Forex Risk Management – Learn The Basics

By Wilbert S

January 10, 2024 • Fact checked by Dumb Little Man

Want to jump straight to the answer? The best forex broker for traders is Avatrade

The #1 Forex Trading Course is Asia Forex Mentor

Forex trading has been a popular source of online income for several decades. The forex market involves exchanges of currencies that are based on various external factors. Hence, the market has fluctuating demand, which results in quick changes in prices. The wide range of tradable currencies is a popular perk for forex traders. Most trading platforms have begun to offer zero-commission trades, which provide traders with magnified profits.

Although the perks of forex make it lucrative for investors, sometimes the forex market is merciless for new traders, and they lose money. Traders can compromise on lower profits, but a hit at their trading capital is often depressing and pushes them into demotivation. Studies show that more than 66% of forex investors end up making net losses in a year. The problems can be associated with their forex risk management strategies.

If you are a new investor in the forex market, then this blog is essential for you. We shall discuss the most significant risks involved in the forex market and how you can avoid them with the right trading strategy. With proper risk management rules, you can make a fortune without compromising on your hard-earned investment.

Forex Risks Management: What is Forex Risk Management

Forex risk management talks about trading rules and strategies that can help investors in saving their investments. The trading strategy consists of conditions that minimize the risks of investment and protects investors from losing money rapidly.

Forex markets are vulnerable to external factors, which makes them highly volatile. A sudden rumor can change the shape of the market, and forex traders lose money.

Recently, the fall of Ukrainian hryvnia can be a helpful example to understand. The currency pairs fell to their lowest of the year on 1st March 2022. The fall might have been profitable for some traders, but overall, many forex traders end up suffering from a loss.

Our goal of trading in foreign exchange is to trade in a profitable market that is recognized by the national futures association and Commodities Futures Trading Commission. If the losses are recurring, it can be difficult to stay committed to the goal.

What are the Risks of Forex Trading

#1. Exchange Rates: Foreign exchange is based on the prices of currency pairs against each other. A rise in the price of currency A will reduce the worth of currency B and vice versa. When a country takes loans from the IMF, the exchange rate takes a significant hit that can result in losses for traders.

#2. Interest Rates: Most investors like to play it safe; hence, instead of trading in forex, they will invest their money in foreign banks that pay high-interest rates. Once the interest rate in a country lowers, the investors withdraw their money, which results in reduced demand for the currency. Thus, the foreign exchange rate of the currency falls.

#3. Losing your Money: On average, 2 out of every 3 forex traders end up making losses at the end of the year. Regardless of the reason, a spectator can infer that forex is a risky market, where one wrong step can create a series of losing trades.

#4. Margins and Leverage: usually, forex investors are confident about their expertise. Thus, they leverage their investments against the collateral of their assets. The additional money comes at a marginal cost and can be used to enhance their profits. However, margin carries significant risk. If a trade ends up as a loss, investors will not only have to repay the original amount but the cost of capital borrowed.

#5. Low Liquidity: A USD EUR currency pair is fairly liquid, and a user can sell them whenever they wish. However, some currency pairs have low liquidity due to regulations by their central bank. The regulations may include a volume of currency units that can be sold in a day or a price floor for the currency valuation. In such cases, it can be difficult to sell back the currency, and a profitable trade may not materialize.

#6. Local or Regional Volatility: New forex traders also have to suffer a significant risk due to regional volatility. Some countries have an unstable political environment, making it difficult to predict the growth of the currency. A slight rumor about the country will translate into a negative impact on its currency pairs. Hence, forex traders are again at risk.

#7. Credit Issues: Although credit management doesn’t bother retail investor accounts on a trading platform, it is worrying for corporate and trading firms. In some instances, the second party in a contract may develop credit issues, which makes a collection of debts difficult. Usually, the court cases take a long time to bring a reasonable judgment, and the creditor can’t do anything except wait.

| Broker | Best For | More Details |

|---|---|---|

|

| securely through Avatrade website |

| Broker | Best For | More Details |

|---|---|---|

| securely through FXCC website |

How to Manage Risk in Forex Trading

#1. Understand the Forex Market

The importance of knowledge can’t be overstated in the forex market. If a new investor starts trading with the power of luck alone, materializing profits will be a dream, and losses will be a harsh reality. The Forex market isn’t as simple as holding a stock of US dollars and selling them once the other currency devalues; it is a lot more than that.

