Traders Increase Net-Short Positions by 13.36% Over the Week

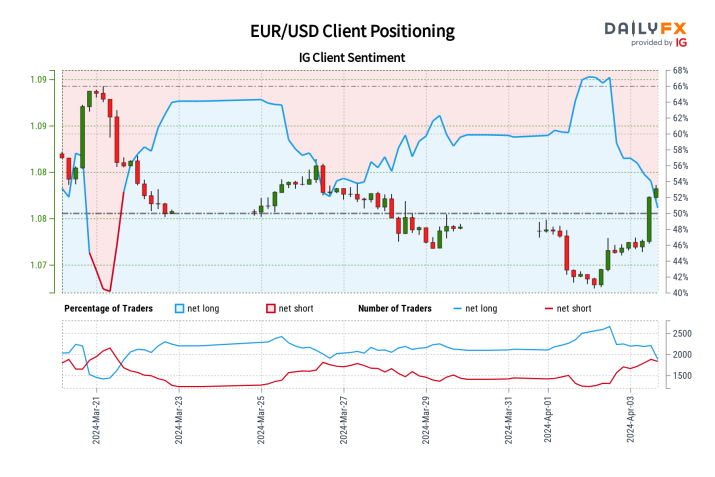

Retail trader data indicates that 48.57% of traders are net-long, with a short-to-long ratio at 1.06 to 1. Notably, a net-short sentiment has prevailed since March 21, when EUR/USD was around 1.09, witnessing a 0.27% decline since.

Current figures show a 19.55% decrease in net-long traders from yesterday and 15.37% from last week. Conversely, net-short traders have risen by 18.69% since yesterday and 13.36% over the past week.

Adopting a contrarian perspective to crowd sentiment often, the prevailing net-short stance hints at a potential uptrend for EUR/USD prices.

Since March 21, 2024, traders have shifted to a net-short position in EUR/USD for the first time, when it was trading near 1.09. The increase in net-short positions both from yesterday and last week, combined with the current sentiment, strengthens our bullish outlook for EUR/USD, suggesting a contrarian bias towards an upward movement.