Dow and Nasdaq 100 Rally, Nikkei 225 Experiences a Minor Retreat

By Daniel M.

January 5, 2025 • Fact checked by Dumb Little Man

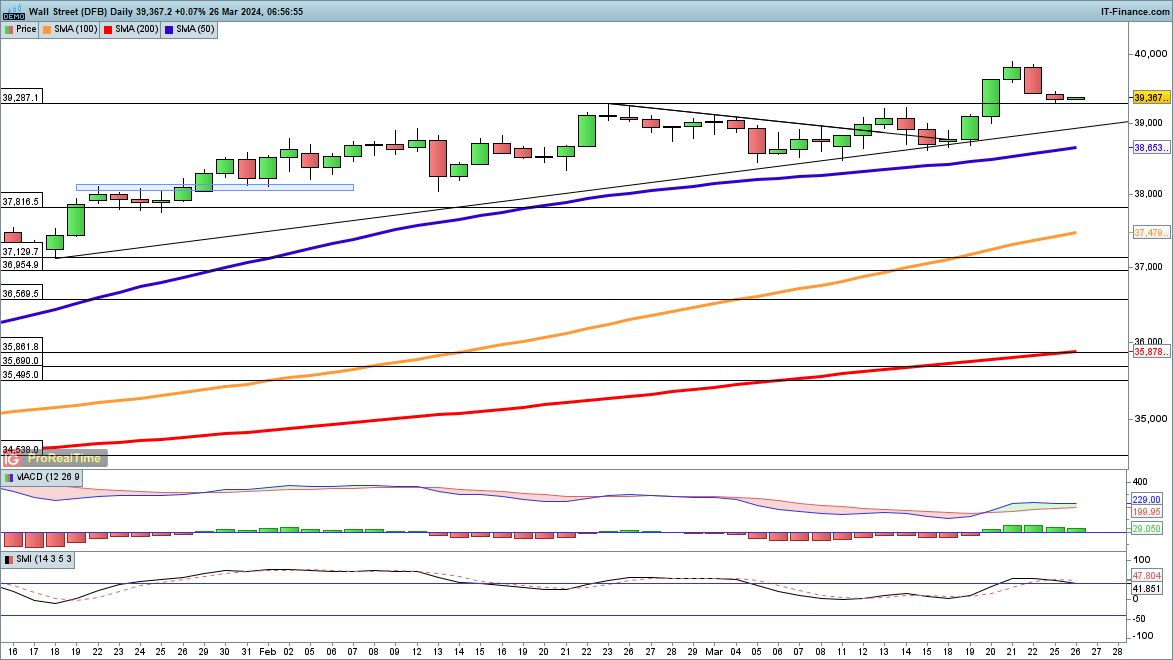

Dow Gains Momentum

After a slight retraction from its latest peak, the Dow is now leveraging its previous peak of 39,287 as a base of support. A dip below this level could quickly shift focus to a rising support trendline that originated in January, which was a critical support throughout early March.

Beneath this trendline, the 50-day simple moving average (SMA) becomes relevant.

Nasdaq 100 Aims for Record Peaks Again?

