Financial Harmony for Couples: Navigating Money Management and Joint Finances

By Wilbert S

January 21, 2024 • Fact checked by Dumb Little Man

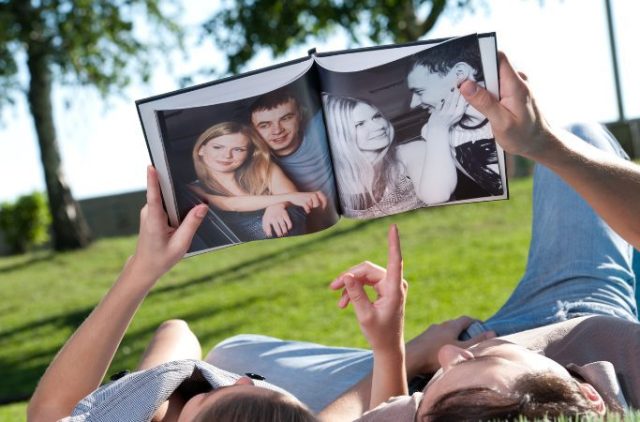

Navigating financial matters as a couple often presents a complex landscape, where achieving financial harmony becomes pivotal for a healthy, enduring relationship. This guide serves as a beacon for couples, steering them towards making informed financial decisions. The crux lies in fostering an environment of open and honest communication, crucial for navigating the often turbulent waters of joint finances.

In pursuit of financial harmony, couples are encouraged to engage in regular, transparent discussions about their financial aspirations and challenges. This process not only demystifies financial complexities but also builds a strong foundation of trust and mutual understanding. The aim is to transform money conversations from potential conflicts into opportunities for growth and unity, ensuring both partners feel empowered and aligned in their financial journey.

The Importance of Open Communication in Finances

Achieving true financial harmony hinges on the cornerstone of open and honest communication. Transparent discussions about finances are not just about numbers; they are a gateway to understanding and respecting each other’s spending habits and financial goals. This openness paves the way for a relationship built on mutual trust and understanding, key elements for a harmonious financial future.

The practice of discussing money matters openly within a relationship fosters a deeper connection, enabling couples to align their financial objectives. By sharing insights into personal spending patterns and future financial aspirations, couples can work together to create a unified financial strategy. This collaboration is instrumental in establishing a solid financial foundation, essential for the long-term stability and success of the relationship.

Also Read: Achieving Your Relationship Goals: Strategies for a Stronger Bond

Building Financial Literacy Together

Enhancing financial literacy is a vital, shared journey for couples aiming to strengthen their financial understanding and capabilities. This journey encompasses gaining knowledge about budgeting, savings, and investments, essential components for making informed financial decisions. By collectively enhancing their financial acumen, couples can navigate the complexities of their financial landscape more effectively and with greater confidence.

Embarking on this path of financial education together not only bolsters individual understanding but also fortifies the partnership through a common financial language and objectives. This shared learning experience fosters an environment where both partners can contribute to and benefit from a well-informed approach to money management. As a result, it becomes easier for couples to develop and execute a cohesive financial strategy, crucial for achieving their long-term financial goals.

Joint Money Management Strategies

In any relationship, effective money management plays a critical role. Key to this is the development of a family budget, which serves as a blueprint for managing both individual and shared expenses. This budgeting process is integral to maintaining financial health and harmony, ensuring that both partners have a clear understanding of their financial standing. Additionally, couples face the important decision of whether to merge their finances into a joint account or maintain separate financial accounts, a choice that significantly impacts how they manage their money together.

The approach to managing finances, whether through a joint account or separate accounts, should align with the couple’s overall financial strategy and personal preferences. Having a joint account can foster a sense of unity and shared responsibility in financial matters, while separate accounts may provide a sense of financial independence. Whichever path is chosen, the key lies in ensuring that both partners are comfortable with the arrangement and that it supports their broader financial goals and spending habits. This careful consideration and mutual agreement in managing finances are fundamental to building a strong, resilient financial partnership.

Dealing with Debt as a Couple

Debt, particularly in the form of credit card debt, can be a significant source of stress and strain in relationships. Its presence can lead to financial uncertainty and conflict, making it imperative for couples to confront and strategize on how to pay off debts together. Addressing debt collectively not only eases the financial burden but also strengthens the bond of trust and cooperation within the relationship. This shared responsibility in tackling debt is crucial in maintaining a healthy financial dynamic.

