest point in the pattern.

The XA line stretches as far as the prices decline, and the AB line traces the bounce back. For a Cypher pattern to be valid, the B point or the next fall wave should come amid 38.2% and 61.8% retracement of the XA line.

Then, the BC line goes beyond the level of A, indicating a decline in prices below the previous support.

The CD line wraps up the pattern and is a 78.6% retracement of the XC line. Traders must be well aware of the Cypher pattern and its implication; you must not confuse other profitable harmonic patterns with a specific Cypher pattern; otherwise, it could turn your profitability into losses.

Similarly, you should keep a close eye on the CD line; it contains a buy signal, as prices are supposed to rise after the D point. The entry point for a bearish market would be at point C; you should go with a stop loss at C because if prices fall any lower than the level, the Cypher pattern may not realize, and the strategy would fail.

Cypher Pattern Trading Strategy Success Rate

Before you start using the strategy, it is vital to be well aware of its success rate, so you aren’t into a loss-making spree. No harmonic pattern can offer a success rate of 100%; however, it doesn’t mean that none of the most profitable harmonic patterns are reliable.

Experts have settled for 40% as the threshold to judge the applicability of a pattern.

According to the custom, any harmonic pattern offering a success rate of less than 40% shouldn’t be used as the sole basis for your trading decisions. Cypher pattern trading strategy has a success rate of over 70% and has been a popular choice for new traders.

Many recent entrants have attained significant profits by using the strategy. While it might not be the most exciting harmonic pattern, Cypher patterns simplify your trading decisions and help you gain excellent results.

Best Forex Trading Course

Asia Forex Mentor is one of the most credible forex trading courses available today. It is headed by Ezekiel Chew, a trader making six figures per trade for over a decade. The trading methods are backed by mathematical probability and the trainer behind banks and trading institutions.

AFM PROPRIETARY ONE CORE PROGRAM is the core program that covers from beginner to advanced, and every segment must include the above points. The program is designed to make you confident and earn as quickly as possible in live markets.

It starts with the basics of forex trading and moves on to more advanced topics such as risk management, market analysis, and trade execution. The course also includes a live trading session where you can see the techniques being applied in real-time. If you’re serious about learning forex trading, sign up now!

Best Forex Brokers

Conclusion: Cypher Pattern

Traders have widely used harmonic patterns for several decades; the wave ideology is based on investor sentiment that varies based on ongoing market conditions. The market swing wave movements can be identified in multiple time frames depending on the usage of the trader.

The Cypher pattern is an intelligent harmonic pattern that can help you determine your trade’s entry and exit points and minimize risks. The use of points and legs simplify price action charts, and traders can quickly evaluate the profitability of a deal.

However, no indicator could bring 100% correct results, and Cypher patterns are no different.

You need to use the dual strategy to make profitable decisions; the first task should be to analyze the insights provided by Cypher patterns. Once you have an indication, you can recheck it through market research and other technical analysis.

The key should be to exit the trade as soon as your profits can be realized; it is better to navigate the market than wait for it to take turns. Investment education is fundamental to your success; thus, you should use the available resources to gain quality information.

Cypher Pattern FAQs

Is Cypher Pattern Profitable?

Cypher pattern has a profitability rate of about 70%, which is higher than most harmonic patterns; you can use it to analyze the price action movements of a security. The CD line indicates the future price movements, and they provide you an opportunity to enter or exit a trade.

However, you may need to readjust the Fibonacci retracement if the CD backtracks. Harmonic Cypher pattern needs to be used alongside other technical indicators to form a profitable forex trading strategy.

Who discovered the Cypher Pattern?

Darren Oglesbee discovered the cypher pattern in the late 1900s; it provided an easy method to analyze technical wave patterns and attain valuable insights to direct trading decisions. The pattern is used alongside other harmonic patterns to generate reliable insights that can help you achieve your profit target.

You can draw the Cypher pattern with integrated tools in your trading platform. It shall help you analyze the entry point for easy profits with minimal risk.