Dow and Nikkei 225 Experience Selling Pressure, Nasdaq 100 Losses Contained

By Daniel M.

January 5, 2025 • Fact checked by Dumb Little Man

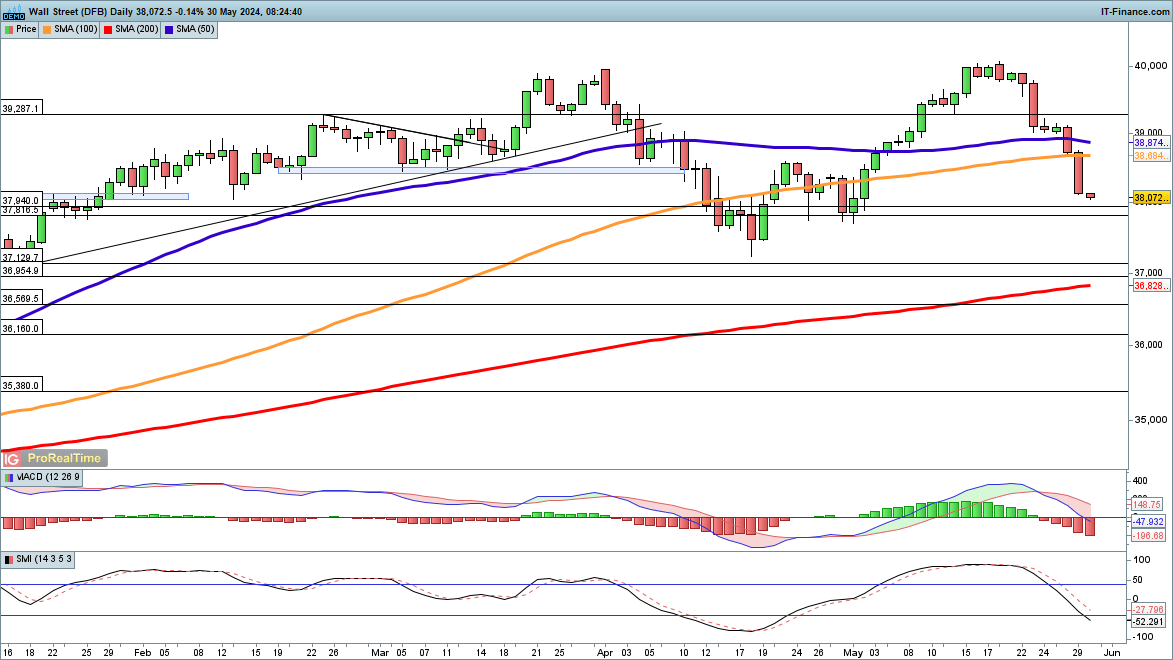

Dow’s May Gains Disappear

The Dow Jones index has surrendered most of its gains from the beginning of May, dropping 2000 points in just two weeks. This sharp decline has shifted the outlook from short-term bullish to one of near-term caution. Buyers previously entered the market above 37,000 in mid-April and around 37,850 at the end of the month, indicating these levels might offer some support. A close below the mid-April low could prompt the index to test the 200-day simple moving average (SMA) for the first time since November.

In the short term, a close back above 38,500 could indicate that a bottom has been reached.