Avoiding financial infidelity – the act of hiding debt, spending, or financial decisions from a partner – is equally vital. Such actions can erode trust and undermine the financial stability of the relationship. Open and honest communication about all aspects of debt, including the reasons behind it and the proposed methods for repayment, is essential. This transparency fosters a supportive environment where both partners feel involved and committed to overcoming financial challenges together, thus fortifying the foundation of their relationship.

The Role of Financial Planning in a Relationship

Developing a robust financial plan is a cornerstone in efficiently managing finances for individuals and couples alike. It involves clearly setting financial goals, which act as guideposts for all fiscal decisions and behaviors. These goals could range from short-term objectives like saving for a vacation to long-term ambitions such as retirement planning. Understanding the tax implications of various financial decisions is also a critical component of this plan, as it can significantly impact net income and savings.

Beyond goal-setting and tax considerations, a comprehensive financial plan also encompasses strategies for big purchases or investments. This involves evaluating the potential risks and returns of different investment options, as well as planning for substantial expenditures like buying a home or funding education. Making these decisions within the framework of a well-thought-out financial plan ensures that all actions are aligned with the individual’s or couple’s overall financial objectives, thereby aiding in the achievement of financial stability and growth.

Planning for Major Life Events

Major life events like buying a home, having children, or starting a business are significant milestones that bring about substantial financial implications. Careful and proactive financial planning is essential to navigate these events successfully. Planning for such events involves assessing current financial status, estimating future costs, and adjusting financial plans to accommodate these new responsibilities. By doing so, individuals and couples can mitigate the financial strain that often accompanies major life changes, ensuring that these joyous occasions do not become sources of financial stress.

Discussing and preparing for these life events well in advance is crucial in ensuring a smoother financial journey. Open conversations about expectations, fears, and aspirations associated with these milestones help in aligning financial goals and strategies. Early preparation allows for more time to save, invest, or adjust spending habits, thereby reducing the likelihood of financial surprises. Ultimately, this foresight and preparation pave the way for a more secure and enjoyable experience of life’s key moments.

Conclusion

Achieving financial harmony in a relationship is deeply rooted in the principles of open communication, understanding, and cooperation. It’s essential for couples to engage in transparent and ongoing dialogues about money matters, breaking down any barriers of discomfort or taboo surrounding the topic. This level of openness facilitates a deeper understanding of each other’s financial perspectives and priorities, allowing for a more empathetic and cooperative approach to managing finances. By fostering this environment of open communication, couples can effectively navigate the complexities of financial planning, ensuring that both partners are heard and their concerns addressed.

Couples who actively talk about their finances, jointly create a solid financial plan, and work collaboratively towards their financial goals, are more likely to experience a stable and secure financial future. This collaborative approach to finances not only strengthens their financial footing but also reinforces their relationship. Working together in harmony towards shared financial objectives helps in building a strong foundation of trust and mutual support, essential for weathering financial challenges and uncertainties. Ultimately, this united front in financial matters becomes a key driver in achieving not just monetary success, but also a deeper, more resilient partnership.

Also Read: What Should a Woman Ask For in a Prenup?

FAQs: Achieving Financial Harmony

What are the key steps for couples to achieve financial harmony?

Achieving financial harmony involves open and honest communication about money matters, setting shared financial goals, and creating a joint financial plan. It’s important for both partners to be involved in budgeting, decision-making, and managing finances. Regular financial discussions and a commitment to mutual understanding are essential.

How important is financial literacy in a relationship?

Financial literacy is crucial in a relationship. It empowers both partners to make informed financial decisions. Understanding the basics of budgeting, saving, investing, and the impact of debt helps couples manage their finances more effectively and achieve their financial goals together.

What is the best way for couples to manage debt together?

Couples should approach debt management with transparency and teamwork. This includes openly discussing all debts, creating a unified plan to pay them off, and avoiding financial secrets, which can lead to financial infidelity. Prioritizing debts, considering consolidation options, and setting realistic repayment goals are key strategies.

Wilbert S

Wilbert is an avid researcher and is deeply passionate about finance and health. When he's not working, he writes research and review articles by doing a thorough analysis on the products based on personal experience, user reviews and feedbacks from forums, quora, reddit, trustpilot amongst others.