FTSE 100 Pulls Back from Ten-Month Peak as Dow and Nasdaq 100 Show Resilience

By Daniel M.

January 5, 2025 • Fact checked by Dumb Little Man

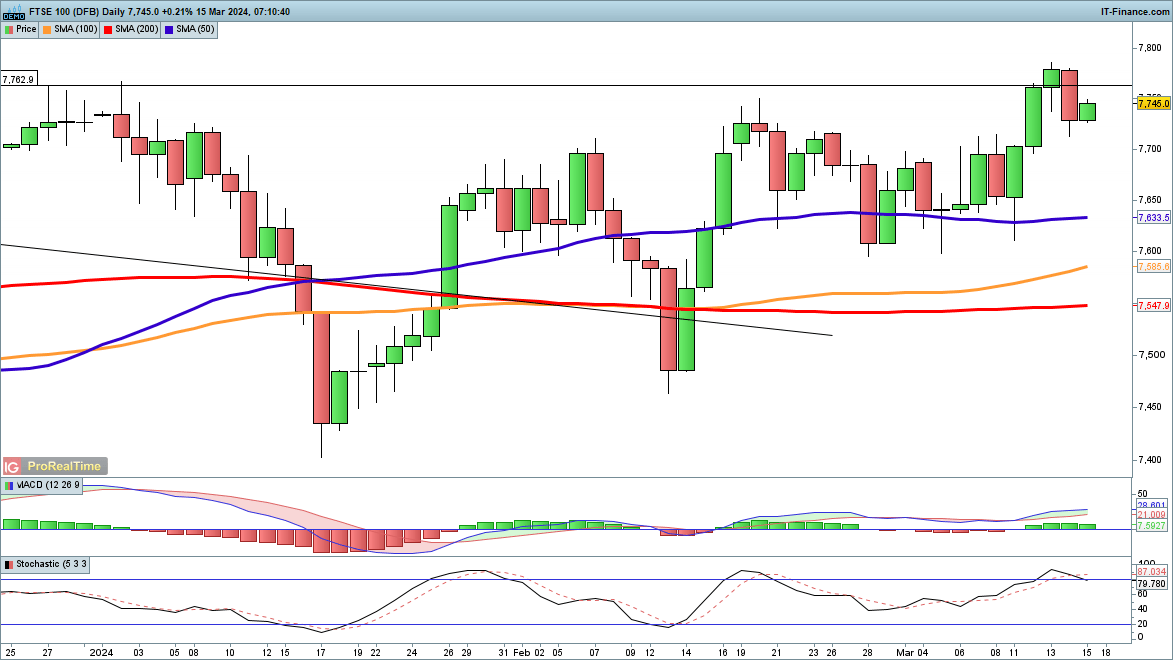

FTSE 100 Faces a Reversal After Reaching Ten-Month High

The FTSE 100 experienced a significant uptick on Wednesday, achieving a ten-month peak. However, Thursday’s market activities hinted at potential downturns, possibly towards the 50-day simple moving average. Support levels are noted around 7600, a zone where buying momentum was evident in late February. Should the index sustain above 7700, it might gear up for another upward movement.

Analysis of retail trader data reveals that 35.37% of traders hold a net-long position, with the short-to-long ratio standing at 1.83 to 1. Compared to previous periods, today’s net-long traders have increased by 17.44% from yesterday but decreased by 4.00% from last week. On the flip side, net-short traders have dropped by 16.63% since yesterday and increased by 7.95% from the previous week. Given these trends, a contrarian perspective to crowd sentiment suggests a potential rise in FTSE 100 prices.

