Dow and Nasdaq 100 Stabilize, Dax Faces Ongoing Challenges

By Daniel M.

January 5, 2025 • Fact checked by Dumb Little Man

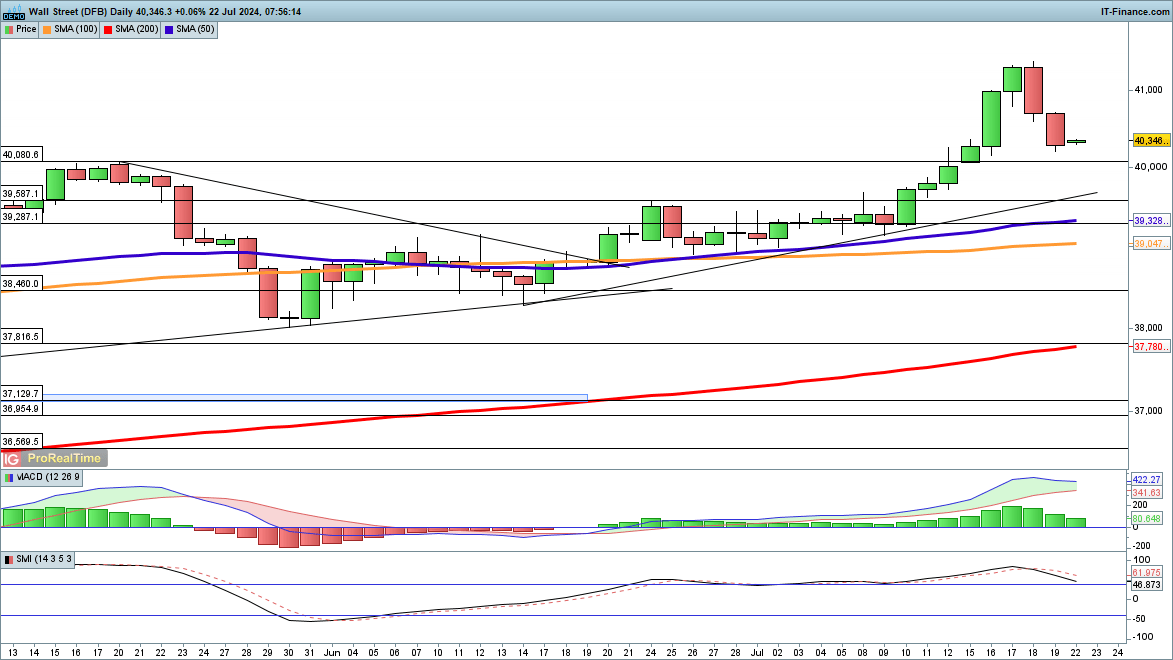

Index Losses Slow, Dax Under Pressure

After two days of significant losses, the index still remains above its previous highs, as investors prepare for a busy week of earnings.

Further declines may target 40,080, and potentially down to the rising trendline support from mid-June. Bulls will look for a resurgence above 40,500 to suggest that a temporary low has been established.

