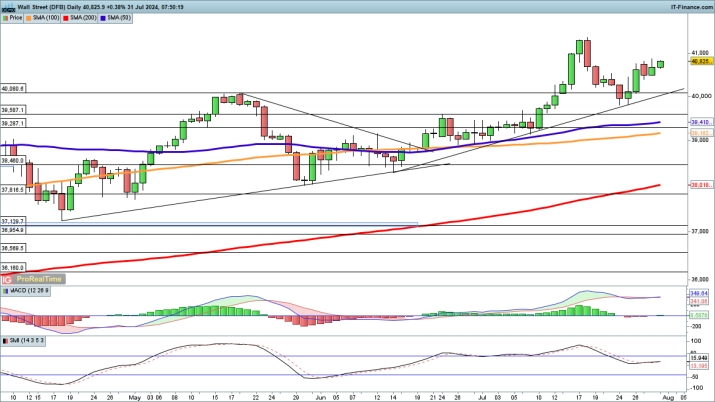

Dow’s Recovery Progresses

The Dow continues its recovery, with the lower weighting of tech stocks now serving as a benefit rather than a hindrance, as it had been for much of the year. After climbing back above 40,000 last Friday, the index has gained further ground, approaching the 41,000 level and the record high set earlier in July.

A close below last week’s low of 39,800 would be necessary to invalidate the short-term bullish outlook.

Nasdaq 100 Stabilizes After Microsoft Earnings

The Nasdaq 100 rebounded from its low last evening, following Microsoft’s earnings report. It has bounced from the 18,000 area and climbed back above 19,000. However, with Meta’s earnings and the Fed decision tonight, along with Apple and Amazon’s results tomorrow, volatility is expected to continue this week.

The index appears to be forming a higher low, maintaining its broader uptrend, suggesting a potential further recovery once key earnings are released.

Dax Continues Uptrend

After dipping below the 100-day simple moving average (SMA) yesterday, the Dax has regained strength, continuing its upward movement from the past two months. While substantial gains have been challenging to maintain, an initial target is 18,600, followed by the July high at 18,750. Beyond this, the May high at 18,935 is within reach.

A close below 18,100 would be required to negate this bullish perspective.