EUR/USD Falls as German Economy Contracts

By Daniel M.

July 30, 2024 • Fact checked by Dumb Little Man

German Economy Shrinks in Q2

The German economy contracted in the second quarter, contrary to expectations of a minor expansion. Initial data from Destatis showed the economy shrinking by 0.1% in Q2, compared to forecasts of 0.1% growth and 0.2% growth in Q1. According to the Federal Statistical Office (Destatis), ‘investments in equipment and buildings, adjusted for price, seasonal and calendar effects, particularly decreased.‘ Revisions to the GDP data will be announced on August 27th.

Later today, the latest German inflation figures will be closely watched for any signs of weakening price pressures. Financial markets currently indicate a 66% probability of a rate cut on September 12, and any further decline in German inflation will increase these odds. Preliminary German inflation data is scheduled for release at 13:00 UK time.

EUR/USD Analysis

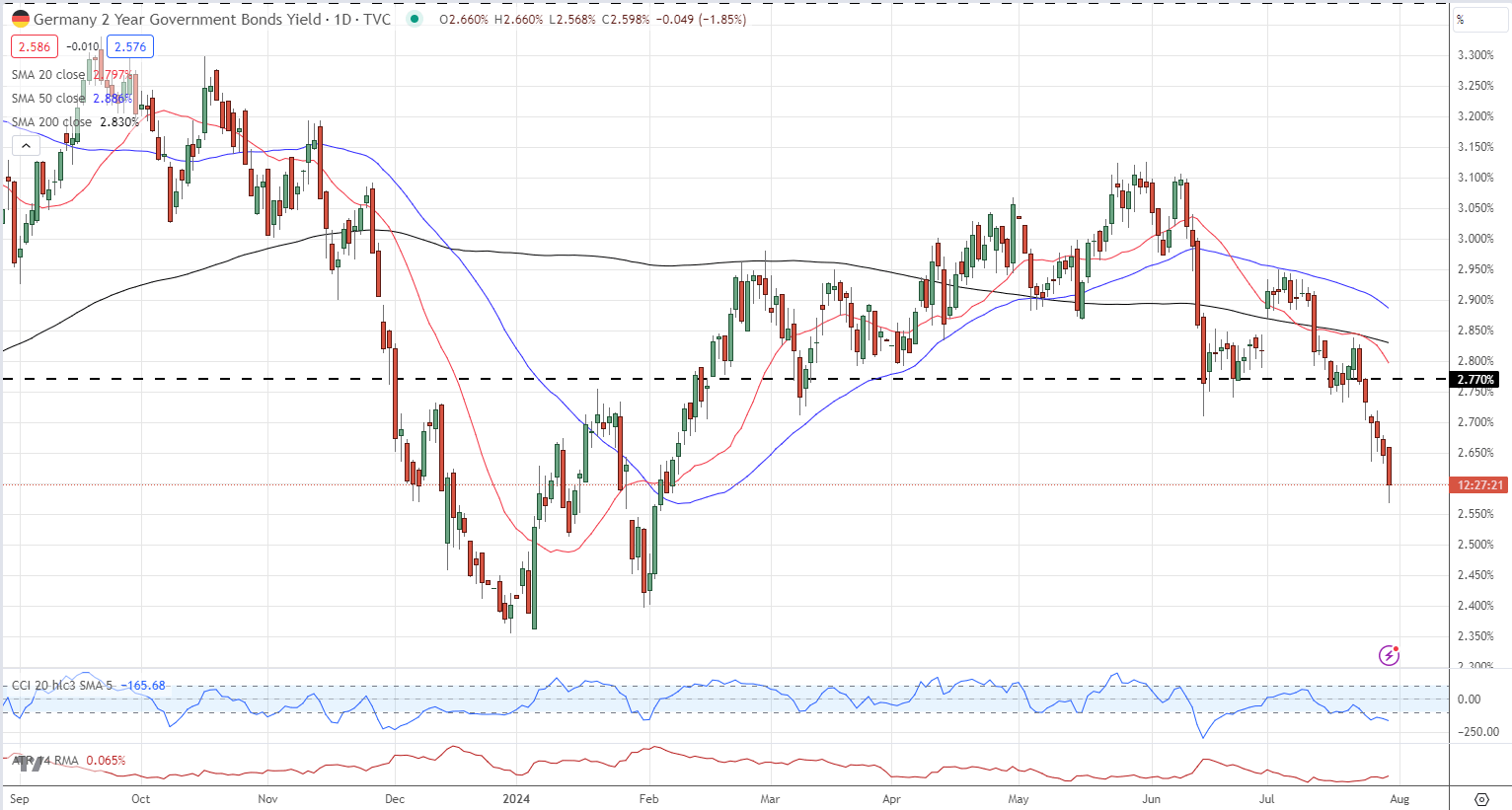

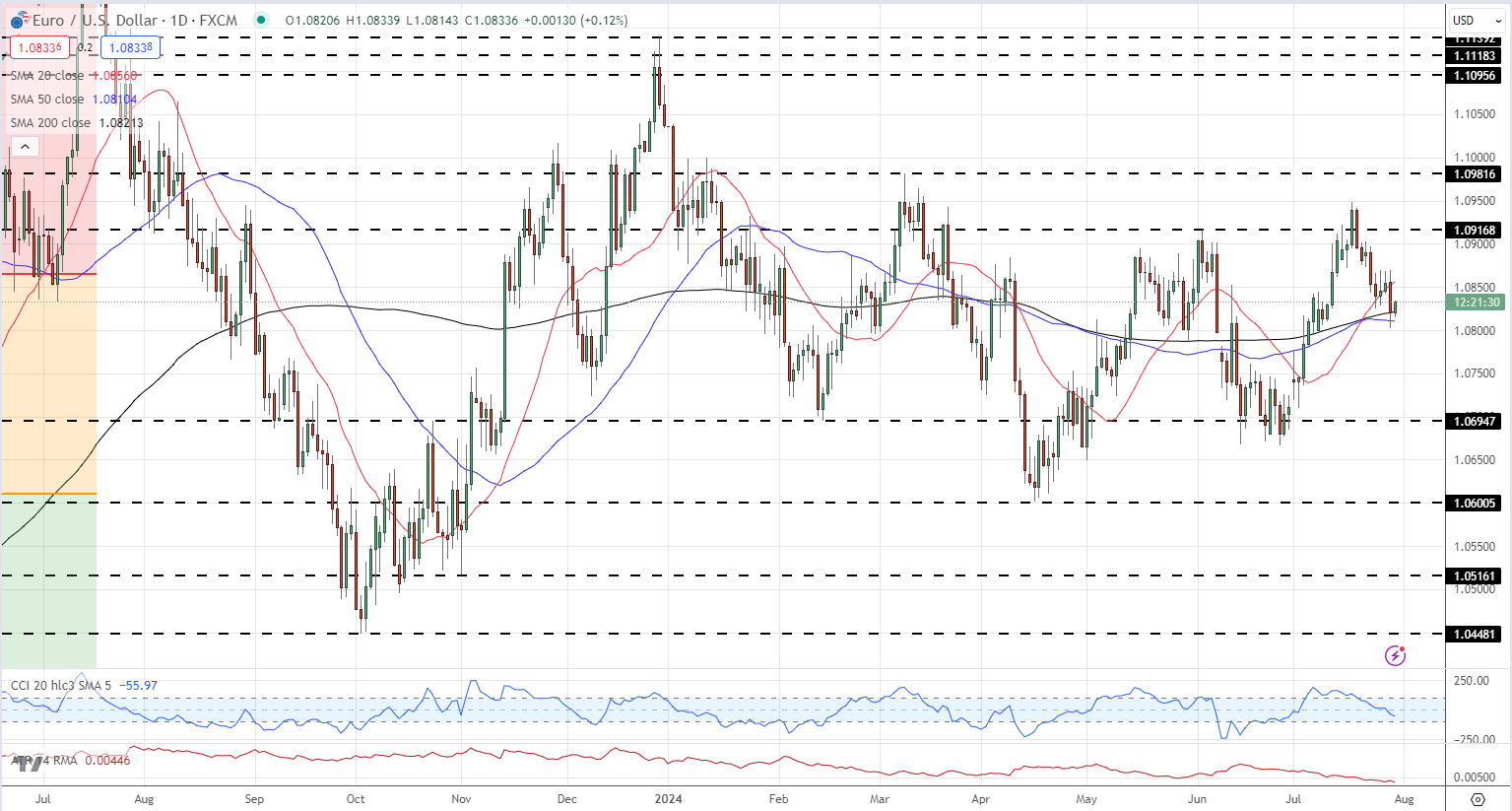

The EUR/USD pair is attempting to recover some of Monday’s losses, but the latest German GDP report is exerting renewed downward pressure. Short-dated German bond yields have returned to lows last seen in early February, further weighing on the Euro.

