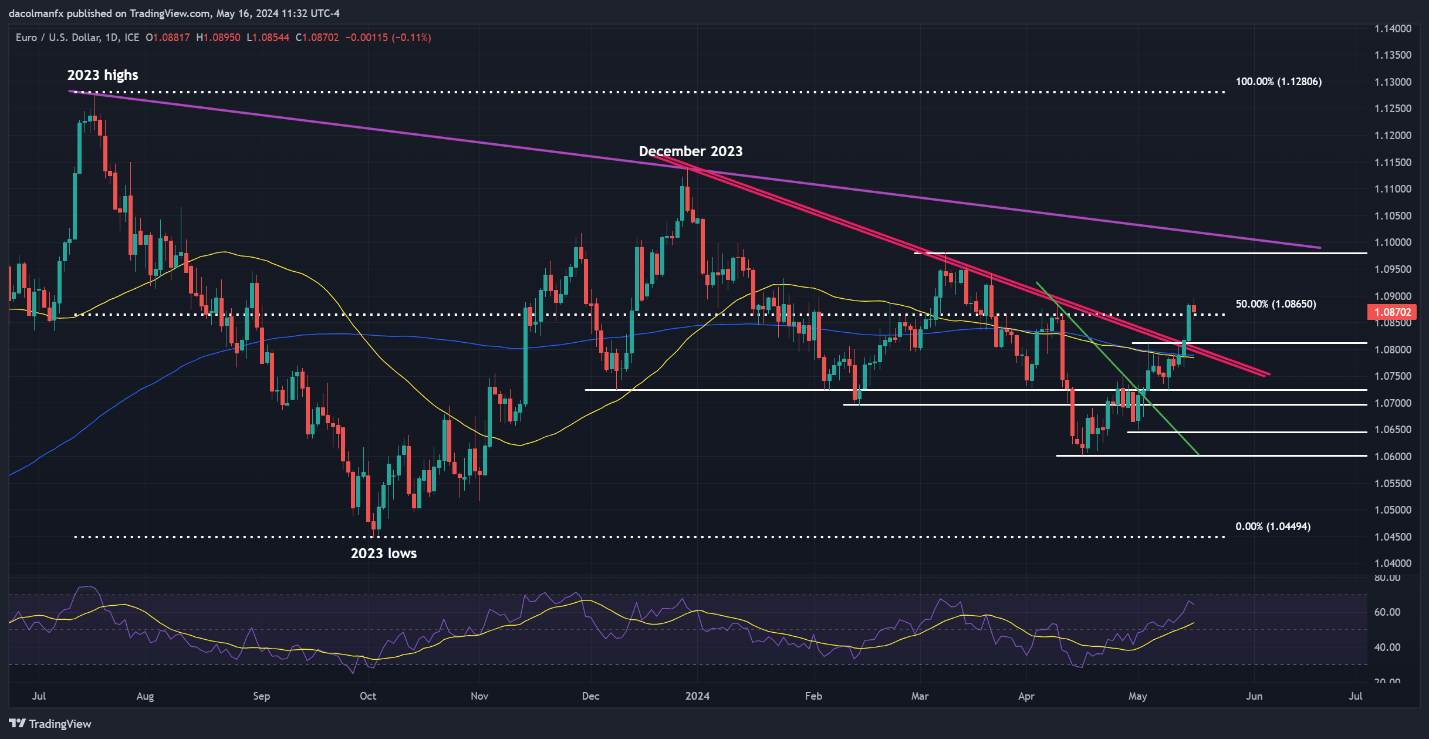

EUR/USD Forecast

On Thursday, EUR/USD was subdued, failing to capitalize on the previous session’s bullish breakout. The pair retreated modestly but remained stable above 1.0865. To prevent a resurgence of sellers, it’s crucial for bulls to maintain prices above this level; falling below could lead to a pullback towards 1.0810/1.0800.

Conversely, if buying momentum resumes and the pair pivots upwards, overhead resistance might appear near 1.0980, a significant technical barrier from the March swing high. A further increase could propel buyers to challenge the 1.1020 mark, a dynamic trend line from the peak of 2023.

GBP/USD Forecast

GBP/USD ticked lower on Thursday after a strong performance earlier in the week, as buyers took a moment to assess their next moves following the recent rally. If bullish momentum picks up again, the pair could encounter resistance at 1.2720, highlighted by the 61.8% Fibonacci retracement of the 2023 downturn. Beyond this level, the 1.2800 handle may become relevant.

If, however, the upward pressure weakens and triggers a bearish reversal, support between 1.2615 and 1.2590 could provide a buffer against further declines. A breach here might shift focus towards the 200-day simple moving average at approximately 1.2540. Any subsequent drop below this could prompt a descent towards 1.2515.