The latest developments in trading platforms have come with an addition of trading CFDs, ETFs, and options. All of them are technical commodities and may get difficult to interpret for most investors. Usually, most novice traders think that watching a youtube video will reveal the secrets of the forex market.

However, it is far from the truth. It is improbable to understand the forex market from one source alone. You will have to create a mix between videos, lectures, educational resources for your trading platforms. You should also seek independent advice from experienced traders, as it will come in handy for you to attain lessons from their mistakes.

#2. Get a Grasp on Leverage

Leverage is a double-edged sword. If you make the right decision at the right time, it will translate into an amazing profit; however, if you get any of the components wrong, the losses will eat your trading capital like none other. Leverage risk management is essential for your success in the forex market.

Using leverage to generate profits is a fairly common tradition of experienced forex traders. For new investors, It is difficult to resist leverage when the opportunity to maximize your gains is clearly visible. Hence, we need to find a middle route.

Margin plays a significant part in determining the overall risk of leverage. If the margin is high, you will have to pay an increased cost of attaining the capital; hence, it is advisable to avoid leverage at a high rate.

Nevertheless, you should keep an eye on margin rates over time. Usually, as the demand for capital shrinks, the margin drops down. It is a good time to make profits from its use. You should also look for different leverage platforms and identify the most feasible conditions.

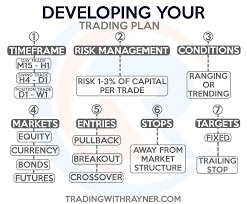

#3. Build a good trading plan

A goal without a plan is a wish. The popular saying is accurate for the forex market. If you don’t have a well-defined idea of how to make decisions and what is your profit target, it won’t be surprising to see you fail.

A trading plan is a system that contains your objectives, timings, risk, and preferred securities. It will outline a set of guidelines that determine your purchase and sell decisions.

A trading plan serves as a roadmap for traders; it highlights the specific conditions that you should trade in. You should add your profit targets, loss points, and portfolio proportion rules. The document shall also assist in preventing emotional damage to your portfolio. However, it isn’t rare to see investors failing despite a trading plan.

A trading plan should only be finalized after a trial and error procedure is carried out. It is difficult, if not impossible, to create a trading plan that works in the first go. You will have to keep on amending the plan with the right investment advice and market conditions.

| RECOMMENDED TRADING COURSE | REVIEW | VISIT |

|---|---|---|

| #1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |  |

#4. Set a risk-reward ratio

Risk reward ratios are a simplification of forex decisions. It cumulates your trading strategies to ratios that give an objective view. Unlike perceptions, ratios can be compared against each other, and the best ratios can be used to materialize trade. A risk-reward ratio compares the cost of investment to the possible reward that you can earn.

For instance, you decide to invest $1000 in a company whose shares trade for $50 in the NYSE. The cost of investment will be $1000, and you will have to analyze the possible reward you can earn.

Technical indicators and trend analysis can be useful for the prediction of profits. Suppose, the share will possibly rise to $58 over the next few days, making $8 per share for you. Hence, you earn a total of $160 at an investment of a thousand dollars.

The risk-reward ratio for this investment will be 0.16: 1. The ratio is considerable for most traders. However, in the forex markets, the prices for each currency are generally low, and the fluctuations often result in a higher ratio.

A rule of thumb is to select trades with a risk-reward ratio of at least 0.25:1 in the forex market. The ratio shall help you analyze whether entering a deal is feasible or not. Similarly, if the loss increases by proportion, you can exit the trade without thinking twice.

#5. Use Stops and Limits

Currency trading platforms have grown over time, and their growth has meant the introduction of the latest technologies. The improved versions of the applications include a degree of automation, which allows traders to enter and exit a trade as soon as the conditions are achieved. The trading platforms generally let traders set profit and loss stops.

The trade rules work as a helpful tool in avoiding losses and making profits. Once the trade is set, an investor can determine a set of rules that shall determine the entry and exit to the trade. Profit and loss stops are generally created as the percentage of the trade value. For instance, a trader may set a stop loss at 2% and a profit stop at 5%.

Hence, if the value of the trade rises by 5%, the trade will be exited on the behalf of the investor. On the other hand, if the currency falls by 2%, the currency pair would be sold without any physical interaction by the trader.