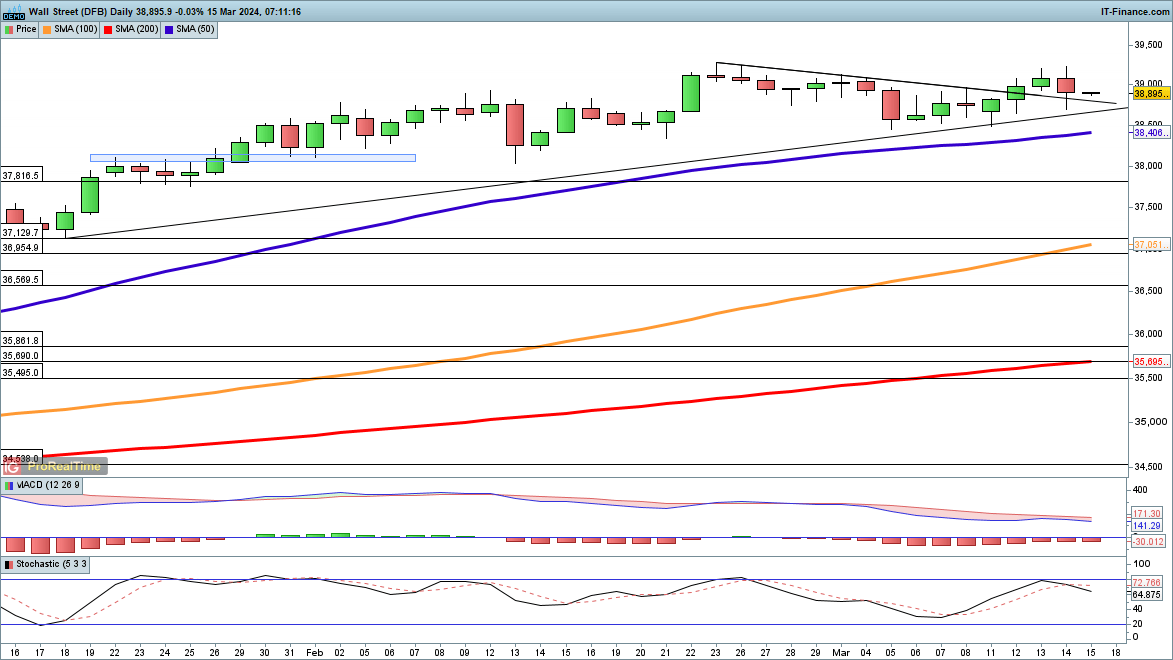

Dow Jones Avoids Potential Downturn

Despite a halt in the post-CPI rally on Thursday, the Dow Jones managed to stay above key resistance levels. A break below the trendline support from January, followed by a drop beneath the 50-day SMA, could signal a more extensive retreat, possibly towards 37,816 and revisiting prior highs.

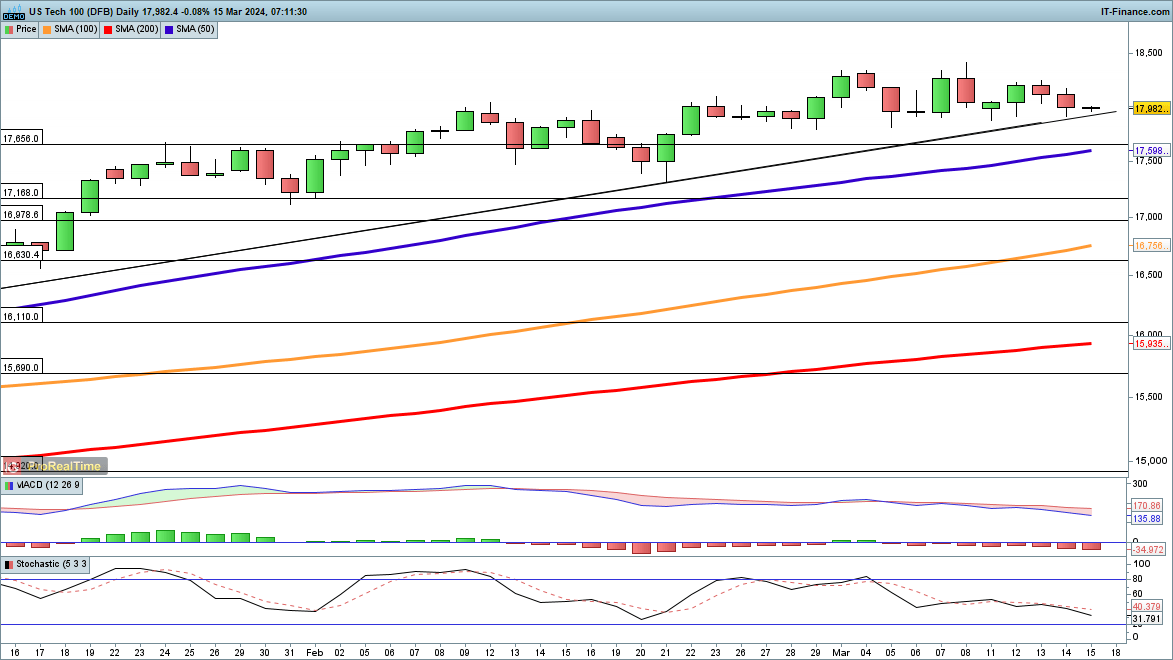

Nasdaq 100 Maintains Support Amidst Challenges

The Nasdaq 100 witnessed a slight pullback, retreating to 18,000 in Thursday’s session. A move below the trendline support, originating from January’s lows, could signify a shift in market dynamics for the index, potentially leading to support levels at 17,656 and subsequently, the 50-day SMA.

Should the index preserve its trendline support, there’s room for a recovery, possibly revisiting and surpassing last week’s peak.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.