Euro Positioning, US Inflation, And Rate Expectations

A 25 bps cut from the ECB is widely anticipated, as several committee members have shown support for this move. The European economy has required a boost since Q4 2022 due to stagnant growth. Several quarters of zero or near-zero GDP growth and encouraging inflation progress have provided the ECB with room to consider dropping interest rates for the first time since 2019. Although Eurozone inflation slightly exceeded expectations in April, it is unlikely to disrupt the progress towards the 2% target.

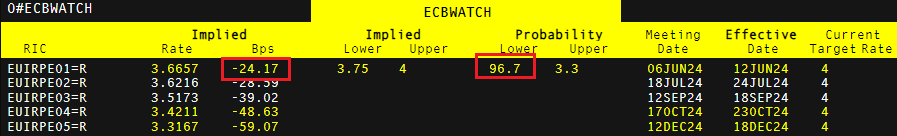

Market expectations indicate a 96.7% chance of a 25 basis point cut this week when the governing council meets to decide interest rates. The key focus will be on any hints regarding future rate cuts and timings. Prior statements from ECB officials suggest a gradual approach to cuts, with indications of a potential hold in July to assess the impact of the first cut and review new data. Markets will closely watch the press conference.

Commitment of Traders Report (CoT) for Euro Positioning with EUR/USD Price Action

Recent euro positioning has improved, with a significant reduction in euro shorts by speculative money managers, while longs are increasing. This shift may indicate further upside for the euro as net positioning becomes positive again.

EUR/USD Rises On Weaker Dollar – More Upside If U.S Data Weakens

The US economic surprise index suggests incoming data is likely to be soft due to ongoing restrictive monetary conditions and the disinflation process.

Weaker US data has pushed EUR/USD higher, despite the expected ECB rate cut. The medium-term outlook shows a 2.8% gain since the April low. However, since mid-May, the pair has moved within a gentle downward-sloping channel.

Support is at channel support and the 200 SMA around 1.0800. Upside levels are at channel resistance, followed by 1.0942/1.0950.

SNB Chairman Jordan's Inflation Comments Support Swiss Franc

Thomas Jordan, the departing Chairman of the Swiss National Bank (SNB), shared his views on inflation risks, noting potential impacts from a weaker Swiss franc.

His comments led to the franc recovering lost ground, pushing EUR/CHF lower. The SNB was the first major central bank to cut interest rates in March, leading to a broader franc depreciation, which seems to have ended in late May with the appearance of an evening star.

The evening star marked a recent top in EUR/CHF, appearing before Jordan’s comments. The pair shows a downside bias and recently broke below the 50-day simple moving average (SMA), with channel support as the next key level. Additional downside levels include 0.9694, followed by the 200 SMA at 0.9565.