#6. Manage your Emotions

Emotional decisions can have a wrong impact on all spheres of our lives. The forex market is no different, and the fear of loss or missing out can be more hazardous than the loss itself.

It isn’t common for day traders to miss on a good deal because they think the currency would rise even further. Similarly, some might be too quick to sell their currency after the initial loss. They fail to enjoy the possible profits that could have been attained by keeping the asset a little longer.

Emotional management is an important part of forex risk management, and if you can’t control your emotions, there is a fair chance that your profit won’t be in your control either. It can be troublesome to decide when to enter/exit a trade. A trading plan comes in handy at this instance. It contains a list of objectives that can help you assess whether buying the currency is worth it.

Similarly, the profit and loss stop is also vital in preventing emotional losses. They will execute a deal as soon as the conditions are achieved regardless of any interaction by the trader. The latest platforms also come with trading bots that further reduce the role of an investor. These trading bots apply a trading strategy to your portfolio and make decisions on your behalf. As they are computer-programmed, you won’t have to fight with your emotions.

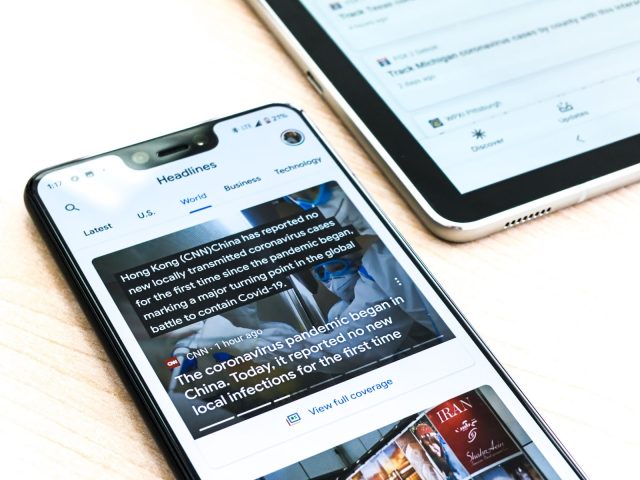

#7. Keep an eye on news and events

As we said in the beginning, exchange rate valuation has high importance for any country. It determines the prices of its imports and exports; hence, they like to keep it at a stable rate. The exchange rate is influenced by interest rates, political instability, and market rumors. You must find the relevant information about the respective countries on the news and keep yourself updated.

News about interest rate changes, the discovery of minerals, a popular firm’s IPO can result in the change in demand of a currency pair; hence, you must keep an eye on these subjects specifically. Nevertheless, general knowledge can sometimes come in handy to predict what’s about to come.

Most trading platforms come with a news section integrated into their application, allowing traders to access the relevant economic news within the app. You can also look out for particular youtube videos as they also provide useful insights into how the currency may progress in the future.

Nonetheless, educating yourself on the news should not overtake your willingness to study the forex market, which is more important. You should create a good balance between different sources of educational resources.

#8. Start with a Demo Account

It is crucial to learn in a swimming pool before you go surfing in the ocean. The risks of the ocean are massive. But as similar conditions can be replicated in a swimming pool, you don’t have to risk yourself without preparation. The analogy can be compared to forex trading and demo account.

A demo account is like any other retail investor account except that it doesn’t contain your hard-earned investment, and the profits made aren’t material. Demo accounts provide you with a real-time experience of the market and its fluctuations. The currency pairs bought in the demo account will vary depending on the actual market price. Hence, you can practice your forex trading plan without risking your hard-earned money.

For new forex traders, it is advised to begin trading with a demo account. It will provide them the opportunity to practice multiple trading strategies without losing money rapidly. Therefore, you should also focus on the demo account features before selecting a broker.

Some brokers offer a real-time investors demo account for free, while others may charge for the features. Similarly, some brokerage firms have multiple platforms. Hence, the demo account may work on a platform while not on others. These were some conditions that you should pay heed to before making your final decision about the brokerage.

Best Forex Trading Course

Investing in the Forex market might seem to be a daunting task especially if you are a beginner, and have just started exploring the Forex market. Although experience is said to be the best teacher when dealing in the Forex market, it is good to learn about the Forex market briefly before making your first investment.

There are several ways in which you can start expanding your knowledge of the stock market. You can either start reading books or ask for tips from your friends or family members who have prior experience of trading on the Forex platform. However, the former is a time-consuming method while the latter is not always a credible learning source.