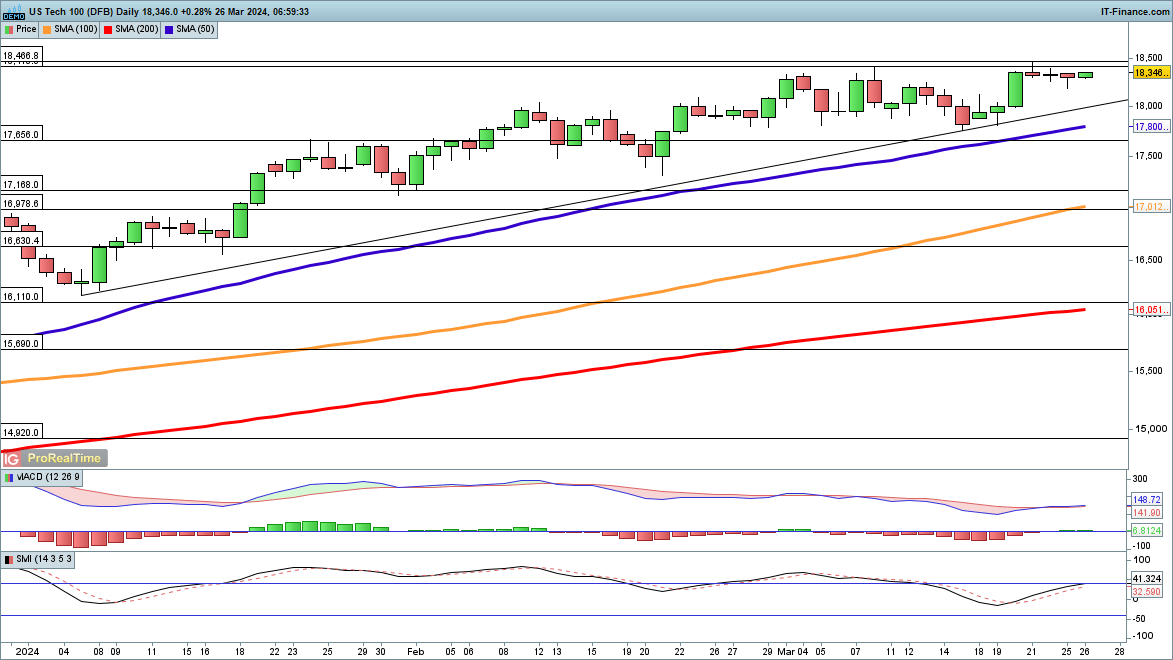

The Nasdaq 100 has seen buying interest at the Monday low of 18,180, with minor gains in early trading signaling a potential retest of the record high of 18,468 set last week.

Short-term support is reinforced by a rising trendline from January, along with the 50-day SMA, maintaining its trend without a 5% correction.

Nikkei 225 Slightly Retreats

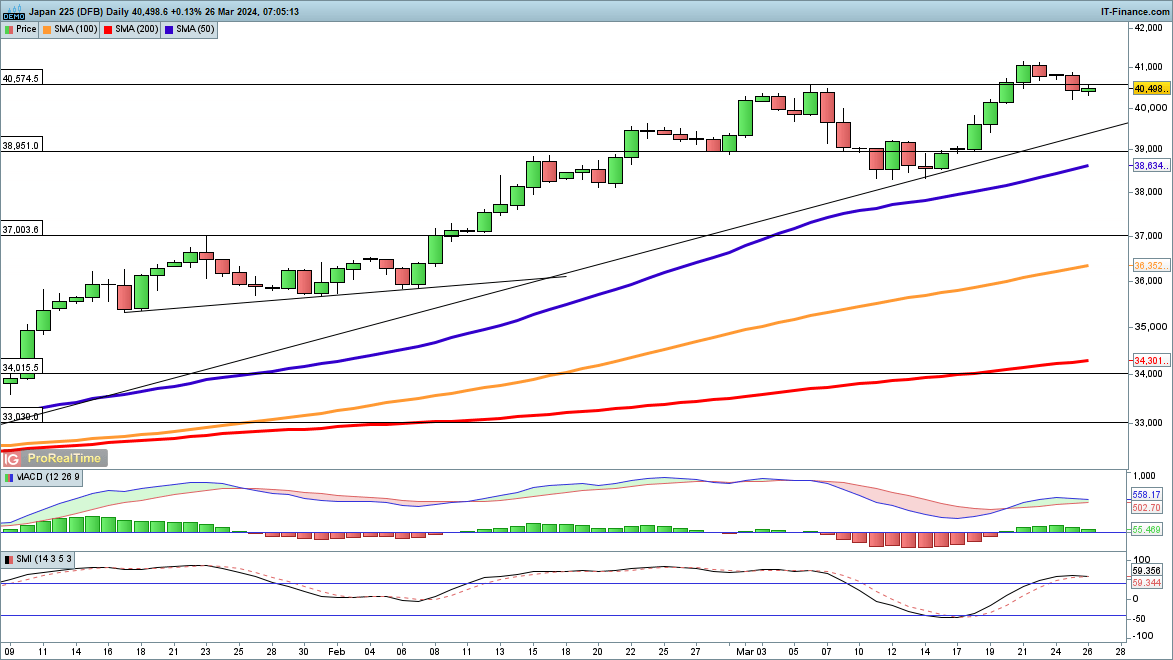

Following a rally from the mid-March lows, the Nikkei 225 has begun a gradual decline. Support is anticipated from a trendline starting in early January, around 39,640, beneath which the horizontal support from the 1990 record high at 38,951 lies.

With the index dropping below the early March peak of 40,574, reclaiming a position above this level would suggest a return to a bullish outlook in the short term.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.