Dow and Nasdaq Hit Record Highs, Nikkei Advances

By Daniel M.

January 5, 2025 • Fact checked by Dumb Little Man

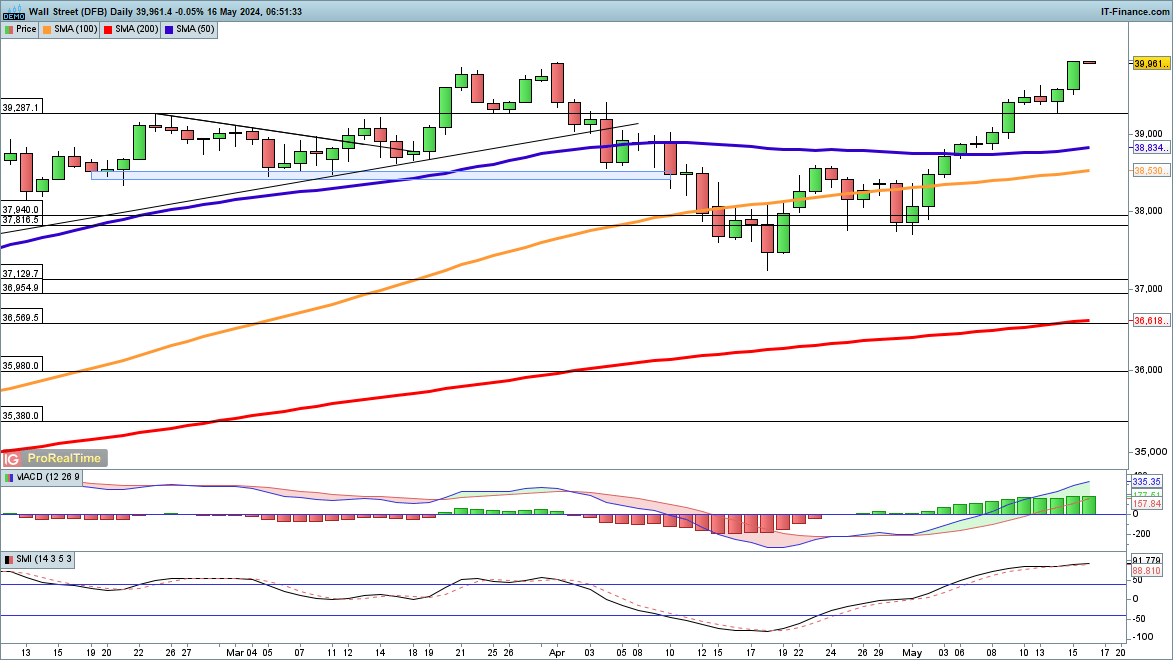

Dow at the High

The Dow Jones Industrial Average reached a new record yesterday, approaching the 40,000 mark but not quite surpassing it.

Following the latest U.S. inflation report, which indicated a slowdown, the Dow surged, building on the recovery from April’s lows. This renewed investor optimism has sparked expectations of potential Federal Reserve rate cuts.

Should the momentum continue, surpassing the 40,000 psychological barrier seems imminent, potentially setting the stage for further record highs. However, any short-term declines would likely necessitate a drop below the recent high of 39,287 to confirm a reversal.

NASDAQ 100 Shoots to New Peak

Similarly, the Nasdaq 100 soared to a new all-time high on Wednesday, fueled by the same inflation data, breaking past the previous record set on March 21 of 18,466.

The next significant milestone for the Nasdaq is the 19,000 mark, as new capital inflows push the index higher. The establishment of a higher low in mid-April suggests that the index’s uptrend remains robust.

A fall back below 18,200 would indicate possible consolidation and a pause in the bullish trend.

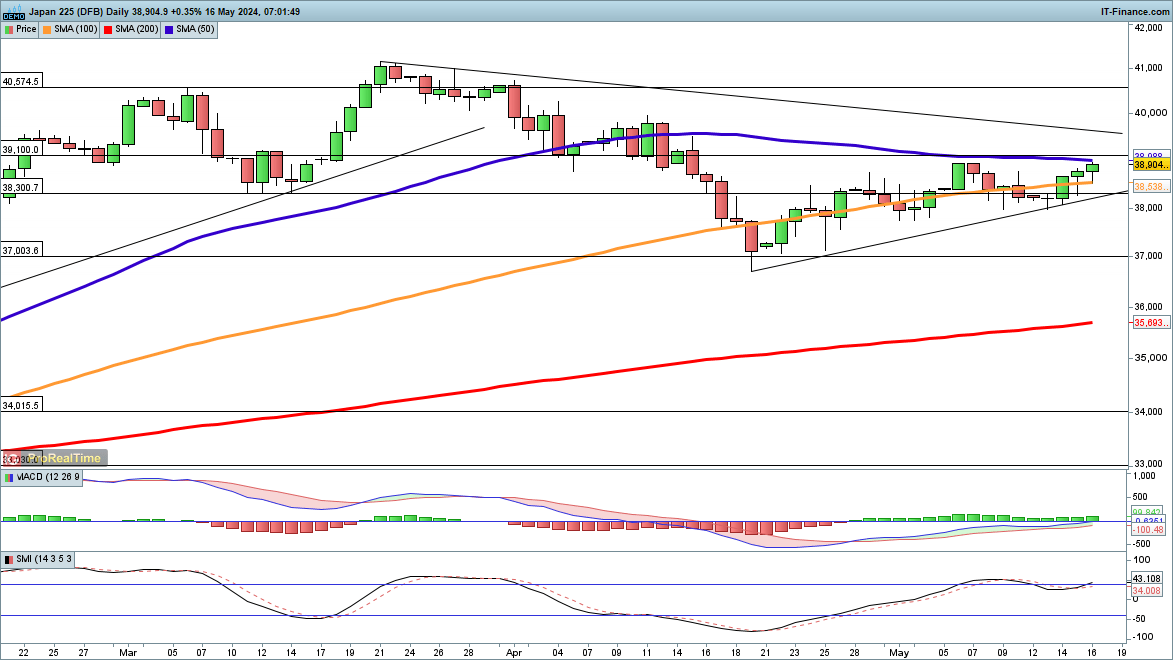

NIKKEI 225 Gains Continue

Despite a rising yen, Japanese stocks progressed, with the Nikkei 225 reaching its 50-day simple moving average (SMA).

The index’s steady ascent from April’s lows continues to support a bullish outlook, especially if it sustains a close above the 50-day SMA. Looking ahead, the next targets include trendline resistance from late March’s record highs and the early April peak near 39,800.

Conversely, a close below 38,300 would indicate a downturn, breaking the trendline support established since mid-April.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.