During today’s trading session, there was a minor movement in the EUR/USD exchange rate, showing a -0.01% shift. One EUR’s exchange rate ranged from a low of 1.08438 USD to a high of 1.08523 USD, suggesting that the currency pair had a limited trading range.

On the other hand, the German GDP shrank by 0.4% in Q4 2023 compared to the same quarter the previous year, according to figures from the Federal Statistics Office (Destatis). Due to this slump, Germany had a challenging end to 2023, with lower investment levels having a negative impact on economic activity despite a little increase in consumption.

Germany’s GDP performance remained essentially unchanged in the first three quarters of 2023, underscoring the persistent challenges facing the world economy. The year’s final economic performance improved slightly to -0.1% from a 0.3% drop after taking calendar adjustments into account.

Today, the EUR/GBP exchange rate experienced a slight change, increasing by 0.01%. Throughout the trading session, the currency pair moved within a narrow range, hitting a low of 0.85493 GBP and reaching a peak at 0.85593 GBP per 1 EUR. This minor fluctuation highlights the current stability between the Euro and the British Pound, with traders closely monitoring these subtle movements for potential trading opportunities.

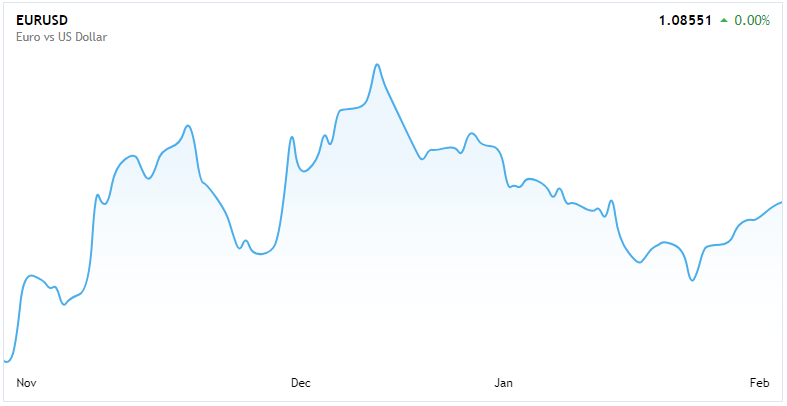

EUR/USD Shows Resistance

Source: Charts Using TradingView via DailyFX

The momentum of the Euro vs the US dollar faced resistance, particularly in the vicinity of the 200-day simple moving average (200-dsma). The EUR/USD pair ended the day below this line, indicating that its rising momentum has stopped, though it has briefly above it. A push toward the 50-dsma and the 1.0900 level might be initiated by a close and open above the 200-dsma, signaling a sustained break above this level. As of right moment, support levels range from 1.0787 to 1.0760.

EUR/GBP Slipping Down

Source: Charts Using TradingView via DailyFX

The EUR/GBP pair’s drop from the 0.8500 level has paused, and a break above the 0.8580 zone looks improbable. If the pair breaks below 0.8530, it may, in the immediate term, retest the 0.8500 support level.

According to IG’s data on retail traders, 72.75% of them had long holdings, indicating that traders are typically upbeat. A rise in long positions and a decrease in short positions during the previous day and week are shown by the long-to-short trader ratio of 2.67 to 1.

Final Thoughts

These occurrences show how a complex interaction of technical resistance points, economic data, and trader attitude affects the Euro’s performance against the US dollar and the British pound. While the currency market continues to respond to these factors, traders and investors will be closely observing any signs of sustained direction change.