Euro Trading Outlook: Sentiment & Forecast for EUR Pairs

By Daniel M.

January 5, 2025 • Fact checked by Dumb Little Man

Contrarian strategies highlight the potential hidden behind the market’s collective sentiment, offering insights into potential reversals when optimism or pessimism peaks. While not foolproof, these signals, especially from sources like IG client sentiment, become more powerful when combined with thorough technical and fundamental analyses.

This approach provides a deeper understanding of market dynamics, often missed by the majority. Let’s dive into the sentiment surrounding the euro across four significant FX pairs: EUR/USD, EUR/CHF, EUR/GBP, and EUR/JPY.

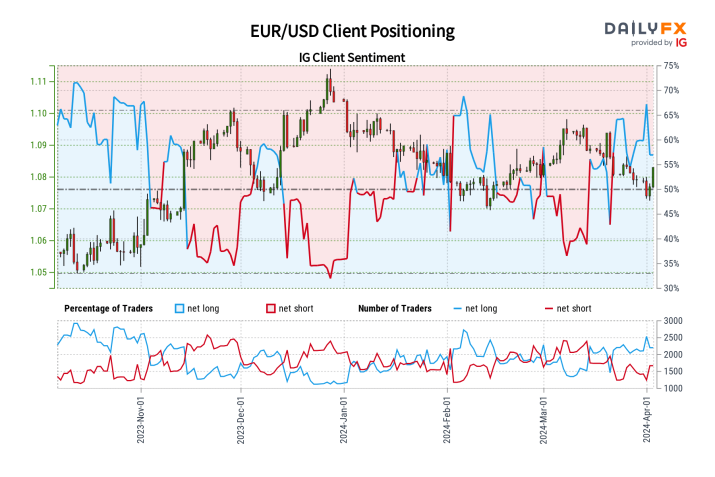

EUR/USD Outlook – Mixed Sentiment

IG data shows a slight but diminishing bullish sentiment towards EUR/USD, with 53.15% of traders net-long, yielding a 1.13 to 1 long-to-short ratio.

However, a 10.90% decrease in net-long positions and a 31.26% increase in net-short positions complicate the forecast, suggesting a cautious approach and the importance of comprehensive analysis.

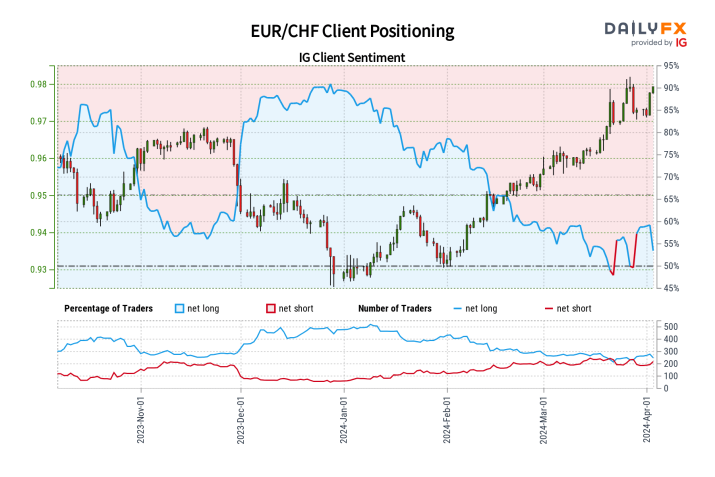

EUR/CHF Outlook – Shifting Sentiment

53.08% of traders are net-long on EUR/CHF, showing bullish sentiment. Yet, with a decrease in net-long positions and an inconsistent trend in net-short positions, the outlook remains unclear, emphasizing the need for caution and a balanced trading strategy.

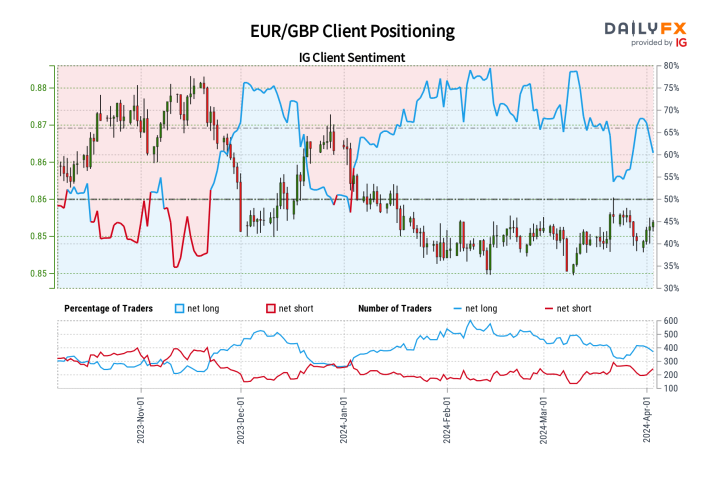

EUR/GBP Outlook – Optimism with Caution

61.22% of traders hold net-long positions in EUR/GBP. Despite a recent decline in net-longs and a surge in net-shorts, the sentiment analysis presents a complex picture, suggesting potential downward pressure but urging a careful, analysis-driven trading decision.

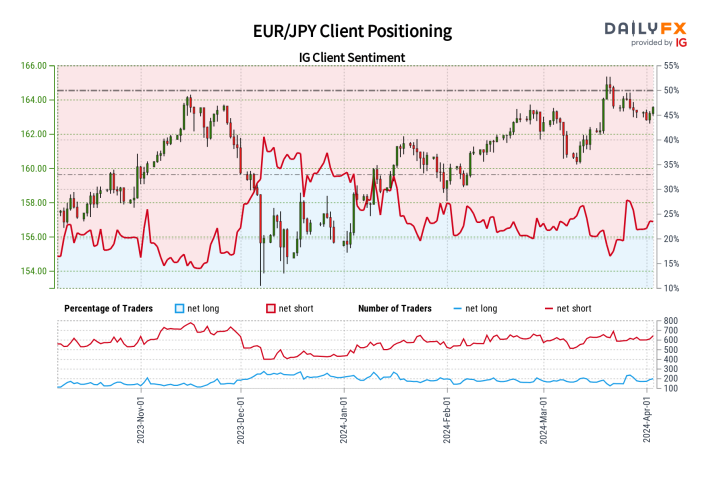

EUR/JPY Outlook – Contrarian Gains Possible

A pronounced bearish sentiment exists towards EUR/JPY, with 73.47% of traders net-short. However, an uptick in both net-short and net-long positions introduces uncertainty, hinting at possible gains for EUR/JPY but advising a strategy enriched with comprehensive market analysis.

Final Thoughts

In conclusion, while sentiment analysis offers valuable insights, traders are reminded of the importance of integrating these indicators with a robust trading strategy, considering both technical and fundamental aspects to navigate the complexities of the forex market effectively.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.