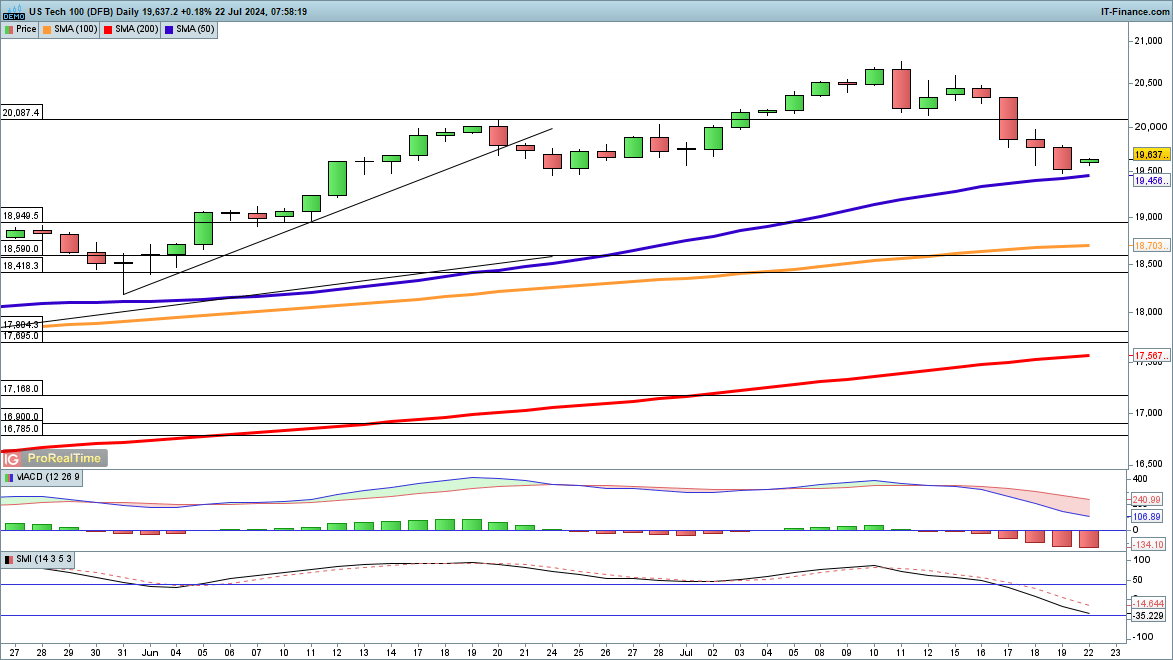

First Major Pullback Since May

The past two weeks have seen the index experience its first real pullback since May.

The price approached the 50-day simple moving average (SMA) last week and has climbed higher this morning. A move above 19,800 will be needed to indicate that a low has been formed. This could then drive the index to aim for the previous highs around 20,750.

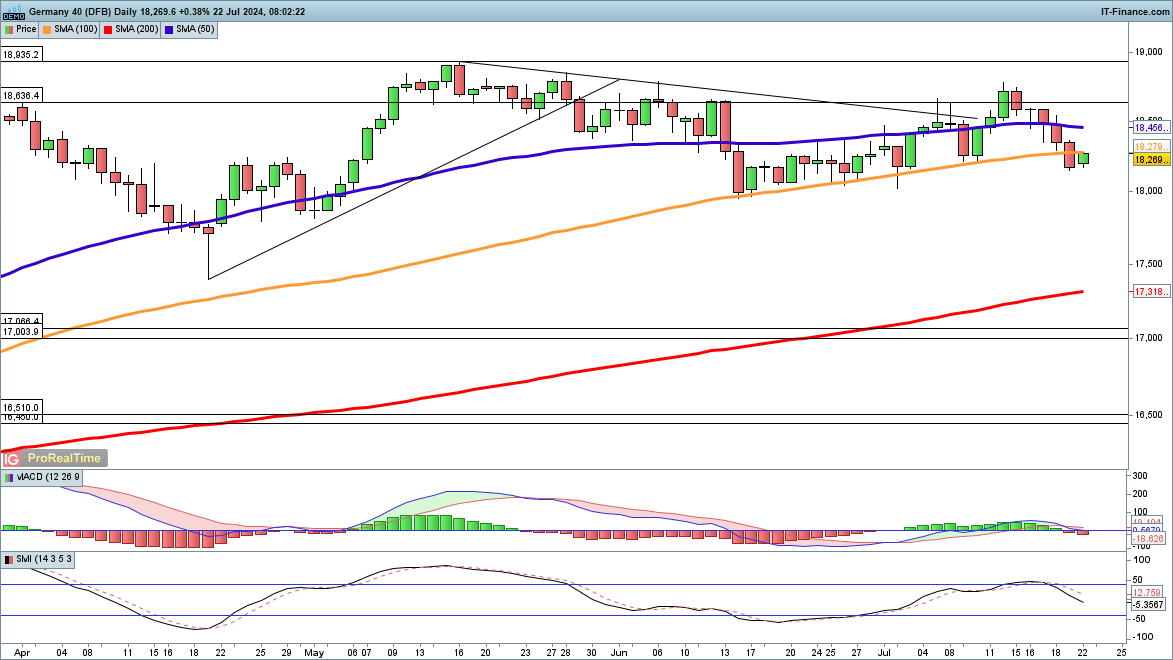

Weak Close Below 100-Day SMA

Friday marked the first time the index closed below the 100-day SMA since November 13.

June and July had the price holding above this indicator, so Friday’s weak close might indicate more losses are ahead. A close below 18,000 reinforces this perspective. Bulls will seek a move back above the 100-day SMA to fend off further decline expectations.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.