FTSE 100, DAX 40, S&P 500 Rebound Before US CPI and FOMC

By Daniel M.

June 12, 2024 • Fact checked by Dumb Little Man

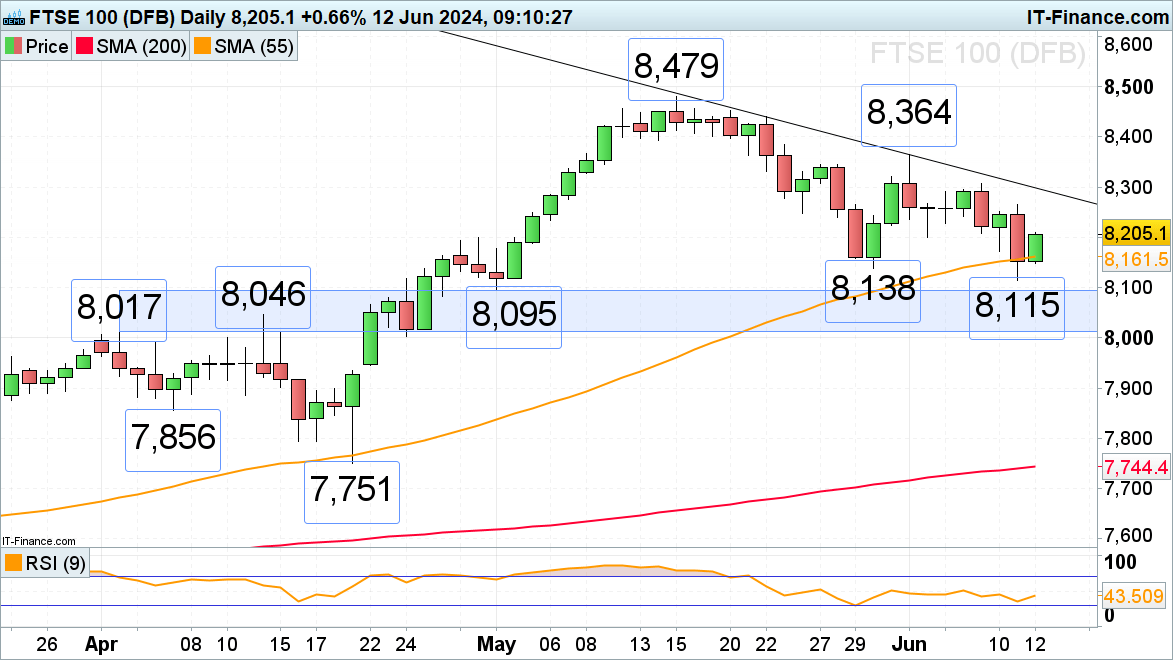

FTSE 100 in Recovery Mode Despite Stagnant GDP Growth

The FTSE 100 bounced back from Tuesday’s low of 8,115, despite the UK GDP marking its weakest performance in four months due to declines in industrial output and construction offsetting a rise in services. Further gains depend on US CPI data and today’s FOMC meeting outcome. For the bulls to regain control, a rise above Tuesday’s high of 8,266 is necessary.

Potential declines might find support around the 55-day simple moving average (SMA) at 8,162, ahead of the late May and current June lows between 8,138 and 8,115.