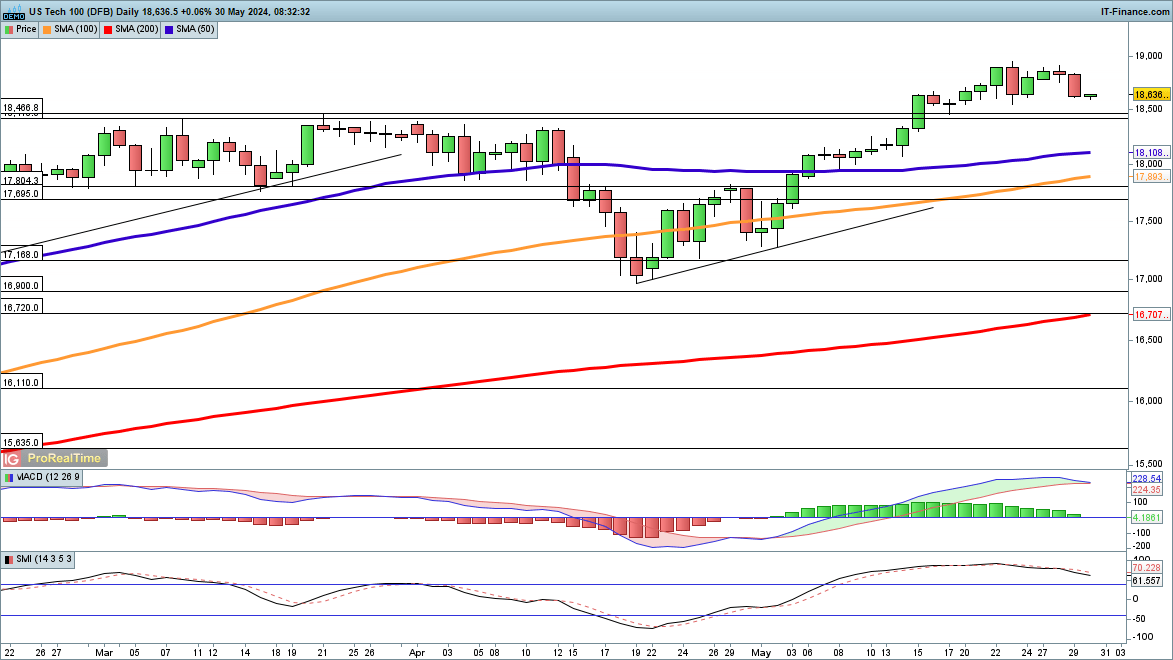

Nasdaq 100 Losses Limited So Far

Strength in technology stocks has so far shielded the Nasdaq 100 from the severe losses experienced by the Dow in the latter half of the month. The index remains close to its previous highs, and a close above 18,800 could signal the beginning of a new upward move towards 19,000.

Conversely, a close below 18,400 would push the price below the highs set in February and March, potentially leading to a test of the 50-day SMA.

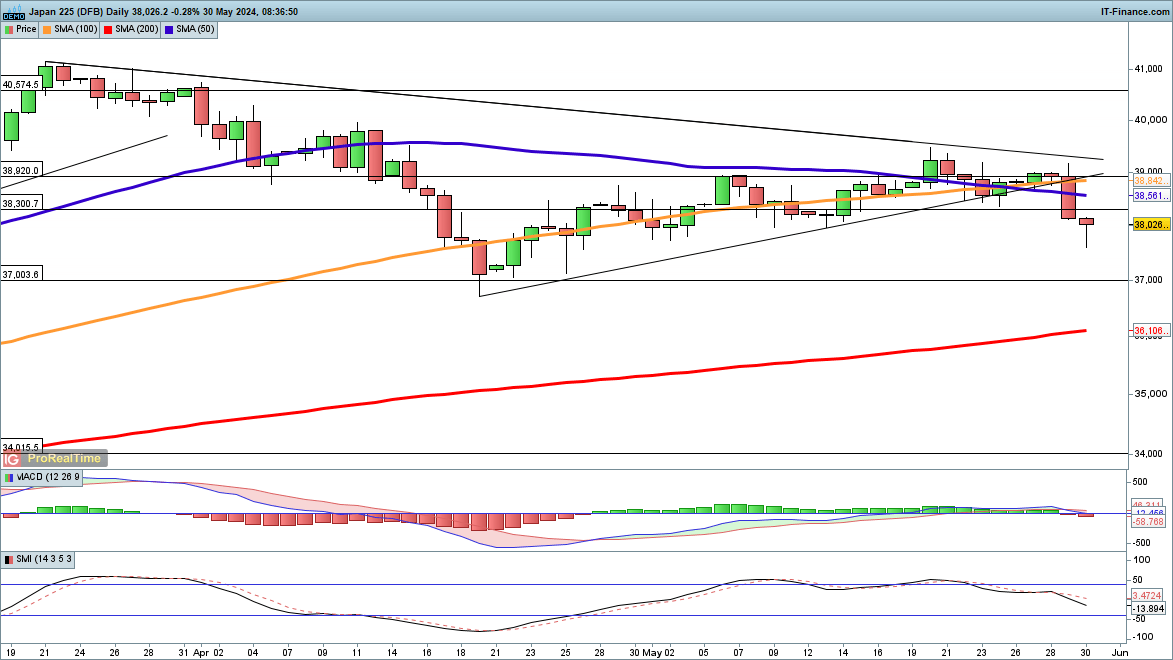

Buyers Emerge at Nikkei Session Lows

Wednesday’s session brought significant losses for the Nikkei 225, resulting in a close well below the trendline support established from the April low. The price reached a three-week low, and Thursday’s trading saw further declines, briefly hitting a one-month low. While buyers have stepped in at today’s session lows, they will need to push the price back above 38,300 to suggest some stabilization.

Further declines from the current level could lead to a drop toward the mid-April lows of around 37,000.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.