ECB Rate Cuts Loom Despite German Inflation Rise

By Daniel M.

January 5, 2025 • Fact checked by Dumb Little Man

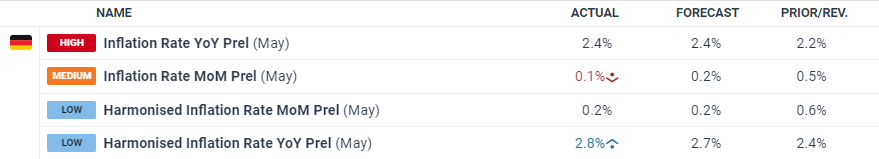

May’s preliminary inflation data from Germany shows a mixed picture, with annual inflation ticking up to 2.4% from 2.2%, aligning with market forecasts. However, monthly inflation only rose by 0.1%, below the expected 0.2% and down from 0.5% last month. Final results are slated for release on June 12.

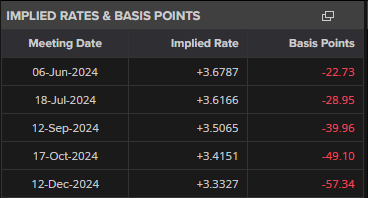

Despite the inflation uptick, the ECB is poised to start reducing interest rates next week, with financial markets forecasting a more than 90% chance of a 25 basis point cut. Additional cuts are expected at the October 17 meeting, and a third reduction in December is becoming increasingly probable. These moves are anticipated to precede any loosening of the Fed’s monetary policy.

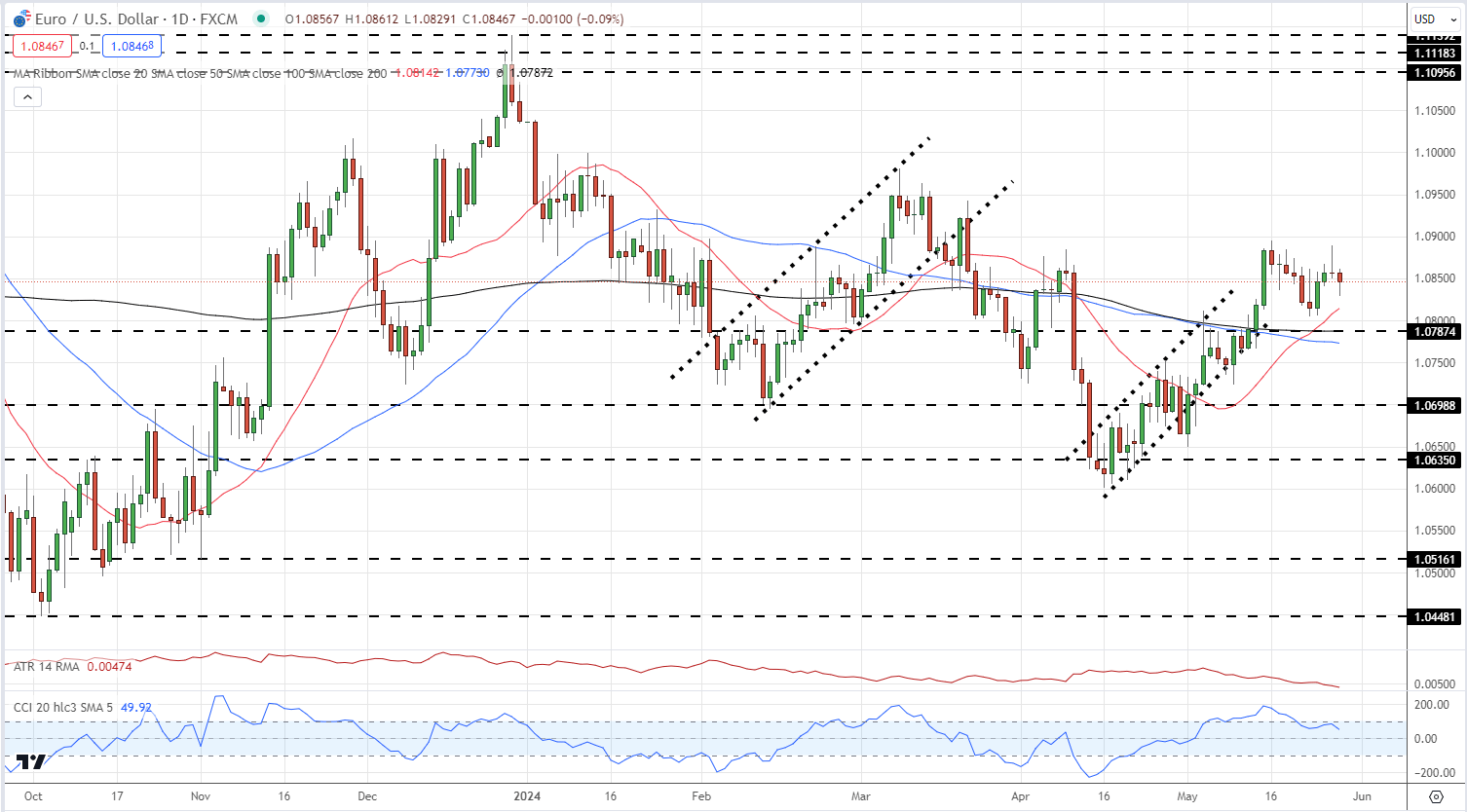

The Euro has shown resilience against the backdrop of rising German inflation, maintaining a steady position within a 32-pip range against the USD. Major data releases, like the US Core PCE on Friday, are currently restraining FX market activity and volatility. The EUR/USD pair consistently traded at 1.0857 across recent sessions.

EUR/USD Daily Price Chart

IG retail trader data reveals that 41.46% of traders are net-long on EUR/USD, with a short-to-long ratio of 1.41 to 1. Net-long positions have increased by 4.35% from yesterday, though they’ve declined by 6.59% from last week. Conversely, net-short positions have decreased by 10.27% from yesterday and 2.78% from last week.

Despite a prevailing net-short sentiment, contrarian strategies might suggest a potential rise for EUR/USD. The mixed retail sentiment data indicates a complex trading bias for the currency pair. While trader sentiment is informative, incorporating both technical and fundamental analyses remains crucial for informed trading decisions.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.