EUR/USD is currently trading around 1.0830, below the 20-day SMA and just above the 50- and 200-day SMAs. A break below the SMAs and Monday’s 1.0803 low could leave the pair vulnerable to a move towards the 1.0750 area before 1.0700 becomes relevant. On the upside, EUR/USD would face resistance around recent highs and the 23.6% Fibonacci retracement level at 1.0866.

Retail Trader Sentiment

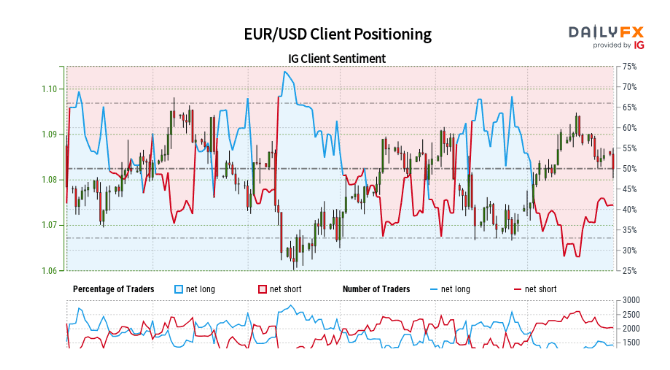

Retail trader data shows 47.20% of traders are net-long, with the ratio of traders short to long at 1.12 to 1. The number of traders net-long is 14.81% higher than yesterday and 15.95% higher from last week, while the number of traders net-short is 9.23% lower than yesterday and 23.48% lower from last week.

Analysts often take a contrarian view to crowd sentiment, and the fact that traders are net-short suggests EUR/USD prices may continue to rise. However, traders are less net-short than yesterday and compared with last week. Recent changes in sentiment indicate that the current EUR/USD price trend may soon reverse lower despite the traders remaining net-short.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.