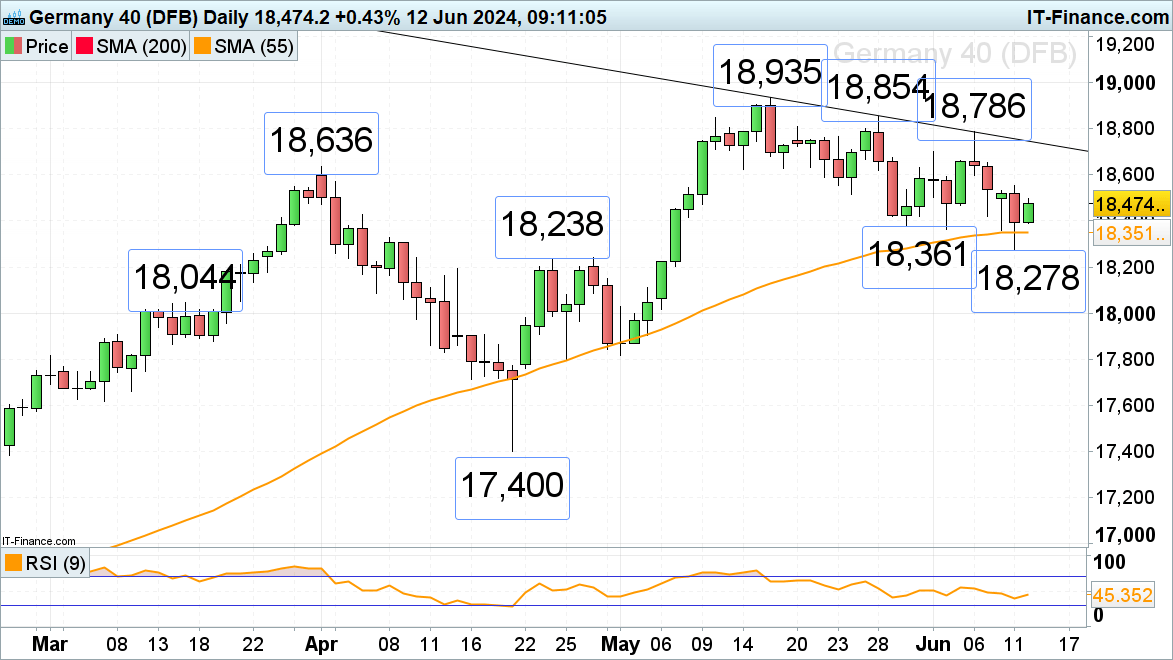

DAX 40 Rebounds from One-Month Low

The DAX 40 recovered from Tuesday’s one-month low of 18,278, ahead of US inflation data and today’s Fed meeting. For a bullish reversal to gain momentum, a rise above Tuesday’s high of 18,552 is needed.

Minor support is noted between the late May and early June lows of 18,379 to 18,361, ahead of the 55-day simple moving average (SMA) at 18,352. If this week’s low of 18,278 holds, a rise towards the 18,700 region is possible. Failure to hold 18,278 would target the late April high of 18,238.

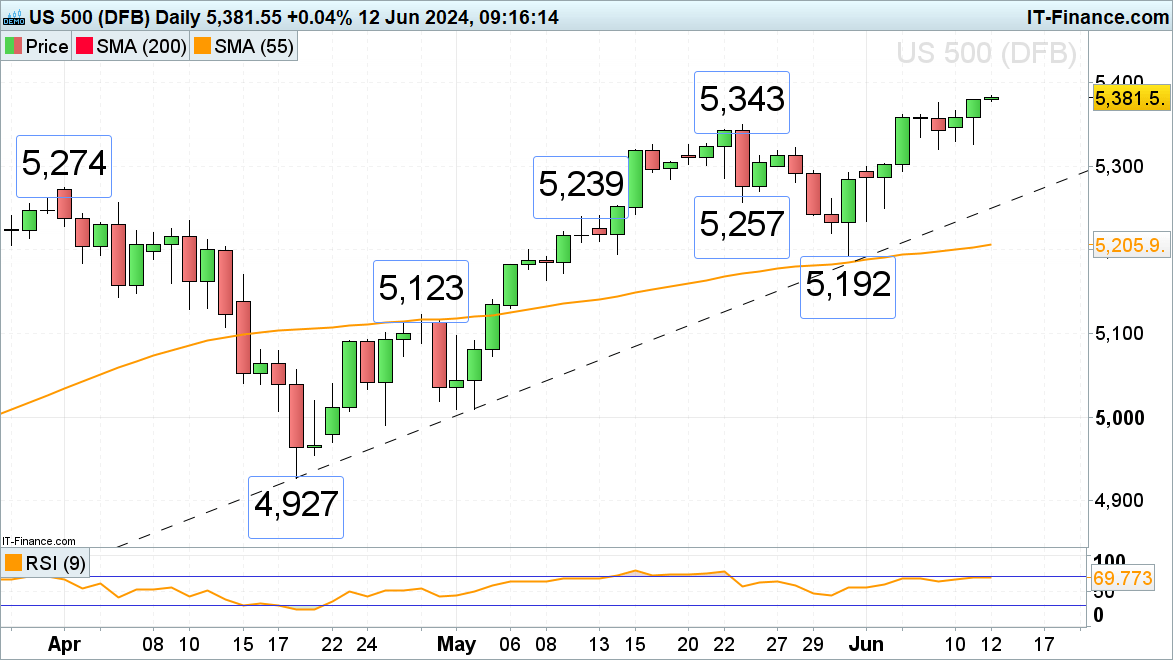

S&P 500 Near Record Highs Ahead of US CPI and FOMC

The S&P 500 trades near its all-time highs around 5,380, ahead of today’s US inflation data and the FOMC meeting conclusion. As long as Tuesday’s low of 5,327 underpins, the 5,400 mark remains in reach.

Potential declines might find support around last week’s high of 5,376, ahead of the 5,327 to 5,320 lows from Friday and Tuesday. As long as these levels hold, the short-term uptrend remains intact.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.