USD Performance and Key Drivers

The DXY index, which measures the US dollar, plummeted over 0.8% last week. This dip was caused by a drop in US Treasury yields in response to weaker-than-expected US Consumer Price Index (CPI) data.

In April, headline CPI increased by 0.3% seasonally adjusted, falling short of the predicted 0.4% and dropping the annual rate to 3.4% from 3.5%.

This modest CPI print reignited hopes that the disinflationary trend seen in late 2023 would repeat. Traders expected that the Federal Reserve may loosen policy restraints in the fall, putting negative pressure on the dollar as bearish bets rose.

Although cautionary words from numerous Fed members later in the week led to a minor rally in the US dollar, it was insufficient to overcome prior losses.

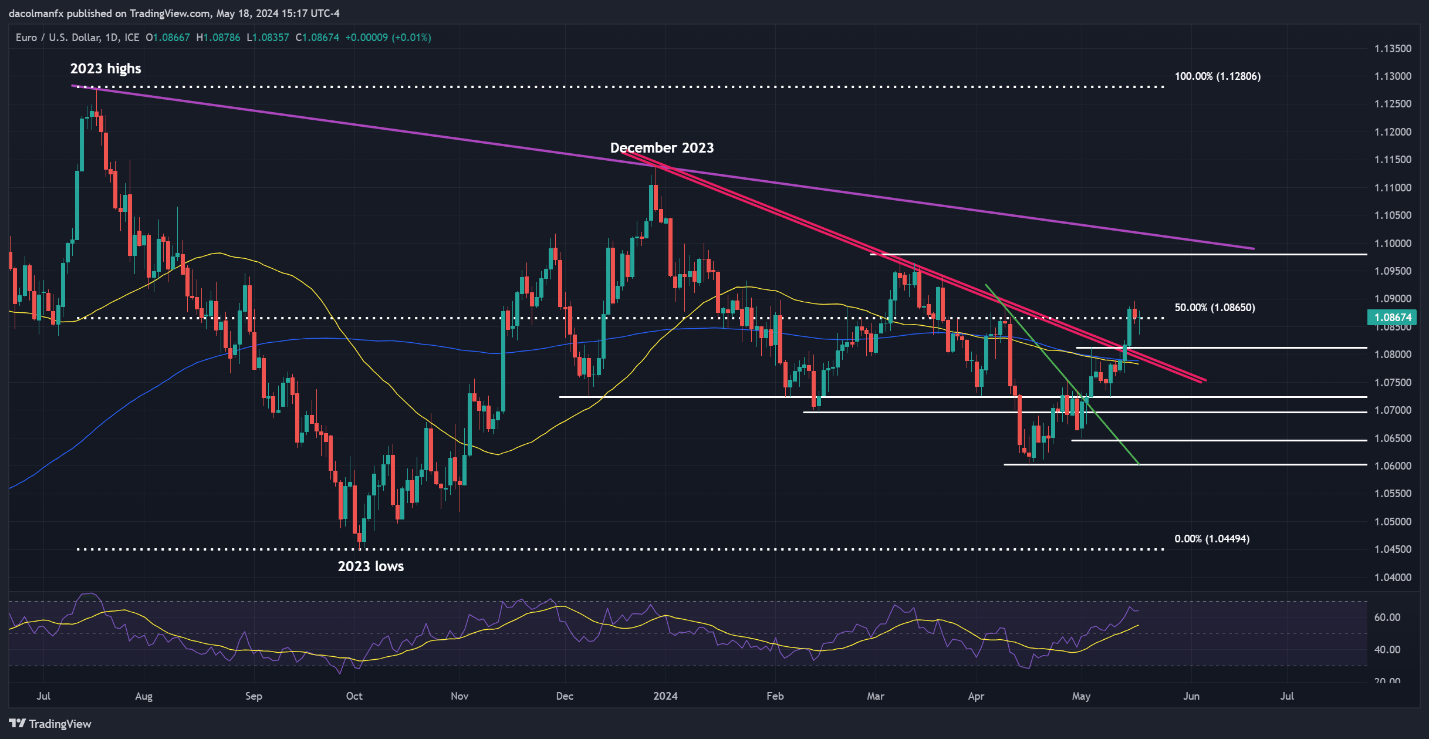

EUR/USD Technical Analysis

The EUR/USD exchange rate remained above 1.0865 late last week. The pair rose by roughly 1% for the fifth consecutive week. Resistance near 1.0980, represented by the March swing high, is an important technical level to keep an eye on.

If the pair continues to gain, the next target is 1.1020, a dynamic trend line drawn from the 2023 peak.

The weak U.S. economic docket for the coming week suggests that current foreign exchange fluctuations will be consolidated.

However, the next set of core PCE statistics, due later this month, will provide vital insights into the inflation picture, directing the Fed’s policy decisions and market direction.

GBP/USD Technical Analysis

The GBP/USD surged last week, temporarily reaching its highest level in nearly two months. If the rally continues, resistance will be found at 1.2720, which is the 61.8% Fibonacci retracement of the 2023 fall. Further rises could take the price above 1.2800.

If momentum fades, support between 1.2615 and 1.2585 could help to steady the pair. A breakdown might lead to a move towards the 200-day simple moving average of 1.2540.

Fed Rate Cut Speculations

Recent macroeconomic data from the United States, notably consumer and producer inflation estimates for April, has reignited hopes of a Fed rate drop in September.

The CME FedWatch Tool shows that the chance of a 25 basis-point drop has increased somewhat, to 49.0%, up from 48.6% a week ago. This possible relaxation could weaken the USD, boosting the EUR/USD and GBP/USD pairs.

Despite the rumors, several Fed officials, notably Michelle Bowman and Thomas Barkin, have been cautious. They observed that inflation progress may not be as steady as anticipated, highlighting the need for more time to meet the Fed’s 2% target.

GBP/USD Supported by UK Economic Data

In the UK, the Bank of England (BoE) is forecast to reduce interest rates by 60 basis points in 2025, with the first cut scheduled for August. April’s CPI data, which is expected to grow by 2.7% annually, will have a substantial impact on the Pound Sterling (GBP).

Governor Andrew Bailey of the Bank of England has warned that inflation may soon approach the 2% objective.

Final Thoughts

The US dollar’s drop last week, which was fueled by lower CPI data and Fed rate cut forecasts, underlines significant downside risks. Traders should keep an eye on the impending core PCE numbers in the United States, as well as significant technical levels in EUR/USD and GBP/USD.

Fed officials’ statements and UK economic data will also have a significant impact on short-term currency swings. As always, maintaining awareness on these issues is critical for making sound trading selections.