In a remarkable testament to the resilience of stock markets, the FTSE 100, Dow Jones, and Nasdaq 100 have showcased impressive upward movements, reaching and potentially surpassing previous highs despite facing economic headwinds such as hotter US inflation figures. This bullish momentum underscores the market’s ability to navigate through inflationary pressures, buoyed by investor optimism and strategic positioning within the global financial landscape.

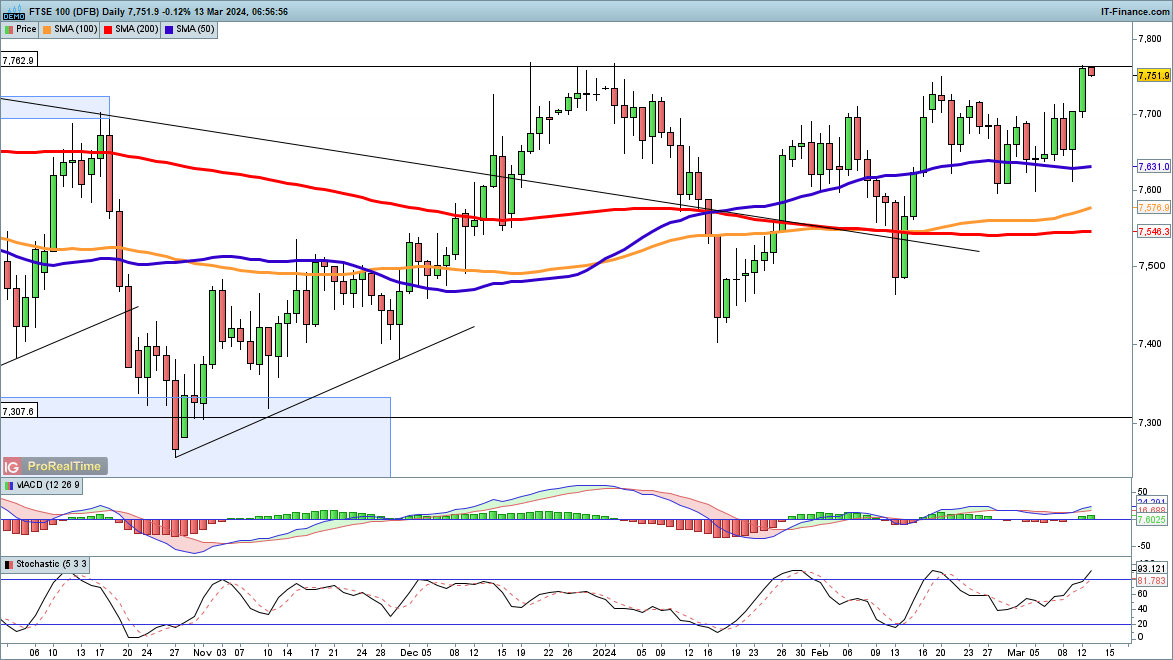

FTSE 100 Reaches December Peak Levels

After two days of gains, the FTSE 100 has approached the December highs of 7770. Over the last two weeks, a rally from 7600 has set a new higher low, suggesting the index could further ascend with an immediate goal of reaching 7800.

Dow Jones Overcomes Hot US Inflation, Eyes Record Highs

Despite a hotter-than-expected US CPI report, the Dow Jones has continued its upward trajectory, breaking through trendline resistance from February peaks. This breakthrough hints at a potential return to record highs, with support now found near 38,500. Below this level, the 50-day simple moving average stands untested.

Nasdaq 100 Surpasses 18,000 Amid Inflation Concerns

Crossing back over the 18,000 mark, the Nasdaq 100 shows promise for reaching new record heights, undeterred by the recent uptick in CPI figures. Support since the start of January bolsters the potential for further upward movements.

Final Thoughts

As we witness the FTSE 100 flirting with December peak levels and the Dow and Nasdaq 100 navigating through inflation uncertainties with notable gains, it’s clear that investor sentiment remains robust. These trends highlight the enduring strength and potential for further growth within these indices. Investors and market watchers alike should keep a keen eye on these developments, as they may offer valuable insights into the broader economic outlook and investment opportunities in the times ahead.