If you want to learn about investing in the Forex market that would help you gain knowledge, and tell you all you need to know about the market, then you can opt for some professional courses available on the internet. These courses are developed by Forex markets experts who have years of training Forex traders.

Now, there are thousands of courses on the internet that claim to teach you about Forex investment. However, not all of these courses are reliable and give accurate information. So which is the best Forex course for learning the ins and out’s of the Forex market?

Asia forex mentor course by Ezekiel is by far one of the best Forex learning courses on the internet, and they are one of the best learning sources if you want to expand your Forex trading knowledge.

They have been featured on multiple different leading forex platforms and Forex events happening around the world. Ezekiel’s platform is the perfect solution for you to learn because their clients include multiple trainees and bank traders from private trading institutions around the globe.

It is the number one course available on the internet because it also reaches new bank traders and has fun managing if you want to make money from trading forex stocks and other commodities.

You can get a great return on investment by indulging yourself in this systematic course. Even if you are a beginner in the field and do not have enough experience and knowledge about Forex trading, you still join this program with zero knowledge. Everything will be taught to you from scratch, and you can enroll yourself in this program right now to get started.

Check out the testimonials on the website and start your Forex trading journey right away. The good thing about this course is that you will be crystal clear about what you need to do from day one.

They are using a return on investment approach to teaching their students. It is a scientific method of beating the market, and you will not be taught this somewhere else.

| RECOMMENDED TRADING COURSE | REVIEW | VISIT |

|---|---|---|

| #1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |  |

Best Forex Brokers

| Broker | Best For | More Details |

|---|---|---|

| Advanced Non US Traders Read Review | securely through Avatrade website |

| Intermediate Non-US Traders Read Review | securely through FXCC website |

Overall Broker | securely through Forex.com website | |

| Professional Forex Traders Read Review | securely through Interactive Brokers website |

Conclusion: Forex Risks Management

Forex risk management is essential to achieve your profit targets without falling for losses. The forex market involves tons of risks, most of which are beyond the control of any investor. Hence, it is important to look out for strategies that can be used to overcome them. The best way to avoid regional volatility and liquidity risk are by avoiding currencies that have shown an abrupt behavior previously.

Interest rates are published in news and on the official website of the countries’ federal banks; hence, you can avoid the risk of fluctuation by keeping yourself updated with the news. Similarly, other factors, such as political instability, can also be found in news; thus, you can make the right decision with accurate information.

Margin and leverage rates are a risky game, and it can backfire if your analysis goes wrong. You should only utilize leverage if it’s available at a reasonable rate. The goal should be to get out of the deal as soon as possible. Once you have made profits with the deal, it is better to get rid of the leverage to avoid making mistakes later on.

Finally, you can also utilize the trading automation features to avoid trading under emotional influence. The latest trading platforms come with an improved interface that consists of various AI-powered trading bots. The purpose of the bots is to create trades on your behalf based on the respective strategy. We have finally reached the end of the blog. I hope it helped you understand the importance of forex risk management.

Forex Risks Management FAQs

What is risk management in forex?

Forex risk management consists of outlining a series of trading strategies that can minimize your forex trading risks. It helps investors in making profitable deals while minimizing their risks. We have talked a fair deal about the possible risks involved in the forex market. You can read the earlier sections of the blog to learn more about them.

How do you do risk management in forex?

Forex deals with currency exchange; the market is rising rapidly and has reached close to $2 quadrillions. Nevertheless, the size of the market makes it vulnerable to several external factors that may have a powerful impact on the market. Usually, a new investor enters the forex market to earn a profit without falling into traps of less reliable markets. If you are a new trader, here is a list of things you can do to reduce your risk. We have discussed them in detail earlier in the blog.

- Educate yourself about the forex market. You need to use multiple sources to understand how the market works and various assets traded on it.

- Leverage and margin are vital components of the forex market. They are double-edged swords and should only be used when no other way is visible.

- A trading plan is a must for forex investments. If you enter the market without a trading plan, there is a fair chance that you would exit it with empty hands.

- Objective ratios can provide a reliable basis for identifying the right decisions. A risk-Reward ratio can be useful in analyzing the profitability of a deal.

Wilbert S

Wilbert is an avid researcher and is deeply passionate about finance and health. When he's not working, he writes research and review articles by doing a thorough analysis on the products based on personal experience, user reviews and feedbacks from forums, quora, reddit, trustpilot amongst others.