Ethereum Spot ETFs Launch

By Daniel M.

January 5, 2025 • Fact checked by Dumb Little Man

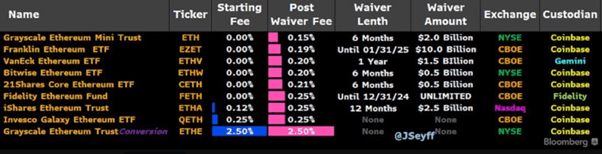

Ethereum spot ETFs are now available for trading, providing a broader audience with a second cryptocurrency exchange-traded fund to consider, following the introduction of Bitcoin spot ETFs earlier this year. All nine ETFs are launching today. While there is anticipated demand for these products, it is expected to be lower compared to the initial Bitcoin spot ETF launch.

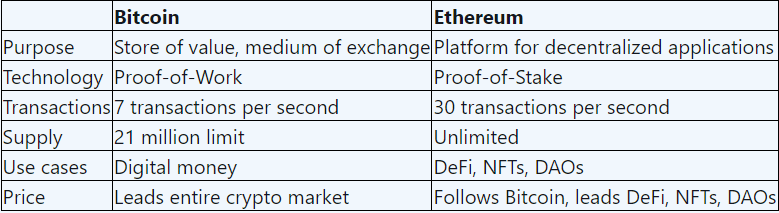

Key Differences Between Bitcoin and Ethereum

There are several significant differences between Bitcoin and Ethereum. Bitcoin (BTC) is often regarded as digital money, whereas Ethereum (ETH) is seen as a global application platform. Bitcoin’s supply is capped at 21 million, while Ethereum’s supply is technically unlimited. The fixed issuance and halving of Bitcoin are considered major selling points, whereas the Ethereum Foundation’s ability to issue new ETH as needed reduces its scarcity appeal for some investors. Additionally, while current Ethereum token holders can stake their tokens, the new ETFs do not offer a staking option due to SEC concerns.

Ethereum’s Staking System

Ethereum’s staking system allows users to actively participate in network security while earning rewards. By staking their ether tokens, Ethereum holders contribute to the network’s operation and security. In return, stakers receive new ether tokens and transaction fees, providing a yield on their staked funds. Currently, the Ethereum staking yield is approximately 3.2%.

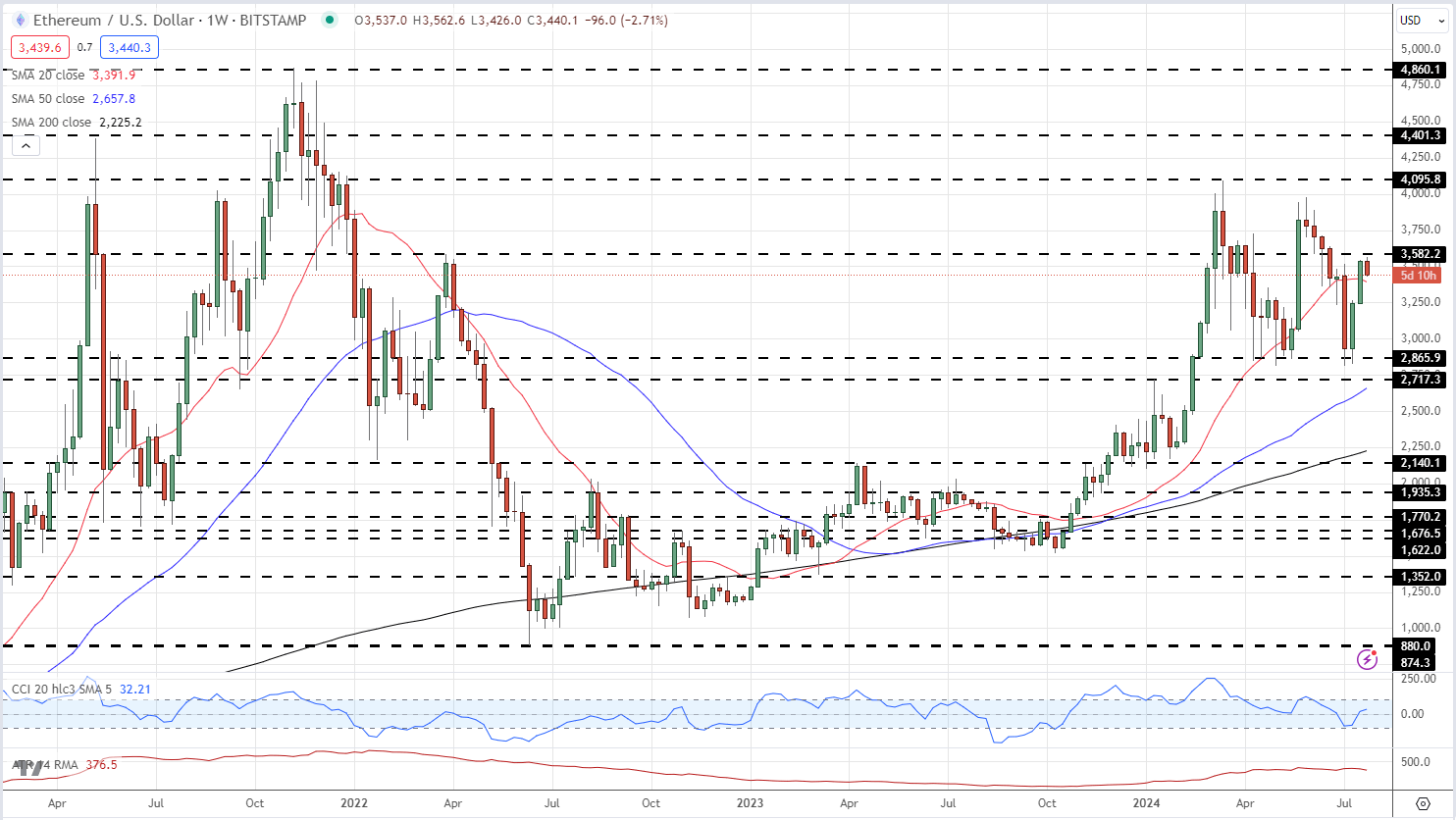

Market Outlook for Ethereum

With the anticipated new demand, Ethereum is expected to rise. However, gains might be limited in the short term due to other macroeconomic factors, particularly the upcoming US elections. In the longer term, especially if spot ETH staking gets approved, Ethereum’s price should increase and potentially surpass its November 2021 all-time high of $4,898.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.