Fed Expected to Maintain Current Interest Rates Amid Ongoing Inflation Concerns

By Daniel M.

January 5, 2025 • Fact checked by Dumb Little Man

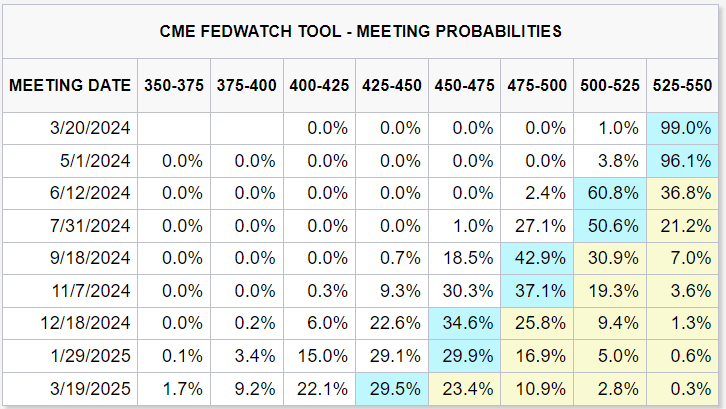

The Federal Reserve is set to announce its monetary policy decision this Wednesday. For the fifth consecutive meeting, the benchmark rate is expected to be kept at its current range of 5.25% to 5.50%.

With no adjustments planned to its quantitative tightening program, which aims to gradually reduce its bond holdings, this move indicates the central bank’s continuous fight against persistent inflation.

Market Anticipation and Economic Projections

Investors are bracing themselves for the Fed’s forward guidance, which will be important in determining the path of future monetary policy. According to the consensus, the Fed should proceed cautiously and wait for additional proof of deflation before lowering borrowing prices.

This strategy recommends delaying any potential rate cuts until the central bank is more certain that inflation is steadily approaching its 2% objective. Resilient economic indicators have been observed, with recent PPI and CPI data emphasizing sticky pricing pressures.

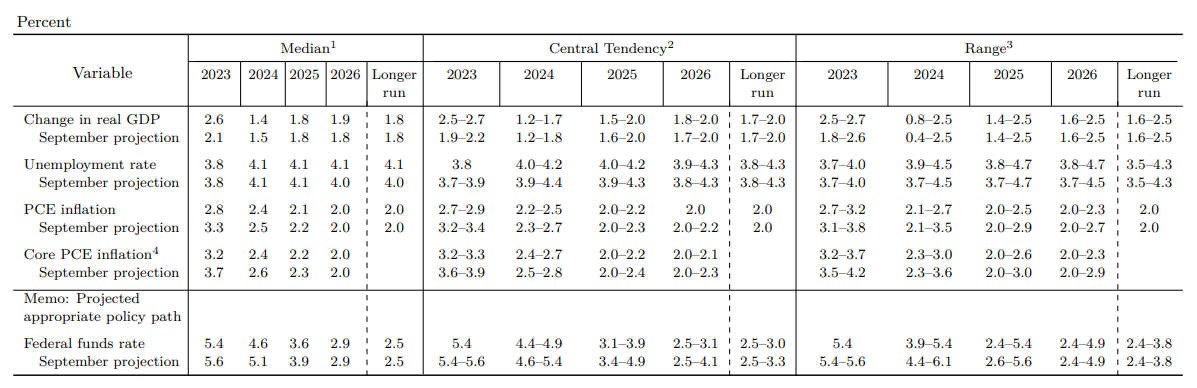

The prospect of fewer rate cuts in 2024 than first anticipated is indicated by the possibility that the Fed may raise its macroeconomic projections for GDP and core PCE deflator forecasts.

Potential Market Impact

As markets acclimate to the possibility of a more patient and cautious Fed, many predict that this stance could result in a brief spike in the U.S. Treasury yields and the U.S. dollar.

This would unsettle gold and stocks, which have enjoyed rallies under the impression of an impending shift in policy toward easing.

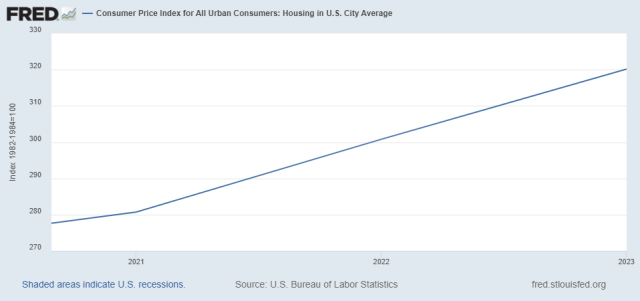

Inflation Challenges and Housing Costs

The Fed’s goals are challenged by ongoing inflation, particularly in housing expenses. Rising mortgage rates and a lack of available homes nationwide have made renting the most popular choice for most Americans, despite forecasts of a decline brought on by building booms in some areas.

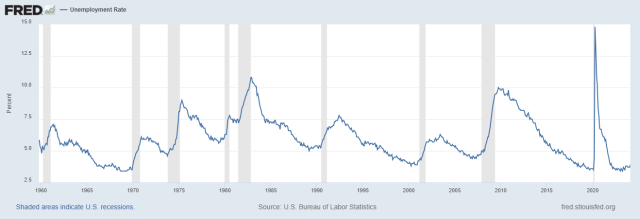

With the unemployment rate remaining below 4% for the longest period since the 1960s, employment stability has at least somewhat mitigated these effects.

Economic Outlook and Inflation Dynamics

Bankrate analysts highlight how entrenched inflation is, speculating that the Fed’s efforts to achieve the 2% inflation target may be limited to just two interest rate cuts this year.

The labor market has mixed results, with rising immigration and productivity providing possible inflation hedges. These elements may present a potentially stable economic future by enabling the economy to accommodate higher wages without causing more inflation.

Political Considerations and Timing

Political sentiments towards the economy remain divided, influencing public perception and potentially the timing of future Fed actions. To avoid appearing politically motivated, the Fed is trying to hold off on making any changes to interest rates until June at the latest. This is due to the closely approaching general election.

Final Thoughts

As it sets the tone for economic expectations in the future months, the Federal Reserve’s impending policy announcement is pivotal for traders and market observers.

In light of persistent inflation and a complex economic landscape, the Fed’s cautious approach signifies a delicate equilibrium between promoting economic stability and managing obstacles to price stability.

The market’s reaction to the central bank’s decision-making will depend on its capacity to guide the economy toward fulfilling its dual mandate of low inflation and full employment without caving into outside pressure or jeopardizing its credibility in front of consequential political turning points.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.